- Even as someone who is tech-hesitant, the Cardless app is easy and straightforward

- Cardless is now available for both iPhone and Android users

- All three Cardless team-affiliated cards are offering a bonus of 25K points — worth at least $250 in statement credits, with no annual fee

I’ve written about Cardless, which is a new credit card company that has the potential to transform the co-brand credit card space. Cardless is unique in that it’s looking to develop co-brand credit cards with smaller businesses that wouldn’t have previously had the volume to have a credit card partnership.

Cardless is able to launch these cards faster and in a more cost effective way than in the past, which is why this has virtually unlimited potential.

In this post I wanted to talk about some exciting updates to Cardless, and also share my experience with the company’s awesome app, which is the best I’ve seen from any credit card issuer.

In this post:

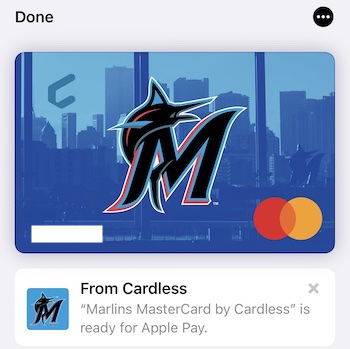

Cardless launches Miami Marlins credit card

Cardless launching its Android app isn’t the only major update this week. Up until now Cardless has launched co-brand cards for Manchester United and the Cleveland Cavaliers, and this week Cardless has launched the Miami Marlins credit card. Even though I’m not much of a team sports person, as a Miami resident I’m happy to at least see one of my hometown teams get a credit card.

As far as the no annual fee Miami Marlins credit card goes:

- There’s a welcome bonus of 25,000 points after spending $2,500 within three months

- The card offers 5% cash back at retail and concessions at loanDepot park, and 5x points on Marlin tickets, 3x points on dining, food delivery, gas, and drugstores

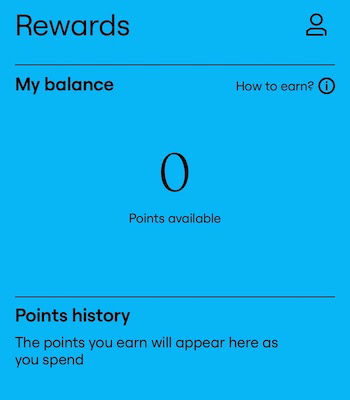

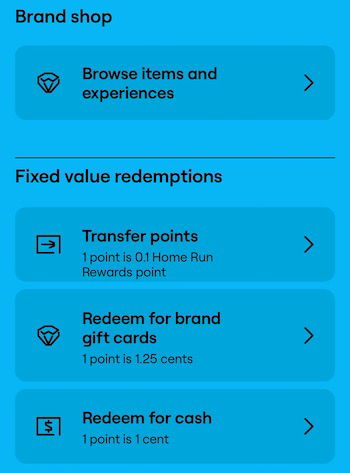

- Points can be redeemed for one cent each towards statement credits, for 1.25 cents each towards Marlins merchandise, or can be transferred 10:1 to the Marlins Home Run Rewards program

- Rewards can be redeemed for some unique experiences and merchandise that Marlins fans could enjoy, from autographed baseballs and jerseys, to being able to throw out a pitch at a game

Current Cardless welcome offers

All three Cardless team cards have no annual fee, and currently offer a special bonus of 25,000 points after spending $2,500 within three months. This includes:

Like most co-brand credit cards, Cardless’ cards so far are very much designed around those who are engaged with their sports partners. I’d say being able to earn 3x points on dining, gas, and drugstores, with a no annual fee card is great in general.

But the real value will come for those looking to redeem for special experiences with partners, as there are some cool redemption opportunities available.

Cardless’ application process is seamless

Since Cardless is a new platform, I’ve enjoyed getting a firsthand look at the credit card application process and app. The process of applying for a Cardless credit card couldn’t be much easier, and feels a lot higher tech and cleaner than the processes you’ll find with some other issuers. I figured I’d share what that process is like, for anyone who is considering a card from Cardless.

You can either apply through Cardless’ website and then activate your account through the app, or you can apply directly through the app.

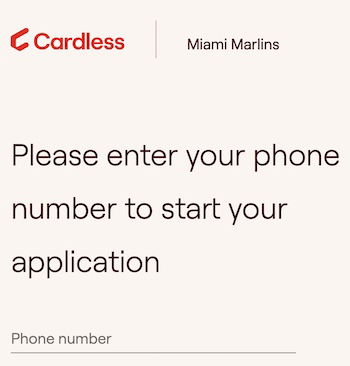

The application process starts by having to verify your phone number, and then you’ll be texted a six-digit verification code.

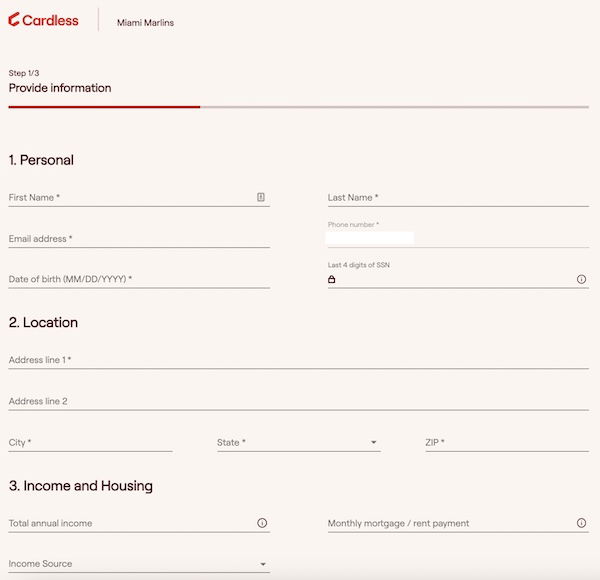

Then you’ll go through the process of providing personal details, including your name, date of birth, last four digits of your SSN, address, income, etc., all on a single page.

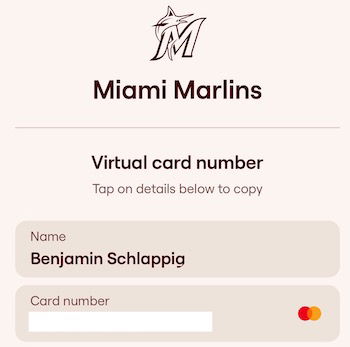

At that point you agree to have your application submitted, and ideally your account will be immediately approved. If you’re approved, you’ll see the credit limit on your card, and will immediately be able to start spending with your virtual card.

Unlike with some other card issuers that promise instant virtual cards, there’s one major advantage with Cardless — the company is aiming to have the highest approval rate of any credit card provider, which is possible thanks to the company’s unique approach to funding transactions.

Cardless’ app is user friendly

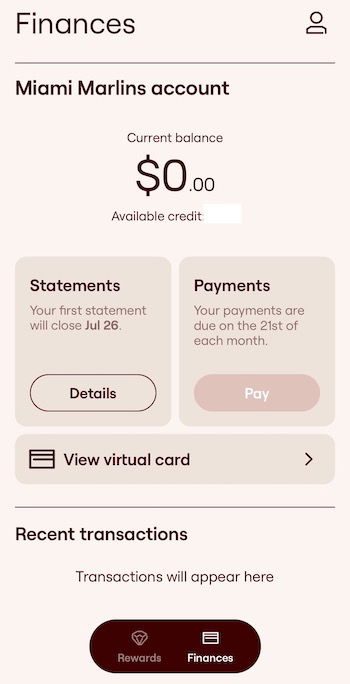

The good experience with Cardless’ app doesn’t end with the credit card application process. Once you’re approved, you’ll appreciate the easy-to-use and “clean” design… or at least I did.

With the apps of some other credit card issuers I find that you often have to tap around to so many different screens before you get the info you want, while that’s not the case with Cardless’ app. It has two main sections — finances and rewards.

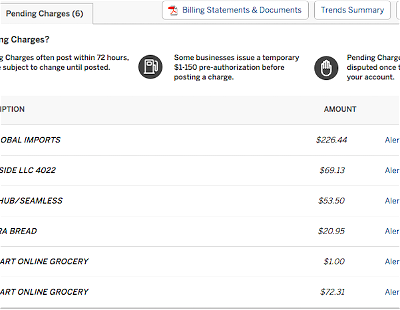

As you’d expect, the finances portion of the app shows everything from your available credit, to your recent transactions, to your payment due date.

This is also where you can access your virtual card number. There’s a direct link to the card number, expiration code, and security code.

You can even add the card to your mobile wallet with the tap of a button, for easy contactless in-person transactions.

The rewards portion of the app is also easy to use — it displays your points balance, earnings and redemption history, and clearly explains all your points redemption options, without having to click to a dozen different pages. This includes redemptions towards statement credits, as well as special experiences you can redeem towards.

Cardless’ Android app is now live

Up until recently, Cardless has only had an iOS app, which admittedly excluded a large percentage of Cardless’ potential customer base (Cardless recognized this, but wanted to make sure the Android app was great as well before launching it).

There’s an important update on that front — Cardless’ Android app is now live, which means a lot more people should be eligible for Cardless products. If you’re an Android user, be sure to download the Cardless app and check it out.

Bottom line

A lot of companies talk about how they have a technology focus, but then the technology isn’t actually good. Fortunately this is an area where Cardless talks the talk. Cardless’ app is spectacular, both during the application process, and once you actually have the card, in terms of managing your finances and rewards.

Cardless has also finally launched its Android app, and has introduced yet another new credit card. While the cards so far are all sports-themed, we should see more cards in other spaces soon, including travel.

How BREX ended for you? Cardless is your new sponsor?

Noted.