Link: Apply now for the British Airways Visa Signature® Card

The British Airways Visa Signature® Card is one of Chase’s popular co-branded airline credit cards. British Airways Executive Club is a valuable frequent flyer program, so in this post, I wanted to take a closer look at this card.

Who should be applying for this card, and under what circumstances is it worth spending money on the card? This is a card that I’ve had for several years, and it’s one that lots of other people would benefit from as well, in my opinion. Note that if you’re looking to earn Avios with a credit card issued in the United States, there are two other options — the Iberia Visa Signature® Card and Aer Lingus Visa Signature® Card.

In this post:

British Airways Visa Card Basics For April 2024

There’s lots to love about the British Airways Visa Card. The card has a large welcome bonus, it has a reasonable annual fee, it offers statement credits when you pay carrier-imposed surcharges, and it earns points that can be useful whether you’re looking to redeem for premium cabin international flights or domestic economy flights.

Let’s take a look at what you need to know about this card, and what the best alternatives are.

Welcome Bonus Of 75,000 Avios Plus 5x Avios

The British Airways Visa currently offers a welcome bonus of 75,000 Avios after spending $5,000 within the first three months. On top of that, with the current offer you can earn 5x Avios on up to $10,000 of spending at gas stations, grocery stores, and dining purchases, for the first 12 months.

This is an improved offer — previously the card offered the 75,000 bonus Avios, but not the 5x Avios in select categories, the value of which can add up.

$95 Annual Fee

The British Airways Visa has a $95 annual fee. This is not waived for the first year, and there’s no additional fee to add authorized users.

Chase Card Eligibility

The welcome bonus on the British Airways Visa isn’t available to those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months. You are eligible for this card if you’ve had the Iberia Visa Card and/or Aer Lingus Visa Card, despite the similarities between the cards. Chase’s other general policies on card approvals apply as well.

Earning Avios With The British Airways Visa Card

The British Airways Visa Card has no foreign transaction fees and offers contactless payment, but does the rewards structure warrant putting spending on the card? It might, but only thanks to additional bonuses offered by the card.

Earn Up To 5x Avios Per Dollar Spent

The British Airways Visa doesn’t have terribly exciting bonus categories. You earn:

- 5x Avios on up to $10,000 in gas, grocery stores, and dining purchases, for first 12 months

- 3x Avios per dollar spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL

- 2x Avios per dollar spent on hotel accommodations

- 1x Avios per dollar spent on all other purchases

There are lots of great credit cards for airfare purchases and hotel purchases. This isn’t a card I would be putting much spending on unless you’re trying to earn a Travel Together Ticket, in which case it could definitely be worth it. More on that below. Furthermore, it can make sense to take advantage of the 5x Avios categories for the first 12 months.

British Airways Executive Club is a transfer partner of Amex Membership Rewards, Bilt Rewards, Capital One, and Chase Ultimate Rewards, so it could make sense to put spending on one of those cards if you want to earn Avios at an accelerated rate.

No Foreign Transaction Fees

British Airways’ credit card has no foreign transaction fees, so it’s potentially a great card to use for purchases abroad.

Contactless Payment

The British Airways Visa Card features contactless pay technology. This means you can pay using your card without even swiping it whenever you see the contactless pay symbol.

How To Redeem British Airways Avios

There are lots of great uses of British Airways Avios. British Airways Executive Club has roughly distance based award pricing, and the program offers value in situations where other programs might not. Generally speaking, here’s where I see value with Avios:

- British Airways Avios give you access to the most award availability for travel on British Airways, and thanks to the Reward Flight Saver scheme, you can even book some of these awards with limited surcharges

- British Airways Avios allow you redemptions on all oneworld partner airlines, and pricing is particularly lucrative for short haul awards; redeeming Avios on Alaska and American can be a great value

- You can transfer rewards between the various “flavors” of Avios, and take advantage of various sweet spots of programs like Aer Lingus AerClub, Iberia Plus, etc.

Personally I find Avios to be one of the most useful frequent flyer programs for redeeming points, thanks to the number of redemptions this opens up.

The Value Of Household Accounts

Often one of the big challenges people have with points is figuring out how to pool them since you typically need enough points in a single account for a redemption. A cool feature of the British Airways Executive Club program is that you can form household accounts. This allows you to pool the Avios you earn with up to six other people registered at the same address as you.

This is especially awesome in the context of a credit card welcome bonus, since you can pool a ton of Avios in a single account if you have two people get for the card in a household, etc.

British Airways Visa Card Benefits

There are some benefits to the British Airways Visa Card that could alone justify having this card. For some people, it will be worth spending money on the card to unlock some perks, while for others just having the card and not spending money on it offers sufficient benefits. Let’s look at what those benefits are, and how they work.

10% Discount On British Airways Flights

One of the best benefits of the British Airways Signature Visa is that it offers a 10% discount on British Airways flights starting in the United States. To take advantage of this, just book through ba.com/chase10, and use your card to pay while using promotion code BACHASE10.

If you fly British Airways with any frequency, this could cover the annual fee over and over. See this post for everything you need to know about the British Airways Visa flight discount.

Reward Flight Statement Credit

If you have the British Airways Visa Card and redeem Avios for a reward flight, you can receive up to $600 in statement credits annually. You can earn up to three statement credits, as follows:

- Earn a $100 statement credit for an economy or premium economy booking

- Earn a $200 statement credit for a business class or first class booking

There are some basic terms to be aware of:

- You have to pay for the taxes, fees, and carrier-imposed surcharges with the British Airways Visa in order to get the statement credits

- The booking must be for a transatlantic itinerary originating in the United States with the transatlantic portion of the ticket on British Airways (though it’s fine if a connecting flight is on a partner airline)

- One-way or roundtrip travel seems to be eligible

- The reservation must be made out of the primary cardmember’s Executive Club account, though it’s fine if someone else is traveling

- The statement credit will post within 45 days of the eligible reservation being made, and will be reversed if the ticket is canceled

British Airways now also offers Reward Flight Saver from the United States, allowing you to redeem more Avios and pay lower surcharges. Getting a further statement credit of up to $200 on that is pretty great.

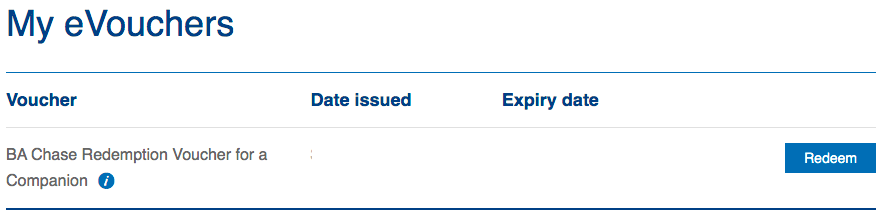

British Airways Travel Together Ticket

One of the potentially great perks of the British Airways Visa is that you can earn a Travel Together Ticket when you spend $30,000 on the card in a calendar year.

This companion ticket will be deposited in your Executive Club account four to six weeks after you’ve completed the required spending.

With this certificate, you can book a British Airways award ticket at the full cost of Avios (plus taxes, fees, and surcharges), and then for the second passenger you don’t have to pay any Avios, but rather just have to pay all the fees.

This also offers a lot of flexibility — you can also use the voucher as a solo traveler and get 50% off the Avios required for a ticket. Your ticket can originate anywhere in the world, and you can even travel on Aer Lingus or Iberia.

This can represent a fantastic deal for first and business class travel, given how much those tickets would otherwise cost. This isn’t for everyone, though it has the potential to represent a good value, and I know it’s a feature that many value.

See this post for everything you need to know about the British Airways Visa companion voucher.

Is The British Airways Visa Card Worth It?

The British Airways Visa Card has an excellent welcome bonus, and that could be a legitimate motivator for picking up this card. However, personally this isn’t a card I would use for everyday spending, since you can earn British Airways Avios at a better rate with other American Express or Chase cards.

That said, I absolutely think this card is worth holding onto if you fly British Airways with any frequency:

- The value of saving 10% on British Airways flights will add up quickly

- The up to $600 in credits for taxes and fees can cover the annual fee on this card over and over, if you redeem Avios for travel on British Airways that originates in the United States with any frequency

- If you redeem Avios on British Airways, Iberia, and Aer Lingus, the Travel Together Ticket could be well worth it

What About The Aer Lingus Card & Iberia Card?

There are three Avios currencies, all belonging to International Airlines Group (IAG) airlines — there’s British Airways, Aer Lingus, and Iberia. There are also two other US-based credit cards that directly earn Avios. Specifically, we’re talking about the Iberia Visa Card (review) and Aer Lingus Visa Card (review).

Which of these cards should you select? They have a lot in common:

- They have the same annual fees

- They all offer the same welcome bonuses

- They all have the same bonus categories

- If you meet certain conditions, you can transfer Avios between all programs at a 1:1 ratio

The differences mainly come in the form of the perks associated with just holding onto the cards, and also the perks associated with spending $30,000 on the cards in a calendar year:

- The British Airways Card offers 10% off British Airways flights and up to $600 in reward flight statement credits; you can get an award companion ticket for any class if you spend $30,000

- The Aer Lingus Card offers priority boarding for Aer Lingus flights; you can get an economy companion voucher on a paid ticket if you spend $30,000

- The Iberia Card offers 10% off Iberia flights; you can get a $1,000 companion flight discount voucher if you spend $30,000

The best card to select comes down to which benefits you value most. Also, remember that you’re eligible for all three of these cards, should you be interested, so you don’t necessarily have to choose between them.

See here for a full comparison of cards earning Avios.

Best Alternatives For Earning Avios

If you want to earn British Airways Avios, I’d recommend getting a card that earns either Amex Membership Rewards, Capital One, or Chase Ultimate Rewards points:

- These points currencies can be transferred at a 1:1 ratio to British Airways Executive Club

- Some of these cards offer bonus categories that can earn you points at an accelerated rate

- Sometimes we even see transfer bonuses to British Airways, though we haven’t seen as many of those in recent months

With that in mind, which cards should you consider? Here are some of my favorites:

- The Chase Sapphire Reserve® Card (review) offers 3x points on dining and travel

- The Chase Sapphire Preferred® Card (review) offers 3x points on dining, online groceries, and select streaming services, and 2x points on travel

- The Ink Business Preferred® Credit Card (review) offers 3x points on the first $150,000 spent per cardmember year on travel, shipping purchases, internet, cable and phone services, and advertising purchases made with social media sites and search engines

- The American Express® Gold Card (review) offers 4x points at restaurants, 4x points at U.S. supermarkets (on up to $25,000 of spending per calendar year), and 3x points on airfare

- The Capital One Venture X Rewards Credit Card (review) offers 2x miles on all purchases

Bottom Line

The British Airways Visa is one of the best co-branded airline credit cards out there, in my opinion. The card offers a solid welcome bonus, and it can be worth spending money on the card to earn a companion ticket.

Beyond that, the card can be worth having for the discounts offered on both paid tickets (up to 10% off) or award tickets (up to $200 in statement credits), which can cover the annual fee over and over.

However, when it comes to earning British Airways Avios long term, personally I’d much rather earn Amex, Capital One, and Chase points, and transfer them to British Airways. Not only does this allow you to earn points at a much faster rate, but it also gives you a lot more flexibility.

If you want to learn more about the British Airways Visa Signature Card or apply, follow this link.

Doesn't QR also accept Avios, these days?

I’ve got this card and forgot I had it. I could do with a chunk of Avios for an upcoming booking. If I cancel the card, can I reapply for it and get the bonus again? It’s been two years since I got it.

BA card is totally useless as is the Avios program.

You can spend one million dollars on this card and receive no status upgrade from BA.

As far as obtaining flights with points these are severely restricted by BA.If you are lucky enough to get one you will be mugged by British government.

Status should come from actual bums in seats, not buying 500 laptops for your business on your Amex. BA do it right IMO.

The last several years Chase had also extended bonus Avios upon my renewal without asking! Anywhere from 2,500 (this year & last) up to 5,000 during covid. Chase spend offers throut the year on the BA card are also better than most of their other cards.

I liquidated over 100k Avios several years ago on a round trip Business Class ticket in one direction and Premium Economy in the other between North America and London.

Because I was traveling to Ireland a lot the BA rental car insurance benefit saved me a lot of money. I used it for Hertz rentals and as a backup for my Bank of America Visa with Alaska Air.

I somehow managed to get close to...

I liquidated over 100k Avios several years ago on a round trip Business Class ticket in one direction and Premium Economy in the other between North America and London.

Because I was traveling to Ireland a lot the BA rental car insurance benefit saved me a lot of money. I used it for Hertz rentals and as a backup for my Bank of America Visa with Alaska Air.

I somehow managed to get close to 100k miles again and found a Business Class redemption on Fiji Air between SFO and SYD. I later found a one way Business redemption on Alaska between MEL and NAD and a separate redemption between NAD and LAX.

I was relieved to have liquidated the miles and continue to use it as a backup card and for overseas and Hertz rentals.

British Air lost my golf travel bag for three days on my way to Ireland and messed up on four of six luggage transfers at Heathrow. I got no response from an automated reporting system about the mishandling of golf equipment. They didn't respond to a paper version submitted with tracking number I verified as received.

I'll take the BA Chase Card, but they lost me as a flyer. All the Heathrow charges and fuel surcharges diminish the value.

@ Ben: is the the 10% only for me (the cardholder) or if I buy a ticket for myself, wife and 2 kids all on one reservation do we get 10% off the entire reservation?

The linked article for the 10% flight discount has the details:

“This is valid for up to eight people traveling on the same flight, and the cardholder must be one of the passengers.”

Awesome. Thank you.