This week United Airlines secured $5 billion in financing thanks to the MileagePlus loyalty program. But at least to me there’s something much more interesting than that…

In this post:

United secures $5 billion from MileagePlus

All major airlines are looking to build up cash reserves given the uncertainty at the moment, and loyalty programs can make great collateral, given what big businesses they are, and also given how profitable they typically are.

United has announced plans to have $17 billion in liquidity at the end of the third quarter, thanks to an additional $5 billion of committed financing secured through the company’s loyalty program.

Goldman Sachs Lending Partners LLC, Barclays Bank PLC, and Morgan Stanley Senior Funding, Inc., have committed to providing the financing, which is expected to close by the end of July 2020.

United is using the MileagePlus program to raise cash

United is using the MileagePlus program to raise cash

Newly revealed details about United MileagePlus

United has a new 8-K SEC filing that reveals some fascinating information about the MileagePlus program. Generally speaking programs are tight-lipped about so many aspects of their membership, though a lot has been revealed here.

To start with some basic details:

- United MileagePlus has over 100 million members

- 50%+ of United’s flight revenue is from MileagePlus members

- The program generated $5.3 billion cash flow from sales in 2019, which represents roughly 12% of United’s overall revenue

- The program generated $1.8 billion EBITDA, which represents roughly 26% of United’s total adjusted EBITDA

Over 50% of United’s flight revenue comes from MileagePlus members

Over 50% of United’s flight revenue comes from MileagePlus members

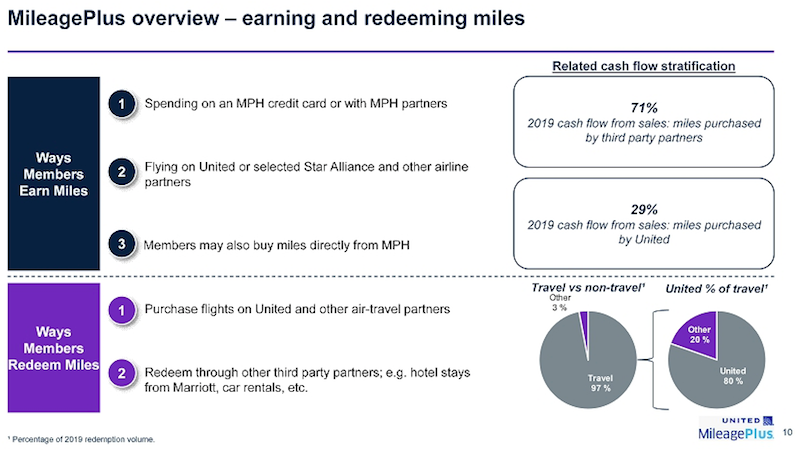

How MileagePlus miles are earned by members

This is where it gets really interesting to me. First of all, when it comes to miles being issued:

- 71% of cash flow comes from the sale of miles to third party partners

- 29% of cash flow comes from the sale of miles directly to United

- 97% of miles are redeemed for travel, while only 3% of miles are redeemed for non-travel rewards

- Of miles redeemed for travel, 80% are redeemed for travel on United, while only 20% are redeemed for travel on partner airlines

Those are all things that are cool to know, but I would assume most of these aren’t that much of a surprise.

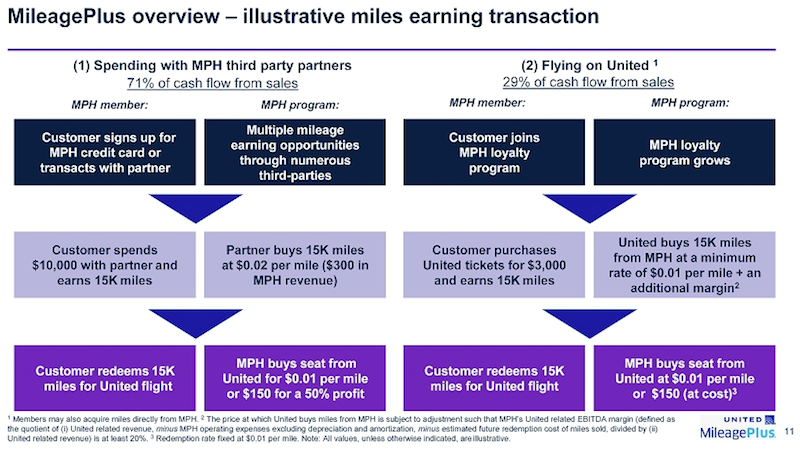

It’s the page about earning and redemption costs that I find most interesting. It’s noted that the numbers are for illustrative purposes only, but even then I still find this intereting:

- For the 71% of cash flow from sales to third party partners, United claims that on average partners buy miles at the cost of $0.02 each

- For the 29% of cash flow from sales directly to United, United is paying $0.01 per mile, plus an additional margin

- When it comes to members redeeming miles, MileagePlus essentially buys seats from United at the cost of $0.01 per mile

- We don’t know if the $0.01 and $0.02 numbers are accurate (since they’re illustrative), but presumably the margin is, which is to say that United’s redemption costs are about half the cost at which they sell miles, based on their math

United probably isn’t selling miles to partners for $0.02

I suspect that the above numbers must be way off (unless United has the sweetest agreements ever) in terms of how much they’re selling miles to partners for. There’s simply no way they’re selling miles for $0.02 each on average:

- United often sells miles directly to consumers for under two cents each, so you’d expect they’d have lower prices when third parties buy in bulk

- Presumably not all partners are paying the same costs; I would assume Chase has among the most attractive pricing, given co-branded credit cards and the Ultimate Rewards program

- I know that at least some other programs are compensated in the range of 1.0-1.5 cents per mile through transferable points currencies, but I’ve never heard of a program getting more than 1.5 cents

If these numbers truly are only illustrative, then I’d guess United is actually selling miles for closer to 1.5 cents each. If that’s the case, I guess you could also assume they’re internally accounting for redemptions at about half that cost, which is significantly less than a cent per mile.

Is United charging credit card partners two cents per mile?!

Is United charging credit card partners two cents per mile?!

Bottom line

United has secured an additional $5 billion loan thanks to MileagePlus. That’s great and all, but the amount of info in the 8-K filing about MileagePlus is unlike anything I’ve seen before, and I find a lot of it to be super interesting.

I don’t think United is actually charging partners two cents per MileagePlus miles, because that seems on the (way) high side. However, it does seem that in general United’s redemption rates are about 50% of the cost at which they’re selling miles to partners.

Perhaps the way United is internally billing for redemptions also explains why the program is increasingly moving revenue based.

What details of this filing do you find to be most interesting?

I also find it hard to believe United is selling its miles to partners at $0.02/mile.

One of my companies is a Travel Industry Marketing firm. One of our projects was to build a cross-promotional relationship between CO (before the merger) and a major International brand which I will not reveal to protect confidentiality. Purchase of Onepass miles was one facet of the campaign. The price per mile paid to CO of $0.015 plus of course, advertising impressions and various other benefits CO would receive. At the time, this appeared to...

One of my companies is a Travel Industry Marketing firm. One of our projects was to build a cross-promotional relationship between CO (before the merger) and a major International brand which I will not reveal to protect confidentiality. Purchase of Onepass miles was one facet of the campaign. The price per mile paid to CO of $0.015 plus of course, advertising impressions and various other benefits CO would receive. At the time, this appeared to be the going rate for very large points consuming relationships aside from CC's. CC companies negotiated better pricing due to the sheer volume and continuity which was proprietary and of course never revealed to me (no need to know). This project was not UAL of course but seems to have been industry standard at the time.

Is it just me or has the frequency of comments being held in moderation increased. It seems like my every other comment is moderated, which is a puzzle when there is not a single word that could flagged as 'offensive' in most of the comments that are 'moderated'...

Then why is UA trying so hard to kill its golden goose? Due to their punitive rule changes for making top elite, I was already all the way out of MP and looking forward to becoming a SQ Gold by May 2020 and then CV-19 happened. Even with the status extension, which is really great, I am going to focus on making SQ Gold asap when long-haul flying resumes. It is likely that I will...

Then why is UA trying so hard to kill its golden goose? Due to their punitive rule changes for making top elite, I was already all the way out of MP and looking forward to becoming a SQ Gold by May 2020 and then CV-19 happened. Even with the status extension, which is really great, I am going to focus on making SQ Gold asap when long-haul flying resumes. It is likely that I will hold both UA 1K and SQ Gold for a while before I lose the 1K status and focus on maintain SQ Gold.

@ernesto illustrative is an example

Slide 26 is one of the more important and relevant slide fo the presentation. It lays out the aggregate financial data regarding the MP Program. That is what potential lenders will look at in determining credit risk.

Anyone who thinks Chase ( a primary revenue contributor to MP revenues) would be a likely lender , just shows their lack of understanding of how financial markets work ( Chase would have a massive conflict of...

Slide 26 is one of the more important and relevant slide fo the presentation. It lays out the aggregate financial data regarding the MP Program. That is what potential lenders will look at in determining credit risk.

Anyone who thinks Chase ( a primary revenue contributor to MP revenues) would be a likely lender , just shows their lack of understanding of how financial markets work ( Chase would have a massive conflict of interest and thus would be nowhere near being a lender on this transaction).

Just Saying!!

i am amused at the ignorance of so many folks commenting on forums such as this regarding how US capital markets work with Ben (Lucky) being one of them, along with folks like Ron, Duncan and Sean whose posts are shown above.

As a former (now retired) US financial capital markets professional, my suggestion is that all you folks stick to the business of frequent flyer miles, lounge access and privileges etc.

Please leave...

i am amused at the ignorance of so many folks commenting on forums such as this regarding how US capital markets work with Ben (Lucky) being one of them, along with folks like Ron, Duncan and Sean whose posts are shown above.

As a former (now retired) US financial capital markets professional, my suggestion is that all you folks stick to the business of frequent flyer miles, lounge access and privileges etc.

Please leave the workings of the financial markets to others who have a better understanding of these matters.

Lucky,

To me the most interesting thing in this financing deal is the absent of Chase as participating lender. Intuitively, I thought Chase should be the one who lead this financing round as they're the ones with the most risks given they generate 71% of the demand for MP miles thru their credit cards deals.

@ Ben - Have you seen that Emirates is not charging YQ on their flights redeemed through partners?

On JAL MB, Alaska MP, Gol Smiles and TAP M&G, just airport taxes are being charged. What I find strange is that Skywards still charges for YQ (don't know about Qantas).

Illustrative = fact ?

English is not my first language so please help me understand.

Even though the EBITDA out-performs the airline as a whole, it's of course not going to stop United from continuing to hack away at the MP value proposition. Keep trying to kill the golden egg and see what happens...

A well run points program is a cash cow for any airline i.e. QF 50% of total profits from their FF program. If the points have a value above the paid price by say credit cards, their customers may value these at a higher rate than the supplier paid for them. People want to use your crefit card because of the points and the bank has to buy more from the airline and the airline...

A well run points program is a cash cow for any airline i.e. QF 50% of total profits from their FF program. If the points have a value above the paid price by say credit cards, their customers may value these at a higher rate than the supplier paid for them. People want to use your crefit card because of the points and the bank has to buy more from the airline and the airline makes money. QF at the moment is promoting heavily with all its partners "points earns" in adition for QF you can now earn status by selected dollars spend on products or CC. QF is marketing their FF points aggressivly to earn funds in a non flying environment and me thinks their new most profitable department is the FF Program. If it was .02 per dollar spend (2%) most buinesses and bank merchant fees could easily handle this with ease if it does provide an increase in turnover relative to the investment. Mind you in redeaming these points and the conversion rate charged to do so is another area of profit for the FF program and it's partners!

Based on the fine print, United is paying MPH at least 1.2 cents per mile (since the 1 cent per mile ticketing expense back to united plus the 20% margin makes 1.2 cents). Could be more depending on whatever other operating overhead might go into the breakdown on that portion, but for simplicity in calculating lets pretend that's 0.

You can then take the fact that 29% of total miles are sold at 1.2 cents...

Based on the fine print, United is paying MPH at least 1.2 cents per mile (since the 1 cent per mile ticketing expense back to united plus the 20% margin makes 1.2 cents). Could be more depending on whatever other operating overhead might go into the breakdown on that portion, but for simplicity in calculating lets pretend that's 0.

You can then take the fact that 29% of total miles are sold at 1.2 cents for an EBIDTA margin at 20% of that revenue, versus an overall total 1.8 billion EBITDA over 5.3 billion of revenue, or ~33% average margin, to estimate that the other 71% being sold to third parties are at an average of ~38% EBITDA margin, or around 1.38 cents per mile.

This is all napkin math so there could be other factors throwing it off: Accounting profit due to devaluations reducing the value of outstanding miles, people with expiring miles, the 3% going to subpar rewards, etc.

I also haven't accounted for any expenses united reports.

Finally it assumes 1 cent is the current value united actually gets 'paid' by MPH for each mile in ticket booking. The slide seems to imply that number specifically is real, but its not 100% clear.

@ Lucky You are reading way too much into the illustrative example.

The 8K filing is an SEC requirement which requires United to show how the Mileage Plus Program works. United is required to show the simplest example of how the program works . It is not required to show actual realized numbers.

The actual financial results of the Mileage Plus program (income statement, summary balance sheet and cash flow data are required to be...

@ Lucky You are reading way too much into the illustrative example.

The 8K filing is an SEC requirement which requires United to show how the Mileage Plus Program works. United is required to show the simplest example of how the program works . It is not required to show actual realized numbers.

The actual financial results of the Mileage Plus program (income statement, summary balance sheet and cash flow data are required to be shown ) and these are detailed in Slide 26 and labeled Mileage Plus Financials.

I think that was just an example. I wouldn't consider buying 15k miles as 'bulk'. I'd imagine the third-party would normally buy United miles in millions to qualify for the bulk price.

So MileagePlus pays $0.01 per point paid by the customer to United or they reimburse based on a hidden award fare like a partner would?

What % of the miles expire or aren't used within 5 years of earning/purchasing?

You did read that the values on slide 11 (the one you are referring to regarding the price partners pay for miles) are illustrative only, right?