Buying miles & points strategically can represent a great value, especially for first and business class travel. The avianca lifemiles program has just launched its newest promotion on purchased miles (the program has offers more often than not).

Note that nowadays lifemiles promotions are generally targeted, so different members may see different offers, and on top of that, some members may not see any offers at all.

Historically, I’ve found lifemiles to be one of the most useful frequent flyer programs for redeeming miles, thanks to the ability to redeem for long haul premium cabin Star Alliance awards. However, let me emphasize that the program recently devalued miles considerably, both increasing award costs, and seemingly blocking more award space.

I’m writing about this deal because there are some people who will be able to get outsized value from this offer in the short term. However, I’d only consider buying miles with a very specific use in mind, as you should proceed with caution. For what it’s worth, I don’t get any sort of kickback if you buy miles — I just want to make OMAAT readers aware of the deals that are available.

In this post:

Promotion on purchased lifemiles

Through Monday, July 14, 2025, the avianca lifemiles program is offering a bonus on purchased miles. Different members may be targeted for different offers, though it appears the standard offer is for a bonus of up to 160%. The offer appears to be tiered, as follows:

- Buy 1,000-20,000 miles, receive a 140% bonus

- Buy 21,000-200,000 miles, receive a 160% bonus

You’ll of course want to check your account to see what offer you’re targeted for. Note that there’s mention of those with a lifemiles+ subscription being eligible for up to a 200% bonus on purchased miles. However, I’m a subscriber, and don’t see that offer available, so I imagine it’s targeted beyond that.

How much does it cost to buy lifemiles?

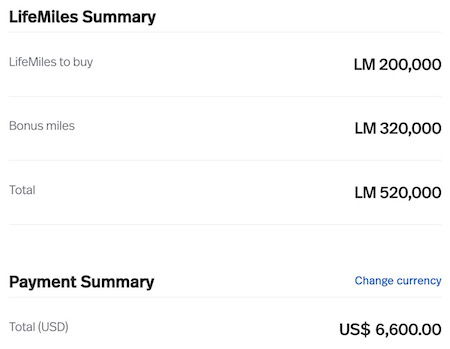

Ordinarily you can buy avianca lifemiles for 3.3 cents each, before any discounts or bonuses. That means that if you purchased 200,000 lifemiles (pre-bonus) with a 155% bonus, you’d receive a total of 520,000 lifemiles for $6,600, which is a cost of 1.27 cents per mile.

How many lifemiles can you buy?

The lifemiles program lets members purchase up to 200,000 miles per account per calendar year, before factoring in any bonuses.

Which credit card should you buy lifemiles with?

Mileage purchases are processed directly by avianca lifemiles, which means the purchase of miles does qualify as airfare spending. Therefore you’ll want to consider using one of the below cards for your purchase, since you’d earn bonus points for airfare purchases.

The Platinum Card® from American Express

The Platinum Card® from American Express

American Express® Gold Card

American Express® Gold Card

Is buying lifemiles worth it?

For context, avianca is in the Star Alliance, which means you can redeem lifemiles on all Star Alliance airlines without any fuel surcharges. Really this is the core value proposition of buying lifemiles, since this is a great way to book Star Alliance premium cabin seats at a huge discount. Check out my guide on how to redeem lifemiles for ideas on how to redeem these miles.

With a specific use in mind, this lifemiles promotion can be a great value, whether you’re looking at traveling first class on All Nippon Airways or Lufthansa, or are looking at traveling in business class on a countless number of airlines.

Everyone has to crunch the numbers for themselves and decide whether this makes sense or not.

Do note that in some cases lifemiles doesn’t have access to the same award availability as Star Alliance partners, for better or worse. Sometimes lifemiles doesn’t have access to partner awards that other programs do have access to, and other times the inverse is true.

That’s why I always recommend doing some “dummy” award searches before buying miles, so you can get a sense of how award availability lines up with your needs. Keep in mind that you can get even more value from the program with a lifemiles+ subscription, and lifemiles’ credit cards offer a discount on that.

How much are lifemiles worth?

Everyone will value mileage currencies differently, but personally I value lifemiles at ~1.4 cents each. That’s based on the redemption values on Star Alliance partners, as there’s tons of value to be had. I tend to value miles very conservatively, so if you’re maximizing miles you should be able to get way more value than that.

Do lifemiles expire?

Miles with the lifemiles program don’t expire as long as you accrue some miles at least once every 12 months. Any mileage earning activity, including buying miles, will extend the expiration of your miles. However, redeeming miles as such doesn’t extend the expiration of your miles.

How else can you earn lifemiles?

If you’re looking to earn lifemiles, the good news is that there are lots of options beyond outright buying them. Specifically, avianca lifemiles is partners with several bank currencies, including Amex Membership Rewards, Capital One, and Citi ThankYou, so there are lots of ways to pick up these miles.

Bottom line

The avianca lifemiles program is offering a promotion on purchased miles. Different members may be eligible for different offers, though it appears that the standard offer is for up to a 160% bonus, which is an opportunity to acquire miles for 1.27 cents each. This has the potential to represent a solid value, though I’d only recommend buying miles with a specific, short term use in mind.

Do you plan on buying lifemiles with a bonus?

It didn't take long for them to remove every single mention of the 200%/3x1 promo for LM+ subscribers.

Interestingly, I just received an email (in Spanish) saying that **new** LM+ subscribers in **Latin America** will receive a top-up 7 days after the purchase. This means that, upon purchase, new subscribers will get a 160% bonus and the remaining 40% will be credited later on. A minimum purchase of 5,000 miles is required to be eligible for the 200% bonus.

As expected, this doesn't solve the question about people who are already subscribed and...

Interestingly, I just received an email (in Spanish) saying that **new** LM+ subscribers in **Latin America** will receive a top-up 7 days after the purchase. This means that, upon purchase, new subscribers will get a 160% bonus and the remaining 40% will be credited later on. A minimum purchase of 5,000 miles is required to be eligible for the 200% bonus.

As expected, this doesn't solve the question about people who are already subscribed and can't see the 200% bonus... nor does it clarify anything about those subscribed to LM+ plans in North America.

I'm now wondering if this promo was supposed to be only for Latin American subscribers to begin with...

To use the miles within a year and a complete lack of award seats makes this a hard no

I think they now use points.com to process when you purchase miles, so Amex Plat doesn’t get 5x. Can anyone confirm who has bought recently?

As a DP, I have lifemiles+ and could only get the 160% promo.

They ditched points.com a couple of months ago.

I have tried literally 14 times on two computers, four browsers and an iphone to purchase and not possible. I even tried over the phone and they got an error. I am at a loss as to how the hell this company is in business.

To anyone who can get the 200% bonus -

- Did you receive an email about it?

- How many miles do you need to buy to qualify for the 200% bonus?

Thanks!

I have a relative subscribed to LM+ but they got only 160%.

Been a Lifemiles+ member for about 9 months now, per the tracker on my account. Not seeing the 200% bonus on my side either. Curious if this is supposed to be one of those moments where they'll retroactively add more miles to the account once we buy miles.

I wouldn't risk it. The website clearly says 'LM+ members get ***up to*** 3 for 1 miles.' It's not that all LM+ members will see the same offer, sadly.

The words you quote could mean that all LM+ members get e.g.

140% bonus on 1k-20k miles

160% bonus on 21k-50k miles

200% bonus on 51k-166k miles

but I recognise that this probably isn't the case.