If you’ve read this far you’re likely sold on the three main flexible points currencies, and for good reason.

These programs are going to give you the most options for redeeming your miles, allow you to transfer to any of the major alliances, and help protect you against major changes to any single airline program.

How To Get Credit Card Points

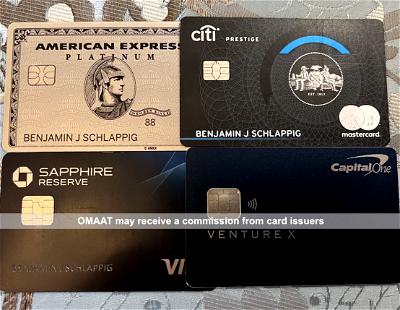

So if you are only going to open one new credit card, I would recommend the Chase Sapphire Preferred® Card. It has the best all-around benefits, has great bonus categories, and you earn Ultimate Rewards Points, which are incredibly versatile. It also has a reasonable $95 annual fee.

The Chase Sapphire Preferred® Card offers 3x points dining, 2x points on travel, plus has no foreign transaction fees, so is great to use when traveling abroad.

Alternatively, it could make sense to apply for the Chase Sapphire Reserve® Card, which is the premium version of the Preferred. It has a $550 annual fee, but offers a $300 annual travel credit, airport lounge access, 3x points on dining and travel, and many other perks that make it a keeper.

While you want to be careful not to over-diversify your miles and points (keep in mind you’ll generally need at least 100,000 miles per person for an international business class award), it does make sense to accumulate miles in a variety of programs.

The Citi Strata Premier℠ Card (review) is another great option. Not only does it have a big welcome bonus, but it offers triple points on gas stations, supermarkets, airfare, hotels and dining, all with a reasonable $95 annual fee.

If you prefer to earn cash back rewards towards travel, I recommend the Capital One Venture Rewards Credit Card . The card offers two miles per dollar spent, and each mile can be redeemed for one cent towards a travel purchase. In other words, the card offers about two cents of value per dollar spent. You can also get a big chunk of points when you are approved for the card and meet a minimum spend!

I try to highlight the best current credit card offers each month, but if you are just starting out I would choose two or three of the above cards, and then build from there. You’ll also want to keep an eye out for “mega” offers (that can be as high as 100,000 miles), so stay tuned to the blog for updates!

Business Credit Cards

The other way to really bolster your mileage balances is by taking advantage of small business credit cards. These often have different bonus categories and benefits, and can pair nicely with the personal cards.

You don’t have to have a company with a tax ID to apply. Any business — even a sole proprietorship — would make you eligible. If you’re a sole proprietorship without a tax ID then you’d just put your social security number in that field.

I know many people that have been approved for small business cards with start-ups and limited business income. Just be honest about the type of business, income, and so forth.

Meeting Minimum Spends

Most of the great credit card offers award a certain number of miles or points after a certain spending requirement is met in a given period of time. We typically refer to these as “minimum spends” – the bare minimum amount you need to spend on a card to receive the reward being advertised.

This is a key part of earning points through credit card applications – you must keep track of how much you’ve spent, and when the deadline is. It makes no sense to sacrifice points on your credit score if you aren’t going to get the welcome bonus!

I typically just set a calendar reminder for the date I need to complete the spend requirement, and a second for when I expect the points to post, so it doesn’t have to be a complicated system.

While it can be intimidating to meet minimum spending requirements, there are probably more opportunities than you realize to place every day charges on your credit card. Things I’ve done in the past include:

- Putting even small charges on your credit card, rather than using cash

- Paying auto, health, and home insurance online

- Some universities, apartment buildings, and other institutions accept credit card payments

- You can make federal tax payments via credit card for a small fee (I wouldn’t make a habit of this, but it can make sense if you wouldn’t otherwise meet the minimum spend)

- It may even make sense to buy a few gift cards (say, to the gas station) for shopping you plan to do next month if it helps you reach the spending threshold.

There are also more creative methods, but let’s stick to the basics for now 😉

Maximizing Credit Card Rewards

There are so many ways to maximize credit card rewards as a beginner. The first step is to evaluate where you do the majority of your spending. If you spend $2,000 on groceries each year, that could be 2,000 points on one card or up to 14,000 on another!

The bonus categories for spending at certain types of merchants can really add up, even for someone on a strict budget. Some of the most common categories with bonus points are travel, restaurants, and groceries, but you can still earn extra points on the purchases you make everyday too!

It’s also worth mentioning that you and your significant other can apply for cards separately. Bank applications ask for your household income, so this is a great way to double your potential rewards!

The welcome bonuses on these cards will get you well on your way to improving both the quality and the quantity of your travel. The next step is to make sure you’re leveraging every opportunity to build those mileage balances!

My question is how do you know how long to hold a credit card. At some point you MUST cancel some?? Right? No one talks about that

If I get approved for a business card, can I put personal expenses on it? I have a side hustle that generates a little extra money so I qualify for a business card, but my business expenses are almost nothing and there's no way I'd ever meet the minimum spend to get the welcome bonuses with business expenses alone.

of course you can. My side hustle is so small I haven't applied for biz cards, I can't see them getting approved, But once you have one, there is no rule on what you may charge on it.