Link: Apply now for The New United Club℠ Card

United Airlines and Chase issue several co-branded credit cards, and we’ve recently seen this card portfolio completely overhauled. In this post, I want to take a closer look at The New United Club℠ Card, which is the most premium personal card issued with this partnership.

In this post:

United Club Card Basics For June 2025

The United Club Card provides a huge welcome bonus, lounge access, the ability to earn elite status through credit card spending, and strong perks. If you’re a United frequent flyer and value lounge access, this is the card for you.

United Club Card Welcome Bonus Of 90,000 Miles

The United Club Card is offering a welcome bonus of 90,000 MileagePlus miles after spending $5,000 within the first three months. This is a great bonus with a reasonable spending requirement. I value United miles at 1.1 cents, so to me, this bonus is worth $990.

Who Is Eligible For The United Club Card?

The welcome bonus on the United Club Card isn’t available to those who currently have this exact card, or have received a new cardmember bonus on the card in the past 24 months. However, you are eligible for this card and the bonus if you have (or have had) any other United Airlines credit cards.

There are also general restrictions when applying for Chase cards, including the 5/24 rule (though that’s not consistently enforced anymore).

United Club Card $695 Annual Fee

The United Club Card has a $695 annual fee. This annual fee is no doubt on the steep side, though it’s in line with the fees you’ll find on many premium credit cards. The card also offers a variety of perks for frequent flyers that could more than justify the fee.

Earning Miles With The United Club Card

The United Club Card offers anywhere from 1-4x MileagePlus miles per dollar spent, as follows:

- 4x MileagePlus miles for United purchases

- 2x MileagePlus miles on all other travel purchases

- 2x MileagePlus miles for dining at restaurants and eligible food delivery services, including Caviar, DoorDash, GrubHub, and Seamless

- 1x MileagePlus miles for all other eligible purchases

For a co-branded airline credit card, those are some solid bonus categories, and in particular, it’s nice to earn bonus miles on dining purchases. The United Club Card also has no foreign transaction fees, making it a good option for purchases abroad.

Earning PQPs With The United Club Card

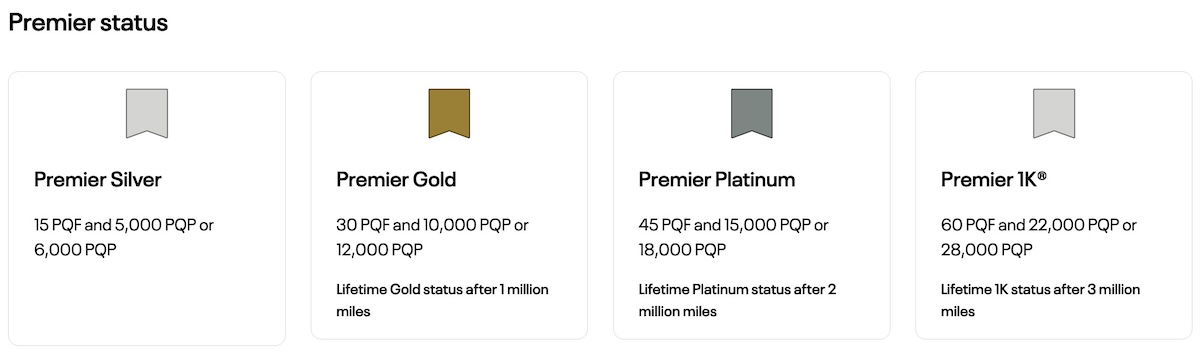

If you want to earn elite status with United MileagePlus, the United Club Card can help. As a reminder, below are the MileagePlus elite requirements for 2025, with Premier Qualifying Points (PQPs) being one of the primary metrics.

So, how does spending on the card count toward status? The card offers one PQP for every $15 spent on purchases, up to a maximum of 28,000 PQPs per year. This is the most lucrative United personal card for spending in terms of being able to earn PQPs. As you can see, it’s possible to earn all the way up to Premier 1K status exclusively through credit card spending, should you want to.

Earning Award Discounts With The United Club Card

As an additional incentive to spend money on the card, the United Club Card offers the ability to earn award discounts of 10,000 miles. You can earn one of these for spending $20,000 in a calendar year, and a second one for spending a total of $40,000 in a calendar year.

Each award discount can save you up to 10,000 miles on the cost of an award ticket on United or United Express. So if you redeem with any frequency, that’s potentially quite valuable.

United Club Card Benefits & Perks

The area where the United Club Card really shines is when it comes to perks. The value you get from these perks is what should determine if this card makes sense for you or not. Let’s take a closer look at what perks are offered by the card.

Receive A United Club Membership

Arguably the key benefit of the United Club Card is that it comes with a United Club membership for as long as you have the card. We’ve recently seen some changes to United Club memberships, and there are now two kinds of memberships:

- A United Club individual membership offers access exclusively to United Clubs (and not partner lounges), and only for the primary member

- A United Club all access membership offers access to United Clubs and Star Alliance lounges, for the primary member and up to two guests

So, what kind of membership does the United Club Card offer? Well, it’s somewhere in between the two:

- You automatically receive an individual membership, but with improved guesting privileges, where you can bring one guest and any children under the age of 18

- If you spend $50,000 on the card annually, or if you have Premier Gold status or above, then your membership is upgraded to an all access one, offering access to more lounges and better guesting privileges

Getting the United Club Card is arguably the best way to get United Club access, especially when you consider that the card’s annual fee is lower than most membership costs, and that doesn’t account for all the other perks.

First & Second Checked Bag Free

The United Club Card primary cardmember and one companion traveling on the same reservation receive a free first and second checked bag. In order to be eligible for this, you have to pay for your ticket with your United Airlines credit card.

This is a value of up to $360 per roundtrip ticket (assuming two people are checking two bags roundtrip – $40 for the first and $50 for the second).

Premier Access Travel Services

Just for having the United Club Card, the primary cardmember receives Premier Access travel services when flying with United, including the use of Premier Access check-in lines, priority security lanes, priority boarding, and priority baggage handling.

25% Savings On United Inflight Purchases

If you have the United Club Card you receive 25% back in the form of an account statement credit on purchases of food, beverages, and Wi-Fi, onboard United. You have to pay with your United Club Card Card, and your statement credit should post within 24 hours.

Up To $240 In Instacart Credits Annually

The United Club Card offers up to $20 in Instacart credits monthly, up to $240 total each calendar year. This comes in the form of two monthly $10 credits. This applies for purchases made through Instacart with your United Club Card, and currently the benefit is valid through December 31, 2027.

If you use Instacart anyway, then this could be worth close to face value. For others, the small increments of the credits will make it hard to get much value.

Up To $200 In Renowned Hotels and Resorts Credits Annually

The United Club Card offers up to $200 in statement credits each anniversary year for hotel purchases, when you prepay directly through Renowned Hotels and Resorts with your United Club Card. This is essentially United’s hotel booking platform for select luxury hotels. You can receive extra perks for booking this way, though admittedly there’s also sometimes an opportunity cost to booking this way.

Up To $200 In JSX Flight Credits Annually

The United Club Card offers up to $200 back on JSX flight purchases per anniversary year. This comes in the form of a statement credit, and you must use your United Club Card to make the purchase. JSX is a hop-on jet service, which United owns a stake in. If you fly JSX with any frequency, then this is a great perk.

Up To $150 In Credits On Rideshare Purchases Annually

The United Club Card offers up to $12 back per month on rideshare purchases ($18 in December), in the form of a statement credit, when paying with your card. This allows you to earn up to $150 in statement credits every calendar year, and an annual opt-in is required.

On the one hand, these statement credits are easy enough to use. The catch is that there are probably better cards for rideshare spending in terms of maximizing rewards.

Save 10% On United Economy Saver Awards

If you have the United Club Card you can save 10% on economy award tickets when traveling on United. This is valid for saver level awards for travel within the United States, or between the United States and Canada. The discount applies to all passengers on the same reservation as the primary cardmember, and the miles must be redeemed through the primary cardmember’s MileagePlus account.

Access To More MileagePlus Award Space

If you have the United Club Card, you get access to additional MileagePlus award availability for travel on United. This includes both access to additional saver level award availability, as well as last seat access to United’s standard awards, which are valuable when flights are full.

Receive IHG Platinum Elite Status

The United Club Card offers Platinum Elite status in the IHG One Rewards program. This IHG status offers perks like upgrades, bonus points, late check-out, and much more. While it’s not my favorite hotel status, it does come in handy when staying at IHG properties. Cardmembers can register for this perk here by providing the last four digits of their credit card number, plus their MileagePlus number.

Global Entry, TSA PreCheck, Or NEXUS Credit

The United Club Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee to your card, and it will automatically be reimbursed.

Nowadays quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. They just have to use your credit card to pay, and you’ll automatically receive the statement credit.

Should You Get The United Club Card?

The United Club Card is United’s most lucrative personal credit card if you’re a frequent flyer with the airline:

- United Club access comes in handy, and this card offers the best pathway to receiving lounge access on the airline

- If you want to spend your way to elite status, this card gives you the best opportunity to do so, both in terms of the rate at which you earn PQPs, and how many total PQPs you can earn through spending

- While the card has a high annual fee, the credits and other perks really add up, and should help offset that fee

The math on getting the United Club Card checks out. Also keep in mind that if you want to downgrade the card to a lower annual fee card in the future, that should be possible once you’ve had the card for at least 12 months. You might as well pick up the card with the best welcome bonus and richest perks, and then you can decide in the future which card makes the most sense for you.

How Does The United Quest Card Compare?

The New United Quest℠ Card is the mid-range United personal card, and I’d say the card is a great option for those who maybe aren’t super frequent flyers on United, but who still value perks. The card has a $350 annual fee, but I find that to be easy to justify, thanks to the card offering perks like $200 in United TravelBank cash annually, a 10,000 mile discount on awards annually, a variety of credits, and much more.

Read a full review of the United Quest Card.

How Does The United Explorer Card Compare?

The New United℠ Explorer Card is probably United’s most popular co-branded credit card, given the reasonable annual fee and solid perks. The card has a $0 introductory annual fee for the first year, then $150. I’d consider this to be the best card for the occasional United flyer, as the card gets you basic perks like two United Club passes annually, a first checked bag, priority boarding, savings on inflight purchases, and more.

The deciding factor between the two cards should partly come down to whether you value a United Club membership or not. If it’s something you would otherwise pay for, you should get the United Club Card. If it’s not something you would pay for, I think the United Explorer Card is the better option.

Read a full review of the United Explorer Card.

Bottom Line

The United Club Card is United’s most premium personal credit card. While the card has a $695 annual fee, it offers incredible perks, including a United Club membership, a free first and second checked bag, a variety of credits, and more. If you’ve been considering this card, this would be a great time to apply, given the bonus.

If you want to learn more about the United Club Card or want to apply, follow this link.

My husband, daughter, son, and I recently signed up for the United Chase black club card, paying $3,000 in fees, at $750 per person. We got stuck in the Long Island airport yesterday due to weather, and were not allowed to enter the club because we were not flying United that day. We fly many airlines, including United, and would have never signed up for the United Chase club cards had we known about the...

My husband, daughter, son, and I recently signed up for the United Chase black club card, paying $3,000 in fees, at $750 per person. We got stuck in the Long Island airport yesterday due to weather, and were not allowed to enter the club because we were not flying United that day. We fly many airlines, including United, and would have never signed up for the United Chase club cards had we known about the restriction that you can only enter with a United boarding pass. We thought paying the $750 fee for the "club card" gave us access to the club regardless of who we happened to be traveling with. Sometimes, we need a different flight option for timing purposes. I feel this stipulation should be better highlighted in the materials Chase uses to promote this card, so that people know before committing to this "club" card. This was a very disappointing lesson. The United desk agents at Long Island Airport's United club were also very unfriendly. We are sorry that we all jumped in on this card instead of other options we should have investigated.

A little misleading to show a Polaris Lounge photo here alongside a lounge card

Chase ? Chase this. Most readers are not getting airline miles. They are not getting lounge access. They are going in to debt.

Then they are definitely reading the wrong blog.

Ben, speed the heck up! Are you going to post about the Hong Kong airlines a320 that had an inflight fire? What about the Sri Lankan A330 that CRASHED off the cost of Colombo? HURRY UP! we do not care about United club card reviews!!!

@ Stupido -- A SriLankan A330 crashed?!

Yes! that's what I heard! May be a good post! Heard it from someone who is not that good with planes, so maybe they misspoke ;]. Or maybe they meant the Hong Kong airlines plane that had an INFLIGHT FIRE!

Ben, Have things changed with access for Star Gold Members...??? Is that now an even better option now given these changes [i.e. the Aegean route of the past]...???

@ SEM -- That's still a great way to access lounges if you put in the effort, though it's not really something you can easily buy. But if you can swing it, it's definitely worth it.

Wow!~ Ben, your kind of slow this morning again. Is it Miles or Winston :) ?

Haha. Yeah I refreshed my aviation feed today and Cranky had the same number of posts as Ben. Wild!!

…just teasing though Ben. You deserve to take weekends off.

I wish all these airline vloggers would take the weekend off. Take two.

@ Stefen -- Hah, family stuff, and also I was working on my next review post (those take hours to write, unlike average blog posts). But more coming soon!