In March we learned that American Express and Costco would be cutting ties, which was a pretty big loss for American Express. The loss of Costco threatens roughly 8% of the annual worldwide spending on American Express cards. But American Express was losing money on the agreement, and it just didn’t make sense to sustain it.

Instead, as of April 2016, Costco’s co-branded credit card will be a Visa issued by Citi.

Sam’s Club now accepts American Express

It seems like American Express wasn’t going to just take the loss without a fight, as they’ve now worked out an agreement with Costco’s biggest competitor, Sam’s Club (which is the eighth largest retailer in the US).

As of October 1, 2015 (today), American Express cards are accepted at more than 650 Sam’s Club locations in the US.

To celebrate the new partnership, card members can receive a one-time $25 statement credit after they use an enrolled, eligible American Express Card to spend $45 or more on a new Sam’s Club membership in-store between October 1 and October 31, 2015.

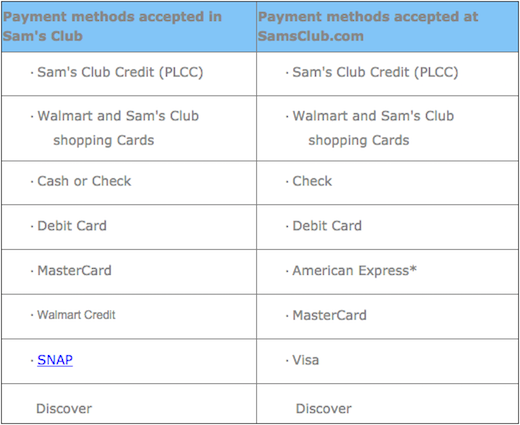

As a reminder, prior to this the only credit card that Sam’s Club accepted in store was Mastercard. You could use American Express when making purchases online, but not in-store. So this nicely increases the payment options at Sam’s Club.

Which credit card should you use at Sam’s Club?

Now that Sam’s Club accepts both American Express and Sam’s Club, what’s the best credit card to use for Sam’s Club purchases?

Warehouse stores typically don’t qualify as grocery stores for the purposes of credit credit card, so there aren’t really any bonus categories you can take advantage of by shopping at Sam’s Club. So in general you’ll want to use a credit card which maximizes your return on everyday spend. A few of which include:

Bottom line

American Express certainly made the best of a bad situation here. Their relationship with Costco wasn’t sustainable, so they managed to accomplish the next best thing, which is partnering with Costco’s biggest rival.

This is great news for consumers, as it it increases the variety of cards accepted at Sam’s Club.

If you’re a Sam’s Club customer, are you excited about these changes?

I have been using my Barclay's arrival card or AAdvantage MasterCard for my business purchases but now I'm tempted to use my SPG amex. Which one of the 3 do you consider the best option?

Hi Ben,

My Amex Everyday Preferred card got suspended few days ago. I called the card center, the manager told me she suspended the card because amex wants some info from me, then she asked me all the personal info including why I purchased an item from ebay for 780 dollars. I think that's too personal, and she asked me what to do with the item. That's way too far from gathering info in my...

Hi Ben,

My Amex Everyday Preferred card got suspended few days ago. I called the card center, the manager told me she suspended the card because amex wants some info from me, then she asked me all the personal info including why I purchased an item from ebay for 780 dollars. I think that's too personal, and she asked me what to do with the item. That's way too far from gathering info in my opinion. She said I need to fax her the past 2 months of my debit card statements to review, otherwise she will close my card. I think this is absurd! I paid my monthly payments full all the time! She said because I'm a college student the money my parents give me shouldn't count as reliable income. The whole thing is out of my mind and I'm really mad. Is this normal for amex to review customers like this?

This is GREAT news. I am already a Sam's Club member, and had been using my AAdvantage MasterCard here. I am excited to use my SPG Amex here though, instead, as it is a much greater return points wise and I do spend a decent amount at Sam's!

Will this promo work with serve cards?

Sam's Club has accepted Discover for a very long time. Much longer than mastercard.

I wonder if Sam's Club Gas stations would be considered a gas station or warehouse club.

@Mason

That's why only the Amex addition excites him.

Why not mention Discover? Do you not have a referral link for them?

So the $25 credit is only for buying a new membership rather than for actual purchases at Sam's Club? Doesn't sound very useful then...

How classy, they dropped food stamps (SNAP) and added AMEX!

It would appear that Discover is accepted at Sam's Club as well. I thought they even had a co-branded deal some time ago with Discover.