The lifemiles program has rolled out a new promotion to generate miles — rather than offering an outright bonus on purchased miles, lifemiles is offering a bonus when you transfer miles to another member.

While the program used to have offers like this all the time back in the day, they’re rarer nowadays, and this is only the second time one of promotions has been offered this year (and this one is better than the previous one).

In this post:

Transfer lifemiles and get a 125% bonus

Through Sunday, November 10, 2024, lifemiles is offering a 125% bonus when you transfer lifemiles to another member.

To be clear, this bonus is only valid when transferring miles between lifemiles accounts. This doesn’t apply when transferring flexible points to lifemiles, for example. This is only useful if you have an existing lifemiles mileage balance, since you can’t transfer miles you don’t have.

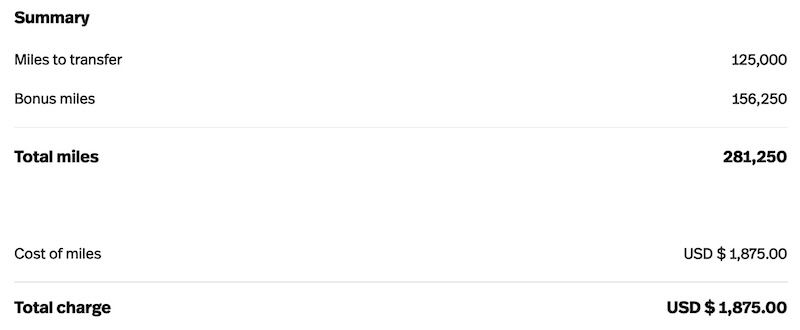

The lifemiles program charges 1.5 cents per transferred mile, and you can transfer up to 150,000 miles per year (before the 125% bonus). However, there’s a maximum of transferring 125,000 miles per transaction. So you could transfer 125,000 miles at a cost of $1,875, and then you’d receive a total of 281,500 miles in the account you transfer to.

That’s like being able to generate miles for 1.2 cents each (since you’re generating 156,250 miles for $1,875), while being able to consolidate miles into a single account.

Earning miles for 1.2 cents is a solid price, and is in line with the cost at which lifemiles ordinarily sells miles, when there’s a bonus. So this could be worth it both as a way to acquire points, and also to consolidate points between accounts.

Is generating lifemiles at this cost worth it?

For context, avianca is in the Star Alliance, which means you can redeem lifemiles on all Star Alliance airlines without any fuel surcharges. Really this is the core value proposition of buying lifemiles, since this is a great way to book Star Alliance premium cabin seats at a huge discount. Check out my guide on how to redeem lifemiles for ideas on how to redeem these miles.

With a specific use in mind, this lifemiles promotion can be a great value, whether you’re looking at traveling first class on All Nippon Airways or Lufthansa, or are looking at traveling in business class on a countless number of airlines.

Everyone has to crunch the numbers for themselves and decide whether this makes sense or not.

Do note that in some cases lifemiles doesn’t have access to the same award availability as Star Alliance partners, for better or worse. Sometimes lifemiles doesn’t have access to partner awards that other programs do have access to, and other times the inverse is true.

That’s why I always recommend doing some “dummy” award searches before generating miles, so you can get a sense of how award availability lines up with your needs.

Bottom line

The lifemiles program has just brought back a promotion that allows you to transfer miles to another member with a bonus. At the moment you can receive a 125% bonus when transferring miles. Being able to generate lifemiles for 1.2 cents each (potentially even less after factoring in credit card rewards) is a solid value.

Do you plan on transferring lifemiles with a 125% bonus?

Twitter post says 110%