The Amex Offers program often has promotions that can save you money on hotel stays. We frequently see offers with Hilton and Marriott, since these are also Amex co-branded credit card partners. We’ve just seen a new offer introduced for Marriott stays, and it has the potential to be great deal.

Spend $375+ with Marriott, get $100 back

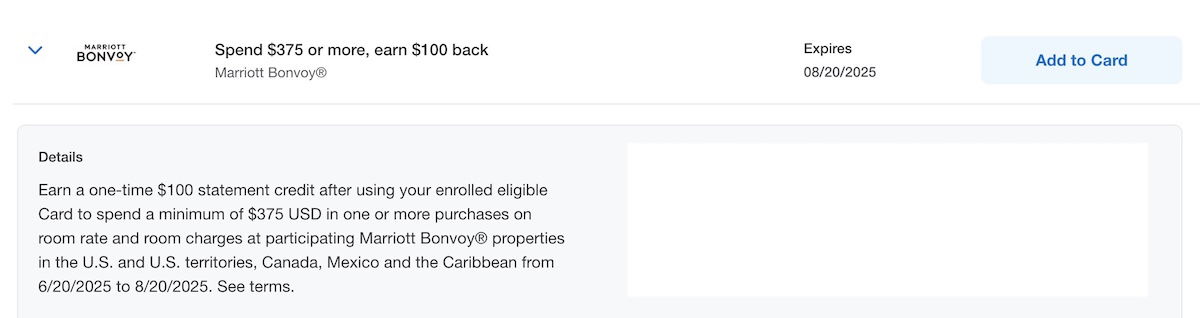

There’s a targeted Amex Offers deal for stays at select Marriott properties:

- Save $100 when you spend $375+ across one or more transactions (up to 27% back)

- This is valid when you pay for your stay between June 20 and August 20, 2025

- This is valid for stays at properties in the US, US territories, the Caribbean, Canada, and Mexico

- The offer is valid at all brands except Marriott Vacation Club, Marriott Grand Residence Club, Design Hotels, Protea Hotels, Marriott Executive Apartments, Homes & Villas by Marriott Bonvoy, Vistana Signature Network, and Vistana Residence Network

- This offer excludes gift card purchases, online retail purchases, and purchases of Bonvoy points

- The terms state that you need to book directly with Marriott to take advantage of this

- This can be combined with any promotion being offered directly by Marriott

- Registration is required

Note that it’s likely that there are different versions of this offer, and some might be better, while others may be worse.

Bottom line

There’s a new Amex Offers deal for Marriott stays, which can save you $100 when you spend $375+ at a majority of Marriott brands. If you stay at Marriotts with any frequency, using this offer is a no-brainer, and basically good as cash. Ideally, you’ll see this on a co-branded Marriott card, so that you can earn 6x points on your stay while also earning cash back.

Was your account targeted for this Amex Offers deal, and do you plan on taking advantage of it?

On my Amex Bonvoy business card:

"Spend $500, get $100 back" on qualifying room and room charges. (Same dates.)

Appreciate the heads up on the possibility of targeted offers.

Have the $500/$100 offer. It is solid promo from Amex. I dont recall Chase ever offering anything similar for their Marriott co-branded card holders.

I was offered $350/$140 also

Ben, the offer on my wife’s AMX Business Platinum card is even more generous: “Spend $350 or more, earn $140 back” Hence, this targeted offer (doesn’t appear on any of my cards) appears to have varying offer terms.