There are lots of reasons to pick up a credit card — some are worth getting for the welcome bonus, some for the return on spending they offer, and some for the long term perks that they offer.

There are a lot of cards that offer big welcome bonuses and a generous return on everyday spending. In this post, I figured it would be fun to look at some of the credit cards that offer the best long term perks. I’m not including spending bonus categories, and I’m also not including travel credits, because in many ways I view those as offsetting the annual fee, rather than being an actual “perk” of a card.

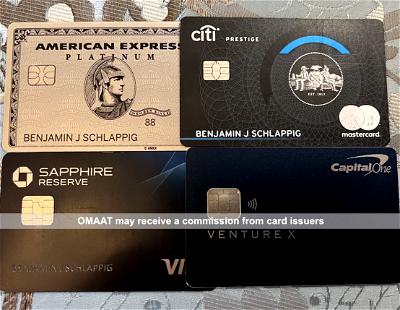

In this post, I’m focusing on six of my favorite perks offered by any credit cards, in no particular order.

In this post:

Too-good-to-be-true authorized user perks

The Capital One Venture X Rewards Credit Card (review) has a $395 annual fee, and that’s easy enough to justify based on the perks, which include a $300 annual travel credit, 10,000 anniversary bonus miles, a Priority Pass membership, Capital One Lounge access, primary rental car coverage, cell phone protection, and more.

I’d argue what really differentiates this card is that you can add up to four authorized users at no additional cost, and each authorized user receives a Priority Pass membership and access to Capital One Lounges. There aren’t many premium cards that let you add authorized users at no cost and get perks that valuable, making this a great card for families.

Top tier Hilton status without credit card spending

The Hilton Honors American Express Aspire Card (review) is in my opinion the most lucrative hotel credit card out there. The card has a $550 annual fee, but offers incredible perks, including Diamond elite status, an anniversary free night certificate, a $400 annual Hilton credit, a $200 annual airline ticket credit, and a $199 annual CLEAR® Plus credit.

This card pays for itself over and over, in my experience, and getting top tier status with a hotel group without any sort of a spending requirement is pretty remarkable.

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Valuable Marriott status without credit card spending

It’s not just Hilton offering valuable elite status without any spending requirement. Nowadays the Marriott Bonvoy Brilliant® American Express® Card (review) is pretty lucrative in that regard as well.

The card has a $650 annual fee (Rates & Fees), and offers several worthwhile benefits, including Marriott Platinum status, an anniversary free night certificate worth up to 85K points, a $25 monthly dining credit, a Priority Pass membership (Enrollment required), and more.

I think the math very much checks out on this card — you’re getting up to $300 in annual dining credits, and the free night award can easily be redeemed at a property costing hundreds of dollars.

You’re then getting Bonvoy Platinum status, which offers perks like suite upgrades, complimentary breakfast, guaranteed late check-out, and more.

American Admirals Club access for authorized users

The Citi® / AAdvantage® Executive World Elite Mastercard® (review) is the most premium American Airlines credit card, and it has a $595 annual fee. Like many premium credit cards, this one offers lounge access. However, the perk is a bit more generous than what you’ll find on other cards.

With the Citi AAdvantage Executive Card, not only does the primary cardmember get an Admirals Club membership, but authorized users on the card receive Admirals Club access as well. The best value is that you can pay a total of $175 for the first three authorized users (after that you pay $175 per authorized user). In other words, for the first three authorized users you’re potentially paying under $60 each.

Each authorized user is able to bring up to two guests or their immediate family into Admirals Clubs when flying American or an eligible partner airline the same day.

Annual hotel free night certificates

It can be worth having hotel credit cards simply for the perks that they offer, as some cards offer both elite status and free night certificates. For example, the $99 annual fee IHG One Rewards Premier Credit Card (review) and IHG One Rewards Premier Business Credit Card (review) each offer an anniversary free night award.

These can be redeemed at properties costing up to 40,000 points per night. It’s even possible to supplement these with points to redeem at a hotel costing any amount. This is only one of the many great perks of the cards, as they also offer IHG One Rewards Platinum status, and more.

Similarly, the World of Hyatt Credit Card (review) has many great perks, including a Category 1-4 free night award annually. To me, that alone more than justifies the $95 annual fee on the card.

Travel & rental car protection

Nowadays we’re seeing a lot of travel disruptions, so having some kind of coverage when things go wrong really comes in handy. This could include trip delay coverage, lost or delayed baggage coverage, or rental car coverage.

There are many cards offering these kinds of perks, though I tend to think that the Chase Sapphire Preferred® Card (review) and Chase Sapphire Reserve® Card (review) are the leaders in their respective competitive sets. This is one of those benefits that’s hopefully not needed 99% of the time, but when it is needed, it really comes in handy…

Bottom line

There are lots of reasons to consider picking up a credit card, ranging from big welcome bonuses, to generous returns on spending, to valuable perks. The above are some of my favorite credit card perks, ranging from lounge access, to authorized user benefits, to hotel status, to hotel free night certificates. These are all perks that I think people could get a lot of value out of even if they don’t plan on spending a lot on a particular card.

What are your favorite perks offered by any credit card?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Marriott Bonvoy Brilliant® American Express® Card (Rates & Fees).

@Paul Weiss I am in Germany now, and before we left I saw that my AAA insurance doesn't cover us for liability outside the US. But then I found that in Germany the liability is included in the rate by law. Shockingly a very nice Kia Sportage for only $500 for 2 weeks.

Also note that many credit cards don't cover even collision in Italy.

One huge advantage to the Chase CDW coverage is that it is zero dollar deductible and covers rentals in nearly all countries. Furthermore CDW when purchased from the agency rarely covers glass or tires, Chae does.

I have used it to cover the loss of a totaled car in Nicaragua, radio theft in Nicaragua, coconut falling on a windshield in Costa Rica, and repair cost to repair a flat in Cyprus. The paperwork at...

One huge advantage to the Chase CDW coverage is that it is zero dollar deductible and covers rentals in nearly all countries. Furthermore CDW when purchased from the agency rarely covers glass or tires, Chae does.

I have used it to cover the loss of a totaled car in Nicaragua, radio theft in Nicaragua, coconut falling on a windshield in Costa Rica, and repair cost to repair a flat in Cyprus. The paperwork at times can be daunting but in all four cases my claims were settled.

The ability to scrape ice off a windscreen so that you can drive home.

Brian Kelly used it to cut cucumber once.

He's probably still high from a party.

I'm sorry but all these super premium annual fee cards, when in the hands of one person, is a recipe for getting poor slowly. I don't dispute that one good premium card might pay for itself. But get all of them and you're a sucker.

I think this article was a bit basic and I think the benefits are equally the drawbacks. While the high hotel status provides a great benefit easily, then the benefits at the specific hotel properties have gone down and other issues come up as a result of so many people with the status. I also think the Marriott free night certificates are easier to use than IHG and in general can be used at better...

I think this article was a bit basic and I think the benefits are equally the drawbacks. While the high hotel status provides a great benefit easily, then the benefits at the specific hotel properties have gone down and other issues come up as a result of so many people with the status. I also think the Marriott free night certificates are easier to use than IHG and in general can be used at better properties. One thing that has annoyed me about this is many properties are not charging just above the amount so you cannot use it at as good of a property as before. Some benefits that are cash value and do not divide into smaller increments are also good.

For someone renting cars here and there, few times a week, you don’t need a credit card with primary cdw, but for road warriors and folks who rent a lot it absolutely is worth it and the savings absolutely adds up. Liability can be covered via your own insurance (which you must have), and if you need to use liability then it means you got in to huge crash and you have more important things to worry about.

CDW is only one side of the insurance. It protects the car you're renting (with exclusions for high-end cars). Frankly, this type of insurance is very cheap.

Liability is the other side of the insurance and much more expensive. No credit card offers liability protection. Any renter who does not have a personal automobile liability policy is well advised to buy the rental agency's supplemental liability insurance, which runs ~$15 per day.

Also, Turo and similar non-traditional agencies are not considered car rental agenices by credit cards.

Great comment, Paul. I’ve never understood the fascination with the car rental insurance perks of CCs. I guess maybe if you’re renting a car on a weekly basis for work those *small* savings could add up, but otherwise just pay the $20 per day for “walk-away insurance” and have peace of mind.

Not to mention, “luxury” exclusions are pretty broad and include most nice cars.

Calling collision insurance very cheap and liability much more expensive. Do you ever pay for insurance?

Your imaginary biglaw $3M Bugatti on PS5 doesn't count.

LOL, Paul Weiss is really a juvenile with big fluff. You remind Tim Dunn of himself in middle school. At least you own your fluff and you're not claiming fluff as facts like little Timmy.

Amex offers a policy for about 17.95 or so per rental, not per day. You have to enroll each of your cards, etc. It's been a few years that I've had it so I'm not sure what the coverage amounts are now. And perhaps the rate has gone up a buck or 2.

The Aspire is still pretty great even after the recent changes.

How valuable is CDW if your regular car insurance covers it already? Tier status dillusion is a bad thing. Marriott FNCs have become less and less usable with dynamic pricing. Exactly how many authorized users might one actually have and how often might they actually travel? Sounds great but in practice not so much.

Your response means you either

1. Don't own a car.

2. Ignorant and naive.

3. Crazy rich.

Get out of here, Eskimo. You don’t have to be crazy rich to tolerate paying an extra $20 on a car rental.

CDW perks are overrated.

@Redacted

It's $20 per day not per rental.

Hence you fall into category 1 or 2 "Don't own a car" or "Ignorant and naive"

I don’t think you have to be ignorant and naive to not believe in CDW benefits from a CC. I am squarely middle class, travel quite a bit and almost always pay the $20 for peace of mind. I don’t trust the CC benefits to be full proof nor do I want to deal with the aftermath of a rental wreck so I’d spend the money. I also rarely to never rent a car. I...

I don’t think you have to be ignorant and naive to not believe in CDW benefits from a CC. I am squarely middle class, travel quite a bit and almost always pay the $20 for peace of mind. I don’t trust the CC benefits to be full proof nor do I want to deal with the aftermath of a rental wreck so I’d spend the money. I also rarely to never rent a car. I drive for a living until pandemic so avoiding a car was a positive of any vacation we took. Now I have just kept that habit unless we road trip with our dog. Each person has their preferences and your level of risk is higher than mine, I have never got a CC for CDW benefits and could careless about them I’d love cards to save money by getting rid of those instead of jacking up fees, devaluations etc

Ignorance is nothing to be ashamed of. That's why questions exist.

On the other hand dissing someone for asking a question, is.

Forgive my lack of clarity. I'm not talking about the rental car agency's insurance. I'm talking about rental car coverage afforded by a person's AAA insurance, State Farm insurance, etc. Typically an annual rider is available if not already included.

Wouldn't it have been just as easy to answer Fred's question?

Chase CDW is primary so the credit card pays the damages without making a claim against your regular insurance.

Not having to make a claim means the amount you pay for your regular insurance generally won't go up whereas if you don't have CDW or the CDW is secondary it almost certainly will.

@Steve

Unlike you, who knows the answer and the obvious reason behind it.

Anyone who doesn't know that either,

1. Don't own a car.

2. Ignorant and naive.

3. Crazy rich.

I stand by my earlier post.

Venture X Primary CDW covered a $6,000 repair for us. Was a total pain to deal with the process, but worth it in the end for sure.

Yeah, it's great to have the coverage but not great if it's too hard to use it. Would be interesting to see some sort of more methodical look at the actual claims process across all these cards for different coverages (rental, devices, trip delay).

Would your regular car insurance policy have covered it?

Right but the insurance offered by the rental company would have done the same thing… for a trivial daily cost.

CDW can easily be more than half again as much as the car's per day cost. Say, a $48 rate for a mid-size car and $29.99 per day for CDW. So, sorry, not trivial relative to the cost of the service you're buying in the first place. Context matters.

Years ago someone ran into our rental car in the parking lot at Taos Ski Valley. We'd rented using the Chase Sapphire Reserve and Chase took care of everything without any involvement on our part. Could be the process has changed since then but it was wonderful to not have to deal with it.

Except when I need the additional four hours the Amex Platinum gives to return a car to avoid an extra days...

Years ago someone ran into our rental car in the parking lot at Taos Ski Valley. We'd rented using the Chase Sapphire Reserve and Chase took care of everything without any involvement on our part. Could be the process has changed since then but it was wonderful to not have to deal with it.

Except when I need the additional four hours the Amex Platinum gives to return a car to avoid an extra days charge I always use one with Primary CDW and can't see why anyone would do otherwise given the extremely low cost of doing so (net of benefits the Venture X has effectively no annual fee).