I sure am having a rough month when it comes to credit card fraud!

My credit card fraud earlier in the month

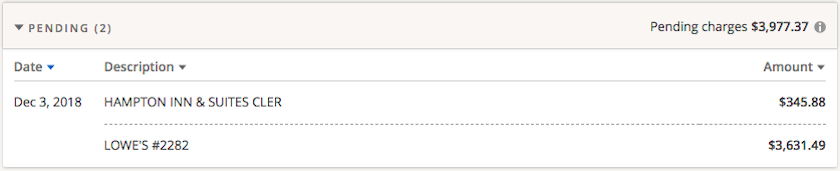

At the beginning of the month I wrote about how I was dealing with fraud on my Chase Sapphire Reserve® Card. I found this out because I received an email from Chase asking me to verify the number from which I supposedly called Chase. That wasn’t my number, and then I looked at my statement I noticed a couple of unauthorized charges.

Both of those purchases had been made in-person, meaning that a copy of my credit card had been made, since I had the card in my possession.

This was my third time experiencing credit card fraud (that I can remember), as I previously dealt with this in June 2015 and June 2017.

My latest case of credit card fraud

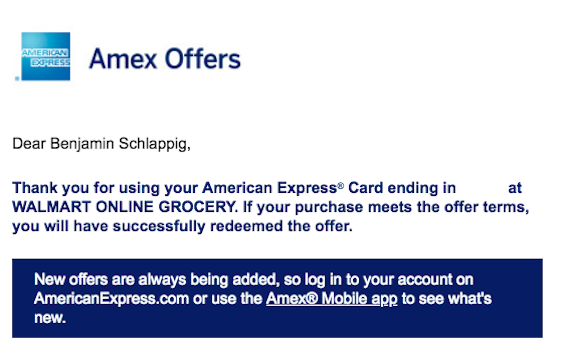

Yesterday I received an email from Amex confirming that I had used an Amex Offer. At first I was excited. I love the Amex Offers program and go out of my way to use it, so thought “yay, I used an Amex Offer without even realizing it.”

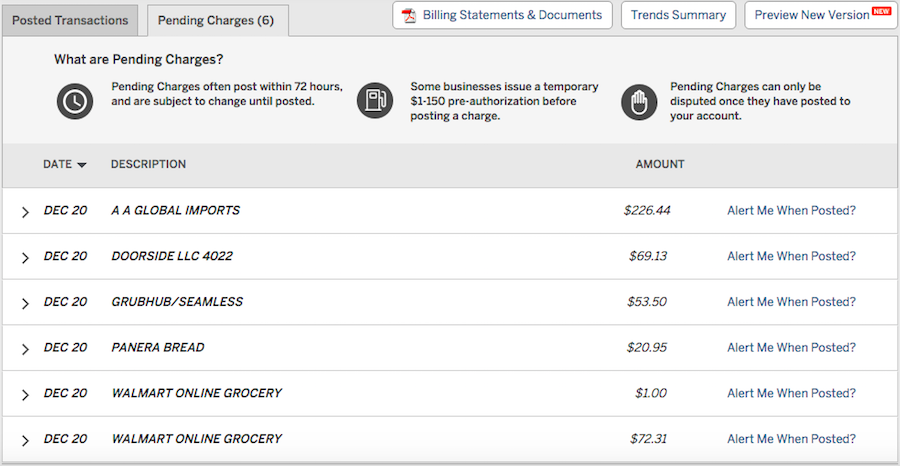

Then I looked at my statement for The Platinum Card® from American Express. While no unfamiliar posted transactions were on my account, there were six pending charges, none of which looked familiar.

Around the same time I was getting voicemails from My Mamma’s Bar-B-Q saying that the order I placed through Grubhub was ready for pick up.

After doing some Googling it appeared that this restaurant is in Riverview, FL, the same place that the other purchases had been made.

So it’s clear my credit card had been fraudulently used for that, but they left my phone number as well? Huh?!?

I called up Amex, they confirmed that none of these transactions were “in-person,” meaning that clearly someone just had my card number without actually having created a replica of my credit card.

Of course I’m not responsible for the fraudulent charges, and they’re sending me a new card.

What makes this situation very strange

Credit card fraud happens, and it’s something I expect to deal with when using credit cards as much as I do. I’m still better protected than if I were using a debit card. However:

- This is the second time this month that it has happened

- I get how fraud happens on my Sapphire Reserve since I use it all the time for in-store transactions, though the Amex Platinum I use almost exclusively for airfare purchases, which makes me think this was more likely to be part of a data breach than anything

- Maybe it’s a coincidence, but all of this fraud has happened in Central/West Florida, in Brandon, Clermont, and Riverview, all of which are close to where I grew up, in Tampa; I imagine the fact that these places are close to where I grew up is a coincidence, but is the fact that fraud occurred across two cards in the same area also a coincidence, or no?

While I’m not on the hook for any of this fraud, I feel like if it happens on one more card in this area, I’m going to take this into my own hands, Chris Hansen style. I’ll set up shop at the Hampton Inn Clermont, sit at My Mamma’s Bar-B-Q in disguise, and will then go to Panera for dessert for some of those delicious cinnamon roll things.

Bottom line

Credit card fraud happens, and generally it’s not something that concerns me much. Usually I experience it every 1-2 years, and that’s roughly what I expect, given how many credit cards I have.

However, there’s something I find a bit strange here, given that it has happened twice in less than a month, and these both happened just shortly after the Marriott data breach was revealed.

I’m not sure if both of these cards were part of the same data breach or what, but beyond that I find it strange how my phone number has been part of this, and how it has all happened in the same general area. I’m keeping a close eye on my identity otherwise, and as of now it seems it’s only these two cards that have been compromised.

Oh, and lastly, I find it funny that Amex Offers helped me figure out this fraud before anything else.

What do you make of this situation? Do you think this is all just a coincidence, or is this slightly creepier than typical credit card fraud?

Received a fraudulent charge on CC on Sept 20th 2023 for $26.79 and was declined by my provider.

Our chase sapphire reserve card was compromised three times in four months (Dec 2022-Mar 2023).

There is a failure of oversight and governance at JPMorgan Chase.

Based on the wait times to speak with people at Chase Card Services, I presume there is a widespread issue.

Your credit card company is also updating every Apple Pay account that has been linked to your original credit card. What happened was the fraudster added your card to Apple Pay. After you cancel your original card, they just sat back and waited until your credit card company pushed the new card to Apple Pay. And there you go a new card without working for it.

Credit card companies are allotted reimbursements for past due acts...fraud...no payment ect every year and usually its 10xs more then what there losing so theres no incentive to switch technology's.....amazon usps fedex ups all have options to redirect packages and when you buy fullzzz on the darken or whatever your name address phone number email ect comes Long with the card info so usually a little google search will reveal enough info to pretty much...

Credit card companies are allotted reimbursements for past due acts...fraud...no payment ect every year and usually its 10xs more then what there losing so theres no incentive to switch technology's.....amazon usps fedex ups all have options to redirect packages and when you buy fullzzz on the darken or whatever your name address phone number email ect comes Long with the card info so usually a little google search will reveal enough info to pretty much change or modify any order. As far as cloning cards chips make it harder but it's unbelievably simple. Msr606 resderwriter visa/Mastercard prepaid cards and a embossed and boom I can be anyones card at any time. Test charges are for amateurs so if u see one cancel ur card or check your statements for other larger charges. Usually online charges such as amazon best buy uber never flag bc there so common and they dont use ip or radial GPS monitoring. Cards usuly go for between 8 and 30 dollars depending on quality validity and balence. Debits are more but harder to TAKEOVER or max out. I got into this at a very young age and unfortunately has been my professional "side on for the last 13 years.....every company website ect has loopholes and kinks that make them very vulnerable when companies get hacked millions and millions of numbers are take. It's just whether or not they get dispersed in time before they get shutdown or move onto the next BIN or batch. Best thing for prevention is text email updates or lock unlock card right before after use. It is a pain but unfortuanlty fraud will only get worse.....

I recently experienced cc fraud with Capitalone. It’s a cc account that had been maxed out for quite some time. On a Monday, I made a large online payment reducing the balance to zero. On the following Wednesday someone began using the card fraudulently. Fortunately, the option for notifications was set.

I agree that it has something to do with the data breaches. I had Fraudulent charges on an old Amex Card Number that was replaced two years ago, I do not like how Amex lets a card number you cancel stay active for 'recurring charges from prior merchants, dumb idea if you ask me', the charge was for GameStop, someplace I purchased something from once three years ago. The charge was reversed and I demanded...

I agree that it has something to do with the data breaches. I had Fraudulent charges on an old Amex Card Number that was replaced two years ago, I do not like how Amex lets a card number you cancel stay active for 'recurring charges from prior merchants, dumb idea if you ask me', the charge was for GameStop, someplace I purchased something from once three years ago. The charge was reversed and I demanded that the card number be permanently cancelled, and they did. Fast forward to October of this year, I get notifications in email and on the Amex app for every charge I make on the card, I received one for a charge from some boating supply company in CT, I live in CO and have not done business with anyone in CT. I called Amex and they reversed the charge and sent a new card, I demanded they fully cancel the old card, got the same runaround about prior merchant charges. Well, they ended up cancelling that number permanently, did not tell me and that led to some awkward contacts from vendors that I make monthly payments to. Gah! And this most recent event was right after the Marriott breach was announced, and I've stayed at Marriott and used that card several time in the past couple of years. I wish Amex would bring back the one-time use card numbers. ;)

Stop complaining. It's a simple fix to take care of it. It is just a reminder to everyone to carefully review their accounts. Luckily your credit cards are American cards. Procedures in other countries for cards issued there can be very difficult to prove unauthorized transactions and get them removed or to dispute charges for other reasons. Often it takes agreement of the merchant versus the bank or card issuer being helpful in the matter....

Stop complaining. It's a simple fix to take care of it. It is just a reminder to everyone to carefully review their accounts. Luckily your credit cards are American cards. Procedures in other countries for cards issued there can be very difficult to prove unauthorized transactions and get them removed or to dispute charges for other reasons. Often it takes agreement of the merchant versus the bank or card issuer being helpful in the matter. It also depends if you are careful in where you sign into your bank accounts and credit cards such as if you often do it on public networks, etc.

Simple and easy step to prevent credit card fraud is a chip and PIN system used in most countries (just not in the US). I agree never let someone take your card to process the transaction - if they do not bring a transaction device to you then say I will go with you.

One misconception credit card firms do not cover you losses (for the most part) they charge the merchant back for rejected...

Simple and easy step to prevent credit card fraud is a chip and PIN system used in most countries (just not in the US). I agree never let someone take your card to process the transaction - if they do not bring a transaction device to you then say I will go with you.

One misconception credit card firms do not cover you losses (for the most part) they charge the merchant back for rejected transactions - this results in higher prices for merchants to cover their potential losses etc., etc. etc.

We pay for credit card fraud - the credit card companies don't have a strong motivation to prevent fraud but to their credit do provide a number of services and analytics to prevent fraud.

Demand chip and PIN it will help!

Florida for me also! Some dude used my AmEx Plat to pay the repo man for his car and his power bill! I called the repo guy and asked WTF they were doing? He said that they were given the number so ran it...”how many people do you know get their cars repoed and have an Amex Plat?” “Ohhhh good point, maybe we’ll start asking for id!”

And they could not call Duke Energy and get the persons address?

I left my tablet on the plane. A few weeks later I noticed a charge on Groupon. Since then, I have had point redemptions on my IHG account, a $400 watch purchase from Macy's, an attempted purchase of a tv on Amazon, and a check order in my name. Most trace back to a local address. I had not cleared my credit card number from the purchase history, and my device had "conveniently " saved...

I left my tablet on the plane. A few weeks later I noticed a charge on Groupon. Since then, I have had point redemptions on my IHG account, a $400 watch purchase from Macy's, an attempted purchase of a tv on Amazon, and a check order in my name. Most trace back to a local address. I had not cleared my credit card number from the purchase history, and my device had "conveniently " saved the info. It wasn't enough that I changed the password. Not sure how long this is going to haunt me.

Something wild happened to me on vacation. I was using my primary MC the entire time, then I go try to fill up at a gas station. It was declined for whatever reason. Not willing to cause a delay, I used a secondary MC (MC2) without problem. It was a replacement card from a previous fraud and was the first time I used it, and away from home, and accepted immediately. Whatever. I needed gas.

...Something wild happened to me on vacation. I was using my primary MC the entire time, then I go try to fill up at a gas station. It was declined for whatever reason. Not willing to cause a delay, I used a secondary MC (MC2) without problem. It was a replacement card from a previous fraud and was the first time I used it, and away from home, and accepted immediately. Whatever. I needed gas.

The next day I receive a call from MC2's issuer detecting fraud. I figure it was my gas station purchase. Call them up and they inquire about 2 transactions ... back near my home! One BestBuy for $320 and one at Target in the same mall for $400! They oddly let the BestBuy one through, but declined the Target charge. Needless to say I figure it was just dumb luck I had to use the card on holiday or else the fraud may not have been detected.

I went to BB when I got back from holiday to get a duplicate receipt and sure enough, they printed it out and it said that the chip was presented, which I found odd since my physical card doesn't have a chip.

Sadly though they did not capture a signature and I wasn't going to ask about any security camera footage, I figure that's someone else's chase. MC2's did obviously reverse the charges but it was still a hassle.

I had a "fraud" experience with Visa. Two bogus charges in 3 days for similar products. VISA quickly agreed it was fraud and wiped off the charges. BUT they would not divulge any info about where the charges came from or how they were made. So, to get their attention, I filed a criminal fraud complaint with the County District Attorney's Office. I did get a little more info. But the main reason for filing...

I had a "fraud" experience with Visa. Two bogus charges in 3 days for similar products. VISA quickly agreed it was fraud and wiped off the charges. BUT they would not divulge any info about where the charges came from or how they were made. So, to get their attention, I filed a criminal fraud complaint with the County District Attorney's Office. I did get a little more info. But the main reason for filing a fraud complaint is that it becomes a recorded crime and statistic on the issuing bank and VISA. If enough people ALSO file fraud complaints with law enforcement, the credit card companies will get more serious about cutting down on these frauds.

I've been hit with fraud twice this year within 30 days without even shopping with the card replaced. Both times started in California and purchases were made online at many global merchants. If you are skimmed at gas stations the owners of the gas station should be held liable. They have the responsibility of checking their pumps daily for skimmer machines. All companies should utilize a two step verification process, with a code being sent...

I've been hit with fraud twice this year within 30 days without even shopping with the card replaced. Both times started in California and purchases were made online at many global merchants. If you are skimmed at gas stations the owners of the gas station should be held liable. They have the responsibility of checking their pumps daily for skimmer machines. All companies should utilize a two step verification process, with a code being sent to your phone before a transaction can be completed. We should not have to pay for monitoring of our issued cards or our credit. The companies who have this information should be wholly responsible for protecting our information and the fines should be stiff when their negligence causes our information to be compromised. The consumers Opt Out laws are a joke.

I used an AMEX corporate card at a touristy museum in NYC. Guy went in back room to "get something" with my card. I didn't think much of it as I watch my charges like a hawk. Within a week we had charges in Florida showing up which we promptly shut down.

AMEX alerts let me know my wallet was stolen. Got a notice about a charge at BBY. I knew by the number...

I used an AMEX corporate card at a touristy museum in NYC. Guy went in back room to "get something" with my card. I didn't think much of it as I watch my charges like a hawk. Within a week we had charges in Florida showing up which we promptly shut down.

AMEX alerts let me know my wallet was stolen. Got a notice about a charge at BBY. I knew by the number which card and which wallet and shut it all down very quickly. If you don't have alerts from AMEX, set them up on every card. Annoying but useful.

I found two great defenses is watching accounts on line for every charge and reconciling them on Quicken/Quickbooks. And randomly reporting my cards lost so they send me a new card with new expiration date and security code.

I just had fried yesterday of somebody in California ordering themselves a very expensive steak breakfast through doordash.com.

What's weird is that there was a name a phone number and an address. I tried to call the phone number but no one answered. Regardless I had that account shut down and called Chase sapphire reserve to stop the card and send me a new one. The fraud department at Chase let me know if...

I just had fried yesterday of somebody in California ordering themselves a very expensive steak breakfast through doordash.com.

What's weird is that there was a name a phone number and an address. I tried to call the phone number but no one answered. Regardless I had that account shut down and called Chase sapphire reserve to stop the card and send me a new one. The fraud department at Chase let me know if you download the app to your mobile device that there is a button that you can simply lock your card on the app, It's a new feature he said. You can't do this from the computer which is weird because that is how I normally access my accounts.

Although the law specifically states that ALL businesses must have a credit card reader that requires that you insert your credit card and imput your PIN number there are many businesses that just refuse to change like the law states. Why? Because there is no enforcement of the law so they just ignore it. The changeover was required by law back in 2015 but if it is not enforced then many will just ignore it.

Am I wrong to think that a lot of this could be prevented if the USA had implemented EMV appropriately with Chip & PIN?

Interesting. I too had my Amex Platinum copied and fraudulent charges from both London and Miami on it - all while I was in San Francisco. In my case Amex found the charges odd as they were out of my usual pattern and emailed me about it.

Like you I am wondering how the Amex PLatinum card got copied, it must be a data breach somewhere. Do you ever use it for Uber?

How many parties have you shared your secret card number and expiry date with ? if its al it takes to debit your account .....#CRYPTOHYGIENE.

The marriott/spg hack was almost certainly a state actor (i.e., foreign spies). However, after the credit bureau hacks, you can be assured that every last bit of your personal info is available. While creepy, your phone number, birthdate, and address is all part of your credit profile.

The craziest fraud was when we discovered someone had hacked my dad's email account (yes, he's one of those old people that uses comcast.net) and was sending copies...

The marriott/spg hack was almost certainly a state actor (i.e., foreign spies). However, after the credit bureau hacks, you can be assured that every last bit of your personal info is available. While creepy, your phone number, birthdate, and address is all part of your credit profile.

The craziest fraud was when we discovered someone had hacked my dad's email account (yes, he's one of those old people that uses comcast.net) and was sending copies to another address. Yes, it is a pita, but two factor authentication is critical to stop this sort of thing.

To that end, amex can push notification of any charges, and most banks have settings to send alerts when charges over a certain amount are made. You cannot prevent fraud when companies like equifax and marriott don't protect your data. You can make it easy to detect and limit how much gets stolen.

It sounds to me like you frequent a gas station or stations that have credit card skimmers and cameras installed.

I seriously doubt it has anything to do with the Marriott data breach and here is why, they would need Your entire credit card number, the expiration date and the security code in order to duplicate your card as was originally done. Marriott does not save the security code, even if you saved the card...

It sounds to me like you frequent a gas station or stations that have credit card skimmers and cameras installed.

I seriously doubt it has anything to do with the Marriott data breach and here is why, they would need Your entire credit card number, the expiration date and the security code in order to duplicate your card as was originally done. Marriott does not save the security code, even if you saved the card to your account, you still have to enter the security code every time.

Another viable alternative is that your computer is infected with a keystroke logger. Given this has happened so much to you, I would take a serious look at these things. For gas stations, you can download a skimmer scanner app (at least on Android, not sure about iOS) that will check if there is a scanner near by. As for your computer, probably safest to reformat all computers you use a d start from scratch, keyloggers can be tricky to detect and almost impossible to eliminate.

Bottom line is since the fraud Jeep's happening from similar locations and keeps happening so frequently, chances are that something in your behavior is causing this to happen, unintentionally on your part of course, but steps can and should be taken to correct this and not just blame it on a data breach.

Yeah, I'm not sure this is scientifically significant or not, but FWIW my wife and I have both had issues with CSR and fraud. Wondering if there is something about the card that makes it more vulnerable or if it is just coincidence bc the cards are so widely used now that it just seems like more fraud on them because there are just more of them out there to begin with.

This is why you shouldn't recommend that anyone has more than one credit card. Each additional card increases the risk of credit card fraud.

This past week one of my Chase cards that I NEVER use...not online or in person... was used for a fraudulent purchase for some type of website company based in Indonesia. There MUST have been an internal hack at Chase.

It is unfortunate that credit card companies still wouldn't give us self generated disposable card number. You would imagine that it is in their best interest to keep card fraud rate low. Yet, because we the consumers won't be liable for the fraudulent charges, we never have the incentive to push for disposable number, which in turn make it even less appealing to the card companies to spend money on this feature.

The card companies do t care. They collect the 'stolen' funds from the merchants directly, plus a fraudulent transaction fee on top, they lose nothing. They are not incentivized to fix this problem. They make too much $$. They could use revolving or one-time cardnumbers, but they dont. Use something like privacy.com to generate burner or limited card numbers tied to your cards.

What I do to prevent CC fraud:

1. Use phone to pay wherever allowed.

2. If can't pay by phone then only let the establishment run your card if they have a chip reader. I never give it to anyone unless I am at the cashiers desk. And I watch so they don't take a picture of the card. Otherwise pay by cash.

3. Online use PayPal if they take it.

I rarely look at my phone when I'm at work. One day a text came on my phone that I had stopped my anytime alearts from my bank, which I had not done. I was on the phone with my bank trying to figure out why this had happened. I logged into my account only to find that all my money had been transferred to someone in Colorado. It took my bank three weeks to...

I rarely look at my phone when I'm at work. One day a text came on my phone that I had stopped my anytime alearts from my bank, which I had not done. I was on the phone with my bank trying to figure out why this had happened. I logged into my account only to find that all my money had been transferred to someone in Colorado. It took my bank three weeks to give me my money back. I had to also file a fraud case with the government. It was a mess. Now everytime I buy a car or anything on credit, I have to answer questions to prove that I am me. It's a big pain in the butt.

I really don’t understand why everybody doesn’t have notifications set for every transaction on their cards. I have caught the test $1 charges which would have then been refunded and never appeared on posted transactions.

Please watch out for Amazon...... This also happened to me three times and with two different banks. The fraud department explains to me that because of me having a card on file because of Amazon policy that they can breach it and they have. The third time I specifically used a card with it maxed out and it was copied and declined so we could find the source. Be careful of AMAZON PRIME.....

There is a lot of credit card processing compaines in that area of Florida

RE Florida as scam central: This geezer in Miami has had credit cards for many years but was scrutinized like never before when I applied for and finally did receive a certain bank card.

It was a time consuming effort as they wanted multiple proofs of my identity and even questioned the clarity of the picture on my Fl driver license.

I nearly gave up but finally was phoned by a factotum in...

RE Florida as scam central: This geezer in Miami has had credit cards for many years but was scrutinized like never before when I applied for and finally did receive a certain bank card.

It was a time consuming effort as they wanted multiple proofs of my identity and even questioned the clarity of the picture on my Fl driver license.

I nearly gave up but finally was phoned by a factotum in security to say I was okayed .

(I live in a very decent area near the central business district.)

He explained that they refuse cards to 95% of the applicants in my zip code, an area they view as rife with fraudulent applications.

Three off-topic comments above, one saying America is racist and two blaming trump and the GOP for credit card fraud. Don’t let politics live in your head rent-free.

My AMEX Gold Rewards card was compromised at a restaurant in Palm Springs. Never again will I let a server take my card away.

As Ken said the terminal comes to the table in Canada. Why is the US so backward?

At least AMEX has AMEX offers in the States but not for AMEX Platinum cardholders here in Canada.

It’s an ill divided world, eh?

My AMEX Gold Rewards card was compromised at a restaurant in Palm Springs. Never again will I let a server take my card away.

As Ken said the terminal comes to the table in Canada. Why is the US so backwards? At least AMEX has AMEX offers in the States but not for AMEX Platinum cars holders in Canada.

It’s an ill divided world, eh?

I never understood how the US credit card companies are still holding out with swipe and sign / ZIP code verification. Among my acquaintances here in Europe, I've only heard about a single case of fraud in the past 5+ years, and that was caught by an automated bot.

All in-person transactions over €20 require a PIN, and even NFC payments for lower amount will occasionally require a PIN (though these are fully covered...

I never understood how the US credit card companies are still holding out with swipe and sign / ZIP code verification. Among my acquaintances here in Europe, I've only heard about a single case of fraud in the past 5+ years, and that was caught by an automated bot.

All in-person transactions over €20 require a PIN, and even NFC payments for lower amount will occasionally require a PIN (though these are fully covered by the banks).

Online transactions will usually require three data points plus some form of multi-factor authorization (3DSecure). It's not flawless, but it presents an extra obstacle to thieves.

My online cards never get hit, only the cards I use in person. If I had fraud charge that linked my phone number I’d be reviewing all my transactions that involved my phone number recently. Hotels come to mind.

The 1.00 charge is the red flag. Happen to me. 500.00 bucks in truck diesel was the next charge. I was driving a truck that week to add injuries to the problem. CC company fixed the problem but I have to use another card that didn't earn me anything.

@Nick, in Canada restaurant servers bring the credit card device to you so they have less opportunity to steal your credit card info. Much better system than here in the United States.

Nope, I have a card I used 2 times in 3 days and it got hit ( first time I sued it in a year as I was paying it down). Used it twice in Houston, liqueur store and golf course in Houston, 2 months later got nailed for 400 bucks at a fast food joint and ice cream shop..... in Dallas, I live in Florida. Never ever used it on the internet/websites etc.

...

Nope, I have a card I used 2 times in 3 days and it got hit ( first time I sued it in a year as I was paying it down). Used it twice in Houston, liqueur store and golf course in Houston, 2 months later got nailed for 400 bucks at a fast food joint and ice cream shop..... in Dallas, I live in Florida. Never ever used it on the internet/websites etc.

Matter of fact I have another card that is used on internet 20 plus times a month, every month for past 12 years and not once (knock on wood) has it been hit. My guess was the liqueur store, I do know the owners, but easy to have camera above your head for code, or a copy machine connected to credit card machine and you would never know. I never use a pin in these stores. Also happened driving to Houston, got gas along the way of course...

Your credit card information is probably being posted on the dark web from a website you're buying things off of. Trust me it happens be careful and use prepaid cards when making online purchases. You dont have to be in that state nor nearby

Maybe it's a coincidence but my Sapphire Reserve had fraud on it on December 5th, the exact same day I made an online reservation with AA and a phone reservation with UA.

Why not setup text/email notifications when a charge is made for more than $0.01? You would be able to catch most of these unauthorized charges pretty quickly even if it was done at a gas station where they normally make a $1 pending charge to ensure the card works before allowing gas fill ups. I have this setup for all my accounts and while its a little annoying to get an email whenever any charge...

Why not setup text/email notifications when a charge is made for more than $0.01? You would be able to catch most of these unauthorized charges pretty quickly even if it was done at a gas station where they normally make a $1 pending charge to ensure the card works before allowing gas fill ups. I have this setup for all my accounts and while its a little annoying to get an email whenever any charge is added to my cards I see this as a way to easily keep tabs on what goes on cards in almost real time without needing to have access to a bank site or app.

You should have ran with it, found out even they ordered food a lot and hung out at the BBQ place until the person arrived.

Why is Lowe’s letting people charge that much on a card where the chip doesn’t work is my question. I wonder if they’re really in-person. Maybe orders to the pro desk by phone for pickup or something?

thing is, chip and pin only works for in-person purchases. With contactless, you can do £30 max per transaction without the pin. I could be anybody purchasing with the card.

Amazon only needs the card details for payment, there is no second or third-step verification involved.

Same with O2, if I want to discuss my account with the chat, I just need to know the details and confirm them, and say I'm the account...

thing is, chip and pin only works for in-person purchases. With contactless, you can do £30 max per transaction without the pin. I could be anybody purchasing with the card.

Amazon only needs the card details for payment, there is no second or third-step verification involved.

Same with O2, if I want to discuss my account with the chat, I just need to know the details and confirm them, and say I'm the account holder, there is no way of verifying I really am who I am, I could be some kid doing purchases, but they never ask for another form of verifiction.

Its the same with pet microchips, you can change the details over the phone with just knowing the serial number and the owner's name and address, so the pet could be stolen, have the details changed, and the real owner would never get it back.

tbh, all purchases should require some sort of photo verification. Shop purchases should require proof of id for every card payment, and online purchases should do a live camera verification with an emailed copy of id

Maybe stolen by a restaurant worker? they are the only ones that walk away with our cards after dining...

You should be claiming you card as lost every 6 months to further reduce fraudulent charges. If by any chance someone gets your card details it'll be an invalid card. I also use Samsung pay and have no issues. Never trust a gas station pump, go inside!

I don't know how it works in other contries, but we have a option here to create a "virtual card" that can be only used one time. It's really useful when buying online or at call centres.

Creepy, and downright scary is how Banco Popular deal with their fraudulent cases - continue to charge you interest, send you to collections and wait for the case to “time-out” so it’s no longer eligible for investigation and watch your credit score drop 175 points....not fun. Beware any of you Lifemiles fans!!!

Something never mentioned in these articles is the harm caused to the businesses that fulfill the orders. As a small family-owned manufacturing business here in the US we have had $7000 worth of product stolen from us this way in the past two months. The person who's credit card was used doesn't pay. The credit card company doesn't pay. Our insurance won't pay. The thief certainly doesn't pay. And it is impossible for us to...

Something never mentioned in these articles is the harm caused to the businesses that fulfill the orders. As a small family-owned manufacturing business here in the US we have had $7000 worth of product stolen from us this way in the past two months. The person who's credit card was used doesn't pay. The credit card company doesn't pay. Our insurance won't pay. The thief certainly doesn't pay. And it is impossible for us to detect which online purchases are fraud. Thieves are able to ship to the credit card holders address, but then redirect the package during transit to a more convenient location to pick up. We, the business sending the package are not informed this has happened. We don't find out for months until there is a chargeback on our merchant account. Out the product, shipping cost and to add insult to injury we are charged a chargeback fee, and told we can lose our merchant account. There has to be a better way to do this!

Samsung Pay

Had a card cloned in 2015. Twice.

Started using Samsung Pay after.

Haven't had one issue since.

It's way more secure because the token details presented during a given transaction are good for precisely one transaction. So when a merchant database gets hacked, your card will not be compromised. Oh. And they pay you to use it. While some of this is true with other mobile payment systems. Samsung...

Samsung Pay

Had a card cloned in 2015. Twice.

Started using Samsung Pay after.

Haven't had one issue since.

It's way more secure because the token details presented during a given transaction are good for precisely one transaction. So when a merchant database gets hacked, your card will not be compromised. Oh. And they pay you to use it. While some of this is true with other mobile payment systems. Samsung pay is virtually the only system offering MST which allows use almost anywhere you can swipe, dip, or tap for payment. FTW

My Capital 1 card, I used 3 times within 3 days. The only time I had used it in over a year. I used it on Spirit airlines, upscale golf course and a liqueur store in Houston. Flew back to Tampa, a month later got it for $300.00 worth of fast food and $150.00 Ice cream. I was reimbursed. My Wells Fargo, 3 times in 6 months, and also reimbursed, but wow what a hassle....

My Capital 1 card, I used 3 times within 3 days. The only time I had used it in over a year. I used it on Spirit airlines, upscale golf course and a liqueur store in Houston. Flew back to Tampa, a month later got it for $300.00 worth of fast food and $150.00 Ice cream. I was reimbursed. My Wells Fargo, 3 times in 6 months, and also reimbursed, but wow what a hassle. Seems to always be charges at gas stations for $150.00.

I think a text pin code prior to purchase would solve the problem.

I work for a corporate bank. I just got promoted from the fraud and disputes department and I must say this happens very frequently. There is a new scam that fraudster have involving them creating a fake card with your card # and name. It’s looks very real, so that could be why they were able to make in person transactions with your card. Lastly, if you are continuiously getting fraud on your card it’s...

I work for a corporate bank. I just got promoted from the fraud and disputes department and I must say this happens very frequently. There is a new scam that fraudster have involving them creating a fake card with your card # and name. It’s looks very real, so that could be why they were able to make in person transactions with your card. Lastly, if you are continuiously getting fraud on your card it’s best to close the card down and get a new one to prevent future fraud. Furthermore if you get a new card and You still have fraud that could mean someone who knows you or someone you do business with is writing down your card number and using them to make purchases. Hope his helps

I’ve had to really lace two cards in the past 6 months that had no fraudulent activity for over 8 years. So yes, something is going on. And that’s after changing all my passwords on every account I have to a unique and different password with my new password vault. After one of them was compromised, I put tin foil in my wallet to hopefully make it less easy to scan my card. Don’t know what else can be done.

As your charges show, often a $1.00 charge will be attempted and if it goes through then they will start charging more and more. Not sure why $1 and not $5 but that seems to be common, at least with American Express cards.

I had someone try that a while ago at a gas station somewhere I never go.

One time I had to get a Hyatt replacement CC due to fraud. I got...

As your charges show, often a $1.00 charge will be attempted and if it goes through then they will start charging more and more. Not sure why $1 and not $5 but that seems to be common, at least with American Express cards.

I had someone try that a while ago at a gas station somewhere I never go.

One time I had to get a Hyatt replacement CC due to fraud. I got the new one and hadn't even used it yet (I think I had activated it) and Chase contacted me to cancel it and replace it again. Apparently someone was guessing CC numbers and got both the zip code and security code wrong. Like I said it was a card that had never been used.

It does happens a lot in Brazil.

I used to work at Tam airlines call centre and there were "rumors" about people who actually took the credit card and document details from someone purchasing a ticket and sell it to criminals.

About buying stuff and shipping to your home. Depending if the person or a "friend" lives in the same city as you, they can just track the shipping and wait near or...

It does happens a lot in Brazil.

I used to work at Tam airlines call centre and there were "rumors" about people who actually took the credit card and document details from someone purchasing a ticket and sell it to criminals.

About buying stuff and shipping to your home. Depending if the person or a "friend" lives in the same city as you, they can just track the shipping and wait near or outside your house, when the delivery guy appears, they pretend to be you or a relative and that's it.

Does it make sense to now simply replace your cards (report them lost) every year?

Minimize fraud by

1) Using temporary cards when making online or telephone purchases. Capital One has been advertising that they offer these. At Bank of America these are called Shop Safe cards.

2) use Apple Pay or Google Pay at places that allow you to tap to pay.

3) look for skimmers on gas pumps, vending machines and ATMs

4) Require a pin before your cell carrier will move your number to a new phone so bad guys can't intercept fraud warnings.

Had fraudulent charges from several D.C. area gas stations on my CSR earlier this year, had to call/cancel and get a new card. It's always a hassle having to go online and enter a new card number for any recurring payments.

Wells Fargo, in Largo FL and just had it happen to me for the 3rd time this year. While it is covered it is beginning to really be a hassle. Seems chips are void. My PayPal card which I used just as frequently, had no chip,and never got hit. Capital 1 has been hit once, but rarely use it. My solution would be random pin by text prior to using it. Simply have a 5...

Wells Fargo, in Largo FL and just had it happen to me for the 3rd time this year. While it is covered it is beginning to really be a hassle. Seems chips are void. My PayPal card which I used just as frequently, had no chip,and never got hit. Capital 1 has been hit once, but rarely use it. My solution would be random pin by text prior to using it. Simply have a 5 minute window. Want to make a purchase? Hit send, retrieve text, use pin. Problem solved. Crooks will not have your phone with them.

Uber Rewards has notified me to fraud one multiple times now on my CSR! The Uber notifications happen almost as soon as the swipe, so when I called up chase they saw transactions being attempted while I was on the phone and put a stop to it!

Another reason to use Amex offers!

I log into my credit card account online several times a week to make sure no strange charges showed up. I also have it set up that the credit card company will send me an automatic e-mail alert for charges over $100. The last couple fraudulent charges on my credit cards, the credit card company found them and reached out to me to confirm my latest charges as they determined those charges were suspicious. Sure enough, they were fraud, and they were online purchases.

The credit card companies are pretty dumb.

"Lets do chip and pin to stop fraud. But not do the pin part"

Fraud in Florida frequently seems higher than elsewhere. Use Apple/Android pay as much as possible & don’t store card numbers in online profiles for merchants.

Someone in Bradenton Fla. did this to me: copied my Citi Prestige and used it to make multiple $500+ purchases at a Shell gas station there last month. Cork texted me after the first one, but over $1500 posted before I could lock the card.

After reading this I decided to run through my AmEx Platinum statement and discovered four fraudulent charges (Outback, Carrabba's, Door Dash and Panera Bread) in Riverview, FL! Pretty weird...

Florida is the hot bed of fraud in the US. I work in e-commerce more than half of our fraud comes from 3 markets, Florida being the largest, by far.

That said it sure is a pain. I had a fraudster rent a car from Enterprise. I am on the do not rent list and I cannot seem to get it removed. Means I can't rent from Enterprise, Alamo, or National unless I pay the $280 that was disputed. It's a real pain.

@Jake. SImilar thing happened to our CSR account earlier this year. My wife noticed a charge for near $1000 laptop from Amazon on our account. Upon calling we found that a second Amazon account had been opened in my Wife’s name, our main account is under my name, and about $1400 in items were purchased through it. The laptop was originally set to ship to our home address but the same day my wife noticed...

@Jake. SImilar thing happened to our CSR account earlier this year. My wife noticed a charge for near $1000 laptop from Amazon on our account. Upon calling we found that a second Amazon account had been opened in my Wife’s name, our main account is under my name, and about $1400 in items were purchased through it. The laptop was originally set to ship to our home address but the same day my wife noticed the charge someone had called Amazon to redirect the shipment to somewhere else in a different state. The same thing had happed to early charges we hadn’t caught, all were redirected after the initial order was placed. Chase quickly handled the fraud and Amazon closed the fraudulent account but I still cannot understand how this came about as my wife rarely purchases from Amazon and usually waits and has me do it. We got lucky that we caught it when we did. I would also say that neither of the two credit monitoring systems we have (due to breached on other accounts) caught this. Because no new credit card was applied for they don’t check for having a second vendor account created tied to your existing card. This might be a new type of fraud scheme to be alert for.

@Beth

It's almost always very, very hard, if not impossible, to track down the individuals doing this. Would you have the authorities conduct a nationwide dragnet to find this person?

It's no different from a mugging, a front-porch package theft, or a car break-in...none of those crimes are going to be pursued by the cops in most cases, either.

I think it’s creepy to him because his phone number was associated with the purchases and led to an interaction (the voicemail).

A few days ago I got an email from Amex saying I used points for an amazon purchase. I hadn’t, and I wasn’t enrolled in amazon pay with points. Amex insisted I was, although amazon insisted I wasn’t. After digging around with an amazon rep on phone and live chat (the key was...

I think it’s creepy to him because his phone number was associated with the purchases and led to an interaction (the voicemail).

A few days ago I got an email from Amex saying I used points for an amazon purchase. I hadn’t, and I wasn’t enrolled in amazon pay with points. Amex insisted I was, although amazon insisted I wasn’t. After digging around with an amazon rep on phone and live chat (the key was them looking up orders by the credit card not by my amazon account) they discovered a different amazon account created in a different name, and enrolled in pay with points with my credit card 2.5 months ago, on the exact day the fake Amazon account was created. Furthermore, the charge that was paid with points was some baby nail clipping file refill, and it was being mailed to my actual address! Amazon immediately canceled the order and shut down that account, and I immediately had Amex shut down my account and refund everything. Had I not done anything, I would’ve received this bullshit nail file and my membership rewards balance probably would’ve been drained within days (I’m guessing the nail file was just a quick test to see if anyone was paying attention).

The key here was that Amex early on in the investigation credited my account back the points (at my request) but wasn’t very concerned about fraud. I kept pushing to figure it out and finally did with amazon. Trust your gut!

These seem to be increasing in frequency for all of us-wonder how long credit card companies will cover us for fraud; or do something new to recoup their increasing losses.

@Beth, you need to be a person of color to be caught and punished in the US. Not sure how it is in other majority white countries.

Beth, say what?? The thief is getting rewards points on top of the stolen loot??

What gets me riled up is how white collar crime almost always goes unpunished; the credit card thief will just keep doing this with other card numbers and continually reap the rewards.

OMG Ben that was hilarious "Chris Hansen style".

C'mon you wouldn't actually confront them if you could, would you?

@ JJ -- I mean, I'd at least like to hear from Kaitlyn if she enjoys her BBQ...

Creepy would be Brett Kavanaugh at a sorority party. This isn't creepy at all.