American Airlines offers a small business rewards program, known as the AAdvantage Business program. This is a great way to earn extra rewards for your travel on American, including qualifying for bonus Loyalty Points and miles. Best of all, eligibility for the program is surprisingly simple, assuming you have the Citi® / AAdvantage Business™ World Elite Mastercard® (review).

In this post, I’d like to take a look at all of the details of the program, as many people find it to be quite complicated. Note that AAdvantage Business was launched in late 2023, replacing the previous American Business Extra program (which no longer exists).

In this post:

How the AAdvantage Business program works

AAdvantage Business is the name of American Airlines’ business rewards program. This allows you to earn extra rewards in a business account, in addition to the rewards you can earn through your own AAdvantage account. Best of all, you have quite a bit of flexibility in terms of distributing the rewards. Let’s go over the details of how this works.

AAdvantage Business program rewards structure

The AAdvantage Business program has a pretty straightforward rewards structure, as it rewards members with both Loyalty Points and AAdvantage miles. With the AAdvantage Business program, you earn the following rewards, which will post within 72 hours of an eligible flight:

- AAdvantage Business offers the individual traveler one bonus Loyalty Point per dollar spent on eligible airfare (that’s not a redeemable mile, but just a Loyalty Point toward earning elite status)

- AAdvantage Business offers the business one bonus AAdvantage redeemable mile per dollar spent on eligible airfare

Just to clarify a few additional points:

- In order for a flight to be eligible to accrue with the AAdvantage Business program, you must book directly with American and add the AAdvantage Business number to the reservation at the time that you make the reservation, and designate it as a business trip; alternatively, an accredited travel agency may book travel on your behalf through its booking tool channel, and have the trip still qualify

- Travel on partner airlines qualifies for the AAdvantage Business program, as long as it’s booked through American

- The AAdvantage miles that the company accrues can be transferred to a designated member at no cost, and can be redeemed like any other AAdvantage miles; however, these wouldn’t earn you any additional Loyalty Points, so also wouldn’t get you any closer to earning more Loyalty Point Rewards

These rewards are all in addition to the standard rewards that AAdvantage members receive:

- AAdvantage members ordinarily earn five Loyalty Points per dollar spent on airfare

- Elite members receive Loyalty Points bonuses — Gold members get a 40% bonus, Platinum members get a 60% bonus, Platinum Pro members get an 80% bonus, and Executive Platinum members get a 120% bonus

- All Loyalty Points earned from flying also count as redeemable miles, so you earn as many redeemable miles as Loyalty Points

Just to be crystal clear, an Executive Platinum member ordinarily earns 11 Loyalty Points per dollar spent on airfare, while if enrolled in the AAdvantage Business program, they’d earn 12 Loyalty Points per dollar spent. There’s no reason to leave those bonus rewards on the table!

Qualifying for the AAdvantage Business program

In order to be eligible to participate in the AAdvantage Business program, you need to have a business in the United States or Canada with a Federal Employer Identification Number (FEIN) or Business Number. Even small businesses are eligible for this program.

You accrue rewards in the AAdvantage Business program without any minimums. While you can redeem directly from there, alternatively, you can transfer the rewards to individual members. In order to transfer the miles in the AAdvantage Business account to an individual AAdvantage account, you need to meet one of two requirements:

- You must have at least five unique travelers who have credited flights to the AAdvantage Business account, totaling at least $5,000 in flight revenue over the course of a year

- Alternatively, you can be a Citi AAdvantage Business Card (review) member, in which case the minimum requirement is waived, as there’s no minimum to the spending or number of travelers

The value of the Citi AAdvantage Business Card

The AAdvantage Business program creates a huge incentive to get the Citi AAdvantage Business Card (review). That’s because just having the card allows many people to unlock the value of the AAdvantage Business program — there’s no need to actually use the card for your spending, but just having it is all that’s needed to redeem AAdvantage Business program rewards with no minimum on the number of travelers or revenue.

There are several potentially useful perks to this card, and on top of that, the card is offering a great bonus. I recently picked up this card for the bonus, plus the value it unlocks with the AAdvantage Business program.

It’s worth understanding how closely this card is actually integrated into the AAdvantage Business program:

- AAdvantage miles earned from spending on the card post to your AAdvantage Business account, and then you can transfer them to the account of anyone linked to the account

- AAdvantage Loyalty Points post directly to the account of the person responsible for the spending, meaning that authorized users actually earn their own Loyalty Points (this is a unique card feature); however, we’ve seen some users targeted for promotions where both the primary cardmember and authorized user can earn Loyalty Points, which is pretty awesome

For American frequent flyers with a small business, this creates a strong incentive to get the card. The card has a $99 annual fee that’s waived the first year, and just having the card will allow many people to earn a sizable number of bonus miles.

Logistics of the AAdvantage Business program

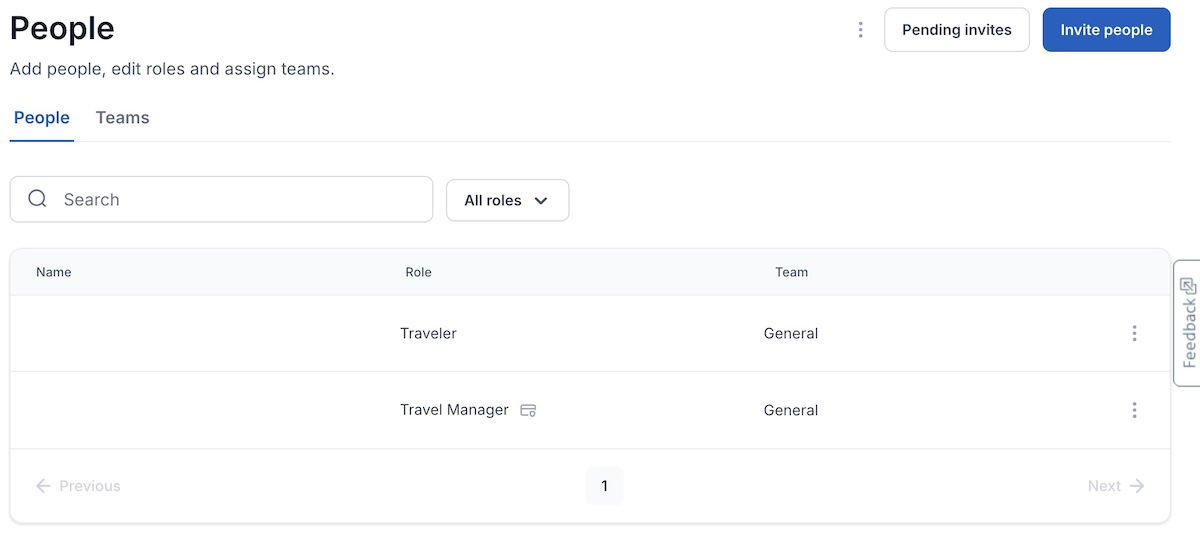

If you’re curious about how the AAdvantage Business program works in practice, let me share some screenshots, for those who are more visual. Once you have an AAdvantage Business account, you can invite people to join your account (these should be people who work for your company, but there’s no verification process, as far as I know).

So you’ll want to click “Invite people,” and then once they accept your invitation, they’ll show up on your account.

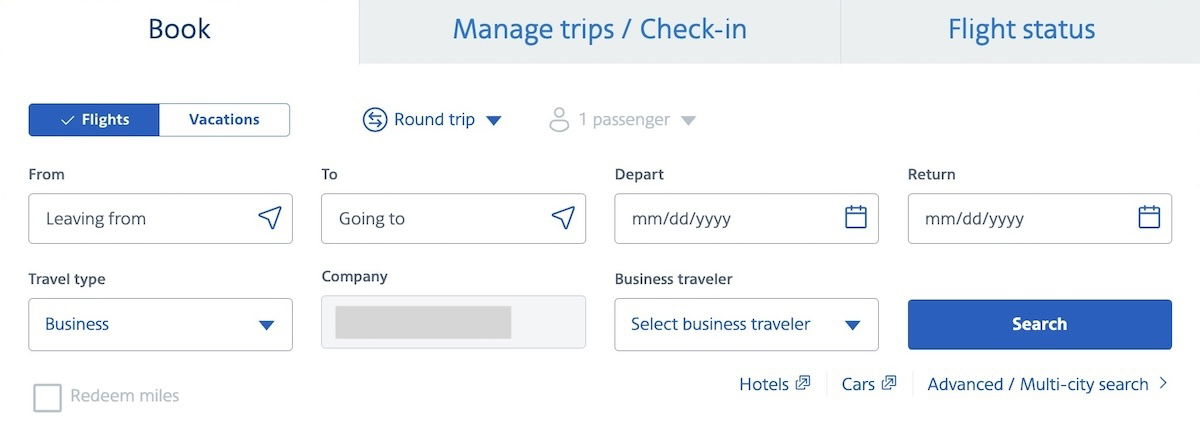

If someone’s AAdvantage account is linked to an AAdvantage Business program account, you’ll see that when you go to make a booking on aa.com, you’ll be asked for your “Travel type,” and can select “Business” or “Personal.” If you select “Business,” you’ll see that the company name populates, and you can select the name of the traveler.

While the Loyalty Points from flights will post directly to the AAdvantage account of the member, the redeemable miles will post to the AAdvantage Business program account (the same is true for miles earned on the Citi AAdvantage Business Card).

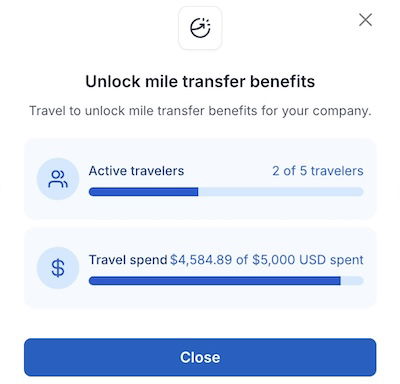

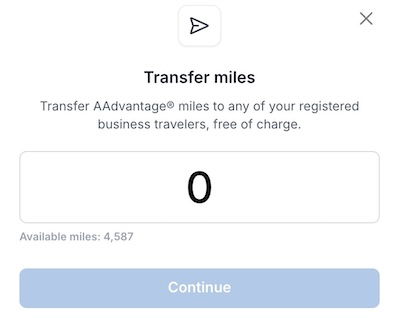

Then if you’re eligible to transfer those miles, you’ll see the mileage balance listed, plus a “Transfer miles” button. There’s also a dashboard that shows your eligible number of travelers and eligible spending. However, as you can see above, I’ve met the transfer conditions even though I haven’t met the required threshold, since I have the Citi AAdvantage Business Card.

The process of transferring miles is super easy. You’ll just enter how many miles you want to transfer, and who you want to transfer them to, and then they should post to the AAdvantage account instantly.

My take on the AAdvantage Business program

My general take on the AAdvantage Business program is as follows:

- This program isn’t really so rewarding that it’s a game changer, or that it’s going to move the needle for people deciding whether or not to be loyal to American

- However, if you are eligible for the program, there’s absolutely no reason not to participate

The program basically offers an incremental 1.5% return on your American spending, since you earn one extra AAdvantage mile per dollar spent, and I value those miles at 1.5 cents each. On top of that, the program offers an incremental Loyalty Point per dollar spent — that will have no value to some, while it will have significant value to others, depending on the extent to which you’re pursuing status in the coming year.

It is interesting the extent to which American has basically given up on corporate travel. American’s priority is getting people to book direct and keeping distribution costs as low as possible. So this program is intended as the major incentive for most small businesses.

Bottom line

American Airlines offers the AAdvantage Business program. With this program, the business earns one AAdvantage mile per dollar spent on eligible airfare, while the individual traveler earns one Loyalty Point per dollar spent. In order to participate, you need a business with at least five registered employees and $5,000 in annual spending, or you need to have the Citi AAdvantage Business Card.

What do you make of the AAdvantage Business program?

It is a huge inconvenience to only be able to book one person per reservation. We had a group of 10 traveling recently when our flight got delayed. AA automatically rebooked us, but we got split up on different flights and even final destinations. It was a nightmare! It is a very overlooked consequence of this program!

One minor inconvenience when booking a "Business" trip:

It apparently becomes impossible to "hold" the booking for free for 24 hours. I had the experience last week. Has anybody seen the same thing or was it a one-time glitch ?

The single most annoying element of this program is the requirement to book tickets individually. This makes it a headache to seat clients or coworkers together and causes travelers to be separated during irrops. So much inconvenience for zero benefit.

Is it actually "zero benefit"? I agree with you that it's absurd that tickets are required to be booked individually (who possibly thought this made sense?!), but no benefit at all, not even a paltry one?

From.about 2006 - 2014. I signed up and earned a slew of rewards. Unfortunately I only redeemed 1 lounge pass and 1 domestic upgrade awards before they changed the program and all the rewards expired. What a waste of.my time and effort.

Great job with this Ben, but ugh. Even a good post about how it works is confusing :)

Hi Ben. I know this isn't relevant to the article, but I'm not sure of the best way to get messages to you.

AeroB13a is clearly Tim Dunn. Same writing style, same obsession with DL in UA stories that aren't relevant to DL, same insults to other posters. Even if it isn't, he's insulting other commenters and doing the same things that got Tim banned in the first place.

His comments can be seen...

Hi Ben. I know this isn't relevant to the article, but I'm not sure of the best way to get messages to you.

AeroB13a is clearly Tim Dunn. Same writing style, same obsession with DL in UA stories that aren't relevant to DL, same insults to other posters. Even if it isn't, he's insulting other commenters and doing the same things that got Tim banned in the first place.

His comments can be seen in the UA A321XLR article. Looks like he changed his IP address to avoid detection.