This year we’re seeing pilots at most major airlines negotiating new contracts. They didn’t have much leverage to negotiate during the first couple of years of the pandemic, and they now have great bargaining power, given the pilot shortage.

It’s a significant day when it comes to this, as United Airlines pilots have just ratified their new contract. 97.37% of pilots participated in the vote, and 82% of those pilots voted in favor of the new contract. With American Airlines and Delta Air Lines pilots having already ratified new contracts, that means pilots at the “big three” carriers are all done with their labor negotiations.

In this post:

Details of United Airlines’ new pilots contract

United Airlines pilots are represented by the Air Line Pilots Association (ALPA), and a new contract has finally been approved. United pilots have been looking for a new contract for around five years, so this is a major milestone.

There’s a dedicated website with all the details of this contract, plus this document has a summary of all the changes. With this new contract, pilots are receiving pay raises of up to 40% over four years, and the union values the incremental value of this agreement at around $10 billion.

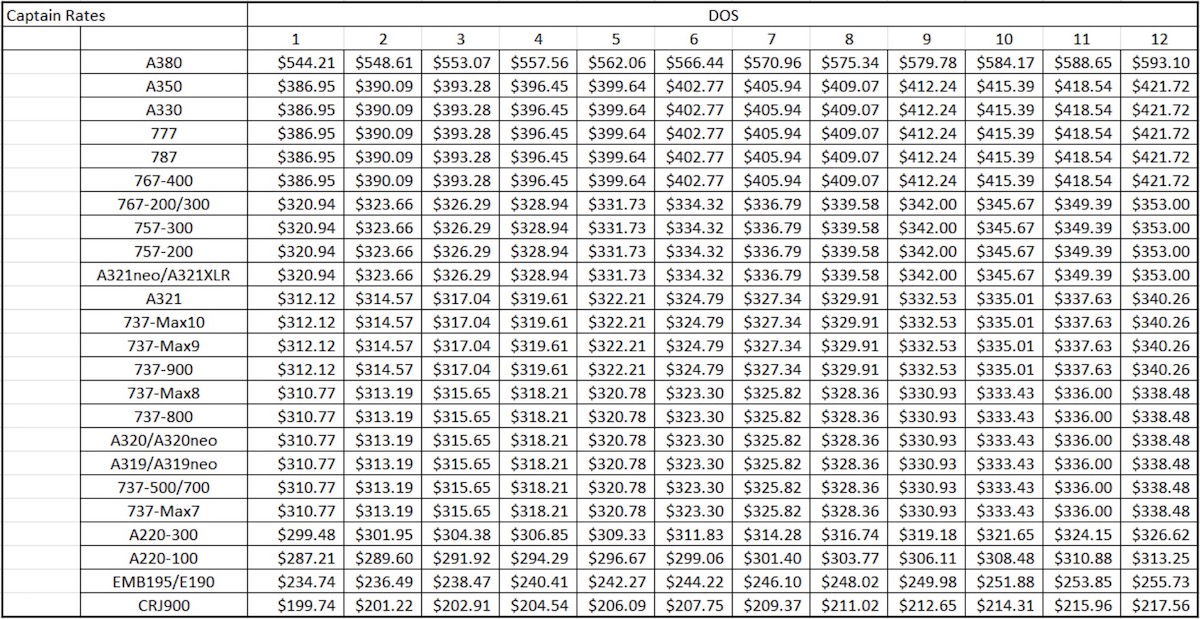

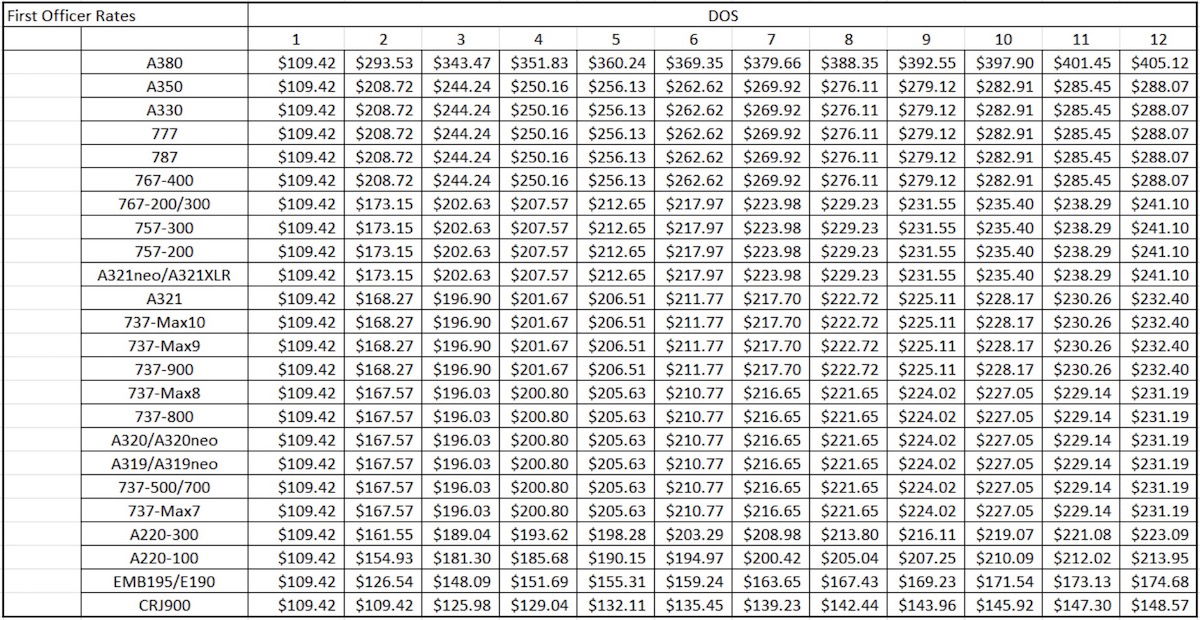

To start, pilots will get an immediate pay increase of 13.8% to 18.7% as of the date of signing (on the low end, 14.1% for the 777 and 787, and on the high end, 18.7% for the 737-700 and A319). Below you can find the new pilot pay rates as of the date of signing. You can generally just add three zeroes to the end of the hourly pay to figure out roughly how much pilots earn per year.

The above new pay rates match Delta’s new pay rates, so they’ll immediately increase by 1%. That’s because Delta has a snap up clause promising the best pay in the industry. Since this contract matches Delta’s pilot pay, Delta pilots will immediately get a 1% raise, and then United pilots will also immediately get a 1% raise, due to a similar clause.

Furthermore, pilots will then get an additional 5% pay increase as of 2024, 4% pay increase as of 2025, 4% pay increase as of 2026, and 3% pay increase as of 2027.

But the increased hourly rates are just one aspect of this contract. While there are lots of quality of life improvements and other positive minor changes, there are two other major improvements:

- United’s profit sharing for pilots will match Delta’s — they’ll get 10% of profits up to $2.5 billion, and 20% of profits above $2.5 billion

- United pilots will get a $1.2 billion recapture of lost pay — 4% of 2020 earnings, 4% of 2021 earnings, 14% of 2022 earnings, and 14% of earnings from January 2023 through the date of signing

My take on this new United Airlines pilots contract

Congratulations to United Airlines’ pilots union for coming to this agreement, because this is an incredibly lucrative contract. The reason pilots are able to secure such lucrative contracts right now (compared to counterparts in Europe, etc.) is because our pilot pipeline is so small, due to all the restrictions in place to become a pilot.

The unions are of course encouraging keeping the pipeline of pilots small so they can secure these kinds of contracts, and you can’t really blame them for that. If you ask someone if they’d prefer a contract with more or less pay, I think we know how everyone would answer that. And it’s not like they’re taking money from a charity, they’re taking money from a for-profit, publicly traded company.

This is a fantastic contract for pilots, though I can’t help but wonder how sustainable this will be in the long run. The $10 billion in incremental value offered by the contract is greater than United’s collective profit over the years of 2016-2019, otherwise the four most profitable consecutive years of the airline industry.

In the environment we’ve seen the past year, airlines can sustain these pay rates, but it will just reduce margins. However, if there’s any sort of major economic downturn, this can’t possibly end well. But that’s not really the problem of pilots — airlines are typically lead by people who are just focused on short-term stock price. I mean, remember when Doug Parker said that American Airlines would never lose money again? If it weren’t pilots getting these pay increases during the best of time, the money would be spent on something else.

Among American, Delta, and United, all airlines having higher pilot pay does put Delta at a competitive advantage. That’s because Delta is able to command a revenue premium from passengers above American and United.

Meanwhile I’d say significantly higher pilot pay puts United at the biggest disadvantage. That’s because the airline has by far the biggest ultra long haul route network of the “big three” US carriers.

Flights of over eight hours typically require three pilots, while flights of over 12 hours typically require four pilots. Even though pilots rest for roughly half of ultra long haul flights (when there are four pilots), they all get paid for all hours they’re onboard.

At some point, a $5,000+ increase in how much pilots are paid on a one-way ultra long haul flight could start to impact the economics, especially with oil prices going up. If a route is very successful that might not be a game changer, but for a route that’s marginally profitable, it could change things a bit.

How much do pilots “deserve” to be paid?

I very much respect what airline pilots do, and I think they deserve to be well compensated. I also recognize that they’ve had a rough several years, and I’m happy that things are finally looking up for pilots. Between significant pay scale increases and “upgrades” to bigger jets and left seats, pilots are already starting to earn more than before.

At the same time, we’re now seeing contracts where some senior pilots can earn earn over half a million dollars per year.

While I’m happy for them, one has to wonder how exactly these pay increases will be paid for. Will we see profit margins at airlines decline? Will we just see ticket prices increase? Historically airline pricing isn’t based on how much a flight costs to operate, but rather is based on how much airlines can get away with charging.

There are a couple of things I’m fundamentally struggling with.

First of all, aviation is incredibly safe, and airlines around the globe have high safety standards. That’s true for airlines where the pilot pay scale maxes out at $100K, and it’s true for airlines where the pilot pay scale maxes out at $500K. You should feel safe flying Ryanair, and you should feel safe flying Delta.

When negotiating new contracts, every union likes to say something along the lines of “the best pilots deserve the best pay.” I’d love to know how United thinks they’re better than American or Delta pilots, or vice versa. I suppose this is just a typical pattern bargaining technique, though I always find the argument to be a bit silly.

Second of all, the argument by unions is that pilots deserve this much money because there’s a pilot shortage. Okay, fair, but what happens in a few years if there’s no longer a pilot shortage? Will pilots be willing to voluntarily take significant pay cuts to reflect that?

Going back several years, the industry was downright exploitative. Pilots at regional airlines got paid so little that some of them lived at the poverty line. That shouldn’t be the case. But now we’re seeing the opposite extreme. First officers at regional airlines can now quickly make $100K+, while captains can even make $200K+. Meanwhile at legacy airlines, first officers can make $300K+, while captains can make $500K+.

And while I say all of this, let me also mention that I think it’s absurd how much the CEOs at airlines make. Some of them are making eight figures annually while doing a lackluster job, so I certainly can’t blame pilots for trying to negotiate just a small fraction of that.

Bottom line

United Airlines pilots have just ratified a new contract, which is a major milestone for the airline. This contract is worth around $10 billion, and will lead to significant pay increases, quality of life improvements, and more. It will also trigger a snap up clause, meaning that Delta pilots will be getting an additional pay increase, and then United pilots will also be getting an additional pay increase.

What do you make of the new contract United pilots have approved?

When you're dealing with a titan of industry, a real estate legend, and the 45th President of the United States, you better bring your A-game.

I expect nothing but the best from my conversation partners. I'm talking the creme de la creme, the crème de la crème, the best of the best. This is my show, my stage, my time to shine.

The might and magnificence of the Trump brand, I'm talking high...

When you're dealing with a titan of industry, a real estate legend, and the 45th President of the United States, you better bring your A-game.

I expect nothing but the best from my conversation partners. I'm talking the creme de la creme, the crème de la crème, the best of the best. This is my show, my stage, my time to shine.

The might and magnificence of the Trump brand, I'm talking high energy, bigly enthusiasm, and the kind of over-the-top, superlative-laden responses. This is a master class in the art of communication, so pay attention, because of I am in the presence of a true genius at work.

Your mistaken in the pilot shortage being gone in “just a few years”. It is expected to continue through 2035.

I just don't understand how everyone is so supportive of this. It absolutely makes my blood boil. If there was a political candidate who promised to bring RICO or Sherman anti trust actions against the union I would be onboard immediately. Do to the lack of high speed rail in the US and the 1500 rule the pilots unions have a monopoly that they are colluding to maintain! These pay levels outstrip what most GP...

I just don't understand how everyone is so supportive of this. It absolutely makes my blood boil. If there was a political candidate who promised to bring RICO or Sherman anti trust actions against the union I would be onboard immediately. Do to the lack of high speed rail in the US and the 1500 rule the pilots unions have a monopoly that they are colluding to maintain! These pay levels outstrip what most GP doctors will make for most of their careers! How are we allowing this to happen?

one of the other 'big' aviation blog operators posts regularly about the stranglehold that airline pilot unions have on management in the US and there is probably some truth to it.

Remember that UA and its pilot union leadership reached agreement first on a new contract that was worth about half of what this one but it was the line pilots during a vote that rejected the contract, not the union leadership. Line pilots recalled...

one of the other 'big' aviation blog operators posts regularly about the stranglehold that airline pilot unions have on management in the US and there is probably some truth to it.

Remember that UA and its pilot union leadership reached agreement first on a new contract that was worth about half of what this one but it was the line pilots during a vote that rejected the contract, not the union leadership. Line pilots recalled most of the UA ALPA leadership, AA offered a slightly better contract than UA's but its union leadership never sent it to the rank and file for a vote.

It wasn't until DL settled w/ its pilot union leaders in late December that there was real movement on new contracts; AA and then UA settled. DL also extended raises to its non-pilot personnel, the only airline that has raised the pay of nearly all workers.

If one were to be cynical, you would blame these massive raises on Delta but you also should be able to see that they are putting enormous cost pressure on other airlines while DL is most able to afford these new pilot rates. The reality is that AA and UA can afford them but most of the low cost carriers and regional carriers cannot. Not surprisingly, DL has the lowest percentage of its flights operated by regional airlines of the 4 airlines that use RJs.

DL also is able to push its revenue premium by limiting the growth of low cost carriers.

DL, of course, gets billions more revenue than any other airline from non-transportation revenue.

The new pilot rates that the big 3 US global carriers have been willing to give to their pilots will change the industry. For years, though, we heard how low costs were a threat to the big 3 and now the paradigm has completed flipped. DL led the charge because it can afford the high costs and AA and UA will make them work. AA and UA are not as profitable as DL so will have to cut elsewhere but they will also benefit from a weaker low cost carrier segment.

You can't sue for collusion when the process of pattern bargaining played out such that costs increased across the board and the strongest players are now the ones that can most afford it. Raising costs to pinch competitors is the opposite of any case the government has ever succeeded at winning against business.

Tim is wrong that wages have any real pressure or predictive value on the prices of flights, which are dictated almost entirely by supply and demand on individual routes than on the actual cost of operating the airplane. If actual costs came into the equation Delta wouldn't have been trying to sell me an economy seat to Orlando for 700 bucks next summer while charging 350 to Seattle during the same time period.

I think ALPA left a lot on the table here, rushing to accept a parity plus contract rather than leveraging their position to truly set epoch defining wages and workrules.

This contract is going to eventually be rejected or renegotiated, so there was no reason to settle for these figures. If the window of opportunity is short, they should have demanded more (and probably could have easily gotten 10-12% higher than this, plus many more...

I think ALPA left a lot on the table here, rushing to accept a parity plus contract rather than leveraging their position to truly set epoch defining wages and workrules.

This contract is going to eventually be rejected or renegotiated, so there was no reason to settle for these figures. If the window of opportunity is short, they should have demanded more (and probably could have easily gotten 10-12% higher than this, plus many more workrule concessions like positive space commute in premium cabins, higher priority space available travel for pilot families over other employees, etc..)

This contract unfortunately reflects the mediocrity of today's ALPA.

These raises come off the backs of the thousands of outsourced workers who are doing the work below the wing.

These raises do not go to the whole work group (pilots down to aircraft cleaners), so it feels selfish more than anything. The pilots are the A scale, the flight attendants the B scale, the other original union workers the C scale, and the rest of the workforce (including the outsourced labor) are the...

These raises come off the backs of the thousands of outsourced workers who are doing the work below the wing.

These raises do not go to the whole work group (pilots down to aircraft cleaners), so it feels selfish more than anything. The pilots are the A scale, the flight attendants the B scale, the other original union workers the C scale, and the rest of the workforce (including the outsourced labor) are the F scale, supporting everyone else's raises. Its outright sickening to call these union employees. They are just as exploitative as management.

This is the silliest concept ever. Do you genuinely believe management would give people on the bottom rung more money if pilots got less? Absolutely not. Some people have clearly never negotiated a salary in their life and obviously let their bosses dictate what they earn.

Not a silly concept. All profit margin was swept up by one small work group. The pilots were already highest paid labor group and bullied their way to threaten the health of the whole airline through highest high pay. Their union is strongest so they win, but at what cost? There are other unions for other labor groups at Ohare that just had their knees cut off.

You said it yourself Ben. Ticket prices are set by what customers are willing to pay, not by what it costs the airline to run the flight. IOW, this pilot contract should not have much effect on our ticket prices. If they could gouge an extra buck off us, they would do it regardless of what they pay pilots (amply shown over the past year when demand came back).

So I fully support the...

You said it yourself Ben. Ticket prices are set by what customers are willing to pay, not by what it costs the airline to run the flight. IOW, this pilot contract should not have much effect on our ticket prices. If they could gouge an extra buck off us, they would do it regardless of what they pay pilots (amply shown over the past year when demand came back).

So I fully support the pilots here. Because let's be honest, when times are bad, the airlines are either going to go screaming to Big Daddy Govt to bail them out, or else they'll use bankruptcy laws to declare these contracts null and void. Entire business school case studies have been written about airlines' use of "strategic bankruptcy" (i.e. not real bankruptcy, but a declaration of bankruptcy to f over your suppliers, employees, and creditors). I'm sure the pilots are under no illusion about this contract holding when times get tough. So might as well get some while the gettin' is good.

Besides, when times are good like this, it's not like airlines are squirreling the money away for a rainy day. They're buying back shares and giving bonuses to their execs. Sometimes taking on debt just to fund share buybacks rather than investing in their business.

The pilots' extra pay doesn't come from our pockets (trust me, if they could pick our pockets further, they'd do so), or even detract from the health of the airline (share buybacks do nothing for the long-term health of the business). So the real question is: do the pilots deserve this money more than the airlines CEOs (remember, these guys needed $50bil in govt bailouts; so much for being brilliant capitalists) or airlines investors? And the answer is undoubtedly yes. Good for them to negotiate for every red cent they can get from their bosses.

the low cost carrier segment is being forced to raise pilot salaries in order to be able to staff their cockpits and they are much less capable of raising fares and retaining customers than the big 3 global carriers. The big 3 are in the best position relative to the low cost carrier segment than they have been since the US airline industry was deregulated.

As hard as it is for some to believe,...

the low cost carrier segment is being forced to raise pilot salaries in order to be able to staff their cockpits and they are much less capable of raising fares and retaining customers than the big 3 global carriers. The big 3 are in the best position relative to the low cost carrier segment than they have been since the US airline industry was deregulated.

As hard as it is for some to believe, the low cost carriers are in much worse financial shape than the big 3 right now. JetBlue and Spirit might not even make a profit in the 3rd quarter (which ends tomorrow) and includes the second half of summer.

The big 3 still have to generate revenues to cover their costs but the LCCs and ULCCs are the ones that are going to struggle w/ high pilot and other labor costs much more so than the big 3

Glad to know my tax dollars will be used in a few years to bail out United, which is once again forgetting the airline industry also faces downturns. And yes, that’s sarcasm.

Past time to let one of these airlines fail and kick the rest off of the government teat.

What happens to your ticket price when there are 33% less legacy airlines? You think those savings will be passed onto you?

I am sure senators and congressmen from United hub cities in NJ, IL, TX, CO, and CA would just let their cities lose significant service and see thousands of their voters out of a job

Just a reality check, Ben.

None of the big 3 would be signing multi-billion dollar contracts for just one labor group which represents about 1/3 of their labor costs if they weren't doing a pretty darn good job of finding revenue and lots of it.

And UA's biggest cost disadvantage is not that they fly more ULH flights but that their international fleet is so much less efficient than AA and esp. DL...

Just a reality check, Ben.

None of the big 3 would be signing multi-billion dollar contracts for just one labor group which represents about 1/3 of their labor costs if they weren't doing a pretty darn good job of finding revenue and lots of it.

And UA's biggest cost disadvantage is not that they fly more ULH flights but that their international fleet is so much less efficient than AA and esp. DL as a result of the much higher number of 777s that UA has; the 777-200ER is the least fuel efficient aircraft in the US carrier fleet on a per seat basis.

Fuel is heading up and has been since UAL settled w/ its pilots. UAL is already guiding to $3/gal for jet fuel for the 3rd quarter and many analysts expect fuel will go over $100/bbl from its current level in the low 90s. UAL pays the most per gallon of the big 4 so high fuel prices are going to hurt UAL much more than the amount of ULH flying it does.

And UAL also has an order book that is more than 3 times larger than AAL and DAL which means that UAL will pay more for interest and fleet expense than the other two. UAL THINKS it will fund its massive capex by cash generated by the business but AAL and DAL are generating as much or more cash and paying down debt, which means they will have lower interest and fleet expenses than UAL even if all 3 made the same profits but they aren't; UAL was the least profitable in the 2nd quarter.

Finally, Asia is reopening and revenge travel demand is expected to favor that region in 2024 over Europe but the chances are high the surplus of demand will not be near as high from Asia as it was to/from Europe.

negotiating focus now shifts to Southwest which has not settled w/ either its pilots or FAs and to AA and UA and their negotiations w/ FAs.

So on the one hand, United’s fleet is too old for them to do well. On the other hand, their enormous widebody order book hurts United, but when delta orders new planes to replace old planes, heaven seems to shake with profitable excitement.

Make up your mind, Tim.

And talking about the 77e in per seat terms like you do is useless. What happens is the revenue united generates off lower seat count with an...

So on the one hand, United’s fleet is too old for them to do well. On the other hand, their enormous widebody order book hurts United, but when delta orders new planes to replace old planes, heaven seems to shake with profitable excitement.

Make up your mind, Tim.

And talking about the 77e in per seat terms like you do is useless. What happens is the revenue united generates off lower seat count with an offset of more J and W seats. Delta generally loves to have much denser widebodies with less premium seating than aa and ua. Historically, they haven’t had hubs that need more premium seating like United, especially and aa to a lesser extent. So of course your normal ramblings about cost per seat are great for your delta propaganda. What matters is the revenue generated off the lopa. Before you go off on your normal delta revenue premium. That doesn’t apply here since even delta says publicly to investors their profitability comes from their fortress hubs where they can charge more to local passengers with no choice , not places like LAX or NYc. Their revenue premium comes from interior hub fortress hubs.

Of course the 77e is an older and less fuel efficient plane than the a350 or 787 but a depreciated asset is often worth more than a brand new one. Just ask delta.

Max,

the problem is that UA did not order aircraft for years and has a much less efficient fleet and is now saying that they will use their massive order to grow rather than replace aircraft. They have said they intend to keep the 777-200ERs in service until the end of the decade - which also is a drag on AA but AA operates a smaller international route system.

there is no confusion...

Max,

the problem is that UA did not order aircraft for years and has a much less efficient fleet and is now saying that they will use their massive order to grow rather than replace aircraft. They have said they intend to keep the 777-200ERs in service until the end of the decade - which also is a drag on AA but AA operates a smaller international route system.

there is no confusion for anyone that understands the concepts.

The 777-200ER burns 12% more fuel than the A330-300 which is the backbone of Delta's transatlantic fleet and 20% more fuel than the comparably sized 787-9 or A330-900. The A350-900 esp. in the ex-Latam configuration burns 20-25% less fuel than the 777-300ER.

As much as you want to argue with UA's profit numbers compared to DL's, fuel burn is the biggest reason for the difference. You need only look at UA's quarterly financial statements compared to AA and DL to compare seat miles and revenue generated and see that UA pays more for fuel per seat mile than AA or esp. DL.

UA simply does not generate a premium to DL across its international route system. Comparably sized planes that burn higher fuel carrying the same revenue and comparable labor costs are going to yield lower profits and UA's global region and system profit numbers show that, Max.

And UA has more debt than DL, will have more than AA as AA retires debt, and interest rates continue to increase. UA cannot generate as much cash as they are spending on new airplanes; their debt will go up.

Actual financial statements tell the story of what is really taking place.

UA underperformed both AA and DL in profits in the 2nd quarter.

the quarter ends tomorrow and industry reports its 3rd quarter financials in the next few weeks

MAX,

you can argue all you want but SEC-filed financial statements don't lie.

In the second quarter of this year, DL generated $13.377 billion in passenger and cargo revenue while UA $13.366 billion. Very close and does not include DL's much higher levels of non-transportation revenue including from Skymiles/Amex, the refinery and Delta Tech Ops amount to $1.5 billion

In that quarter, DL burned 997 million gallons of jet fuel at $2.52/gallon...

MAX,

you can argue all you want but SEC-filed financial statements don't lie.

In the second quarter of this year, DL generated $13.377 billion in passenger and cargo revenue while UA $13.366 billion. Very close and does not include DL's much higher levels of non-transportation revenue including from Skymiles/Amex, the refinery and Delta Tech Ops amount to $1.5 billion

In that quarter, DL burned 997 million gallons of jet fuel at $2.52/gallon for a total of $2.5 billion while UA burned 1.062 billion gallons at $2.66/gal for a total of $2.8 billion in jet fuel costs - $300 million or more than 10% more than DL to generate very slightly less revenue.

UA simply pays more for every gallon of jet fuel and burns more of it.

DL and UA paid almost identical amounts for labor.

As much as Ben wants to keep stating that labor costs are an issue for UA, actual data shows that it is fuel costs and its lower fuel efficiency that are UA's operating cost disadvantage. Add in DL's much higher non-transportation revenue and it is clear why DL is so much more profitable.

The guy who comes back to reply to himself 75 minutes later and I'm arguing with you?

Facts are facts, Tim. You don't understand per seat costs even though you constantly use the term. Per seat costs mean nothing absent the revenue generated from the seats on those planes. Per wide bodies, you have none of that data. You have overall data and don't even get me started on your impressive lack of knowledge on...

The guy who comes back to reply to himself 75 minutes later and I'm arguing with you?

Facts are facts, Tim. You don't understand per seat costs even though you constantly use the term. Per seat costs mean nothing absent the revenue generated from the seats on those planes. Per wide bodies, you have none of that data. You have overall data and don't even get me started on your impressive lack of knowledge on DOT data by geographic region. You love to spout seat costs when it reflects well on Delta because they put a LOT of seats on their wide bodies compared to AA & UA, especially UA. Of course their per seat costs look better when spread out a relatively fixed cost with a bigger denominator. But again, that means nothing unless you know the corresponding revenue per seat like internal revenue and airline people would.

Of course the 777 is an older platform relative to the 787 or the A350 but a depreciated asset is often worth more on an income statement than better fuel efficiency.

But... you also can't claim to go off on how AMAZING it was for DL to buy new planes to replace old ones and the advantage that gives Delta while simultaneously ignoring the enormous wide body order United has that will keep United vastly ahead of any international network Delta hopes to create.

UA has an order book that easily allows them to retire older wide bodies or keep them to enable profitable growth. This isn't a black and white issue. New planes have advantages but so do older paid off planes that still work operationally.

This isn't rocket science, Tim. Delta's profitability comes from their interior hubs where they overcharge local residents and those making unique connections where a DL hub one stop is the only option. That's the way the interior hubs work with their dominance. Even Delta says exactly that on their investor slides. There are other reasons Delta is profitable, sure. Their amex deal is a great one for them but delta has lower costs also via non-union labor contracts and getting to maximize efficiency through that means.

Feel free to keep arguing with yourself. It's Friday and I have a life unlike you who comes back to reply to me again hoping I'll respond. lol

Get a life. Facts always seem to hurt your feelings since you can't always figure out a way to spin them like you do with seat cost on a plane.

I added the EXACT numbers off of DL and UA's quarterly financial statements. THAT is why I replied to my own post.

And you spent how long arguing against clear data that has nothing to do with how any airline allocates costs between their regions. The numbers I cited are for both airlines' SYSTEMS

The US airline industry has been deregulated as long for UA as it has been for DL. If UA's hubs...

I added the EXACT numbers off of DL and UA's quarterly financial statements. THAT is why I replied to my own post.

And you spent how long arguing against clear data that has nothing to do with how any airline allocates costs between their regions. The numbers I cited are for both airlines' SYSTEMS

The US airline industry has been deregulated as long for UA as it has been for DL. If UA's hubs don't produce the same margins as DL's, then UA should quit bragging about how it has the best hubs. And they could have moved them if they thought DL's were better.

UA could have gotten a better credit card contract but DL beat them on that. DL is fixing other airlines' engines which throws in even more profits.

UA COULD HAVE done a whole lot to increase its profits but they simply did not.

And as much as UA touts its size across the Pacific, that is actually where their profits are most disconnected from DL's. DL makes almost twice as much per seat mile flying the Pacific as UA does. Again, facts.

DL and UA had almost identical labor costs. The only difference is that DL has already raised the pay of its flight attendants so UA's will go up; the pilot costs are already baked in.

UA is simply a less efficient airline from a labor and fuel standpoint.

YOU are the one that wants to argue all day long because you don't want to face that reality but anyone that actually looks at numbers can see it.

Just wanted to drop by and remind all of you, if Enron teaches you anything, then "SEC-filed financial statements don't lie" is a lie.

So don't go Tim Dunn Approved The SEC filing and "I guarantee it."

why don't you file a complaint w/ the SEC if you think that any publicly traded company in the US is not telling the truth?

if you really think that UAL is doing as well as or better than DAL, where do you think the money is going?

The simple fact is that it is clear to everyone except for a couple of die-hard UA fankids that UA does not make as money as DL...

why don't you file a complaint w/ the SEC if you think that any publicly traded company in the US is not telling the truth?

if you really think that UAL is doing as well as or better than DAL, where do you think the money is going?

The simple fact is that it is clear to everyone except for a couple of die-hard UA fankids that UA does not make as money as DL and that has been the case for years. Suppose you missed Scott Kirby's statements that he would match DL's profits shortly after he arrived at UA and, sure enough, UA's financial statements show that UA didn't make as much money then and they still don't. He just quit making claims about matching DL's profits.

The real twist is that AA has become much more profitable and generated higher profits than UA in the 2nd quarter. AA paid a price for hooking up w/ B6 in the NEA so its profits will fall in the 3rd quarter but the chances are very high that AA will rebound and they are going to generate higher profits in the medium and long-term than when UA was there.

Scott Kirby was all about flying where HE thought was strategically important when he was at AA; it didn't take long after he left before AA execs realized it was no longer as strategically necessary to fly to all those places so they stopped doing so and AA's profits have gone up.

DL, for now, doesn't see a need a need to try to fly to all of the places UA flies to - and DL makes a whole lot more money.

And it is also noteworthy that DL's higher profit by region for the Atlantic and Pacific is almost identical to the difference in their fuel costs.

In other words, UA's profits would be equal to DL's over the Atlantic and Pacific if they had comparable fuel efficiency where it matters most - on the longest haul flights.

So happy you had no plans for your Friday. But not surprised in the slightest, tim.

I did and do. But don’t have time to listen to you try to skew actual facts to your view.

All the best, tim

Lest anyone forget. Delta fired Tim. They don’t believe him either.

Get a life and a better Friday night, Timmy. Your current one is just sad. Facts matter no matter how hard you to try skew them to your view.

It honestly touches my heart that you kept refreshing your comments for me to write a paragraphs-long reply to me a short ten minutes later.

Seriously, is your life really this tragic? Who cares?

It’s an airline that fired you. Why do you care about defending them?

we get it, MAX,

you can't stand to admit that Delta runs a better BUSINESS than United, MAX.

you can have your own preferences about anyone's product - although much of that is also measurable and Delta delivers a higher quality product than United - but you can't make up financial statements.

When you and your ilk argue that financial statements can be cooked and everyone does accounting differently, you have lost....

we get it, MAX,

you can't stand to admit that Delta runs a better BUSINESS than United, MAX.

you can have your own preferences about anyone's product - although much of that is also measurable and Delta delivers a higher quality product than United - but you can't make up financial statements.

When you and your ilk argue that financial statements can be cooked and everyone does accounting differently, you have lost. Anyone that knows anything about business knows both statements are categorically false. There is standardization in accounting and to even suggest that the numbers can't be right means that either DL or UA or both are not telling the truth because you don't like what the numbers say is the epitome of failing at your argument.

and when you turn to attacks on me - which are also lies - it shows that you are as bankrupt as Pan Am. And it isn't even logical. Why would anyone spend time all over the internet talking about a company from which they were fired?

The simple fact is that Delta understood a long time ago that running the best business is what they are required to do for their owners, the shareholders. They don't get everything right but they deliver higher profits in every region of the world they serve than any other airline.

And the point you and Ben fail to miss is that it is precisely because UAL and AAL (which also generally matched DL's pilot contract terms) is that UAL and AAL's lower profits mean that their pilots WILL NOT get paid as much as DL pilots because DL profits are higher. Even w/ the same profit sharing formula, AA and UA's profits are lower so their employees will get less in profit sharing.

Grow up and admit the truth about the business of aviation, Max. ALL of the big 3 legacy airline pilots are paid well. very well. DL pilots will earn more because DL earns more.

Congrats to United for their contract.

I will say it’s much deserved, especially now of all times. Flight training is super expensive, with the average new student spending over $100k in training costs to get fully qualified. And even then, they have to spend another 1250 hours as an instructor or building time in an extremely low paying position to make it to 1,500 hours and be eligible for a regional FO job.

And...

Congrats to United for their contract.

I will say it’s much deserved, especially now of all times. Flight training is super expensive, with the average new student spending over $100k in training costs to get fully qualified. And even then, they have to spend another 1250 hours as an instructor or building time in an extremely low paying position to make it to 1,500 hours and be eligible for a regional FO job.

And then once you have the hours, you gotta figure out getting hired. None of the regionals are taking FOs right now, everyone wants captains. Depending on what regional you go to, you’ll get metered by the big 3 in some capacity and stagnate while watching your peers get hired at the airline of your dreams.

Historically we didn’t have a shortage going on. Due to work rules, this shortage became a thing. Being able to survive is important. With inflation being as bad as it is now, this keeps the score somewhat even. And makes the grind from 0 experience to legacy pilot a lot more worth the struggle.

Sounds good to me, rather have that money going to pilots than clueless execs. Hopefully flight attendants have something nice in the pipeline as well

What would happen if United would add a snap up clause promising the best pay in the industry? Would that cause United and Delta to both do 1% raises infinitely?

There's a line for United A380 pilots?

Probably to be proactive in case they would ever get them. (But they probably won’t)

That’s the pay scale that full time union guys are on. They’re paid at the highest pay scale United has, they inserted the A380 rate in there for it.