Nowadays there are many premium credit cards that offer Priority Pass memberships, giving cardmembers access to airport lounges around the world. However, not all Priority Pass memberships are created equal, in terms of guesting privileges and experiences you have access to. I’m sure I’m not the only one who has several Priority Pass memberships, given how many credit cards I have.

In this post I wanted to discuss the basics of telling Priority Pass cards apart, and why it matters.

In this post:

Which credit cards offer Priority Pass?

Below are some of the most popular premium credit cards in the United States that offer a Priority Pass membership, along with their guesting privileges (I just realized I have all five of these cards, goodness!).

Capital One Venture X Rewards Credit Card

Capital One Venture X Rewards Credit Card

The Platinum Card® from American Express

The Platinum Card® from American Express

The Business Platinum Card® from American Express

The Business Platinum Card® from American Express

If you’re looking for Priority Pass lounge access, it’s hard to beat the value of the Capital One Venture X Rewards Credit Card (review) or Capital One Venture X Business (review):

- With a $395 annual fee, the cards have the lowest annual fee of any of the above cards

- Most of that annual fee can easily be recouped by the $300 annual travel credit and 10,000 anniversary bonus miles

- Both cards offer a Priority Pass membership for the primary cardmember, and on the personal version of the card, you can even add up to four authorized users at no extra cost, and they receive a Priority Pass membership as well

Beyond the guesting privileges, there are some important differences between the memberships offered by these cards. For example, Priority Pass memberships issued through Chase cards get you unlimited access to Chase Sapphire Lounges, while Priority Pass memberships issued through other cards only get you one visit per year to the US lounge network. Furthermore, Citi cards offer credits at Priority Pass restaurants, while many other cards don’t.

How can you tell Priority Pass cards apart?

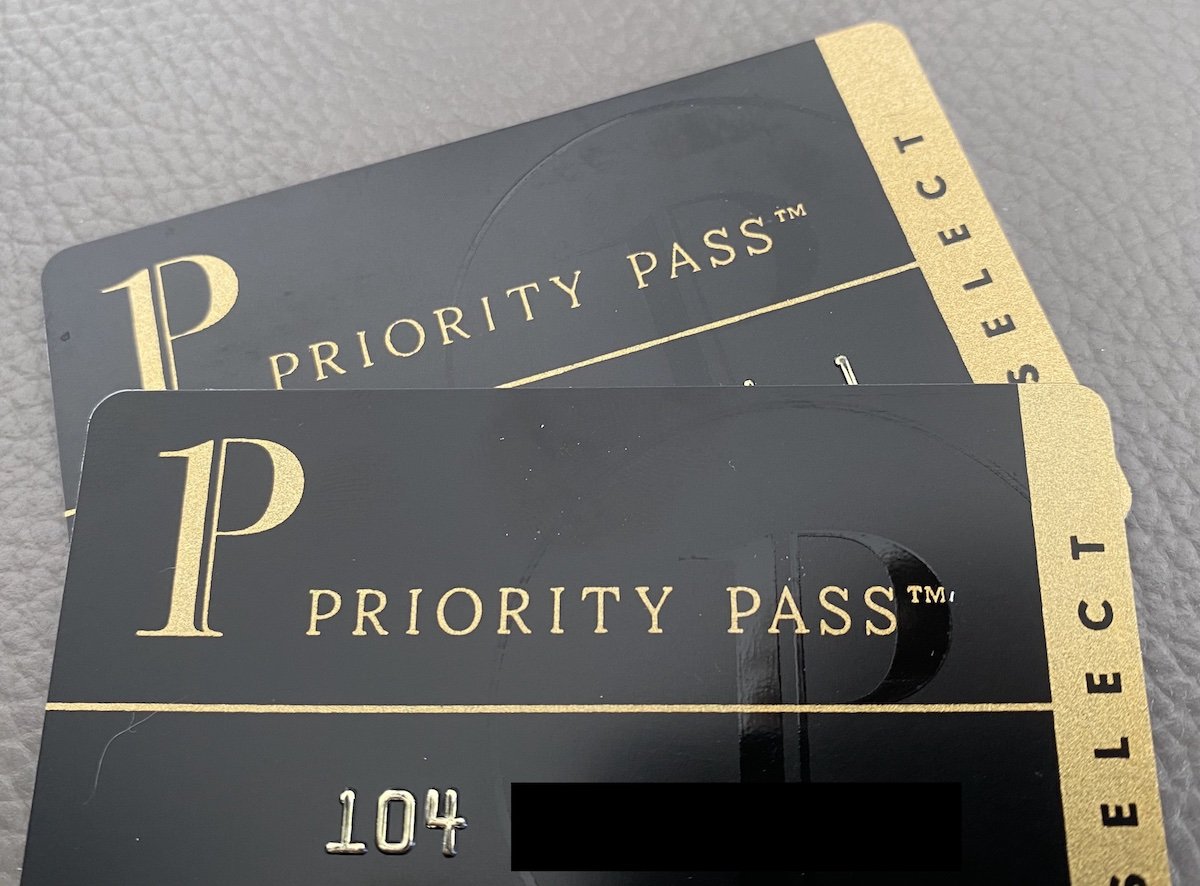

Once you physically have your Priority Pass membership card, how can you tell which card issuer it came from? There are some clues based on the card number and expiration date:

- Priority Pass cards issued through American Express typically have 11 digit membership numbers, the card number typically starts with 100, 102, 104 or 142, and the cards are typically valid for four years

- Priority Pass cards issued through Capital One typically have 11 digit membership numbers, the card number typically starts with 104 or 105, and the cards are typically valid for one year

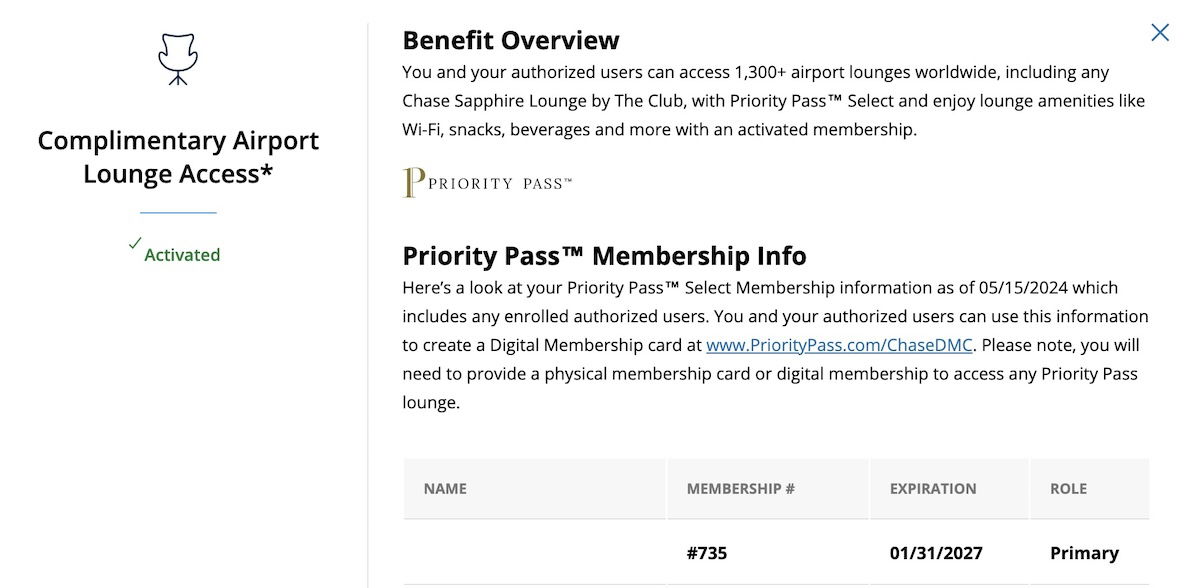

- Priority Pass cards issued through Chase typically have 16 digit membership numbers, the card number typically starts with 735, and the cards are typically valid for three years; one quirk is that Chase’s digital Priority Pass card numbers are 14 digits and start with 150 (with other issuers, the physical and digital number is the same)

- Priority Pass cards issued through Citi cards typically have 11 digit membership numbers, the card number typically starts with 142, and the cards are typically valid for three years

Hopefully between those three identifiers, most people can figure out through which credit card their Priority Pass membership was issued. If anyone has data points that contradict the above, please let me know. This is what I’ve been able to piece together based on looking at my cards, though it’s possible that I’m missing something.

In the case of American Express and Chase, there’s another way you can figure out your Priority Pass number. With American Express, just log into your card account (the one that has a Priority Pass membership), and go to the “Benefits” tab.

Scroll down to where it says “The American Express Global Lounge Collection,” and then if you’re enrolled, you should see a green checkmark, and then next to that you’ll see your full Priority Pass card number.

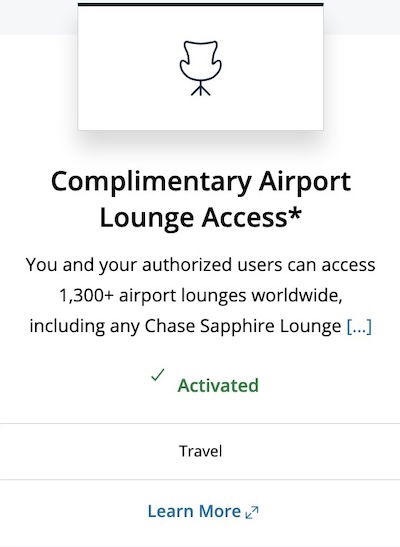

With Chase, just log into your card account (the one that has a Priority Pass membership), and go to the “Benefits” tab.

Scroll down to where it says “Complimentary Airport Lounge Access,” and then click on “Learn More.”

There you’ll see the full membership number listed, for easy reference. Note that this is the physical card number, and not the digital card number.

If you’re still confused about which Priority Pass card is which, you can phone up Priority Pass on the number on the back of your card, and an agent can help you figure out which card issuer the membership is through (however, that requires going through a verification process, which typically includes an agent asking how you got your card, so that’s a whole different adventure).

Tip: mark your Priority Pass cards

Priority Pass membership cards have a signature panel on the back. While I’m not sure this is the intended purpose, personally I use the signature panel to simply write the card issuer through which the card was issued in permanent marker, so I know whether the card was issued by Amex, Capital One, Chase, or Citi.

That makes it easy for me to always remember how I got a card membership, which is useful if you’re trying to figure out which card is best for a particular use.

Bottom line

Nowadays many premium credit cards offer a Priority Pass membership. These memberships can have different restrictions (like Priority Pass restaurant credits or Chase Sapphire Lounge access), so it’s always worth remembering which Priority Pass card is tied to which credit card. If you’re like me and have multiple Priority Pass memberships, it can be tough to tell them apart.

Hopefully the above is a useful guide that can help you differentiate which card comes from which issuer. I always recommend just writing the card issuer on the back of your Priority Pass card, so you can easily remember and don’t have to go through this exercise.

If anyone has any data points that contradict the above guidelines, please let me know so I can get the post updated.

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and The Platinum Card® from American Express (Rates & Fees).

Another data point: my PP through Amex is 111. PP through Capital One is 112.

My capital one Priority Pass card meets the description you listed for Chase cards. And I actually have two of them because I must’ve registered twice and while they have different numbers, they both begin with 735 and meet the Chase description.

I've never bothered to use my Cap 1 Priority Pass. I just give the lounge attendant my Cap 1 card and they run that through -- always accepted

Didn't even realize Priority Pass cards had expirations. My card from the Citi Prestige apparently expired in December 23 but I just used it two days ago for restaurants.

Great tip, thanks!

How about BofA?

What about BofA? He didn't say an "all-inclusive list," he said "some of the most popular." There's City National, there's US Bank, etc., etc.

Additional tip: Get a metallic silver Sharpie to mark anywhere on the card (front or back) besides the signature panel.

Just for a data point: My C1 priority pass starts with 112.

While useful, I got in the habit of printing a label when I received a new PP card to identify them.

This was more important with the Hilton Amex cards that gave you only 10 visits. I did not have my wife as an authorized user on a card that gave her full PP membership so this was the easiest way to get her lounge access. Since she only travels 1-2 a year on her own the 10 max was not important.

Lucky, Chase Digital Priority Pass cards are actually branded as Chase when generated in the Chase app. See here: https://www.flyertalk.com/forum/36147246-post111.html

Another hack if someone goes digital only, then they could also take a screenshot of all the cards and name the screenshot files appropriately on their phone. e.g. Chase Ritz.jpg, Amex Platinum.jpg etc and store the images in a folder using the file management apps on iOS or Android.

I stopped using physical cards a...

Lucky, Chase Digital Priority Pass cards are actually branded as Chase when generated in the Chase app. See here: https://www.flyertalk.com/forum/36147246-post111.html

Another hack if someone goes digital only, then they could also take a screenshot of all the cards and name the screenshot files appropriately on their phone. e.g. Chase Ritz.jpg, Amex Platinum.jpg etc and store the images in a folder using the file management apps on iOS or Android.

I stopped using physical cards a long time ago as no one asks for them anymore? Worse case, they can manually key in the number and even that hasn't happened.

I think we jumped past some logic here. Could I get why I would activate more than one priority pass? I've never seen reason to have more than one

@ Portlanjuanero -- There are a variety of reasons. For one, most people with multiple premium cards didn't acquire them all at once. So maybe you first got the Amex Platinum and activated the Priority Pass membership, and then later you got the Chase Sapphire Reserve and activated the Priority Pass membership, since it offers more value in some situations.

Similarly, different Priority Pass memberships serve different purposes. Some are good for Chase Sapphire Lounges,...

@ Portlanjuanero -- There are a variety of reasons. For one, most people with multiple premium cards didn't acquire them all at once. So maybe you first got the Amex Platinum and activated the Priority Pass membership, and then later you got the Chase Sapphire Reserve and activated the Priority Pass membership, since it offers more value in some situations.

Similarly, different Priority Pass memberships serve different purposes. Some are good for Chase Sapphire Lounges, others are good for Priority Pass restaurants.

If I had 2 non-Chase priority pass memberships, can I use each of them once to get 2 visits to a Sapphire lounge annually?

@ jmikery -- Yep, that should work!

I use two cards when I stay at Minute Suites, I get two hours rather than 1 and then my friend brings his for a total of 3 hours.

Not a benefit anymore but I used to use one for restaurants and the other one for a place to sit (which might be on the same day) and then I need to be mindful if I have travel companions since each card has different quest rules. But now I've gotten rid of all the cards with pp except for chase.

How are those flight and hotel reviews coming along? Surely they are of more interest to your readers than this.

@ chris w -- They're coming along great, and the next review series will be launching no later than tomorrow.