On October 1 I plan on applying for my next credit card, and I have a total of five cards that are on my radar in the short term.

In this post I wanted to share the five cards I want, why I want them, and how I plan on applying for them, since some strategy is needed.

In this post:

The Five Credit Cards I Want, And Why

I already have about two dozen credit cards, though there are several credit cards that I’m really interested in potentially picking up. One of these cards I want because of the incredible return it offers on spending, while I want the rest of the cards for the long term perks and bonuses they offer.

So below I wanted to first share the five cards I’m interested in, roughly in the order in which they excite me. As I’ll explain below, I don’t plan on applying for these cards in the order in which they interest me, though.

Citi Double Cash

In the past week, the Citi Double Cash® Card added a new benefit that makes this my new favorite credit card for everyday spending. This no annual fee card offers 1% cash back when you make a purchase and 1% cash back when you pay for that purchase (in the form of ThankYou points).

Now those rewards can be converted into ThankYou points at the rate of one cent per point, if you have either the Citi Premier or Citi Prestige. In other words, this card will offer 2x ThankYou points per dollar spent (after paying off the bill), which is incredible. This will be my new go-to card for everyday spending.

Read a full review of the Citi Double Cash Card here.

IHG Premier Card

The IHG One Rewards Premier Credit Card is an incredible hotel credit card that is worth having long term for the perks it offers, and typically offers a rewarding welcome bonus.

But long term the card is worth having because it offers an anniversary free night certificate every year (at a property costing up to 40,000 points/night), plus a fourth night free on award redemptions. This is a card that I’ve wanted for a long time.

Read a full review of the IHG Premier Card here.

Southwest Performance Card

While I’m by no means a frequent Southwest flyer, I really want to get the Southwest® Rapid Rewards® Performance Business Credit Card.

The card is also worth keeping long term as it offers some fantastic perks, including 9,000-anniversary bonus points every year, four upgraded boardings per year, a daily Wi-Fi credit for Southwest, and more. This will come in handy for those times where I do fly Southwest.

Read a full review of the Southwest Performance Card here.

Virgin Atlantic Mastercard

The Virgin Atlantic World Elite Mastercard® has a bonus of up to 80,000 Flying Club miles, and this is a card that can actually be worth spending money on thanks to the spending bonuses it offers. I’ve never had this card, and I think it’s time that I get it.

Read a full review of the Virgin Atlantic Mastercard here.

Avianca Credit Card

The Avianca Vuela Visa® Card is the premium of two cards offered by Banco Popular. It has an excellent bonus, and I’ve found LifeMiles to be extremely useful for Star Alliance redemptions.

Read a full review of the Avianca Vuela Visa Card here.

I’m Now Under 5/24

The reason I have a bit of a backlog of credit cards to apply for is that I’ve been trying to get under the 5/24 limit. This is the policy by which Chase typically won’t approve you for one of their cards if you’ve opened five or more new card accounts in the past 24 months (most business credit card applications are excluded from this total).

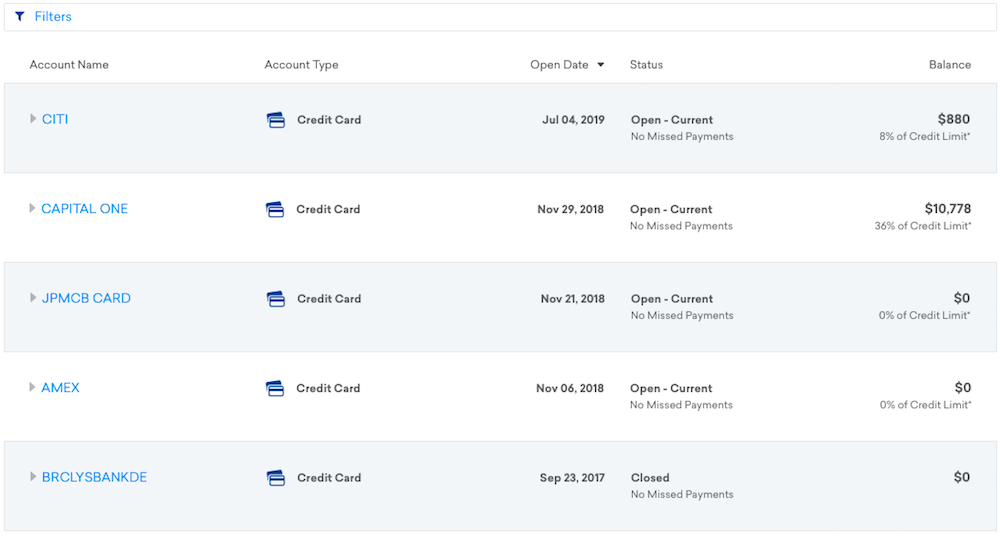

Here are the last five credit card applications showing on my personal credit report:

As you can see, five applications ago was on September 23, 2017, so within the past week I’ve fallen under the limit again.

I generally recommend waiting until the beginning of the following month before applying for cards, so my plan is to apply for my first card on October 1, or a couple of days later.

What’s My Strategy For Getting These Cards?

Each credit card issuer has different policies when It comes to approving people for cards, so I have to be strategic with the order in which I apply. So, what’s my strategy in applying for these cards?

Chase Cards Are The Top Priority

Chase cards are the top priority from an approval standpoint, since I just got under the 5/24 limit. If I apply for another personal credit card now I’ll once again be at the 5/24 limit, and won’t be able to get either of the Chase cards I want.

So, what’s my plan? The IHG Premier Card is the most important card to me, but my plan is still to apply for the Southwest Rapid Rewards Performance Card first. Why? Because Chase business cards don’t count towards the 5/24 limit.

So right now I’m at 4/24:

- If I applied for the IHG Card I’d be at 5/24 again, and wouldn’t be able to get the Southwest Card

- However, if I applied for the Southwest Card first I’d still be at 4/24, since it’s a business card, and that doesn’t count towards the limit; then I could still be approved for the IHG Card

My concern is that this is a race against the clock, though. The IHG offer is limited time, and I’m not sure how long I’ll have to wait between being approved for a Chase business card and being approved for a Chase personal card.

I think I should be able to be approved for one Chase business and one Chase personal card in less than 30 days, though if anyone has any recent data points, please let me know.

The Citi Double Cash Is Next

Once I’m approved for both Chase cards, my plan is to pick up the Citi Double Cash Card. This card is high priority for me since it will become my new card for everyday spending.

This should be pretty straightforward, and I imagine I’ll be approved.

The Avianca & Virgin Atlantic Cards Are Next

Lastly I plan on applying for the Virgin Atlantic World Elite Mastercard and Avianca Vuela Visa Card® Card. I’ll probably apply for the Virgin Atlantic Card first since I don’t know the offer expiration date, while I know the Avianca offer is valid through December 31, 2019. This will be my first application with Banco Popular (issuer of the Avianca Card) and I’ve heard they can be quirky, so I’m curious to see how that goes.

I might have some issues getting approved for the Virgin Atlantic Card, as there are rumors of Bank of America having new restrictions on credit cards. But I guess I’ll find out firsthand.

Bottom Line

I’m excited about all five of these cards.

In particular, I’m most excited about the IHG Premier Card, given that the card comes with perks that just about anyone should get value out of, and the card is worth holding onto long term.

I’m also really excited about the Citi Double Cash Card, as I’ll now be earning 2x transferable points on all of my purchases, on a no annual fee card no less.

I’m going to try and squeeze in the Southwest Rapid Rewards Performance Card, though I’m hoping I can get approved for both that and the IHG Card in less than a month. My one concern is that I already have a lot of Chase cards (all of which I keep long term), and I’m slightly apprehensive about getting approved for the Southwest Card but then not the IHG Card.

Anything you would do differently with my application strategy?

Greg,

I'm sorry to hear about your experience with Avianca. It does put some fear into me because I guard my rating with my life--as I assume everyone here does.

Jim S

@ Lucky, out of curiosity, why do you plan to put spend on the Citi Double Cash vs. the Amex Blue Business Plus? Are you just stocked up on Amex MR points and looking to build up the ThankYou points stash, or is there some strategic reason that using the Double Cash would be better even if one is agnostic as to earning in MR vs. ThankYou?

@ Lucky

Sep 20, 2017, according to credit karma

With the new Citi Double Cash back option do you think that overtakes the Chase Trifecta (for me not really a trifecta since I don't spend much in the CF categories)?

@ Curious -- Tough to say, all depends on the categories in which you spend the most. As someone who likes diversifying points, I think the strategies can still complement one another. I will use the Citi Prestige for 5x points on dining and 2x points on everyday purchases, and then I will then use my Chase cards for most other purchases.

Unlike Jim S.'s comment above, DO BE AFRAID of the Avianca Credit Card. Banco Popular will not hesitate to substantially ding your credit rating over disagreements. They made an error in charging my card something like $25-$35 dollars -- I disputed it -- and next thing I knew my credit rating had dropped 90 points and I'm still trying to recover nearly two years later.

@Lucky, I applied for and was approved for the Ink Business preferred card (using my LLC’s TIN) earlier in September and then the same week I was approved for that card I applied for and was approved for the IHG card. YMMV but in my case same month was fine.

Brian,

Don't be afraid of the Avianca card. It works and can pay off quite well. The widely advertised card start up stretched their poor little organization for a while, but they've gotten through it, improved web site, etc.

Calling can be difficult due to language and accent...depending on what your is. And, worst of all, I've never gotten a clear phone connection. I always get my answer, but sometimes it took a long, halting conversation.

Isn’t Avianca card a disaster?

@Lucky

In regards to your question about data points for applying for a chase biz and personal close to one another- I applied for the Biz Unlimited then applied for the IHG card no more than a week later. The IHG was instant approval and for the Biz Unlimited I went through an address verification bc I moved recently. Ultimately I was approved for both. Hope that helps.

What about BOA's new restrictions? Or do you use them for regular banking? One other alternative is the good old AOR.

Frank it is a separate legal entity but many people use their SSN instead of a TIN # and apply for business cards as sole proprietors. Many of those people don’t have a business of any kind. This has been a great way To get around CHASE 5/24 rule.

@Frank

A business is a separate legal entity from a person. Many people who post on these points and miles blogs keep forgetting that cardinal principle.

@Thanks K.M. - I think that hotel is going on my bucket list.

Curious how come you are applying for the IHG instead of Hyatt--do you already have the Hyatt? And if you had to choose just one, which would you go for? Thanks.

Hi, I was wondering also what service you use to get your credit report to monitor 5/24. Thanks

@Lucky

Do you have a Citi card you can convert to double cash? That's better since no sign up bonus on the DC.

@Terri hey it's the Shanghai wonderland :-) Last time I checked there was a lot of points availability.

What service did you use to get your credit report?

What hotel is pictured in this article? Looks really cool!

Thanks Ben! I thought that was the case as well..

You don't have to wait for October to be under 5/24. My fifth newest credit card is also opened in Sep 2017. I applied for CSR on Sep 1st and got approved. Once you are in your 25th month, you're good, you don't have to wait for the 26th month.

@ HYY369 -- Hmmmm, that's interesting, and the first time I've heard that. Do you know exactly what date in September 2017 your fifth application was? Curious if any people have similar experiences.

In case the Southwest Companion Pass is of value to you, wait until around October 4th or 5th before applying for the Southwest card. That way, if you time your spending right and hit the minimum spend on January 1st (with it posting a day or two later) you will receive 80k towards the 110k needed for the Companion Pass in 2020 and have the rest of the year to earn the other 30k and the pass would be valid until the end of 2021.

Just tried to product change my citi business for citi double cash ! No luck . They said I need to apply. I thought I read somewhere they allow business to personal product changes.

@ Frank -- You can downgrade any personal card, but you can't downgrade a business card. There's not a single issuer that lets you change a business card to a personal card, since the account info is very different.