The major banks have all kinds of rules when it comes to approving people for credit cards. Probably the most well known of these rules — and also the most complicated to understand — is the Chase 5/24 rule. What makes it even more complicated is that it no longer seems to be consistently enforced.

In this post I wanted to take a closer look at how exactly the Chase 5/24 rule works, how you can check your 5/24 “status,” and the best strategy to take when applying for Chase cards in light of the 5/24 rule.

You’ll want to understand the Chase 5/24 rule if you plan on applying for one of Chase’s popular cards, like the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card.

In this post:

What is the Chase 5/24 rule?

The Chase 5/24 rule limits your ability to be approved for Chase credit cards, based on how many other cards you’ve opened in the past two years. With the 5/24 rule, you typically won’t be approved for a Chase credit card if you’ve opened five or more new card accounts in the past 24 months.

The thing to understand is that in the past couple of years, the Chase 5/24 rule no longer seems to consistently be enforced. While some people appear to be subjected to this, others aren’t. There’s also no way to know whether you’re subjected to it, short of just applying for a card and seeing whether you’re approved or not.

Why does Chase have the 5/24 rule?

All credit card issuers have rules in place to attract new cardmembers. Given how generous sign-up bonuses are on many cards, they create certain rules and restrictions intended to encourage profitable consumer behavior.

While Chase has never publicly explained this, my assumption is that customers are more likely to be profitable if they fall under the 5/24 limit. Then again, Chase seems to be backtracking on this rule for some consumers, as it no longer seems to apply consistently.

Which cards are subject to the Chase 5/24 rule?

The Chase 5/24 rule isn’t specific to any card, but rather is specific to certain consumers. So if you are subjected to the Chase 5/24 rule, it would apply for virtually all Chase cards.

Some of Chase’s most popular personal credit cards (which are subject to this rule) include the following:

- Chase Sapphire Preferred® Card (review)

- Chase Sapphire Reserve® (review)

- Chase Freedom Unlimited® (review)

- Chase Freedom Flex℠ (review)

- British Airways Visa Signature® Card (review)

- Aer Lingus Visa Signature® Card (review)

- Iberia Visa Signature® Card (review)

- Southwest Rapid Rewards® Priority Card (review)

- United℠ Explorer Card (review)

- World of Hyatt Credit Card

- IHG One Rewards Premier Credit Card (review)

- Marriott Bonvoy Boundless® Credit Card (review)

- Aeroplan® Credit Card (review)

Some of Chase’s most popular business credit cards (which are subject to this rule) include the following:

- Ink Business Preferred® Credit Card (review)

- Ink Business Cash® Credit Card (review)

- Ink Business Unlimited® Credit Card (review)

- Ink Business Premier® Credit Card (review)

- Southwest® Rapid Rewards® Performance Business Credit Card (review)

- Southwest® Rapid Rewards® Premier Business Credit Card (review)

- United℠ Business Card (review)

- World of Hyatt Business Credit Card

- IHG One Rewards Premier Business Credit Card (review)

Are business cards subject to the Chase 5/24 rule?

This is a point that confuses people. As you hopefully understand by now, Chase’s 5/24 rule means that you may not be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months.

There’s an exception, though — most business card applications (from Amex, Bank of America, Barclays, Chase, and Citi) don’t count toward the 5/24 limit. Why? Because business accounts opened with these issuers typically don’t show on your personal credit report.

However, if you want to be approved for a Chase business card, you’ll still need to be below the 5/24 limit, based on what’s counted.

To summarize:

- Chase business cards are subjected to the 5/24 rule, meaning that you may not be approved for them if five or more new card accounts show on your personal credit report in the past 24 months

- When you do apply for a Chase business card, it won’t count as an additional card toward that limit (because it won’t show on your personal credit report)

In case that’s still confusing, let me give an example:

- If you’re at 4/24 (based on four cards showing on your personal credit report) and you apply for a Chase business card, you’ll still be at 4/24

- You could then apply for another Chase business card, and even if you’re approved for that, you’ll still be at 4/24

- If you then apply for a Chase personal card, you’ll be at 5/24 (since the personal card shows on your personal credit report)

How do you check your Chase 5/24 status?

For some people it can be tough to determine if you’ve opened five or more new card accounts in the past 24 months. Furthermore, it’s not like Chase can tell you if you’re at the limit or not, given that the limit is based on your applications with all card issuers.

Now, as a general tip, I think it makes sense to keep a spreadsheet listing the cards you’ve applied for, the dates on which you’ve applied, etc. However, if you haven’t done that, what’s the best way you can determine if you’ve surpassed the Chase 5/24 limit or not? There are two best methods, as I see it…

Check Chase 5/24 status with Experian app

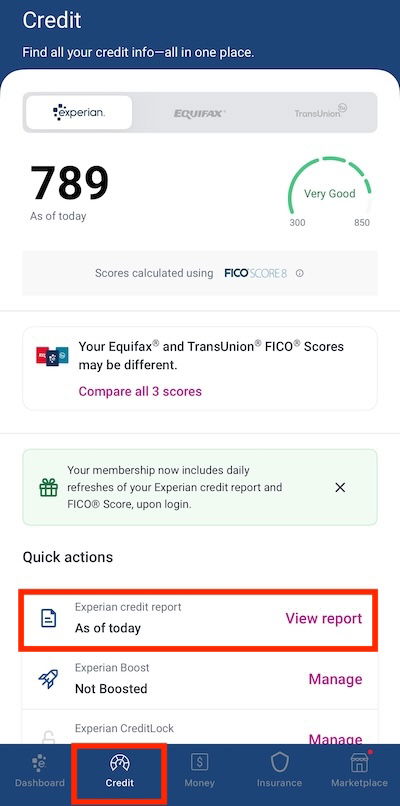

If you ask me, the easiest way to check your Chase 5/24 status is using the Experian app. Download the app and then create a (free) account. Once you’re logged into your account, click “Credit” at the bottom left, and then on the next page, click “View report.”

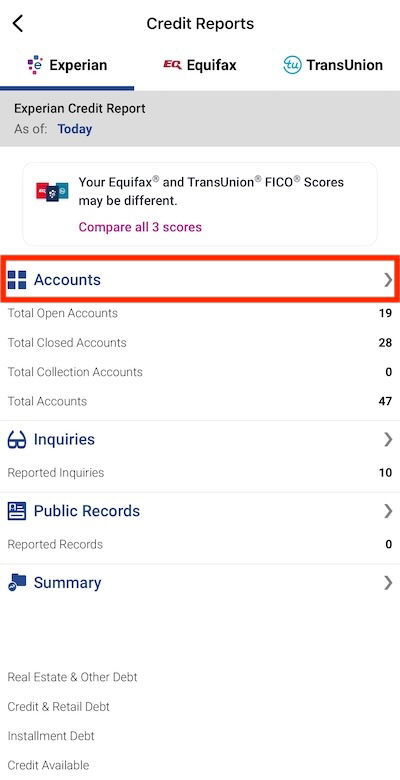

On the next page, click “Accounts.”

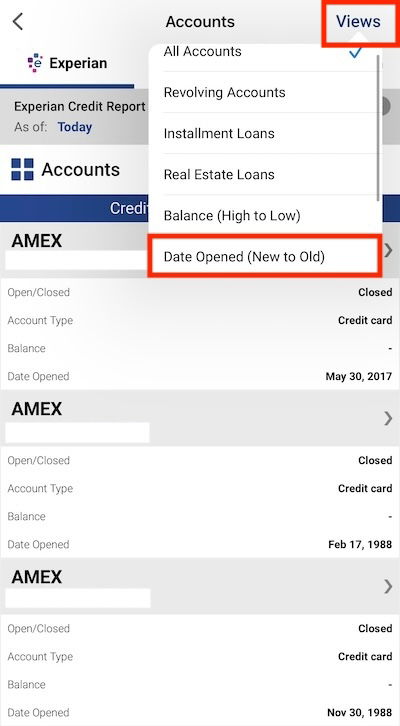

Then at the top right click “Views,” and then “Date Opened (New to Old).”

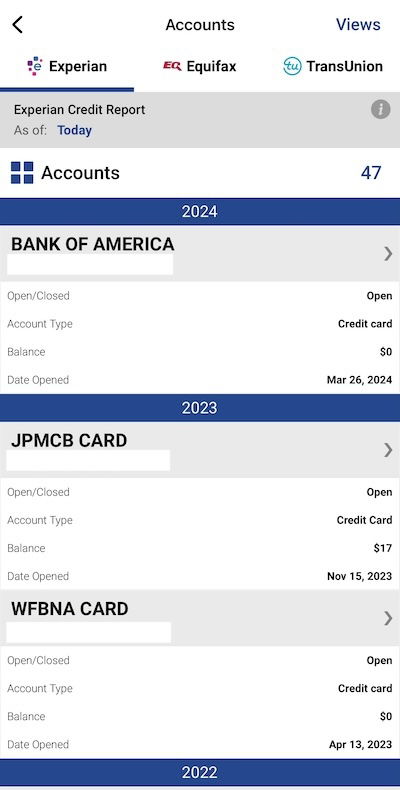

You’ll then see all the accounts that you’ve opened in chronological order, starting with the most recent. So just start counting and looking at dates, and you can see how many cards you’ve opened in that timeframe.

Check Chase 5/24 status with Credit Karma

Another way to check your Chase 5/24 status is through Credit Karma. This isn’t terribly straightforward, but it still works, and it doesn’t require downloading an app. To start, you’ll need to register for Credit Karma for free, which is an easy process.

Once you’ve registered and are logged into your Credit Karma account and are on the main page, take a look at the green half circles at the top of your account page, which show your credit score. Click on either of those circles.

On the next page, you’ll see more details about a variety of your credit factors. Click on the “Credit age” section.

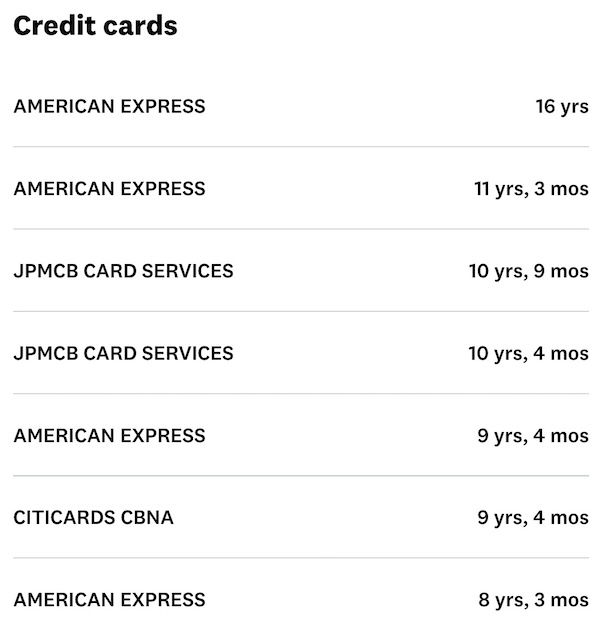

There you’ll see all your cards listed that are currently open. They’ll generally be sorted starting with the oldest cards…

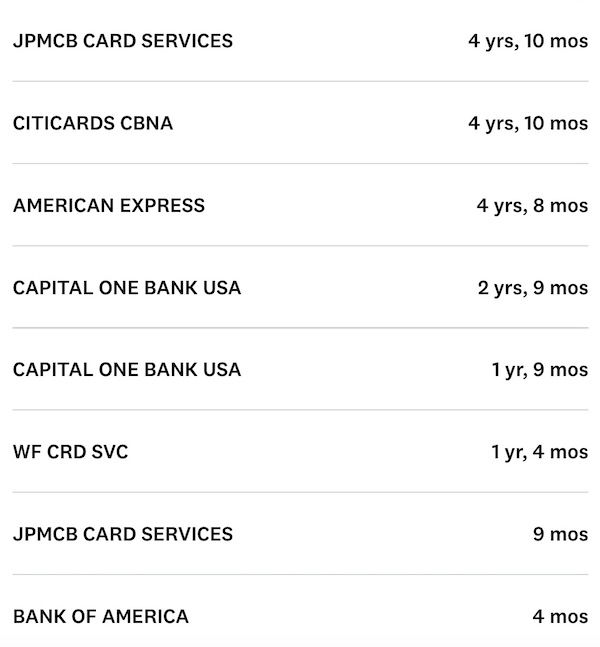

…to the newest cards. For example, as you can see below, I have four cards that Ii’ve opened in the past two years, which show on my personal credit report.

Now, there’s one catch — this only shows the accounts you’ve opened that continue to be open. If you’ve closed an account, it won’t show on this page. If you haven’t opened and closed accounts in the past 24 months, then this is a non-issue.

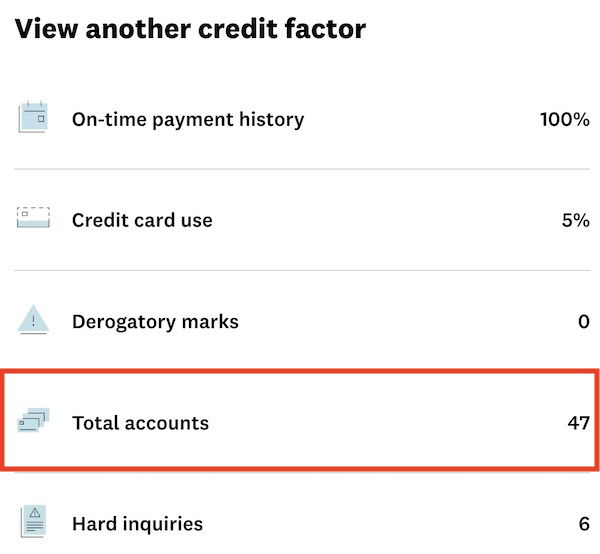

Fortunately figuring out cards that have been both opened and closed in the past 24 months isn’t too tough either. On the same page, go to the “View another credit factor” section, and click on “Total accounts.”

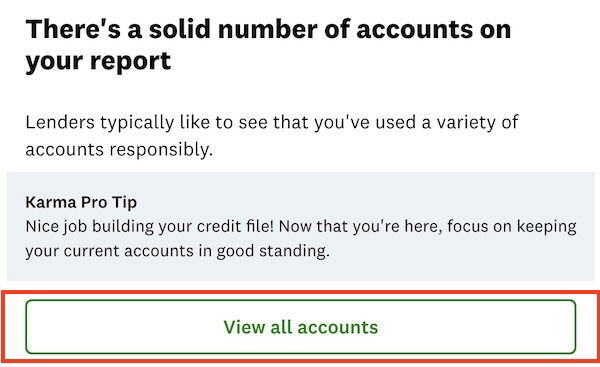

On the next page, click on “View all accounts” button. At the bottom you’ll then see a list that can show you all your closed accounts. Just add in any accounts that have been both opened and closed in the past 24 months, and you’ll have your 5/24 total.

It is worth noting that it can sometimes take a while for recent applications to show on your credit report, so if you’ve applied for a card in the past few weeks, it may not be on there yet (for example, my most recent card application isn’t showing yet).

Chase 5/24 rule FAQs

There are some further nuances when it comes to Chase’s 5/24 rule, so I think those are probably best addressed in the form of some frequently asked questions.

Are there exceptions to Chase’s 5/24 rule?

Nowadays it seems that not everyone is subjected to the Chase 5/24 rule. Some people have no issues getting approved for cards while beyond the limit, but there doesn’t seem to be much rhyme or reason to it.

Meanwhile for those who are subjected to the Chase 5/24 rule, there are generally no exceptions. So it doesn’t matter which card you apply for, as you’ll face the same issues no matter what.

Do mortgages and loans count toward the 5/24 limit?

The Chase 5/24 rule is based on having opened five or more new card accounts in the past 24 months. Other credit inquiries, including car loans, mortgages, etc., don’t count toward the 5/24 limit.

How long after falling under the 5/24 limit should you apply for a card?

If you’re subjected to the 5/24 rule, I recommend waiting until the beginning of the following month after you fall under the 5/24 limit before applying for a card.

In other words, if your fifth most recent card application was on January 15, 2023, then 24 months from then would be January 15, 2025. However, I’d wait until February 1, 2025, to apply for a card, since often falling underneath the limit isn’t instant.

Some report being able to get approved for cards sooner, but if you can wait I’d recommend doing so, just to be on the safe side.

Does Amex have a 5/24 rule?

The 5/24 rule is specifically a Chase credit card approval guideline. Every card issuer has different restrictions on approving members for cards, though the 5/24 rule is only a factor when applying for Chase cards.

Does product changing a card affect the 5/24 limit?

There can be a lot of value to product changing or downgrading a credit card, since this allows you to preserve your credit history (which can be good for your credit score). If you do product change a credit card — whether a Chase card or not — does this count as a further card toward your 5/24 limit?

The answer is that it depends — if there’s a hard pull and/or your card number is changed, then it will typically appear on your credit report as a new account, and would count toward that limit. Meanwhile if there’s no hard pull and the card number stays the same, then generally it wouldn’t count as a card toward that limit.

Does being an authorized user on a card count toward the 5/24 limit?

If you’re the authorized user on someone else’s credit card, does that count toward the 5/24 limit? Unfortunately it usually does, at least in situations where you need to provide your social security number to be an authorized user, and when you’re being added on a personal credit card. This can be a reason to minimize the number of cards on which you’re an authorized user.

Do charge cards count toward the 5/24 limit?

Yes, charge cards and hybrid cards do count toward the 5/24 limit, unless they’re business cards. For those of you not familiar with charge cards or hybrid cards, some Amex cards are designated as such, and the distinction is that you have no set credit limit, and you generally have to pay your balance in full every billing cycle.

Since these cards still show on your personal credit report, they would count toward the Chase 5/24 limit.

Can you be added as a Chase authorized user if you’re over the 5/24 limit?

If you’re over the 5/24 limit you can still be added as an authorized user on someone else’s Chase cards. You just can’t outright be approved for your own Chase card.

What is the Chase 2/30 rule?

With Chase’s 2/30 rule, you will typically be approved for at most two personal Chase cards in a 30 day period (and you can generally be approved for at most one business card in that period). This is an additional restriction for Chase approvals, beyond the 5/24 rule.

Does Chase combine hard pulls?

Chase generally doesn’t combine hard pulls. This means that if you apply for two Chase credit cards in one day, that would still count as two inquiries. Furthermore, both cards would be subjected to the 5/24 rule.

Do credit card rejections count toward the 5/24 rule?

No, if you’re rejected for a credit card then that wouldn’t count as a further card toward the limit. While a credit card rejection will typically show as an inquiry on your credit report, it doesn’t show as a new account having been opened, which is what this limit is based on.

Does closing a card bypass the 5/24 rule?

If you applied for a card within the past 24 months and then close it, does that mean it no longer counts toward the 5/24 rule? No, unfortunately it still would count, since it would still appear on your credit report. Just because you close a card doesn’t mean it disappears from your credit report.

Do store credit cards count toward the 5/24 limit?

Many retailers have credit cards that they may try to have you sign up for in-store. Do those count toward the limit? The answer is yes, assuming that they’re actually credit cards, rather than debit cards or store loyalty cards.

Best Chase 5/24 credit card application strategy

With most questions about the Chase 5/24 rule (hopefully) answered, I wanted to provide some advice for the best approach to take toward credit card applications in light of the Chase 5/24 rule.

Apply for Chase cards before other cards

While all major card issuers have application restrictions, Chase’s restrictions are the strictest when it comes to considering the cards you’ve applied for with other card issuers. As a result, I’d recommend applying for Chase credit cards early on in your credit journey.

In other words, if you’re interested in cards from Amex, Capital One, Chase, and Citi, generally pick up the Chase cards first.

Apply for Chase business cards before personal cards

If you’re interested in applying for both personal and business Chase cards, make sure you apply for business cards first. As explained above, while both personal and business Chase cards are subjected to the 5/24 rule, applying for a Chase business card doesn’t count as a further card toward that limit. That’s because a Chase business card won’t show on your personal credit report in the same way as a personal card.

In other words, get the Ink Business Preferred® Credit Card before you get the Chase Sapphire Preferred® Card.

Apply for “hub” Chase cards first

There are so many great Chase cards, so it can be tough to choose which card to apply for first. You’ll want to be sure you get the “key” cards first, which can help you maximize the value of other cards, especially within the Ultimate Rewards ecosystem.

If you’re looking for a personal credit card strategy:

- I’d recommend starting with the Chase Sapphire Reserve® Card or Chase Sapphire Preferred® Card

- I’d then recommend supplementing that with the Chase Freedom Flex℠ and/or Chase Freedom Unlimited®

If you’re looking for a business credit card strategy:

- I’d recommend starting with the Ink Business Preferred® Credit Card

- I’d then recommend supplementing that with the Ink Business Cash® Credit Card and/or Ink Business Unlimited® Credit Card

Chase has some of the best card duos out there.

Bottom line

Chase has a lot of great travel rewards credit cards that are worth acquiring for anyone looking to maximize their credit card strategy. When it comes to being approved, the 5/24 rule is the most important restriction to understand.

With this, you typically won’t be approved for Chase cards if you’ve opened five or more new card accounts in the past 24 months. However, this is no longer consistently enforced, so this is very much a case of “your mileage may vary.” Don’t be surprised if you get rejected for a Chase card because of the 5/24 rule, but also don’t be surprised if you’re approved for a Chase card in spite of being over the limit.

Hopefully the above answers any of the questions you may have about this rule, so that you can get the best Chase cards possible.

What has your experience been with the Chase 5/24 rule? Do you have any questions about the rule that I haven’t answered?

There are currently no responses to this story.

Be the first to respond.