I’ve written about the common misconception that applying for credit cards hurts your credit score.

While it’s true that an inquiry on your credit report can ding your score a couple of points short term, in reality there are several metrics that can be positively impacted by opening new credit cards, including lower credit utilization and more payment history.

What matters most is that you don’t utilize too much of your credit, that you make your payments on-time, and that you maintain a decent average age of your credit card accounts.

In this post I wanted to answer another question I get all the time — what impact does closing credit cards have on your credit score?

While I have nearly 30 credit cards at the moment, I do sometimes both open and close cards as my spending patterns change over time, as does the value proposition of some credit cards. Let’s take a closer look at how your credit score is impacted when you close cards.

In this post:

How is your credit score calculated?

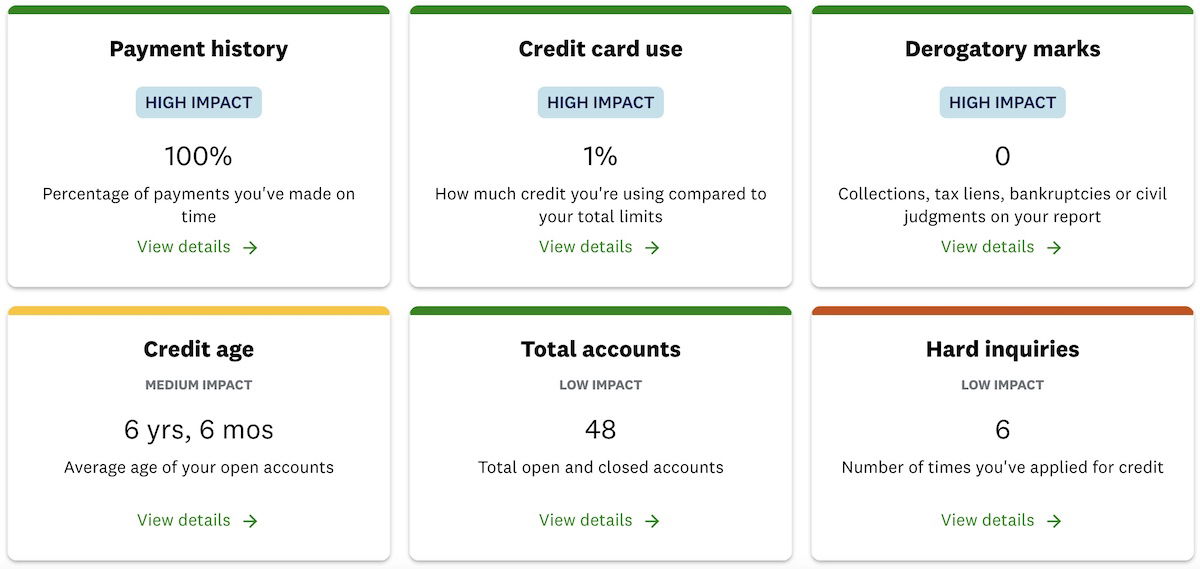

For some context, first let me post a quick refresher of how your credit score is calculated (if you already know this, by all means skip this section). Your credit score is made up of the following components:

- 35% of your score is your payment history (the percentage of payments you’ve made on-time)

- 30% of your score is your credit utilization (how much credit you’re using compared to your total limits)

- 15% of your score is your credit age (the average age of your open accounts)

- 10% of your score is the types of credit you use (how many different types of requests for credit you have)

- 10% of your score is your requests for new credit (how many times you’ve applied for credit)

Your takeaway here should be that if you make your payments on-time, don’t utilize too much of your credit, and keep your average account age fairly old, that’s 80% of your credit score right there.

How is your credit impacted when you close a credit card?

When you open a card, you get an inquiry that counts as a small “ding” on your credit score (though it can go up due to other factors). There’s no such thing when you close a card.

When you close a credit card, your credit score is potentially impacted in a couple of ways.

Your credit utilization may go up when you close cards

When you close a credit card, your credit utilization may go up. Your credit utilization is calculated based on your overall available credit, so when you close a card your overall available credit decreases.

Let’s use the following example:

- A person has two credit cards, each with a $5,000 credit line, for a total of $10,000 in available credit

- This person spends an average of $3,000 per month on their credit cards

If both cards are open that person’s average utilization would be 30%. However, if the total available credit is suddenly $5,000 (due to a card closure), that person’s card utilization rate would double, to 60%.

There are a couple of ways you can mitigate the impact of this:

- You can pay off your balance before the statement close date; that’s because your utilization is calculated based on your balance as of the statement closing date

- When you close your card you could try to transfer your credit line to another card, so that you can keep the same overall amount of credit; this is only possible if you have another card with the same issuer, and if you’re transferring personal-to-personal or business-to-business (even then this isn’t always possible)

What happens to your average age of accounts when you close cards?

A common point of confusion is what happens to your average age of accounts when you close a card. The reality is that this metric could be impacted long term, but when you close a credit card it continues to show on your credit report (and continues to age) until it falls off after up to 10 years.

Let’s use the following example:

- A person has two credit cards

- One credit card has been open for two years, and another credit card has been open for four years, meaning that person’s current average account age is three years

If you were to cancel the card you’ve had for two years, what would your average age of accounts be in two years?

- One card would be six years old

- One card would be four years old (the closed card continues to accrue age, even for the two years since it was closed)

That means your average age is now five years, which is better than before. At some point (up to 10 years after you close the card) it will fall off your account and no longer contribute to your average age of accounts, but that’s not immediate.

Example: how I’m not greatly impacted by closing cards

Now let me use my situation as an example:

- I have nearly 30 credit cards

- I have a lot of available credit and also typically pay my balance before the statement closes, so my utilization is just 1%

- My average account age is six years and six months

For further context, here are some of my credit factors:

In my case I have a sufficiently established history so that opening or closing a card has very minimal impact on my credit score.

One thing that has really helped is that I have a few very old cards, including one that has been on my credit history for 33 years (see this post for how that’s possible). I expect that if I closed that card, it would have a negative impact on my score long term, once that eventually falls off my report.

Strategies for minimizing the impact of closing credit cards

While there’s no magic formula here, in general I have a few takeaways and recommendations:

- Hopefully this demonstrates the value in keeping some no annual fee cards for a long time, since this can really help your credit score

- In the event that you’re no longer getting value out of a card that you’ve had for a long time, call and see if there’s an option to downgrade it to a no annual fee card, so you can at least keep it on your credit history

- When you do cancel a card, see if there’s an opportunity to transfer the credit line to another card card you have, which can also help with keeping your credit utilization low

- If you’ll be greatly impacted by increased credit utilization, pay almost your entire credit card bill before the statement even closes, since it will show a very low utilization that way

- Chase Freedom Unlimited®

- The New United Gateway℠ Card

- Blue Cash Everyday® Card from American Express

- Hilton Honors American Express Card

- Delta SkyMiles® Blue American Express Card

- The American Express Blue Business Cash™ Card

- The Blue Business® Plus Credit Card from American Express

- Citi Double Cash® Card

- Earn 3% Cash Back on Dining

- Earn 3% Cash Back at Drugstores

- Earn 1.5% Cash Back On All Other Purchases

- $0

- Earn 2x MileagePlus miles on United purchases

- Earn 2x MileagePlus miles on gas station purchases

- No Foreign Transaction Fees

- $0

- 3% Cash Back at U.S. Supermarkets*

- 3% Cash Back at U.S. gas stations*

- 3% Cash Back on U.S. online retail purchases*

- $0

- Earn 7x points at Hilton Hotels

- Hilton Honors Silver Status

- Hilton Honors Gold Status With Spending

- $0

- Earn 2x SkyMiles on purchases directly with Delta

- 20% Delta Inflight Savings

- No Foreign Transaction Fees

- $0

- 2% cash back up to $50k then 1%

- Access to Amex Offers

- No annual fee

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

- Earn 1% cash back when you make a purchase, earn 1% cash back when you pay for that purchase

- $0

Bottom line

As a general rule of thumb you shouldn’t be scared to close credit cards as part of a well balanced strategy. The key is to make sure that canceling a card won’t greatly increase your credit utilization (though you can partly get around this by paying your balance before the statement even closes).

In the event that you have had a card for a long time, there’s potentially a lot of value in holding onto it. You can always call the credit card company and see what downgrade options are available to you.

If you’re fairly new to credit cards, this is also why there’s so much value in picking up some lucrative no annual fee cards early in your credit journey, so that those can help boost your credit score long term. After all, maximizing credit card rewards is a marathon, not a race.

What has your experience been with the impact closing credit cards has had on your credit score?

I haven’t done any research on the accuracy but AMEX shows your credit score and has a “what if…” functionality that simulates the effect on your score based on a predefined set of actions you may take. One option is “what if i close my oldest credit card?” According to their simulator, at least for my situation, it has almost no effect.

I get this comment -

Too many accounts with balances

FICO® Scores consider the total number of accounts a consumer holds with balances, including credit card balance amounts that appear from the most recent account statements—even if that balance was paid off. Your score was impacted by having too many accounts with balances.

I am talking about maybe 10 CC which get paid off daily, which have very high credit limits with balances...

I get this comment -

Too many accounts with balances

FICO® Scores consider the total number of accounts a consumer holds with balances, including credit card balance amounts that appear from the most recent account statements—even if that balance was paid off. Your score was impacted by having too many accounts with balances.

I am talking about maybe 10 CC which get paid off daily, which have very high credit limits with balances less than $100, and some have minus balance. Yes - even a negative balance counts a balance. Appears that even if a CC is used once for say $20 and immediately paid off it still counts and a minus $50 balance as well - which you can't clear other than charge more.

Am I reading this right?

You have 10 credit cards you pay off *daily*?

What could possibly motivate that?

How did you see the factors contributing to your credit score?