There are many reasons to pick up credit cards. Some are worth applying for due to generous welcome bonuses, others are worth acquiring for the return they offer on spending, and others are worth keeping for the ongoing annual perks they offer.

In terms of holding onto cards for ongoing perks, there are some specific co-brand cards that offer lucrative benefits. For example, the IHG One Rewards Premier Credit Card (review) and the World of Hyatt Credit Card offer free night certificates on their account anniversaries, which more than justify the cards’ annual fees, in my opinion.

While some cards are worth holding onto for the specific benefits they offer, other cards are worth holding onto simply because of the card’s issuer. Specifically, I’m talking about American Express cards and the awesome Amex Offers program, which is one reason I always recommend having as many Amex cards as possible.

In this post:

Why the Amex Offers program is so valuable

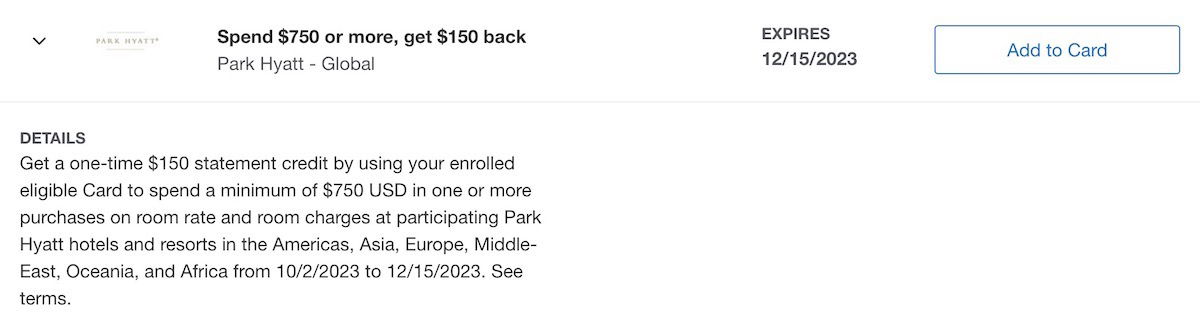

Amex Offers is a program run by American Express where you can earn bonus points, discounts, and other perks for making purchases with select retailers. Different cards are targeted for different offers, so it pays to have as many American Express cards as possible, so you can maximize the offers you have access to. Some offers are widely targeted, while others are much more narrowly targeted.

To me this is nearly free money, given the major retailers, hotels, and airlines, for which we frequently see offers. Personally I save hundreds of dollars per year with the Amex Offers program, as the offers impact which retailers I choose to make purchases with (for example, there are many brand name items that are sold for the same costs by many retailers, so I typically make the purchase with the retailer offering the best Amex Offers deal).

For example, just on the travel front, in recent months we’ve seen savings with Hilton, Hyatt, IHG, Marriott, and much more.

What are the best Amex no annual fee cards?

If you’re looking for the lowest cost way to get access to the Amex Offers program, you can’t beat picking up a no annual fee American Express card. Keep in mind Amex’s general restrictions on card approvals, including that you can have at most five Amex credit cards at any time (this doesn’t include hybrid or charge cards).

There are cards with annual fees that are worth holding onto long term, though the best of both worlds is to apply for a card with no annual fee, so you can keep it long term and use it for Amex Offers. The way I see it, Amex Offers turn many of these cards from no annual fee cards to cards that basically pay you for holding onto them.

Here are my six favorite Amex no annual fee cards, with the first four being personal, and the last two being business:

- The Amex EveryDay® Credit Card from American Express (review) offers bonus points on supermarket purchases, plus a great return on everyday spending, all with no annual fee

- The Blue Cash Everyday® Card from American Express (review) offers a good return on supermarket spending for a no annual fee card (Rates & Fees)

- The Hilton Honors American Express Card (review) offers Hilton Honors™ Silver Status for as long as you have the card, all with no annual fee (Rates & Fees)

- The Delta SkyMiles® Blue American Express Card (review) offers 20% savings on inflight purchases, access to Delta Pay With Miles, and more, all with no annual fee (Rates & Fees)

- The Blue Business® Plus Credit Card from American Express (review) offers 2x Membership Rewards points on the first $50,000 spent every calendar year (1x points after that), all with no annual fee (Rates & Fees)

- The American Express Blue Business Cash™ Card (review) offers 2% cash back on all eligible purchases on the first $50,000 of purchases each calendar year, 1% thereafter, all with no annual fee (Rates & Fees)

I consider it especially noteworthy that two of these cards earn Amex Membership Rewards points, making them great “hub” cards for holding onto Amex’s transferable points currency.

I also want to mention that you should be strategic with picking up no annual fee Amex cards. Don’t pick up so many that you’re locked out from applying for Amex cards with annual fees and lucrative bonuses, assuming you’d otherwise consider them.

The information and associated card details on this page for the Amex EveryDay Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Another benefit of having no annual fee cards

One often overlooked benefit of having no annual fee cards is that it can help improve your credit score. Why?

- 30% of your credit score is made up of your credit utilization, and the more credit you have available but don’t use, the better

- 15% of your score is made up of your credit history, and the older your average account age is, the better

Personally I have several no annual fee cards largely because they’re beneficial for my credit score. They’re a good way to keep my average account age high, and my credit utilization low. Just keep in mind that this only applies for personal cards, and not business cards (at least for the purposes of your personal credit score).

Bottom line

There are a variety of reasons to pick up a credit card. Personally I think picking up a no annual fee Amex card can be well worth it for access to Amex Offers alone, not to mention that it can help your credit score.

On top of that, many no annual fee cards are exceptionally rewarding for spending or for their bonuses. For example, it’s pretty awesome to earn 2x Membership Rewards points with the Blue Business Plus, or to earn a huge welcome bonus with the Hilton Honors Amex.

Do any OMAAT readers use Amex no annual fee cards to maximize Amex Offers?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Blue Cash Everyday® Card from American Express (Rates & Fees), Delta SkyMiles® Blue American Express Card (Rates & Fees), Hilton Honors American Express Card (Rates & Fees), The Blue Business® Plus Credit Card from American Express (Rates & Fees), and The American Express Blue Business Cash™ Card (Rates & Fees).

If you're using your American Express card to buy miles from Avianca, you're not earning extra points like (x3 or x5 )