United MileagePlus has just significantly hiked the cost of some regional business class awards on partner airlines, as flagged by View from the Wing. This follows United recently massively increasing the cost of partner first class awards.

These changes are rough, though I’m not sure this change matters all that much, quite frankly. It’s just a reminder that United is determined to be more like Delta in every way, including with its loyalty program.

In this post:

United MileagePlus raises business class award costs

United MileagePlus no longer publishes award charts, so there’s not much transparency when it comes to award prices being updated. Nonetheless, historically United has had pretty consistent redemption rates on partners.

With that in mind, unfortunately United appears to have massively raised the cost of some business class awards. The good news is that awards originating in the United States don’t seem to have increased in cost this time around (at least as of now), but rather we’re seeing the biggest devaluation to regional business class awards.

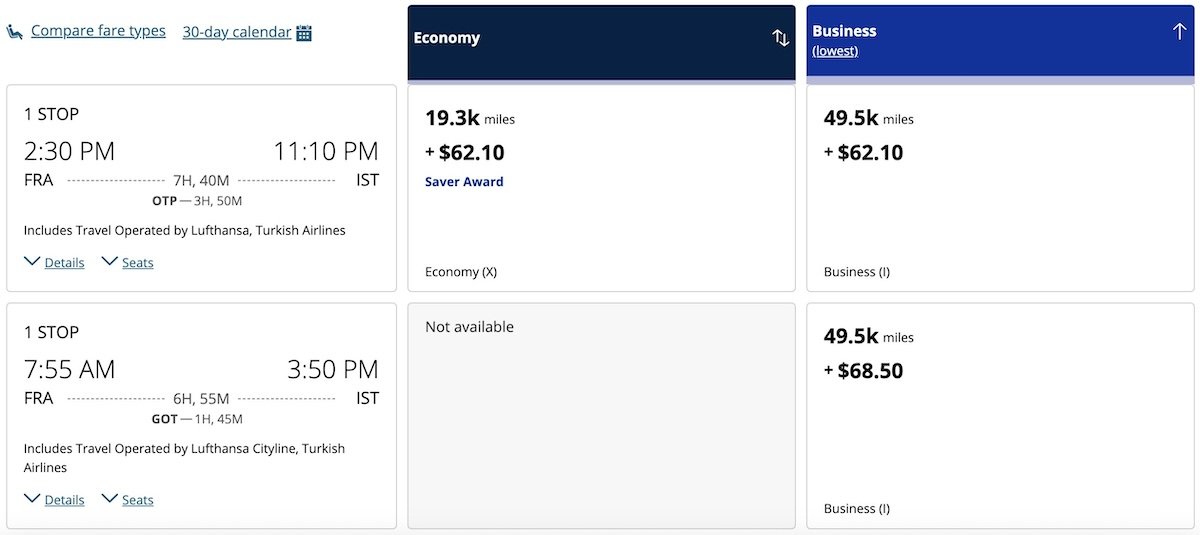

For example, one-way business class awards between Europe and much of Istanbul now start at an astonishing 49,500 MileagePlus miles.

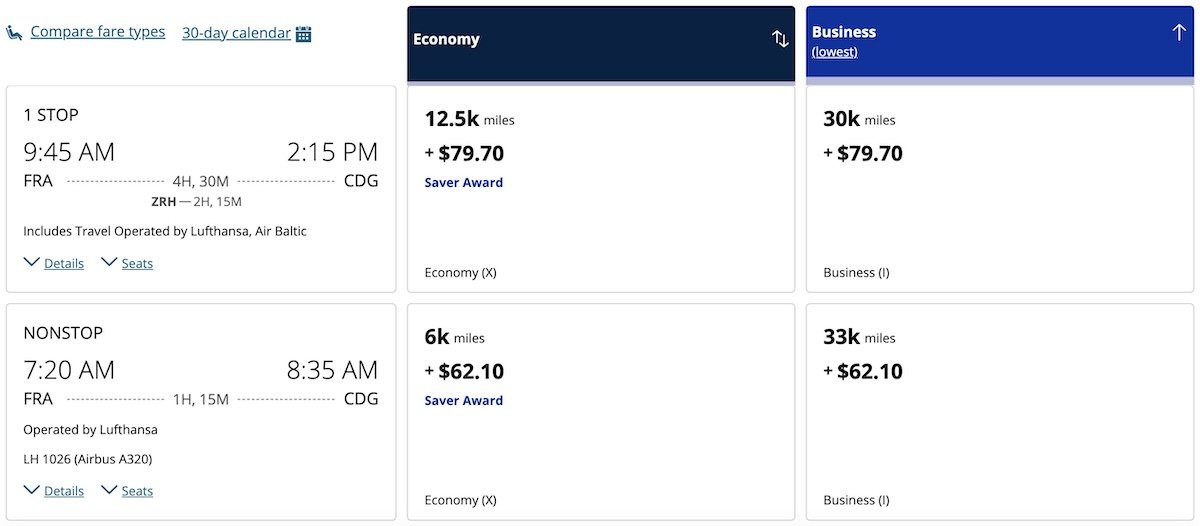

Meanwhile shorter one-way awards within Europe now start at 30,000 to 33,000 MileagePlus miles one-way. Ouch!

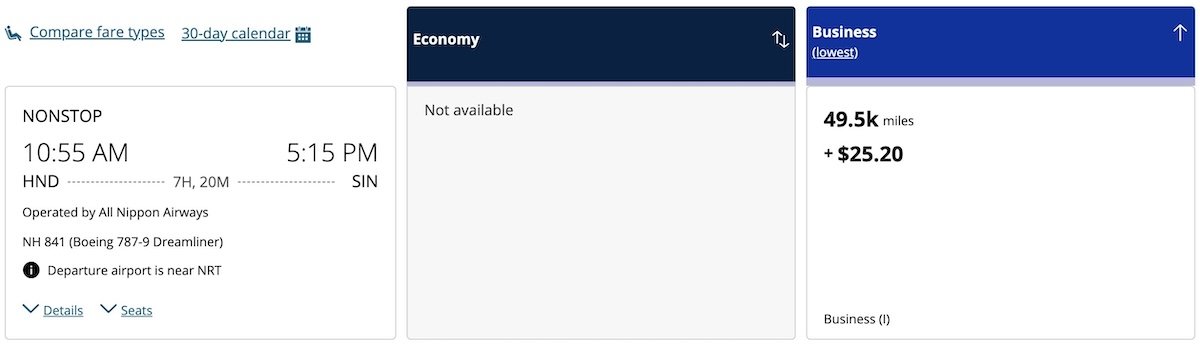

Meanwhile one-way business class awards in many parts of Asia now start at 49,500 MileagePlus.

United MileagePlus wants to be Delta SkyMiles

Bigger than this specific change as such is the direction United MileagePlus is headed, and I don’t think this should surprise anyone.

When you hear United executives speak, they constantly reference Delta. They’re obsessed with being Delta, and view it as the only competition in the market. While I can appreciate the intent behind the goal, I think United executives are falling into the trap of thinking that just because Delta does something it must be the right move (rather than believing that in some cases Delta is successful in spite of certain decisions).

In recent years, United MileagePlus has eliminated transparency when it comes to award pricing, and has made repeated devaluations without notice. What’s most telling here is that presumably these price increases don’t actually reflect any increased costs that United is incurring on these partner redemptions, but rather United is just increasing prices because it can, and to condition consumers a certain way.

It’s exactly the same thing Delta does. Delta SkyMiles’ partner award redemption rates are outrageously high not because Delta incurs such a high cost on redemptions, but rather because Delta wants to condition consumers to pay a lot for premium awards. A one-way business class award to Asia on China Airlines? Of course that’s going to cost 300K+ miles, because why wouldn’t it be! United is headed in the same direction, slowly but surely.

What’s interesting to me is how all the US carriers are trying to greatly increase revenue from their loyalty programs in the coming years, and get people even more engaged. Their goals aren’t modest either, with airlines like Delta hoping to grow loyalty program revenue by close to 50%. Offering less value over time sure is an interesting way to go about accomplishing that goal.

Look, savvy points collectors shouldn’t be going out of their way to earn United MileagePlus miles. If you want to redeem on Star Alliance, you’ll find much better value through Air Canada Aeroplan and Avianca LifeMiles. For example, the short haul business class award within Europe that costs 33,000 miles with United MileagePlus will cost you just 15,000 miles with Air Canada Aeroplan.

Fortunately as consumers we still have good alternatives, at least as of now. Reward the programs that go out of their way to offer value to members, rather than to have punitive pricing just because they can.

Bottom line

United MileagePlus has significantly increased business class award redemption costs on partner airlines on regional flights. United no longer publishes award charts, so it’s hard to know exactly what the extent of the changes are. What we do know is that short haul awards within Asia and Europe have gone up in cost considerably.

I imagine that this is just the beginning, and that we’ll continue to see MileagePlus head in the direction of SkyMiles. American AAdvantage deserves credit for being the only one of the “big three” US programs to actually at least try to offer value and transparency with partner redemptions.

What do you make of these MileagePlus award updates?

I've been a loyal Continental/United customer for 4 decades. Just looked at reward redemptions. They are astronomical! I'm officially finished with United.

Finally, Ben has spoke the truth about the obnoxious Delta, which I believe slowly but sure destroying its loyalty program, with its outrageous award requirements for international travel. Why are doing that? Because paraphrasing what once famously Clinton said: ".. because they can.." Unfortunately, other major American airlines like United are following the suit.

Ben is absolutely correct suggesting that we, as award miles enthusiasts and major users of co-branded credit cards, should walk away...

Finally, Ben has spoke the truth about the obnoxious Delta, which I believe slowly but sure destroying its loyalty program, with its outrageous award requirements for international travel. Why are doing that? Because paraphrasing what once famously Clinton said: ".. because they can.." Unfortunately, other major American airlines like United are following the suit.

Ben is absolutely correct suggesting that we, as award miles enthusiasts and major users of co-branded credit cards, should walk away from those cards, so that the banks that issue them, we press those airlines to completely reverse the course. And they indeed have a power to do because they're the major contributors the airlines' bottom line. (For example, I, who live in the Atlanta area, have stopped applying for any Amex cards years ago, despite being bombarded by all kind of promotional offers, because Amex heavily subsidized Delta).

I get that this is a points and miles site but no rational business will sell its product or service for less than it needs to.

Loyalty programs exist for the purpose of increasing a company's revenue and not for enriching the benefits for consumers. That should be obvious because the companies, not consumers, sponsor the programs.

US airlines reports their loyalty program liabilities and award issuance in both points and dollars in...

I get that this is a points and miles site but no rational business will sell its product or service for less than it needs to.

Loyalty programs exist for the purpose of increasing a company's revenue and not for enriching the benefits for consumers. That should be obvious because the companies, not consumers, sponsor the programs.

US airlines reports their loyalty program liabilities and award issuance in both points and dollars in their annual report. All of the big 3 have fairly similar amounts. DL is actually slightly ahead on AA and UA in total awards given.

The reason so many people are disillusioned about SkyMiles is because they focus on the most valuable program in DL's offering - its premium cabin international awards - and see that the award levels are high. DL has long been able to sell more seats at higher fares than AA and UA.

UA is now translating its success in the international marketplace into tighter loyalty program awards.

AA might or might not come to the same conclusion but they have the weakest international network, the greatest struggle w/ selling premium seats, and more of its network concentrated in one city - LHR - than any other US airline. There are good reasons why they may not be as quick to follow DL and UA - but DL and UA are moving in the same direction in many ways: DL is becoming much more international while UA is using its earnings to build its domestic system where credit card and loyalty programs deliver better returns.

Anyone that thinks that DL and UA's loyalty programs won't increasingly look alike is kidding themselves but they are also becoming the two primary US international carriers. They will both give away only as many awards as they have to; it is precisely because of the strength of the international market that they will be giving away less and less of their most valuable product as loyalty awards

Must admit I have never seen an inter Europe business class seat on any airline that made me wish I was in it…stick with economy.

Aer Lingus A321 Neo… otherwise agreed.

Looks like United has blocked awards on Turkish Airlines nonstops from PTY-IST and MEX-CUN-IST… Now you have to fly back to US to make a connection and at that, the award prices are ridiculous. This was not the case just a week ago when I was checking on availability. 88k ow in business then. I don’t even see award space from Mexico City to Frankfurt or Munich on Lufthansa which is usually plentiful. I had...

Looks like United has blocked awards on Turkish Airlines nonstops from PTY-IST and MEX-CUN-IST… Now you have to fly back to US to make a connection and at that, the award prices are ridiculous. This was not the case just a week ago when I was checking on availability. 88k ow in business then. I don’t even see award space from Mexico City to Frankfurt or Munich on Lufthansa which is usually plentiful. I had a gut feeling this was gonna happen so was very careful with transferring Chase points to United mileage plus… I’ve got a trip booked in the fall which basically cleans out our remaining United miles. That’ll be the last I fly on United unless something drastically changes for the better.

This is why despite being a primarily Delta flyer, I never jumped ship to FlyingBlue, or any of the other US/UK/EU programs.... it's only a matter of time before they're devalued to hell and back, as well. :(

And then there's the Asian carriers-- but mostly avoid their programs due to the draconian expiration dates.

But certain awards have also gone down at the same time, noticing the biggest change on intercontinental flights, but Cairo-SIN prices are out at 60K in LX J compared to the old 66K. Intriguing much.

yuck. so this explains my confusion.

I was searching Europe to Uganda in J on Monday. A LH/ET option was pricing out at 60.5k. I searched yesterday, Tuesday, and same itinerary was pricing out at 99k. I was like wtf, figured it was a temp bug...I guess not :(

So sad what Mileage Plus has become.

Skypesos-lite

which just means UA is not as far along the route to profitability and being a large domestic operator as DL.

It seems United is insistent on making their miles only worth it for Economy travel where there is a cash vs points mismatch. With Excursionist United can fill in the repositioning and ex-NA intercontinental flight while you use another more valuable currency for the long haul business.

Being in an AA hub glad I don't have to spend too much time thinking about it.

Scott Kirby destroying value in United's mileage program is dumb when miles are the profit center.

Give it time, he'll likely be in good company soon.

Anyone believing that top airlines are still going to offer longhaul-First redemptions for 1XX,000 points in the upcoming years, is going to be horribly disappointed in short order.

Not only partner awards. United has just raised GRU-HND flying United through the US from 190K to 500K miles. At first I thought it was a system glitch…

Whats "much of Istanbul"?

MileageMinus

For me the value proposition of Mileage Plus awards has been free changes/cancellations and the ease of making those online (or via phone). Trying to reach the Aeroplan call center required and act of severe patience over multiple days. If that's changed then I'll definitely redeem through Aeroplan more (the change fee, while annoying, isn't necessarily a dealbreaker). I'll have to look at Aeroplan more regardless, as the MP value proposition is definitely getting worse.

For me the value proposition of Mileage Plus awards has been free changes/cancellations and the ease of making those online (or via phone). Trying to reach the Aeroplan call center required and act of severe patience over multiple days. If that's changed then I'll definitely redeem through Aeroplan more (the change fee, while annoying, isn't necessarily a dealbreaker). I'll have to look at Aeroplan more regardless, as the MP value proposition is definitely getting worse.

Exactly. And with cash (which sometimes is better), you get screwed internationally if you're not doing a round trip. So United miles is better for that reason too. But I still don't collect United miles, I collect transferable points.

I always have an awful experience on united and the fact there mileage program is now terrible. I won’t be flying them anymore. I will take my 15K a year somewhere else.

United should just pay Ed Bastian another salary and get rid of Scott Kirby, since Delta is setting strategy for UA now.

Or better yet, why pay AA's CEO at all? I can sit on my rear, lag behind all my competitors, and change nothing, for a way lower price than he charges. Why not hire me?

NYC based road warrior and chose United cause I’d rather have miles to use for personal trips than a slightly better in flight experience on Delta (and no one based in NYC is picking AA for loyalty if you want to have a wide range of non stop options).

Untied giving less and less reason too stay loyal

Exactly the same here. I wasn't a fan of SkyPesos, but there is now less to like about MP. Maybe Aeroplan is the way to go.

Aeroplan is next.

They already block half the partners

There is no way their pricing lasts much longer.

UA is doing what DL has done because it is the financially most successful model. Now that UA is increasingly able to turn its airline operations into similar profits, the two will begin to look more and more alike.

Both reported very similar increases in premium and corporate revenue in the first quarter.

UA is committed to becoming more and more domestic because a strong domestic network delivers better ability to monetize credit...

UA is doing what DL has done because it is the financially most successful model. Now that UA is increasingly able to turn its airline operations into similar profits, the two will begin to look more and more alike.

Both reported very similar increases in premium and corporate revenue in the first quarter.

UA is committed to becoming more and more domestic because a strong domestic network delivers better ability to monetize credit card and loyalty programs than international networks; US credit cards are much more lucrative than in other countries.

UA will grow its domestic network as fast as Boeing can get airplanes to it - which means domestic growth will be much slower than UA expected just a couple years ago. A dozen and a half extra A321s in 2026 and 2027 will help but won't offset what Boeing can't deliver.

DL is now saying it wants to get half of its revenue from international by 2030. In 2023, DL was 70% domestic and UA was 60% domestic. Continental is the closest any viable post-deregulation era airline got to being 50/50 domestic/international.

Based on 2023 revenue, DL would need to double its international revenue to become 50/50 domestic/international.

Transatlantic is largest for both DL and UA. DL's Latin network is about 40% of its TATL network but its transpacific network is just 1/4 the size of its TATL network.

UA's Latin and TPAC networks are about half the size of its TATL network.

UA will obviously grow international but it will be much harder for them to grow int'l than domestic while the reverse will be true for DL - simply based on existing size.

While passenger and cargo networks will look more and more alike, DL has an advantage with lower fuel costs due to its refinery as well as MRO rights and future revenue which will drive more and more revenue growth.

DL and UA will increasingly look more and more alike and distinct from the rest of the industry. Loyalty programs will follow.

Are you an AI?

Actually, the other way around.

My responses train AI

Oh hell nah buddy. If AI was trained after you the world wud be dead right now.

"Continental" and "viable" don't really go together.

A major reason they were so desperate to merge (courted 4 different airlines a total of 5 times, within the span of 15yrs) was BECAUSE they had so comparatively little domestic penetration, yet were too leveraged to acquire the fleet necessary for further organic expansion.

no dispute... but they were profitable at times - which was more than could be said for Pan Am.

Heavily international US airlines never last.

Scott Kirby has seen that movie and is moving to grow UA's domestic operation... it just won't happen near as fast as he wants.

In contrast, DL is realizing it really could operate a lot more int'l routes and is moving in that direction while still keeping up w/ all of the domestic growth opportunities.

Maybe, though I sadly suspect that most of that will come in the form of adding service/seats to Paris, London, Rome, and Seoul...

...would be nice if they ever returned to the likes of Hong Kong, Singapore, Dubai, etc instead (or in addition) though, which DL doesn't seem very inclined to do. :(

as I have said multiple times, if UA can make money flying to those destinations, there is no reason that DL can't also.

The converse is that UA probably doesn't make as much money flying to the some of the places it flies as some people think

And yet, UA's doing it (for years) while DL is not.

That can say many things, from opportunity cost differences to technical capability.

Not having any insight into the per-route financials, which no one here would... I doubt anyone can therefore actually say.

UA hasn't made anywhere near the amount of money DL does.

Remember, despite being the largest carrier across the Pacific by a wide margin, UA lost money from 2017-19 flying the Pacific. It was obvious to those that looked at the data was because UA was after market share in China and HKG. AA bowed out with now just a token presence in PVG. UA's TPAC profits have gone up because it can't add...

UA hasn't made anywhere near the amount of money DL does.

Remember, despite being the largest carrier across the Pacific by a wide margin, UA lost money from 2017-19 flying the Pacific. It was obvious to those that looked at the data was because UA was after market share in China and HKG. AA bowed out with now just a token presence in PVG. UA's TPAC profits have gone up because it can't add all the China capacity it had before.

As Cranky showed recently, UA still is throwing a lot of capacity onto the Pacific which isn't likely making money.

Everyone can make money flying anywhere in the world for 6 months per year. The problem is how to use planes and people for the other 6 months.

DL has simply not been willing to chase that revenue for 6 months if they end up losing it the other 6 months every year. The entire int'l picture has improved for DL and UA and so the economics of int'l growth are much better. DL has a much better chance of adding revenue because it doesn't serve alot of the markets UA does esp. in Asia.

Add in that the A350s that DL is just now taking delivery of are the most capable aircraft in the US carrier fleet by a long margin, only to be followed by the A350-1000s which add even more capability at better economics and DL will be able to operate some routes that no other airline can.

Throw on top DL's equity and JVs including the balance between the seasonality in S. America and Europe and Asia and DL has the ability to do what UA has not itself even been able to do w/ an international network. And DL has the domestic network that UA might build over the next 10 years.

Loyalty programs are simply a reflection of how much an airline has to give away to keep people flying them. DL is just simply further along that process than UA and now has the assets in place to do in the international market what it has achieved domestically.

Meh, everyone stateside was losing money over the Pacific (particularly relative to where those ships could otherwise be going), as the Chinese carriers were dumping capacity, and roundtrip fares of $499 or less weren't uncommon.

Now, the exact opposite is true. I'm going to PEK with a forced connection over ICN/GMP in two weeks, and DL wanted $4500+ for W and $11,000 for J...

...which is insane, considering that just four years ago, I could've...

Meh, everyone stateside was losing money over the Pacific (particularly relative to where those ships could otherwise be going), as the Chinese carriers were dumping capacity, and roundtrip fares of $499 or less weren't uncommon.

Now, the exact opposite is true. I'm going to PEK with a forced connection over ICN/GMP in two weeks, and DL wanted $4500+ for W and $11,000 for J...

...which is insane, considering that just four years ago, I could've done the routing for $3500 or less in J.

Yes, UA's capacity is low on many of those routes, but there's also no mention of fares, which to much of the mainland (and surrounding areas) is through the stratosphere at this time.

actually, DOT data shows that DL made between $225 and $325 million on TPAC for each of 2017-19.

Guess what? DL had the smallest TPAC of the big 3 and people were incessantly talking about how small DL was in that region.

and for people that love to tell us those numbers are wrong, I have yet to see the response of someone that has rewritten profitability by region data to reflect the...

actually, DOT data shows that DL made between $225 and $325 million on TPAC for each of 2017-19.

Guess what? DL had the smallest TPAC of the big 3 and people were incessantly talking about how small DL was in that region.

and for people that love to tell us those numbers are wrong, I have yet to see the response of someone that has rewritten profitability by region data to reflect the reality that profitability by global region adds up to the same total profit number that is reported on the system earnings statements. If someone wants to argue that UA wasn't losing money, then they need to tell us which region they want to reduce in order to make the Pacific profitable for UA.

UA isn't flying alot of the China capacity that dragged it down but has added tons of capacity in other parts of Asia/Pacific and by CF's own data, they are seeing lower load factors and likely weaker revenue performance than DL.

again, as hard as it is for some to accept, the chances are that DL and UA are moving much closer to having similar networks over the next 5-10 years unlike the narrative that many spouted of how much growth UA alone would pull off.

DL will use its JV partners where it makes sense but if it is profitable to fly on DL's own metal, they will. DL and UA's costs aren't that different so if DL can't make money flying routes on its own metal but needs to use its JV partners to finish the trip, then it is doubtful that UA will make the same amount of money flying the same revenue on its own metal.

As DL's TPAC efficiency increases with more A350s, including the - 1000, DL will be better able to serve routes that UA cannot both from an operational and economic standpoint.

Likely examples being ______?

UA cannot serve BOM or any destinations in E. Asia other than Tokyo from the Eastern US

You will see Delta add service from the Eastern US to more and more Asia destinations because of the A350's better range - on top of DL's stronger position in the Eastern US than UA.

I am betting we will see the first routes announced before summer is over.

Having just left an flight from BRU to MAN this a.m., for which I paid 6K in miles and around $40 in taxes, the entire value proposition for a 30K reward flight in Euro-Business was stark. I access the same Priority Pass lounges used by the airline for their Biz class passengers, paid $12 for fast track in the airport, and sat in the same seat with no one sitting next to me, just two...

Having just left an flight from BRU to MAN this a.m., for which I paid 6K in miles and around $40 in taxes, the entire value proposition for a 30K reward flight in Euro-Business was stark. I access the same Priority Pass lounges used by the airline for their Biz class passengers, paid $12 for fast track in the airport, and sat in the same seat with no one sitting next to me, just two rows behind.

Honestly, it's a crappy product on ANY European airline, even with a tea and croissant in the air (which you can buy in the back). It's just not worth the miles OR the price, except for the odd person who can't bear the idea of sitting in the back. Which is clearly an ego / status thing. And just like a Birkin bag, they'll pay what they have to pay for bragging rights.

So, no great loss.

UA AC & AV often offer varying availability and pricing for the same partner flights. As always, savvy points enthusiasts shop around using airline websites and award tools (pointsyeah, pointsme, etc) to get the best value out of transferable points.