Link: Learn more about the American Express Platinum Card® or The Business Platinum Card® from American Express

American Express Platinum Card® (review) and The Business Platinum Card® from American Express (review) are popular premium cards. Many people pick up these cards not because of the return they offer on everyday spending, but rather because of all of the perks of being a cardmember.

For perks-rich cards, there’s often value in adding authorized users, so that you can share your benefits with loved ones and close friends. So in this post I wanted to take a close look at the value proposition of adding Amex Platinum authorized users — how much does it cost, and what does it get you?

In this post:

Amex Platinum authorized users cost

The value of adding authorized users varies quite a bit, depending on whether you’re looking at the personal or business version of the card:

- On the Amex Platinum Personal Card, each authorized user will cost you $195 per year (Rates & Fees)

- On the Amex Business Platinum Card, each authorized user will cost you $400 per year (Rates & Fees)

When deciding whether to add authorized users, also keep in mind that the primary cardmember is responsible for any charges they make, so only add people that you can trust.

Amex Platinum authorized user benefits

If you add authorized users to the Amex Personal Platinum or Amex Business Platinum, what benefits should you expect that they’ll receive?

For one, authorized users get the full suite of airport lounge access perks, which I’d argue are the best offered by any premium credit card. This includes:

- Access to Amex Centurion Lounges; guests cost $50 each, unless you spend at least $75,000 on the card per calendar year, in which case you can bring two guests for free

- Access to Delta Sky Club® when flying Delta on the same day; you can bring guests for $50 each (up to 2 guests or immediate family). As of February 1, 2025, Delta Sky Club access restrictions have been implemented. Eligible U.S. Platinum Card Members will each receive 10 Visits to the Delta Sky Club® each year to be used from February 1 until January 31 of the next calendar year and can earn an unlimited number of Visits by spending $75,000 in eligible purchases on their Card Account in a calendar year.

- A Priority Pass™ Select membership (Enrollment required)

- Access to Plaza Premium Lounges; you can guest up to one person at no additional cost

- Access to Escape Lounges and select Lufthansa Lounges

I’d say the lounge access is the most substantial perk, though there are other useful perks for being an authorized user on the Amex Platinum (Enrollment is required for select benefits), including:

- A TSA PreCheck or Global Entry fee credit for each authorized user (every 4.5 years for the application fee for TSA PreCheck, or every four years for the application fee for Global Entry)

- Complimentary hotel status with Hilton Honors and Marriott Bonvoy

- Complimentary car rental status with Avis, Hertz, and National

- Access to the American Express Fine Hotels + Resorts® (FHR), where you can get additional benefits for stays at many luxury hotels

- Access to the Amex International Airline Program (IAP), offering savings on international tickets

- Authorized user spending will earn points at the same rate as the primary cardmember (like the personal card offering 5x points on airfare on up to $500,000 of flight purchases per calendar year, and then 1x), though the primary cardmember will earn the points, and will also be responsible for paying the bill

There’s one other often overlooked perk. The Amex Platinum earns Membership Rewards points, and those points can be transferred to airline & hotel partners, which I consider to be the best use of these points. However, they can only be transferred to a loyalty program account in the name of a cardmember. If you add an authorized user, you’ll be able to transfer points to one of their airline or hotel accounts after 90 days, which gives a lot more flexibility.

Just to be thorough, what benefits don’t get Amex Platinum authorized users get? Aside from the Global Entry or TSA PreCheck credit, authorized users don’t get any of the additional credits that primary cardmembers receive, whether it’s the airline fee credit, Uber credit, digital entertainment credit, CLEAR credit, Equinox credit, Saks credit, etc.

How do you add Amex Platinum authorized users?

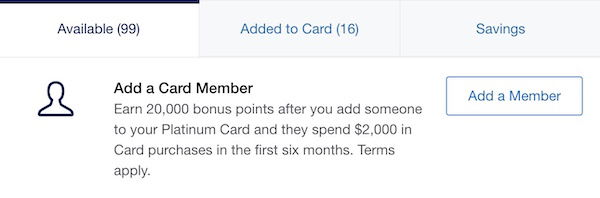

The process of adding authorized users on the Amex Platinum is easy, and potentially even rewarding. Log into your Amex account, and then scroll down to the “Amex Offers & Benefits” section. You should see the “Add a Card Member” option listed there.

While this won’t always be the case, in some instances you may even see a reward for doing so.

You’ll have to provide the name and date of birth of the authorized user you want to add. You also have the option of adding their social security number — if you don’t add it at this point, you’ll have to add it within 60 days of the card being issued.

Note that authorized users on the Amex Platinum must be at least 13 years old.

Is adding Amex Platinum authorized users worth it?

The incremental perks for authorized users between the personal and business versions of the card are very similar, though obviously the costs are different. On the Amex Personal Platinum you’ll pay $195 per authorized user, while on the Amex Business Platinum you’ll pay $400 per authorized user.

I think there’s definitely an argument to be made that the value is there to add authorized users, especially if the authorized user values lounge access. Getting such comprehensive lounge access perks for $195-$400 per year isn’t bad. Then again, on the personal version of the card, adding authorized users isn’t as good of a deal as it was back in the day.

So I don’t think adding authorized users is a slam dunk in the way it used to be, though I think it absolutely could represent a worthwhile deal.

Just as a point of comparison, I’d argue that among the three most popular premium cards, this is the least good value:

- The Capital One Venture X Rewards Credit Card (review) allows you to add up to four authorized users at no extra cost, however, as of February 1, 2026, you’ll need to pay $125 per authorized user to receive a variety of valuable perks, including a Priority Pass™ Select membership and Capital One Lounge access

- The Chase Sapphire Reserve® Card (review) allows you to add authorized users for $195 each, and they receive a variety of valuable perks, including a Priority Pass™ Select membership and Chase Sapphire Lounge access

Bottom line

There are lots of incredible perks to the Amex Platinum Card, from credits to lounge access. Many people may find it worthwhile to add authorized users to the card. While it’s not cheap, they get many of the same lounge access benefits as the primary cardmember, ranging Centurion Lounge access to Delta Sky Club access.

The cost for adding authorized users is substantial — higher than with some other comparable cards — but it is absolutely worth considering.

If you have the Amex Platinum, how do you feel about the value of adding authorized users?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and American Express Platinum Card® (Rates & Fees).

Terrible move on the part of Amex. I aocelling. If I need to give others access to lounges, I’ll pay the $75/year for Sapphire Reserve since the earnings rate is way higher for our spending patters. Amex Plat offers discounts on services that I don’t use. Since I also have Admirals Club full membership, am Exec Plat with AA, and usually fly oneworld airlines, I get enough lounges access anyway. It is really a YMMV...

Terrible move on the part of Amex. I aocelling. If I need to give others access to lounges, I’ll pay the $75/year for Sapphire Reserve since the earnings rate is way higher for our spending patters. Amex Plat offers discounts on services that I don’t use. Since I also have Admirals Club full membership, am Exec Plat with AA, and usually fly oneworld airlines, I get enough lounges access anyway. It is really a YMMV situation.

I just hate the Venture X’s set up which requires you to go through its travel portal to redeem the annual travel credit. I’ve used Amex Travel in the past - if you are traveling internationally, you cannot reach anyone if needed - you’re on your own. My father was dying in Asia while I was in Europe - cannot reach anyone to help with the travel changes. So I avoid these travel agencies like the plague.

I stacked a $2k retention spend bonus with a 10k “Free Companion Card AU” MR bonus, nice haul!

I stacked a $2k retention spend bonus with an AU 10k MR bonus, nice haul!

Currently have the Morgan Stanley version with a free AU. We do some cruise travel and the AU card has gotten some generous Amex offers for a line we cruise, as well as some other Amex offers. Since this version is not "free" as some would have you believe since you have to keep funds there for fee reimbursement, these offers have more than compensated for that.

Other things to add here:

You can add Gold AU for free. This gives the ability to transfer MR to their accounts for free after 90 days.

So basically it come down to whether you can get $500 of value out of having your own Amex platinum ($695) vs being an AU ($195). If you can use the airline fee credits, Uber credits, Amex travel credit and Saks credit, that’s already $700ish of value.

“Cardholder since 1971”

Recognition?

Elite service?

In Feb. I added my daughter for $195 - a substantial increase from last year +3 A. users.

Plus a 10k points bonus.

I have not received the bonus.

Why?

AMEX Rep advises since card was lost in the mail, the replacement card does not qualify.

I appealed and advised the Rep would pass on my complaint. I’ll hear back in a week.

Sad.

Wow! Since 1971! I’m just Since 1983 ;-)

Best Wishes for a resolution in your favor!

No mention of the Companion Platinum Card which is free. No lounge. Rest is same.

https://www.americanexpress.com/en-us/account/get-started/additional-card-member/companionplatinum

If you get a second Amex card, like the Hilton Amex, they split the credit line between the two cards