The Amex Membership Rewards program frequently offers transfer bonuses. The program has just launched its latest transfer bonus — while I wouldn’t say it’s particularly compelling, it’s at least worth being aware of.

In this post:

Marriott Bonvoy transfer bonus from Amex

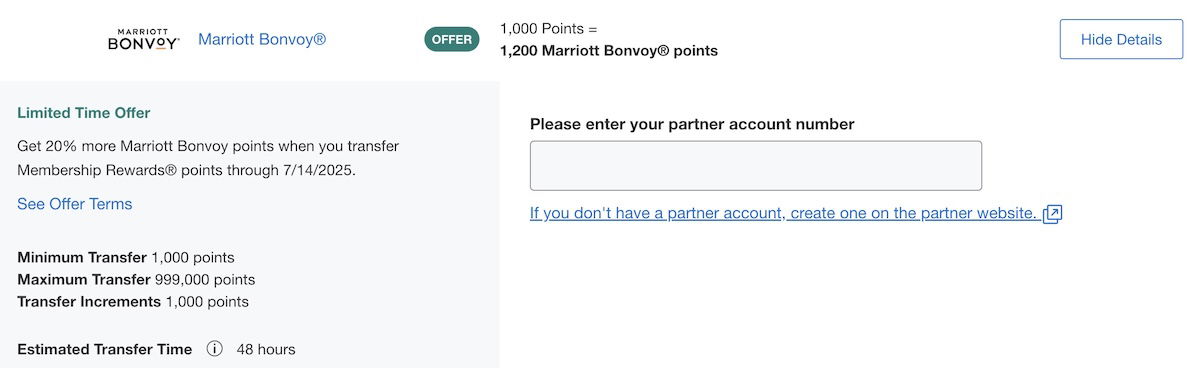

Through Monday, July 15, 2025, the Amex Membership Rewards program in the United States is offering a 20% bonus on points transfers to Marriott Bonvoy.

The transfer ratio is usually 1:1, so through this promotion you can transfer points at a 1,000:1,200 ratio. This bonus is hardcoded into the transfer ratio, so you can take advantage of the bonus as often as you’d like. Transfers from Amex to Marriott are generally instant.

For what it’s worth, we last saw a transfer bonus from Amex Membership Rewards to Marriott Bonvoy in late 2024. The transfer bonuses are typically in the range of 20-35%, so this is at the lower end of that.

Should you transfer Amex points to Marriott with a 20% bonus?

While a 20% bonus might sound exciting, not all points currencies are created equal. Personally, I value Bonvoy points at ~0.7 cents each, give or take. There are certainly ways to get outsized value from the points, but that’s my valuation.

By my valuation, you’re still getting under one cent of value per Membership Rewards point, even with this transfer bonus. That’s quite a ways from my valuation of Membership Rewards points, which is 1.7 cents per point.

Other people will likely have wildly different valuations of Marriott points than I do, and if that’s the case, this bonus could be worth it. That’s especially true when you consider there’s no great way to earn Marriott points through everyday credit card spending anymore. I tend to value points conservatively, and of course there are always ways to get outsized value with the right redemption in mind.

Bottom line

In general, I think transfer bonuses are the way to maximize the value you can get from transferable points. However, that’s usually only true for currencies where even transferring points at a 1:1 ratio could make sense.

In the case of Amex Membership Rewards and Marriott Bonvoy, I find that you lose more than half of the value of your points by making a transfer under normal circumstances. Even with a 20% bonus, I wouldn’t consider this to be much of a deal at all.

Of course, some people may have specific situations where this could make sense, and in that case, it could be worth at least topping off an account.

Does anyone plan on taking advantage of this Amex transfer bonus to Marriott Bonvoy?

There are currently no responses to this story.

Be the first to respond.