While all airlines are struggling right now, Norwegian is probably one of the most vulnerable airlines at this point. The airline is now presenting a business restructuring plan, and it sure is… different.

In this post:

Norwegian was struggling before COVID-19

While the current situation is unprecedented, the reality is that most airlines fall into one of two general categories:

- There are the airlines that were making money and were sustainable going into all of this, but that weren’t prepared for this level of disruption

- There are the airlines that were barely staying alive going into all of this, and are now in an even worse situation

Norwegian is an airline that definitely falls into the latter category. Even though the past several years are probably the “best” consecutive years the airline industry has ever seen, the airline was already on the brink of liquidation.

Until 2019 Norwegian was focused exclusively on growth over profitability, as it seemed like the airline was trying to become an attractive acquisition target. While British Airways was interested a couple of years back, Norwegian overplayed their hand, and it has been all downhill for the airline since then.

Norwegian wasn’t consistently profitable even before the pandemic

Norwegian wasn’t consistently profitable even before the pandemic

Norwegian wants to convert lease liability into equity

One thing is for sure — without significant state aid from Norway, Norwegian won’t survive. The problem is that in order for Norwegian to meet the criteria for receiving state aid, the airline needs concessions from creditors, and that seems questionable at this point.

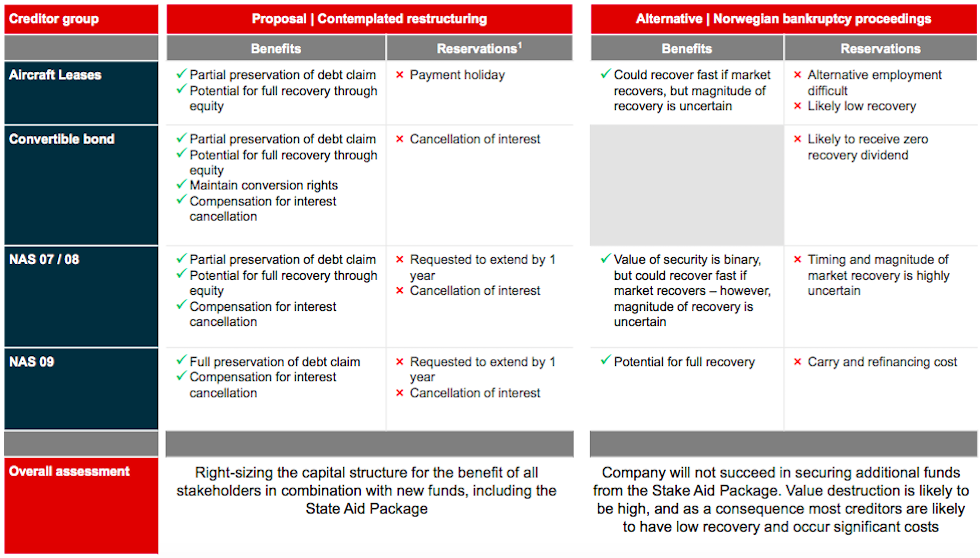

In the presentation to bondholders that Norwegian published today, the airline needs at least $500 million in lease liability to be converted into equity, which seems highly questionable. Here’s how the airline lays out the pros and cons of the two approaches:

Essentially Norwegian’s argument is that if the airline goes out of business, aircraft leasing companies won’t be able to find new airlines to lease planes to anytime soon. That will come with high carrying and refinancing costs, and the recovery remains uncertain.

Norwegian is making a plea to aircraft leasing companies

Norwegian is making a plea to aircraft leasing companies

Norwegian won’t fly again until 2021

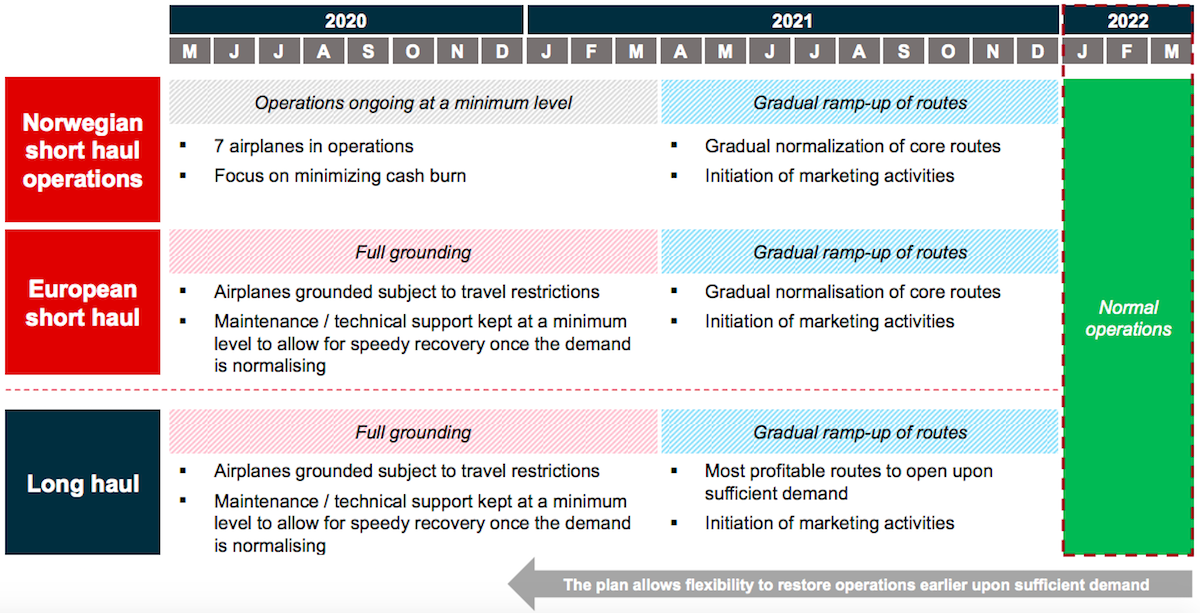

Perhaps the most interesting part of Norwegian’s proposal is when they plan on resuming operations. Most airlines plan to resume operations as soon as practical, but Norwegian is taking a different approach:

- Norwegian would ground all European short haul and all long haul flights until the summer of 2021, in order to minimize cash burn

- In the summer of 2021 we’d only see a gradual resumption of core routes

- Only in the summer of 2022 would we see normal operations resume

Just recently four Norwegian subsidiaries filed for bankruptcy, through which we’ve seen a majority of Norwegian employees laid off. Given that the airline has been able to shed most payroll costs, there’s some merit to Norwegian not resuming operations until demand fully recovers.

Norwegian would only resume flights in the summer of 2021

Norwegian would only resume flights in the summer of 2021

Bottom line

With Norwegian’s turnaround plan, the airline wouldn’t even gradually resume operations until the summer of 2021, and it would be 2022 before most flights resume.

The reality is that this relies on aircraft leasing liability being converted into equity. While it’s true that aircraft leasing companies may have a hard time finding new airlines for Norwegian planes if the airline went out of business, what are the odds that Norwegian would thrive if aircraft leasing companies agreed to this?

It’ll be interesting to see how this plays out. Usually I’d just hope as many jobs are preserved as possible, but with Norwegian having already laid off a majority of their employees due to their creative labor contracts, that’s no longer a factor…

We had two return flights booked and paid for, for May 2020 that Norwegian cancelled, only option offered was to convert to reward points. A second single return flight booked and paid for Oct 2020 was also cancelled and converted. Seeing as they have no plans to re-open long haul international in the foreseeable future and we live in USA so can't book their short haul routes what happens to our money/points

Now that we're days away from starting September, does everyone still feel the same in regards to NAS surviving?

CNBC: Norwegian Air cancels 97 Boeing planes, claims compensation.

https://www.cnbc.com/2020/06/29/norwegian-air-cancels-97-boeing-planes-claims-compensation.html

Not surprising, but that is a lot of planes

I bought a ticket for May to London & then rescheduled it for October. If they're not flying out of The US then can I get a refund? I took out CFAR Insurance

Disgraceful journalism, the airline are still operating and accepting bookings for many international routes.

So I, like many others here, have RT tickets on Norwegian for July 18th LA to Barcelona. I purchased insurance at the same time I purchased the airline tickets. On April 1st I received the lousy news that I have cancer. I would still like to use my July tickets. In the event that my flights are cancelled, or Spain doesn't open their country to foreigners, am I able to use the insurance to obtain...

So I, like many others here, have RT tickets on Norwegian for July 18th LA to Barcelona. I purchased insurance at the same time I purchased the airline tickets. On April 1st I received the lousy news that I have cancer. I would still like to use my July tickets. In the event that my flights are cancelled, or Spain doesn't open their country to foreigners, am I able to use the insurance to obtain a refund?

Also, another thought/question, is there any possible recourse through my Bank of America credit card that was used to purchase the tickets, in the event Norwegian cancels the flights but has no cash to refund my money?

Due to the way Norwegian treat Thier staff it's a horrid company to work for every base gets different benefits and the company tried to employee staff on pennies and uses companies like osm aviation who don't have a clue about aviation I actually think the company deserves this its not the first company I will see go down it was going to happen someday anyway

Thanks to all the comments. I noted there is no formal decision yet on 2020 travel, and May 4th is a likely timing for an update. Question for those more in the know than myself - given the airlines are in such trouble, in particular, if Norwegian cancels 2020 flights, how would they offer any refund - would this essentially be country bailout money provided to the airline?

I have tickets for late June, and...

Thanks to all the comments. I noted there is no formal decision yet on 2020 travel, and May 4th is a likely timing for an update. Question for those more in the know than myself - given the airlines are in such trouble, in particular, if Norwegian cancels 2020 flights, how would they offer any refund - would this essentially be country bailout money provided to the airline?

I have tickets for late June, and increasingly concerned I will not recover the money if they go under. If they do, any recourse actions to take? Thank you to all.

Even if the do survive, myself like many others will probably never use them again, they have honestly been the worst people to deal with in this current crisis, nearly 7 weeks with no response to emails, their call centre cannot give you any answers regarding refunds for cancelled flights that were due to take place the first week of March, i know its tough times but they are withholding nearly £2000 of my money...

Even if the do survive, myself like many others will probably never use them again, they have honestly been the worst people to deal with in this current crisis, nearly 7 weeks with no response to emails, their call centre cannot give you any answers regarding refunds for cancelled flights that were due to take place the first week of March, i know its tough times but they are withholding nearly £2000 of my money with no one being able to explain why.... #refundyourcustomers

@David

Norwegian Sovereign Wealth Fund is managed by very smart people, not the 1MDB type. They are unlikely to invest in a failing airline, nor their expertise is in restructuring, so definitely airlines are not under their scope.

How the government choose to spend the wealth is a different issue.

@Doug R, thank you for educating us. I can imagine those 400 000 non-European migrands/refugees living a fantastic life without absolutely no self-motivation to achieve anything in life based on that they are from a non-European (i.e. non-white) culture. People from third world countries should just get their stuff together instead of having the Norwegian state motivating them to do nothing about their own situation.

Doug R, I am sure that you would, in the...

@Doug R, thank you for educating us. I can imagine those 400 000 non-European migrands/refugees living a fantastic life without absolutely no self-motivation to achieve anything in life based on that they are from a non-European (i.e. non-white) culture. People from third world countries should just get their stuff together instead of having the Norwegian state motivating them to do nothing about their own situation.

Doug R, I am sure that you would, in the very same situation as these refugees, refuse to accept any aid in the help to make a living. You have a great business acumen, and the ability to provide for yourself and your family in any situation, be it a war-torn country, or anywhere lacking natural resources. And if you were given the aid anyway, I am sure you would be more productive, because you're some shade of white.

Besides from that, I don't think the Norwegian state would have the brains to not pour all that cash into the airline which may or may not provide a benefit to the population that flies ten times more than the average European, because how did they get that money in the first place? I mean, if Norway was a real democracy surely, the brains of the country would have stopped the state from being so stupid. Instead, the Norwegians are suffering. Let's cross our fingers that the Norwegian state does not continue their streak of bad decisions that accumulated the wealth in the first place, only to spend it on contributions to these left-wing causes like "environment" and "global healthcare".

Who's going to take a voucher over a refund after seeing this!?

Norwegian won’t die, at least not fully. They are pretty much the only competition to SAS & without them prices will soar for inter Scandinavian flights. They will continue to operate but most likely they’ll leave the long haul stuff and go back to focusing on being a regional Scandinavian carrier with a few key European routes. They’ve been heavily humbled & I don’t think they’ll be able to come back into the long haul/low...

Norwegian won’t die, at least not fully. They are pretty much the only competition to SAS & without them prices will soar for inter Scandinavian flights. They will continue to operate but most likely they’ll leave the long haul stuff and go back to focusing on being a regional Scandinavian carrier with a few key European routes. They’ve been heavily humbled & I don’t think they’ll be able to come back into the long haul/low cost game. It’s going to be very interesting in seeing how much they will end up shrinking by

Norwegian won’t die, at least not fully. They are pretty much the only competition to SAS & without them prices will soar for inter Scandinavian flights. They will continue to operate but most likely they’ll leave the long haul stuff and go back to focusing on being a regional Scandinavian carrier with a few key European routes. They’ve been heavily humbled & I don’t think they’ll be able to come back into the long haul/low cost game

Been watching them carefully as I use them often (MCO - CDG). There are very, very few direct flights to Europe from MCO and their PE product for an 8 hour overnight hop was perfectly fine at a good price (and I am a fan of the 787 - I just sleep better on them).

Bummer - hoping they pull through, but it's looking doubtful.

There are two things Norwegian should do in order to survive. They should close many of their bases across Europe and focus on their home region of Northern Europe. As well as cutting their long haul routes. They are very important in Northern Europe so they should keep that even if they have to make some difficult decisions.

Sadly Norwegian won't survive. If they hadn't of faced the Dreamliner issues or that of the MAX they would of faced a fighting chance. The market share captured for long haul transatlantic worked from 2015-2018 when legacy carriers hadn't rolled out differentiated fares.This meant they could quite easily appear as the lowest cost, since the legacy carriers have caught up, they have been able to price DI out of the market, in many cases being...

Sadly Norwegian won't survive. If they hadn't of faced the Dreamliner issues or that of the MAX they would of faced a fighting chance. The market share captured for long haul transatlantic worked from 2015-2018 when legacy carriers hadn't rolled out differentiated fares.This meant they could quite easily appear as the lowest cost, since the legacy carriers have caught up, they have been able to price DI out of the market, in many cases being £50-70 less. Price coupled with aircraft issues have driven the customers back towards legacy carriers (even at the low price point in economy most would prefer a VS A330 into JFK than a Wamos 747).

Finally the cancellation of LAS,SIN & SJO routes stemmed any markets others than South America where they were constantly having strong yields. Up until the outbreak of COVID 19 they were scheduled to launch direct LGW-CPT & LGW-DPS flights, both of which would of helped gain back market share. It is a shame as they carried on where Laker left off.

Have two RT tickets for June from SFO-OSL. Took the risk to prepaid a financial troubled airline, for now the only thing is to wait for cancellation and hopefully get a refund. Chase trip cancellation insurance might work if the airline is still in business.

By skimming through the documents, my take is the Lessors have no reason to take that offer.

As a lessor if NAS does fail, you either get paid 0 in cash, or you get 0 in equity. Cash is still better than equity in this case.

What I find interesting is the bond holders. This could be a cheap way to acquire NAS.

Either way, NAS doesn't look like they have any unencumbered...

By skimming through the documents, my take is the Lessors have no reason to take that offer.

As a lessor if NAS does fail, you either get paid 0 in cash, or you get 0 in equity. Cash is still better than equity in this case.

What I find interesting is the bond holders. This could be a cheap way to acquire NAS.

Either way, NAS doesn't look like they have any unencumbered assets so if it does fail there isn't pieces left to pick.

They really are in a very bad shape living in borrowed time.

What might be of interest to bring up is the Norwegian government's Sovereign Wealth Fund. This fund is estimated to be around 800-900 billion dollars. It is the result of oil money (yes, Norway is a huge offshore oil and gas producer) and has been the country's umbrella for paying for the future of the country's 5 million plus people's socialist benefits.

The joke is that Norway could choose to keep Norwegian airlines afloat...

What might be of interest to bring up is the Norwegian government's Sovereign Wealth Fund. This fund is estimated to be around 800-900 billion dollars. It is the result of oil money (yes, Norway is a huge offshore oil and gas producer) and has been the country's umbrella for paying for the future of the country's 5 million plus people's socialist benefits.

The joke is that Norway could choose to keep Norwegian airlines afloat from this fund. Please consider - for those who do not know this - that the government of Norway funds the welfare benefits for 400,000 non European third world migrants/refugees from cradle to grave. Most do not do a day's worth of work, but sit around and consume and produce and contribute exactly zero to the Norwegian economy. This annual cost to the Norwegian tax payer is in the billions.

Summer of 2022. That's the earliest that the folks running this airline think that demand for air traffic might be anything like what it was pre-covid.

They are not idiots. Worth thinking about.

I've been in the airline industry for nearly 35 years.

Norwegian Air wings have been clipped. They will not fly again.

I called Norwegian a few minutes ago to try to get a refund for an FCO-SFO flight that I have scheduled for September 2020 and they claimed that nothing is final yet regarding internationa long haul flights for the remainder of 2020. The Norwegian representative that I talked to stated that if the flight is cancelled I will receive an e-mail with instructions for how to get a refund. Apparently there will be more information...

I called Norwegian a few minutes ago to try to get a refund for an FCO-SFO flight that I have scheduled for September 2020 and they claimed that nothing is final yet regarding internationa long haul flights for the remainder of 2020. The Norwegian representative that I talked to stated that if the flight is cancelled I will receive an e-mail with instructions for how to get a refund. Apparently there will be more information available after May 4, according to the Norwegian representative I talked with.

For what it's worth, Norwegian hasn't updated their reservation system to reflect this scenario. Boston to London, for example, is available for booking starting 1 June 2020 (as it has been for the last several weeks).

I've flown Norwegian's premium long-haul and their short-haul Europe routes several times a year for the last several years. Even before the coronavirus, I knew the good times wouldn't last. I will miss them.

Fortunately, my last transaction with...

For what it's worth, Norwegian hasn't updated their reservation system to reflect this scenario. Boston to London, for example, is available for booking starting 1 June 2020 (as it has been for the last several weeks).

I've flown Norwegian's premium long-haul and their short-haul Europe routes several times a year for the last several years. Even before the coronavirus, I knew the good times wouldn't last. I will miss them.

Fortunately, my last transaction with Norwegian was a positive one: I had a refundable London–Stockholm ticket booked for May. I cancelled it in early April, and within a few days the cost was credited back to my Amex.

@Michael Hassall-- I feel you. Bought 9 tix AUS-LGW for $4050 cancelled by Norwegian. Now that's an ouch.

Sitting on $1350 worth of LHR-MIA tickets that they wouldn’t refund last month but that they would let me change to September. So, basically worthless paper. Ouch.

Erin, start saving again. Your money bought one of their VPs a new pair of cross country ski poles. Don’t hang waiting for a thank you.

It’s time to say goodbye to Norwegian.

“For the benefit of all stakeholders” - right...

Editorial request: Please stop putting Wow in headlines; I keep thinking you're referring to WOW Air! Instead, how about Whoa, WTF, Crazy, Bonkers, Surreal, etc.?

I have purchased non refundable tickets from NY to Paris fir August. Will I lose mt money? I saved foe years fie it

@Joeboo Perhaps they will be attractive to operators starting next summer, but that's when Norwegian wants to start using them again anyway. I find it hard to believe anything approaching reasonable demand before then, unless the virus just vanishes or a vaccine is somehow fast tracked beyond any reasonable estimates.

Please correct the headlines: Norwegian is actually operating domestic routes in Norway for the moment being.

A business plan that tries to extort leasors & creditors..?

Ridiculous/ game over for them.

I would imagine the 787s would be attractive to multiple operators

I think the 2021 date is a ruse. If you sit out that long to save cash while your competitors are back in the air, you’re not bringing in any additional cash. Makes no sense. You say “2021” to scare the leasing companies into conceding on the equity demand, thereby convincing the government to approve the bailout. You restart operations as soon as possible with fresh cash and less liability. In the end, Norwegian Air...

I think the 2021 date is a ruse. If you sit out that long to save cash while your competitors are back in the air, you’re not bringing in any additional cash. Makes no sense. You say “2021” to scare the leasing companies into conceding on the equity demand, thereby convincing the government to approve the bailout. You restart operations as soon as possible with fresh cash and less liability. In the end, Norwegian Air goes under anyway, but the C-Suite folks get taxpayer-funded parachutes.

This is actually why I think a lot fewer airlines will be liquidated than thought: The main reason liquidate an airline is to recover assets and get them into money-paying hands again, but with world travel essentially nil and the MAX likely coming back at some point this summer/fall, there will be an insane glut of aircraft. Who would be willing to lease/buy 3 dozen 787s and 100+ 737s at anything approaching what Norwegian has...

This is actually why I think a lot fewer airlines will be liquidated than thought: The main reason liquidate an airline is to recover assets and get them into money-paying hands again, but with world travel essentially nil and the MAX likely coming back at some point this summer/fall, there will be an insane glut of aircraft. Who would be willing to lease/buy 3 dozen 787s and 100+ 737s at anything approaching what Norwegian has agreed to pay?

Same goes for airlines the world over. I expect a banks/leasing companies to offer bridge financing, payment deferrals, and/or payment discounts to many of their struggling airline clients who already have a lot of aircraft financed through them.

In other words, they're dead.