I wanted to publish an updated review of the Virgin Atlantic World Elite Mastercard®, since this is a card that may not be on many peoples’ radar and there are a few perks that are worth being aware of. In this post I wanted to take a closer look at the card, and also compare it to some other cards out there.

In this post:

Virgin Atlantic Credit Card Basics for July 2025

The Virgin Atlantic Credit Card has one of the best returns on spending of any airline card, offers some perks just for having the card, and also has some spending bonuses that could even make it worthwhile to use this card for your purchases.

While many people may have heard of this card before, most people probably aren’t too familiar with how the benefits of this card work, especially as the card recently introduced a companion ticket benefit. So let’s start by talking about some of the basics of the card, then we’ll look at the annual fee, and finally, we’ll compare it to some other cards.

Virgin Atlantic’s new A350 Upper Class

Virgin Atlantic’s new A350 Upper Class

Bank Of America Application Rules

The Virgin Atlantic Card is issued by Bank of America, which has some application rules that are worth being aware of. You can read more about those here.

$90 Annual Fee

The Virgin Atlantic Mastercard has a $90 annual fee. That’s marginally lower than the $95-99 annual fees you’ll find on many other airline credit cards. There’s no cost to add authorized users to the card.

60,000 Bonus Points

Earn 60,000 bonus Virgin Points after spending $2,000 or more on purchases within the first 90 days of account opening

5,000 Bonus Points For Adding Authorized Users

The Virgin Atlantic Card typically has a bonus for adding authorized users, where you can receive up to 5,000 Virgin Points. You receive 2,500 Virgin Points for each of the first two authorized users you add to the card.

15,000 Bonus Points Anniversary Bonus

You can receive 15,000 Virgin Points on your account anniversary every year for completing certain spending. You receive 7,500 bonus Virgin Points if you spend a total of $15,000, and an additional 7,500 bonus Virgin Points if you spend a total of $25,000.

So if you spend a total of $25,000 on the card in an anniversary year you’d receive 15,000 bonus Virgin Points.

Virgin Atlantic A330

Virgin Atlantic A330

No Foreign Transaction Fees

The Virgin Atlantic Credit Card has no foreign transaction fees, so it’s a good card to use for purchases abroad.

Earning Points With The Virgin Atlantic Card (1.5-3x Points)

Among airline credit cards, the Virgin Atlantic Credit Card has a pretty good rewards structure. The card offers 3x points on Virgin Atlantic purchases and 1.5x points on all other purchases.

While not industry-leading, I’d say 1.5x points per dollar spent could be well worth it.

Virgin Atlantic 787-9

Virgin Atlantic 787-9

Tip: Spend $25,000 On The Card Per Year

There is a “sweet spot” to this card, which is spending exactly $25,000 every anniversary year. That’s because you’d receive 15,000 bonus points.

On top of that, you’re earning 1.5x points per dollar spent, meaning that for $25,000 worth of spending you’d actually earn 52,500 Virgin Points, which is more than two points per dollar spent. That’s pretty good!

That doesn’t even factor in the potential other benefits offered by the card for spending, which I’ll talk about below.

Virgin Atlantic Credit Card Benefits

The Virgin Atlantic Credit Card offers some potentially useful benefits. These can help you earn status in the Flying Club program, and can also get you a companion award ticket, which could get a lot of value to cardmembers.

How do these work?

Annual Upgrade Or Companion Ticket

This is a benefit that was only recently added to the card, which has the potential to be pretty useful. If you spend at least $25,000 on the card per anniversary year, you receive your choice of an anniversary award benefit. You have two choices, both of which need to be redeemed within two years of when they’re issued:

One Cabin Upgrade Benefit

You can select a one cabin upgrade for the primary cardmember from economy to premium economy when flying on a reward flight. This is only valid for reward flights, and isn’t valid for an upgrade to Upper Class.

Companion Award Fare

Alternatively, you can select one matching companion fare valid in the same cabin class as the cardholder when you redeem points for the ticket. The class into which you can book is restricted based on the primary cardmember’s Flying Club status at the time of booking:

- Red Tier members may redeem points for a ticket in economy class

- Silver Tier members may redeem points for a ticket in economy or premium economy

- Gold Tier members may redeem points for a ticket in economy, premium economy, or business class

Note that you are still on the hook for taxes, fees, and carrier-imposed surcharges on the companion ticket.

While it would be nice if it were valid for Upper Class (business class) for everyone, this is still a nice added perk.

Earn Elite Status With The Virgin Atlantic Credit Card

Having the Virgin Atlantic Credit Card can help you earn elite status in the Virgin Atlantic Flying Club program.

You earn 25 Tier Points for every $2,500 you spend on the card in net purchases. You can earn a maximum of 50 Tier Points per month, and a maximum of 600 Tier Points per year.

For what it’s worth:

- Virgin Atlantic Silver status requires 400 Tier Points every year

- Virgin Atlantic Gold status requires 1,000 Tier Points every year

Access the Virgin Atlantic Clubhouse with Gold status

Access the Virgin Atlantic Clubhouse with Gold status

So you could earn Silver status exclusively through spending on the credit card, and credit card spending could get you over half the way to Gold status.

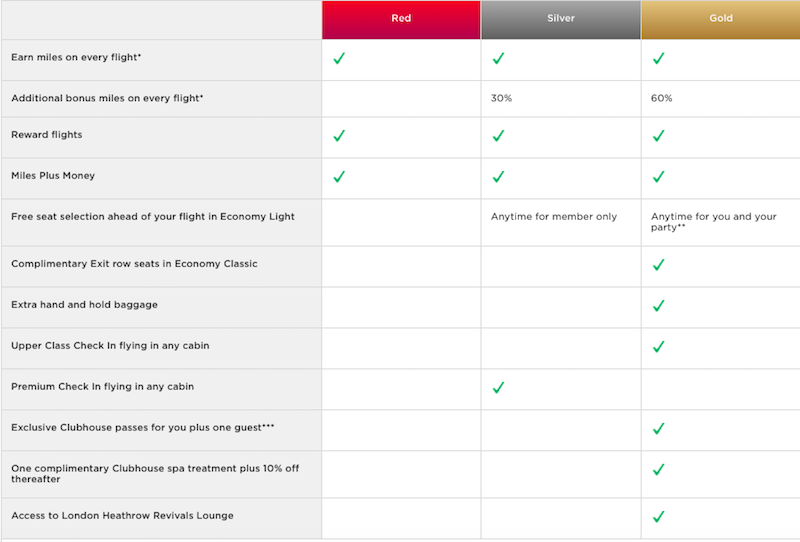

What are the perks of Virgin Atlantic elite status? You can expect perks like bonus points, priority check-in, security, and lounge access, preferred seating, and more. Here’s a full chart comparing Flying Club elite benefits:

Is The Virgin Atlantic Credit Card Worth It?

The Virgin Atlantic Credit Card is definitely niche. However, there are circumstances under which I could see it making sense to spend money on the card.

I really think spending $25,000 on this card every anniversary year is a real sweet spot, as you’d earn:

- 52,500 Virgin Points, which is over two points per dollar spent (this includes 1.5x points, plus the 15,000 bonus points)

- An award benefit, where you can receive either a one-cabin upgrade or a companion award ticket

- 250 Tier Points, which gets you on your way to Virgin Atlantic status

There are no doubt more well-rounded cards, but for someone who would benefit from status with Virgin Atlantic, someone who could use the companion ticket, or someone who values earning over 2x Virgin Points per dollar spent, this is a great option.

Virgin Atlantic’s 787-9 Upper Class

Virgin Atlantic’s 787-9 Upper Class

Tip: Earn Virgin Points With Amex & Chase

In general, I recommend trying to rack up points in a transferable points currency whenever possible. That’s because transferable points currencies:

- Give you a lot more flexibility, since you can earn the points now and later decide how you want to redeem them

- Let you earn points at a faster rate, since they often have bonus categories that can get you outsized value

- Sometimes offer transfer bonuses when you redeem points, especially with Virgin Atlantic

So while there are circumstances where it could make sense to spend money on the Virgin Atlantic Card (like if you spend $25,000 on the card every anniversary year), overall you’re going to rack up Virgin Points at a faster pace through programs like Amex Membership Rewards or Chase Ultimate Rewards.

See here for the best credit cards for earning Amex Membership Rewards points, and see here for the best credit cards for earning Chase Ultimate Rewards points.

There are lots of great credit cards that can potentially earn you Virgin Points

There are lots of great credit cards that can potentially earn you Virgin Points

Virgin Atlantic Credit Card Summary

If I had no credit cards and was just looking for a single card to use for my everyday spending, this wouldn’t be the card I’d go for. However, for someone who has had a lot of other cards, or who flies Virgin Atlantic a lot, this card could be a good option.

In general, I’d much rather use a card earning transferable points for my everyday spending, like earning Amex or Chase points, for example, but I do think it could actually make sense to put spending on this card at the right thresholds.

I think this card can make a ton of sense to pick up. It has an excellent bonus so you can apply for the card and then see how the card works for you. You can even try to spend $25,000 on the card, which I consider to be a sweet spot. Then after the first year you can decide if it’s worth holding onto long term.

If you want to learn more about the Virgin Atlantic Mastercard or apply, follow this link.

Is there a Virgin Atlantic card not affiliated with Bank of America. BofA sucks.

Does anybody know how long it takes for the anniversary bonus miles to post? I do not wish to keep this card past 1 year mark, but i might try meeting the $15k spend for the bonus, then cancel the card.

Hi Lucky, is the companion award only valid on VS metal, or could you use it (for example) on a Delta flight from US to Europe to keep the taxes and fees low?

I would also add that Mastercard works well with Plastiq for a number of charges that neither Visa or Amex will allow. Also, we did an Amex transfer of points a couple years ago and flew VA from England to the US in Premium Economy for 17.5K points. That wasn't such a bad deal as I generally do not sleep on the plane when it flies mostly in daylight.

Good article, something to think...

I would also add that Mastercard works well with Plastiq for a number of charges that neither Visa or Amex will allow. Also, we did an Amex transfer of points a couple years ago and flew VA from England to the US in Premium Economy for 17.5K points. That wasn't such a bad deal as I generally do not sleep on the plane when it flies mostly in daylight.

Good article, something to think about. I also need to think about opening a BOA checking account to get around some of their new rules.

Does VS Gold status get you lounge access on Delta domestic flights, in the same way One world sapphire from anyone but American does with American?

Other than the sign-up bonus this card doesn't seem that promising

Can someone confirm if this card still has trip delay insurance (an earlier version did)

Meeting the min spend on this card gets you halfway to the 120k points needed for a RT first class ticket Japan on their partner ANA. I’m considering getting this card just for that purpose alone - it’s a helluva sweet spot.

Maybe you should consider the value Of Virgin Atlantic miles to buy Delta tickets. I think that moves the needle on the value of the VA Mastercard a lot.

I’m interested in using VA miles for ANA awards, but wondering if VA program has family miles like BA or Etihad?

Who here has any value for this card other than the welcome bonus?

Between the periodic transfer bonuses from CC's (Citi and AMEX) and the overall limited value (other than ANA) for Virgin Atlantic miles, this card isn't particularly attractive. Depending on your spend and end of the year scenario, the Tier Points might be the most attractive perks.

@ Jeremy

Totally agree. Additionally, you can always transfer those miles elsewhere rather than locking yourself with just Virgin Atlantic.

A lot has been left out of this review. They price each segment, so direct flights are helpful.Also fuel charges can be high.

@Lucky,

If we can get a business card, doesn't it make more sense to just get/use a Blue Business Plus card? It gets 2x everywhere (up to 50K, but you were saying to spend 25K on this one). BBP has $0 annual fee too. You lose some of the benefits, but you'd get about the same amount of miles 50K vs. 52.5K. This doesn't take into account the occasional 20-40% transfer bonus though. With this approach I don't lose a HP on my personal and I save $90.

Just my $0.02