Link: Learn more about the Capital One Venture X Rewards Credit Card or Capital One Venture X Business

The Capital One Venture X Rewards Credit Card (review) and Capital One Venture X Business (review) are Capital One’s two premium cards. While each card has a $395 annual fee, the cards offer all kinds of perks that help offset that fee.

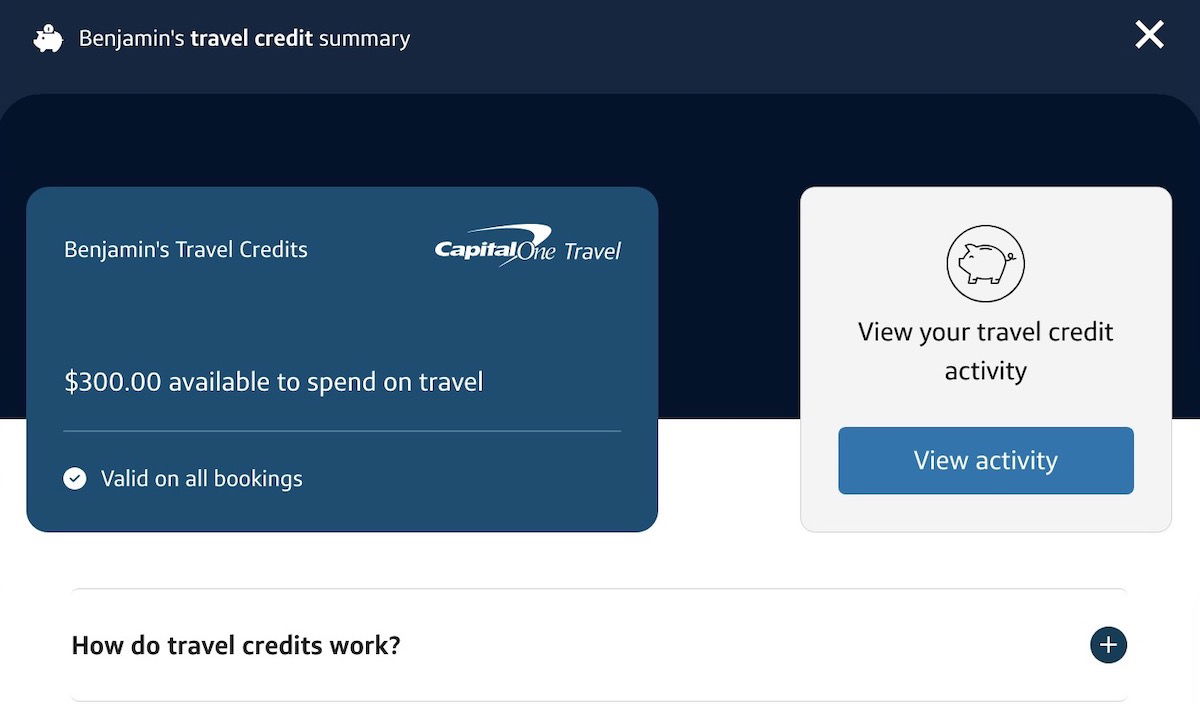

The way I view it, the two biggest perks that help justify the annual fee are the $300 annual Capital One Travel credit and the 10,000 anniversary bonus miles. In this post I wanted to take a closer look at the $300 annual Capital One Travel credit offered by the cards, and how exactly this perk works. Several premium credit cards offer travel credits, but they all work differently, so let’s get into all the details of how this one works.

In this post:

How does the Venture X $300 annual travel credit work?

The Capital One Venture X offers a $300 annual travel credit, which can be redeemed through Capital One Travel. Here’s what you need to know about that:

- The credit applies each cardmember year (or anniversary year, if you prefer), including the year in which you open the card; the credit timing isn’t based on the calendar year

- The credit can be used across one or multiple transactions, until the $300 limit is reached

- There’s no registration required to use the $300 annual travel credit

- Any purchase through Capital One Travel or Capital One Business Travel qualifies toward using this credit, so this credit can be used toward flights, hotels, or rental cars

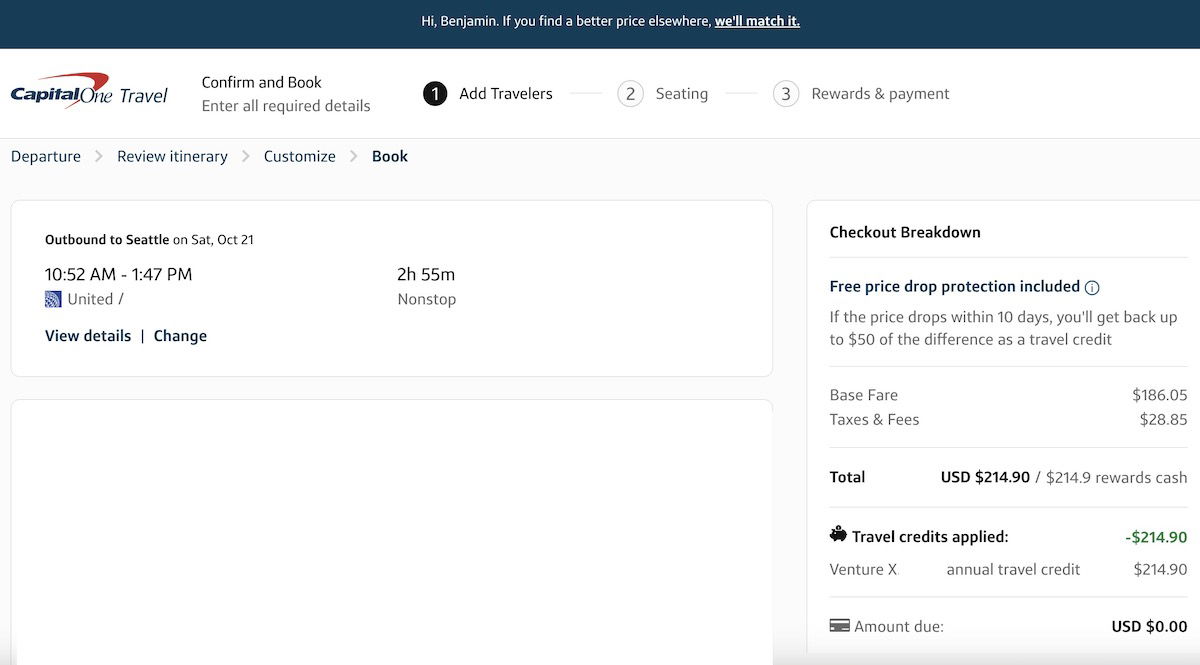

- If you want to use the credit, simply select that you want to pay with the credit during checkout; when this benefit first launched it was issued as a statement credit after the fact, but that’s no longer the case

- If you can cancel a refundable trip booked with the credit, then you can have that credit reinstated, up to the standard expiration date

What travel can you book through Capital One Travel?

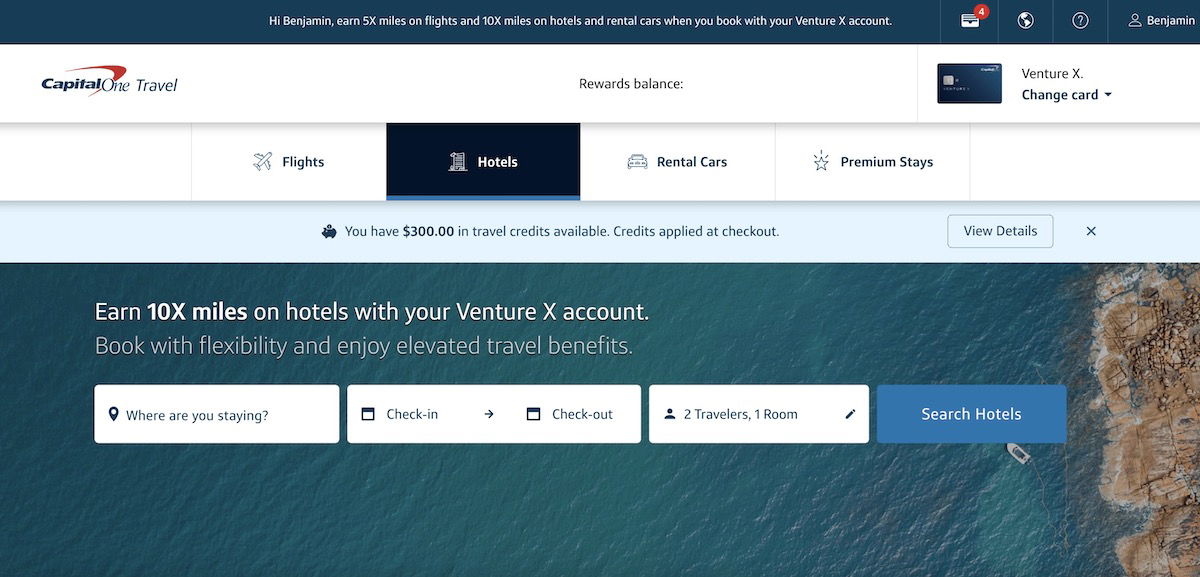

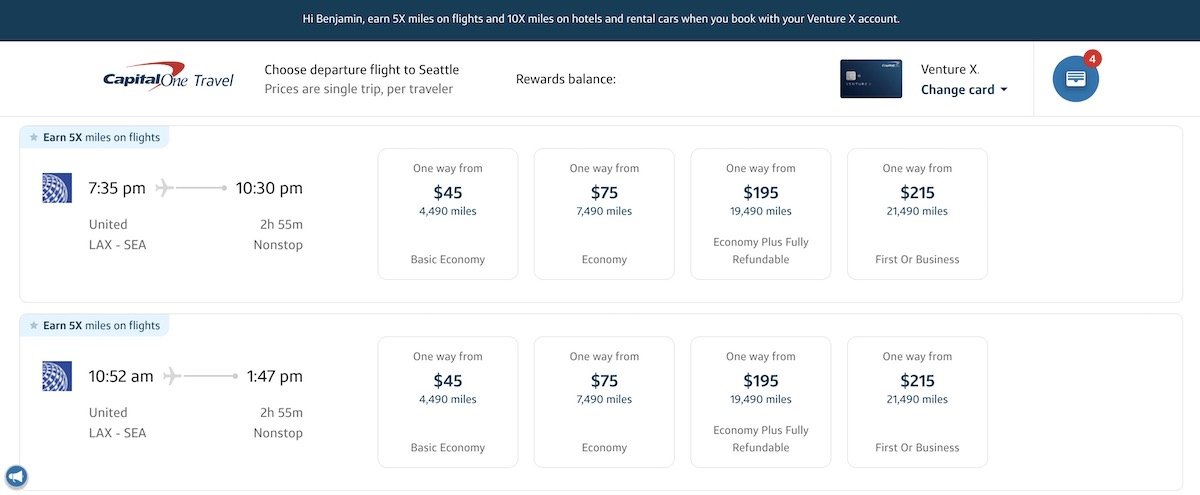

Capital One Travel is Capital One’s travel portal, as you may have guessed based on the name. The portal is powered by Hopper, and Capital One is essentially acting as the travel agent here. You can use Capital One Travel to book everything from flights, to hotels, to rental cars.

In general, I’m not a huge fan of using travel portals, though in my opinion Capital One Travel is the best travel portal of any of the major credit card companies. You can easily search flights, hotels, and rental cars.

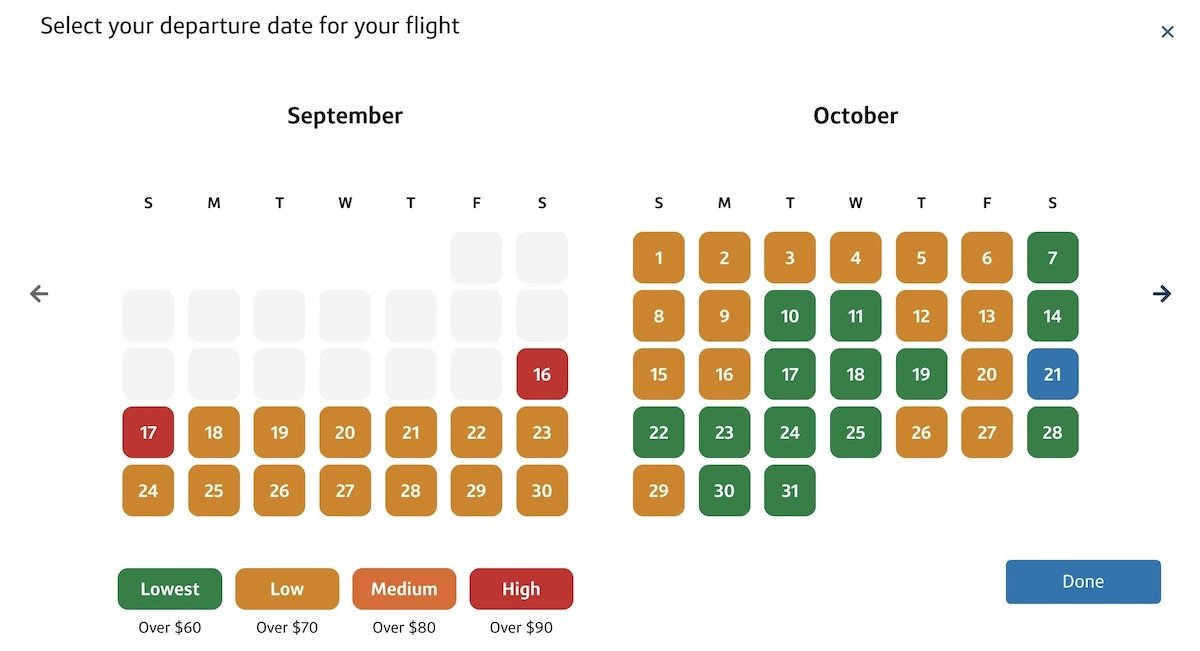

The portal has some nifty features. For example, when searching flights, there’s a calendar showing the dates with the best prices, which is something I wish we’d more consistently see from airlines.

Similarly, the option to filter results is great, better than with most other portals, in my opinion.

If you wanted to apply your $300 annual travel credit toward a purchase (like a flight), you’d just want to start the process of purchasing a flight. Then on the checkout page, you should see the credit automatically applied, unless you specifically choose not to apply it.

Keep in mind that the Venture X is also rewarding for purchases through Capital One Travel, so you can earn lots of miles for purchases beyond the amount that the credit covers. The card offers:

- 10x Capital One miles on hotels and rental cars booked via Capital One Travel

- 5x Capital One miles on flights and vacation rentals booked via Capital One Travel

For what it’s worth, I value Capital One miles at 1.7 cents each, so that’s like an 8.5-17% return on that spending.

But isn’t booking through credit card travel portals annoying?

Some people are probably thinking “I don’t really want to book through a travel portal though.” I hear you. To be honest, I only rarely use travel portals. Even if a travel portal is great, there are downsides to using them:

- On the flight front, in the event of schedule changes or wanting to cancel, it can be easier to do so if you book direct, especially in an era where airlines largely allow free ticket changes

- On the hotel front, you don’t usually receive elite perks or earn points when booking through a third party

- On the rental car front, there are often discount codes available online that can’t be used if booking through a portal, and elite perks also often don’t apply through third party bookings

That being said, I still think the credit is worth pretty close to face value, and have no issues whatsoever using it. What’s my strategy? To keep things simple, my strategy is to book a single flight that costs $300+ at least once per year, which triggers the $300 credit.

You still generally earn points and receive elite perks when booking flights through a portal, and the pricing is almost always identical. Therefore the opportunity cost to booking this way is limited.

The way I see it, having to book through Capital One Travel is hardly a huge deal or anything that prevents this from being maximized, and most people shouldn’t have any issues taking advantage of this.

How does this compare to travel credits on other cards?

How does the Capital One Venture X $300 annual travel credit compare to the credits issued by other premium cards? Just to compare:

- The Chase Sapphire Reserve® Card (review) has a $300 annual travel credit that can apply toward any travel purchase, and it doesn’t have to be booked through Chase’s travel portal; this continues to be the easiest to use travel credit

- American Express Platinum Card® (review) offers all kinds of credits, including an up to $200 airline fee credit (Enrollment required); this is rather complicated to use, and includes all kinds of restrictions

I’d argue that the Capital One travel credit isn’t as easy to use as the travel credit with Chase, but is much easier to use than the American Express travel credit.

This also doesn’t tell the full story of the card’s value proposition, though:

- The Venture X has by far the lowest annual fee of the three cards

- The $300 annual travel credit is only one of the annual perks the card offers — the card also offers 10,000 anniversary Capital One bonus miles, which can be redeemed for $100 worth of travel, or can be transferred to airline & hotel partners at a ratio of up to 1:1

- For savvy travelers, the $300 travel credit plus 10,000 bonus miles should be worth more than the card’s $395 annual fee, not even factoring in anything else

Bottom line

The Capital One Venture X and Capital One Venture X Business are incredibly lucrative. The cards have a $395 annual fee, and one of the primary things that offsets that fee is the $300 annual travel credit, which can be applied toward virtually any purchase with Capital One Travel.

While some people might find a slight hassle factor to using a portal, this really shouldn’t be that hard to maximize on a flight, hotel, or rental car. My strategy is to simply book a $300+ flight every year through the portal, and that gets me $300 back. There’s almost no opportunity cost, so I’d consider that to be pretty awesome.

To fellow Venture X cardmembers — what’s your strategy for using the $300 annual travel credit?

Are the $300 a year travel credits cumulative? So if I don't book a flight one year the next year I would have $600?

Honestly, after our most recent experience with C1, we are canceling the card. The authorized user (spouse) cannot use the travel credit. Even as the primary cardholder, it does not allow me to book two airline tickets at a time and use the travel credit. You must make two separate bookings for two people on the same flight. It is not very useful as a travel card compared to the competition. We will cancel the...

Honestly, after our most recent experience with C1, we are canceling the card. The authorized user (spouse) cannot use the travel credit. Even as the primary cardholder, it does not allow me to book two airline tickets at a time and use the travel credit. You must make two separate bookings for two people on the same flight. It is not very useful as a travel card compared to the competition. We will cancel the card and not look back.

I'm going to hate to lose the lounges, but neither Amex nor Chase has ever caused me an afternoon of frustration with any of their products.

Do better C1.

That’s not true - every year I make flight reservations for my family of three on several occasions ( X and biz X ) and zero issues . May be you need to add them as travel companions or something…

Hi. I'm considering cancelling the card because of the travel credit's lack of value. I recently wanted to fly from FLR to MAD. Direct flights on Vueling, which offered three or four different classes regarding bags, seats, etc. On Cap1, there were two - the most basic and the most expensive.

After viewing costs for seats and bags on Vueling if booking their most basic fare, I booked that fare through Cap1 (a bit...

Hi. I'm considering cancelling the card because of the travel credit's lack of value. I recently wanted to fly from FLR to MAD. Direct flights on Vueling, which offered three or four different classes regarding bags, seats, etc. On Cap1, there were two - the most basic and the most expensive.

After viewing costs for seats and bags on Vueling if booking their most basic fare, I booked that fare through Cap1 (a bit more expensive). But then, when I went to pay for seats and bags, it was HIDEOUSLY expensive. It's like they knew it was a 3rd party booking and so just socked it to me.

Not happy. Chase is exponentially better in this regard.

I have the venture x and venture x business. Ben, you didn't mention that they will price match publicly available rates. It does require a phone call and about 20 minutes but I was able to get them to match the price of booking direct through an airline on a last minute international flight where there was no awards availability. I think this is a huge advantage over other portal I've used like citi and chase where they make money off that margin at your expense.

Ben - I have had the Cap One Venture X since the inception. I used the travel credit once - their hotels are always overpriced compared to the rates on the hotel proprietary websites. I am also hesitant to book through their portal as you may/may not lose elite benefits or stay credits (although this is diminishing by the day amongst most chains).

I have never shopped airfares on the Cap One portal -...

Ben - I have had the Cap One Venture X since the inception. I used the travel credit once - their hotels are always overpriced compared to the rates on the hotel proprietary websites. I am also hesitant to book through their portal as you may/may not lose elite benefits or stay credits (although this is diminishing by the day amongst most chains).

I have never shopped airfares on the Cap One portal - thought they would be more expensive than booking direct. Good to know I can book a trip through them and use the credit.

I've been a big fan of the card and acquired it at launch (thanks to you for the tip). However their lounge situation is not good for me (West Coast guy) and the last few times the DFW lounge was a shitshow with children running amok and parents that did not care. I went to the AC as it was actually a better experience in DFW (!).

Seems that Cap One gives out a lot of cards to their employees in the DFW Metroplex and they end up in the lounge with screaming children.

Hi: Does anyone have any recent experience with application approvals? In the past, Capital One has been completely unpredictable when it comes to them. For instance, instantly rejecting applicants with 800+ credit scores and flawless credit (no late payments or any other credit flaws). I am interested in this card and have flawless credit, but have zero interest in having application dings hitting all three credit bureaus for 2 years, while simultaneously being rejected by...

Hi: Does anyone have any recent experience with application approvals? In the past, Capital One has been completely unpredictable when it comes to them. For instance, instantly rejecting applicants with 800+ credit scores and flawless credit (no late payments or any other credit flaws). I am interested in this card and have flawless credit, but have zero interest in having application dings hitting all three credit bureaus for 2 years, while simultaneously being rejected by Capital One for some mysterious, inscrutable reason.

@Jason, I had a recent bad experience. My credit score is around 817, consistently above 800, I had never been rejected for any other card, but was rejected by Capital One. I thought this had to be a mistake so I called the reconsideration line. They said if I wanted the application reconsidered there would be another hard pull on my credit file, I said that was fine since my score was so high to...

@Jason, I had a recent bad experience. My credit score is around 817, consistently above 800, I had never been rejected for any other card, but was rejected by Capital One. I thought this had to be a mistake so I called the reconsideration line. They said if I wanted the application reconsidered there would be another hard pull on my credit file, I said that was fine since my score was so high to begin with and I was confident I’d be approved, but they rejected me a second time. Now my score is slightly below 800, but I’ve read these hard pulls only impact the score for a short time. But obviously, I’m taking my business elsewhere than Capital One.

Hi James: Belatedly, many thanks for your report. I have heard many similar stories from others with solid credit scores. C1’s approval standards are weird and totally inscrutable. One does not see this with reputable credit card issuers like Amex and Chase: if a person has EARNED a high credit score and is not binging on new accounts, he or she will be approved. C1 has some kind of projected profit algorithm that actually penalizes...

Hi James: Belatedly, many thanks for your report. I have heard many similar stories from others with solid credit scores. C1’s approval standards are weird and totally inscrutable. One does not see this with reputable credit card issuers like Amex and Chase: if a person has EARNED a high credit score and is not binging on new accounts, he or she will be approved. C1 has some kind of projected profit algorithm that actually penalizes financially astute, high income and high credit score applicants. C1 is paranoid that these people will actually pay their bills on time. They are not content to merely earn their share of the merchant fees; they want interest, late payment and other arbitrary fees, too. Basically, they want financially stupid and sloppy customers who can be milked. The fact that they are acquiring Discover supports this idea. I’m sorry they got you to apply a second time. They should have been able to tell you exactly why you were declined, and then you could have correctly inferred that you were going to be declined again. But customer service like that is foreign to them. Yes, the credit impact of the two hits will decline in a few months. But what I find irritating is that the hits stay on one’s record for 2 years. That’s ridiculous for a declined application. What difference should it make to a person’s credit if they apply for an account and are declined??? Nothing has changed about their credit. Same number of accounts and total amount of credit lines. It’s just a way to knock people down and hurt them, by lowering their scores and pushing them into higher interest rate categories. Anyhow, thanks again. Your post helped convince me to pass.

My airline of choice is Alaska Airlines. It is easy to book a $300+ flight on Alaska with the Capital One Travel portal. As long as you wait at least 24 hours; you can cancel that ticket and the price of the ticket gets deposited into your airline account as a credit for a future flight. You can then book directly with airline.

@singleflyer

Did you cancel the AS flight booked through the Capital One portal with Capital One or with AS?

Then you used the deposited Capital One funds to your AS wallet to rebook @ AS for the same or different flight?

I think it's worth pointing out that the credit can only be redeemed out of the primary account holder's account. Authorized users cannot redeem it even if they are an account manager.

Having to use Capital One Travel to use the $300 benefit is a major drawback. I booked a ticket for $480 and used the credit. The airline made a change to my itinerary. I requested an involuntary cancel with refund. Airline agreed that the rules allowed it. Capital One Travel processed it as voluntary and the airline denied the refund. It’s now impossible to undo and I’ve just lost the $480.

What would happen if I book refundable hotel with this year's travel credit and have to cancel it later when new year cycle is already in. Would I loose my travel credit for cancelled reservation?

We have a 2 Spark cards. Since the hotel chains don't cover more rural locations internationally we rent many nights with capitalone. We never book flights because of the concern of "what if..." i am seriously considering the Venture X mainly for the lounge benefit.