Maybe I just have really good luck, but only very rarely do I have to dispute a credit card charge. Over the years I’ve had a few instances of credit card fraud, but that’s different than a case where you’re double charged, charged incorrectly for a purchase, etc.

I can count on one hand the number of times I’ve been charged incorrectly for a purchase over the years, and I don’t think it has ever happened to me on a Chase card. Just today I disputed a purchase on a Chase card for the first time, and in this post I wanted to outline the process, since it was a bit different than what I’ve experienced in the past with American Express.

Unless I’m missing something, Chase doesn’t make it especially easy to dispute a charge. On American Express’ website, when you view your transactions there’s a little button with each transaction that lets you start the process of disputing a charge.

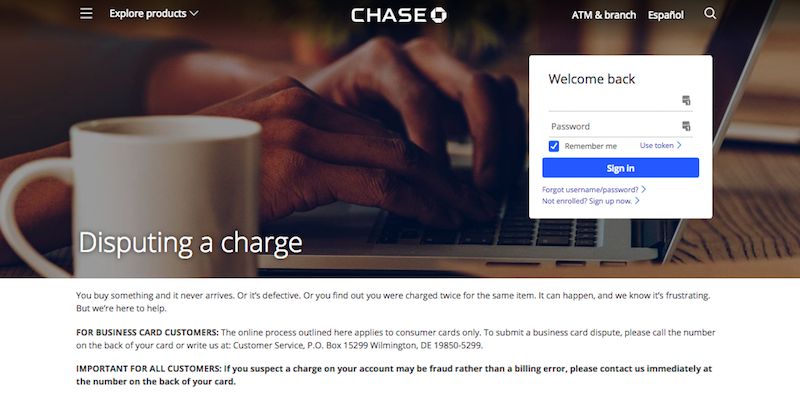

That’s not the case with Chase. Instead I had to follow this link and log into my Chase account that way in order to start the process of disputing a charge. Fortunately once on that page the process was pretty easy.

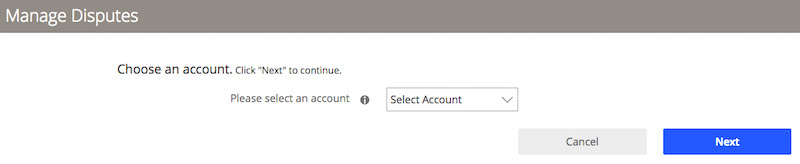

Once logged in I was first asked to pick which card I wanted to dispute a purchase on. I selected my Chase Sapphire Reserve®, since that was the card on which I wanted to dispute a charge.

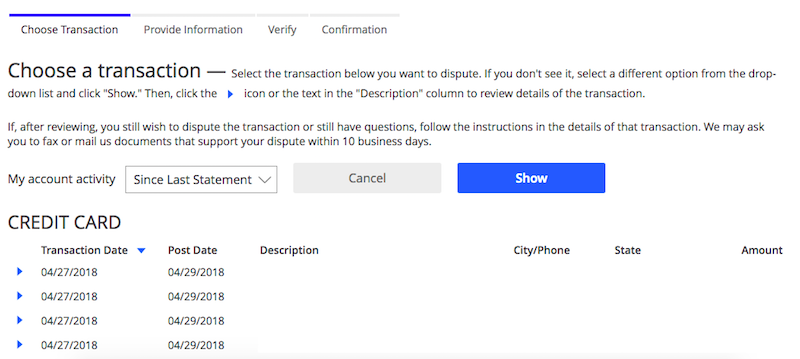

There I was brought to a page showing a summary of all my transactions on the card, asking me to select which one I wanted to dispute.

In this particular case I was trying to dispute a car rental charge from the Seychelles. I wrote about my terrible car rental experience in the Seychelles in a separate post. Basically I had rented from Avis, but there was no one at the counter, so I was forced to use a different car rental agency.

They charged me upfront and then brought me out to the car, which was in horrible condition. It was in such bad condition that I didn’t feel comfortable driving it, and requested a refund. The guy told me that he couldn’t issue it right there, but would go to the bank the next day to request a refund. That never happened (shocking, I know!).

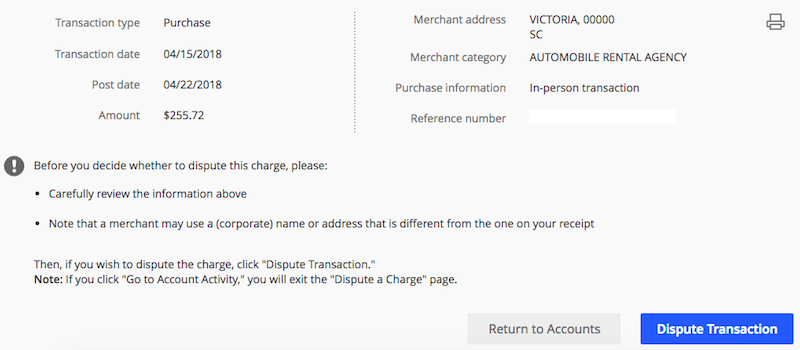

So I selected that transaction, and then clicked the “Dispute Transaction” button.

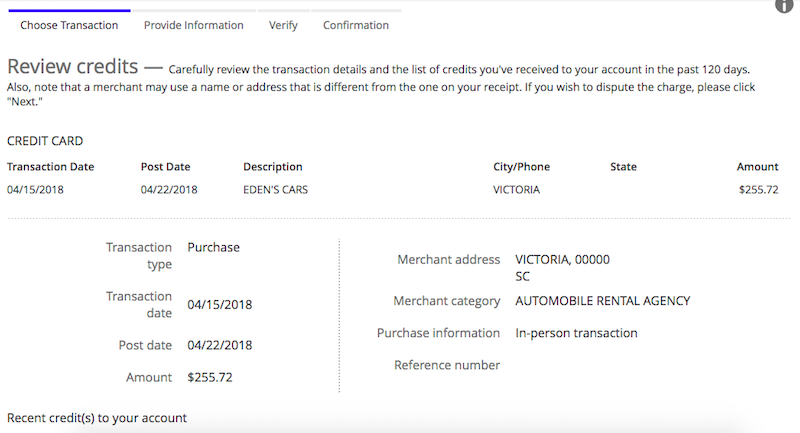

The next page asked me to review all the credits I’ve been issued on the card over the past few months, to make sure that I wasn’t in fact credited for the purchase.

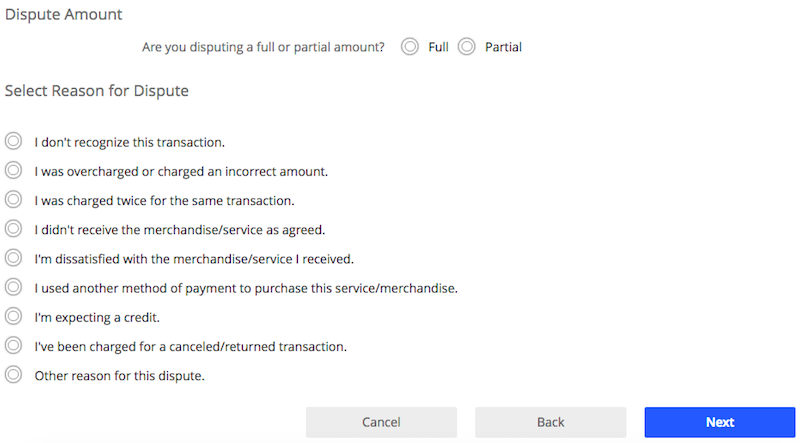

I was then asked if I wanted to dispute the full amount or a partial amount, and was asked to select the reason for my dispute. I wasn’t sure if I should select “I didn’t receive the merchandise/service as agreed” (the car was in unacceptable condition) or select “I’ve been charged for a canceled/returned transaction” (I was promised a refund that never happened). Both are true in this case, so I selected the latter.

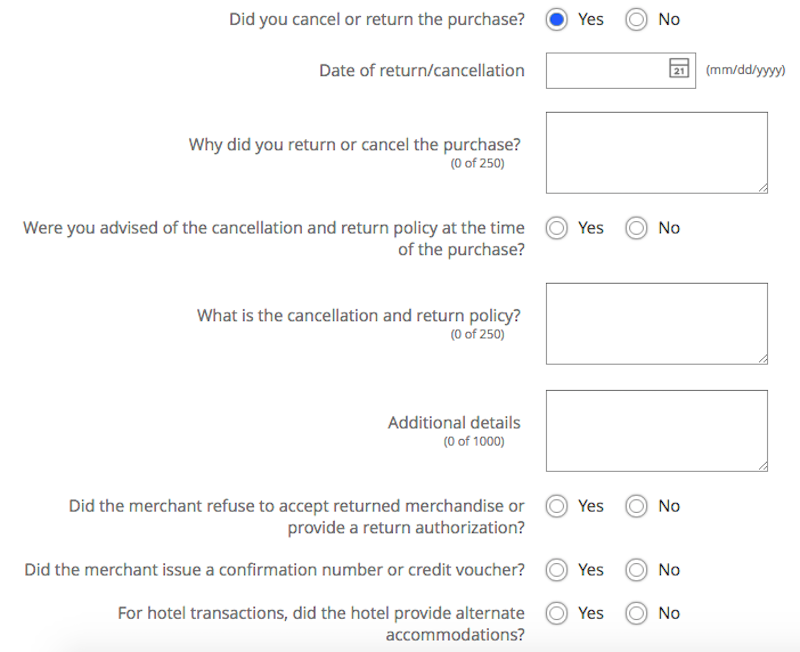

The next page asked the bulk of the questions about the purchase, including asking me to write out why I returned the purchase, what the cancelation and return policy was, and to fill out additional details. All the fields were mandatory, so even though I thought my answer to the first question cut it, I had to write out responses to the second and third question as well.

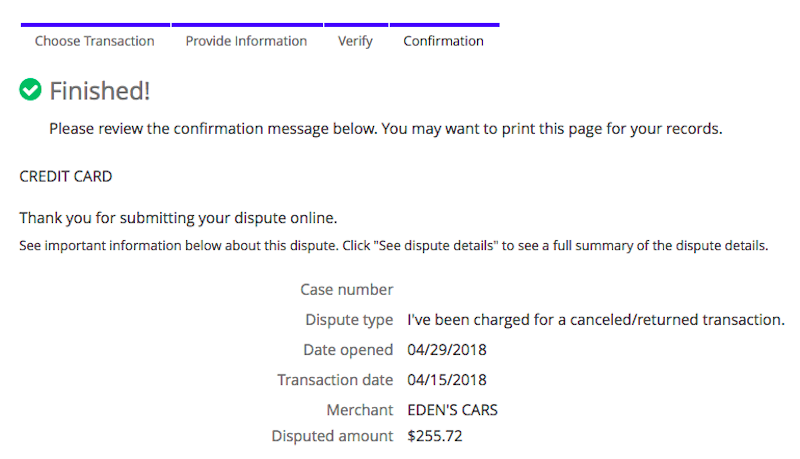

Once that was complete I was given a case number.

The final page indicated that I’d be contacted in 3-5 days regarding the status of my claim, and that in the meantime I didn’t have to pay the disputed amount. Here are the footnotes on the final page:

- While we’re working on the dispute, you do not have to pay for the disputed amount and no interest will be charged on that amount.

- We will contact you in three to five business days to advise you on the status of the dispute or to request additional information. You will receive a letter from us and/or a message sent to your Secure Message Center. If needed, we may also contact you by phone.

- We may request copies of all documents related to the dispute, such as a receipt, credit slip or other items. We may also contact the merchant for information related to the charge.

Bottom line

I’ve had the good luck of not having to dispute that many credit card charges in my day, and for that matter not having to deal with too much credit card fraud. I found it interesting that Chase doesn’t make it easy to dispute a charge directly on the account summary page (unless I’m missing something), but rather you have to go to a separate page. Fortunately once you’re there, the process is quite easy.

Now I guess I’ll see how long it takes for this situation to be resolved.

If you’ve disputed a charge with Chase, what was your experience like?

You got lucky. Chase told me cardholders including Sapphire reserve , CANNOT dispute any travel charge that they didn’t refuse before using . If it’s not as described after you used it you’re stuck with bad flight, car, hotel etc. violates the US federal fair credit act law. that’s with a $550 credit card. Also the included travel insurance won’t pay. They will not back up the customer. Shocking and unacceptable. Time for a cheaper...

You got lucky. Chase told me cardholders including Sapphire reserve , CANNOT dispute any travel charge that they didn’t refuse before using . If it’s not as described after you used it you’re stuck with bad flight, car, hotel etc. violates the US federal fair credit act law. that’s with a $550 credit card. Also the included travel insurance won’t pay. They will not back up the customer. Shocking and unacceptable. Time for a cheaper card. Chase stated yesterday NO travel or transportation charges for not as described can be disputed.

That violates the US federal fair credit billing act,

b) Billing error

For the purpose of this section, a "billing error" consists of any of the following:

(3) A reflection on a statement of goods or services not delivered to the obligor or his designee in accordance with the agreement made at the time of a transaction.

Chase is not adhering to the member agreement , law, and not backing me up.

The Chase card benefit travel insurance is deliberately refusing to pay a valid claim.

I want my $550 annual card fee waived or I’m canceling the card.

I'm having a horrible time disputing fraudulent charges on a Amazon.com themed (and possibly co-sponsored by Amazon) credit card issued by Chase. I only used the card to make a couple of purchases online at Amazon.com in late February of 2020, and then subsequently lost the card, although I was not aware of it at the time. There were then a string of purchases made at local merchants in my area, of which I had...

I'm having a horrible time disputing fraudulent charges on a Amazon.com themed (and possibly co-sponsored by Amazon) credit card issued by Chase. I only used the card to make a couple of purchases online at Amazon.com in late February of 2020, and then subsequently lost the card, although I was not aware of it at the time. There were then a string of purchases made at local merchants in my area, of which I had no knowledge of until I once again made a couple of purchases on Amazon.com in mid-July. I used a coupon for one of these purchases, and I wanted to make sure it was applied correctly and the remaining balance which was supposed to go on the card was indeed the correct amount. So I logged onto Chase.com to view the activities on the card for the first time in a few months. And for anyone wondering how I was able to make the purchases in July at Amazon without having the card in my possession (as I had lost it back after those initial purchases in February), it was because the card info. was already saved to my Amazon.com account, so I didn't need the physical card for the July transactions. Anyway, to my surprise, I discover about 80 or so unauthorized charges made on that card from mid-March to July, as the person who had my card was apparently using it to make relatively small everyday transactions at places all over town! I immediately called Chase and spoke to an agent in their fraud operations dept. and explained what had happened. Several days later, Chase sent me a replacement card with a new account number, and I was credited for all of the unauthorized charges which came out to be around a little shy of $1200, plus any interest that was charged was also credited. There were no late fees as I had autopay enabled, which covered the minimum amount due during those months from March to July, and some of that appeared in my account as a credit balance (which shows as a negative figure for a credit card account), even after deducting the 4 valid purchases that I made on Amazon (which was again, 2 in February, and 2 in July). So all seemed fine for about a month and-a-half or so, and then one day suddenly when I was reviewing my accounts at Chase.com (I also have a checking account, 2 savings accounts, and another credit card account with them), I noticed that I had been RE-BILLED for all those unauthorized charges on my new/replaced Chase Amazon credit card account! Upon seeing that, I immediately called Chase customer service, and I was told that an account specialist from their Fraud "Recovery" Dept. would be in touch with me in a day or two to explain why these charges were reinstated. Sure enough, a couple days later a Chase specialist calls me and starts asking all sorts of questions about the unauthorized charges that I knew nothing about (as I didn't make them), and why I wasn't checking my statements each month so that I could've spotted these charges from March to July as they occurred. I told the specialist--as I did with the agent when I first reported the fraudulent charges in July--that I only used the card to make a couple of charges in February, and after that I had no reason to check my statements or activity for that account (which are not delivered by paper anyway), as autopay would have taken care of the two February purchases. It's only when I checked my account activity in July to verify that the coupon I used for one of the two transactions for that month was applied correctly, that I noticed the 80 or so unauthorized charges from March to July. The agent then told me that they reviewed the activity on another Chase credit card that I had (Chase Freedom), and they found a few charges there that were similar to the unauthorized charges made on the Amazon card. I was astonished to hear this. So I asked the agent if I ate at a local fast food restaurant, or bought groceries at a local Ralphs or something, and used my Chase Freedom card to pay for those purchases, why do they find it so strange if a crook who now has my Chase Amazon card is also using that card at those same places? After all, if those are the only local branches of those particular retailers within the area, then why is it not plausible that the fraudster may use my Chase Amazon card at those same places? The agent replied that it's very suspicious and he believes the charges (all 80 of them or so) are valid, as in not fraudulent! So basically, he was telling me that he believes I'm the one who is trying to defraud Chase bank and the merchants here (without actually saying it in so many words). He then asks if I had reported the matter to the police, and having a police report would help my case. I told him that I didn't at the time in July, as I called the Chase Fraud Operations Dept. right away, and they seemingly took care of the matter during the next several days. But, I would now gladly stop by my local sheriff's station, file a report, and upload a copy to his e-mail later that day--which I did. I got a reply back a few days later, and they're telling me that they have decided to stay with their position, and keep the charges reinstated to my replaced Chase Amazon credit card account. I was again astonished, and called Chase again to be referred to the Fraud Recovery Dept. once more. Upon asking what had happened, and whether or not they received that uploaded scan of the police report that I told them I would be sending, I was told that yes, they do have it on file, and another specialist would be in touch with me soon. And again, another specialist did call me a few days later, but it was basically a repeat of what the first one said... that they find it rather suspicious that some of the charges on my Chase Freedom card account took place at the same locations where some of the reported fraud charges on my old Chase Amazon card took place at. Honestly, it makes me wonder if they even took the police report into account, or the previous specialist who suggested that I get one, was only saying it because he thought I wouldn't. And so this specialist tells me that the charges will remain on the account as Chase believes them to be "valid" (even though I'm clearly denying them), and unless I have new information that definitively counters this belief on their part, I am liable to pay off this nearly $1,200 in charges that I didn't make! Since this last conversation that I've had with Chase, I've been seeking help on the internet about what rights I have as a consumer, and what I can possibly do if the credit card issuer (Chase in this case) will not cooperate in reconciling my disputed charges. So far, people have suggested that I file a report against Chase with the Consumer Financial Protection Bureau (CFPB), but others say that doesn't really help much at all. Some have suggested calling Chase again and threatening to close all of my accounts with them including the 3 bank accounts that I have with them, so that they will never see any of my money deposited to their accounts again. But others point out that Chase probably expects me to do this anyway. So aside from these tactics, is there any other method that I can use to convince Chase to get these charges removed? Would hiring an attorney help--or is it simply not worth it for about $1200 in total disputes? Finally, some people have pointed out that the reason Chase is refusing to cover these fraudulent charges is because SOME of the merchants have likely pushed back as they don't want to incur the loss. But I believe that Chase is actually trying to "double-dip" in this situation, as they have likely already told the merchants that they need to write off the losses, but is telling me that I need to pay for ALL OF THEM regardless. This way, Chase will simply pocket that money instead of passing it onto the merchants if I do go ahead and pay it. So please, any help or advice from anyone who is familiar with these types of circumstances involving a big bank/credit card co. trying to screw over the average guy for money that he can't afford (especially now with the COVID pandemic)... will be greatly appreciated.

I applied for a United Explorer Card when purchasing my airline ticket This is a Chase card. I only applied as the offer was $250 off my first purchase, which was the ticket. The offer displayed my ticket of $331- $250 leaving me with only $81 to pay for the ticket. So I paid my $81 and Chase has refused to honor the rest, sending me a bill for the $250 plus interest. I only...

I applied for a United Explorer Card when purchasing my airline ticket This is a Chase card. I only applied as the offer was $250 off my first purchase, which was the ticket. The offer displayed my ticket of $331- $250 leaving me with only $81 to pay for the ticket. So I paid my $81 and Chase has refused to honor the rest, sending me a bill for the $250 plus interest. I only received that one bill, took it to the bank, called and talked to the head of the credit card department, they refuse to honor it giving me strange excuses like "I applied for a different offer " and "it took a different path". Luckily I took a photo of the offer and have proof. After never receiving any further bill or communication, I now received a bill from a collection agency for $525 almost a year later! I wrote that I dispute the bill and plan to take Chase to small claims court when I return from traveling. I haven't taken further action as I've been out of the country for 6 months. Lucky I even received this collection notice. Don't know what happens next, they said something about getting a judgement... hope they can't do that without me having opportunity to contest it. Any knowledge on this would be appreciated.

I am having a terrible time with CHASE. This involves scam concert tickets which never arrived. This first Chase rep said it was a scam and issued credit, but later I got a letter supporting the vendor as they give no refunds and Chase said they can sent tickets 24 hrs in advance. Despite many reviews on YELP I sent of people who never got tickets or got bogus one, and a letter from Red...

I am having a terrible time with CHASE. This involves scam concert tickets which never arrived. This first Chase rep said it was a scam and issued credit, but later I got a letter supporting the vendor as they give no refunds and Chase said they can sent tickets 24 hrs in advance. Despite many reviews on YELP I sent of people who never got tickets or got bogus one, and a letter from Red Rocks saying they'd had to turn people away as tickets were not valid. I'm out of state and it would cost a lot just to see if the tickets worked. Very disappointed they would not stand by the original representative or data I've sent. I've heard Chase is one of the worse in terms of honoring disputes.

My turn to tell me my story with a $10k charge. Yes $10k and will probably regret it for a long time.

I noticed a charge will be coming from a major named vendor of online services. I called Chase to understand what are the options and route to dispute the charge.

They closed the card and issued a new one. They will not be disputing it as it will not assist in...

My turn to tell me my story with a $10k charge. Yes $10k and will probably regret it for a long time.

I noticed a charge will be coming from a major named vendor of online services. I called Chase to understand what are the options and route to dispute the charge.

They closed the card and issued a new one. They will not be disputing it as it will not assist in the process.

Really need help here figuring what are my options. Put the new card number and let it hit the account ? Put my Amex “basic” card?

wow this is so disheartening! i recently opened a dispute with a pretty airtight case against this bare bones discount airline in Europe that ripped me off, and dealing wiht chase has been endlessly frustrating. long story short i purchased two airline tickets with their "flex" fare attached which stipulates that the ticket can be changed at any time up until 3 days before departure, different day, different destination, whatever. of course this airlines process...

wow this is so disheartening! i recently opened a dispute with a pretty airtight case against this bare bones discount airline in Europe that ripped me off, and dealing wiht chase has been endlessly frustrating. long story short i purchased two airline tickets with their "flex" fare attached which stipulates that the ticket can be changed at any time up until 3 days before departure, different day, different destination, whatever. of course this airlines process is rather than allow you to change the flight directly you must set up a "wizz account" where they will then deposit the "credits" to rebook the flight. no surprise when it came time to get and use my credits, the system was not allowing me to use them, it wasnt showing up as an option on the payment page. back and forth with the airline customer service where they repeatedly failed to provide me an adequate explanation why my credits were not available for use, so i finally went to chase. they get back to me saying they need more information. i called them and said i provided you with my invoice, receipt, a full typed page long explanation of what happened, print outs of their company policies with the relevant parts highlighted to make it super easy, as well as the full email exchange with customer service. i dont know what else i can possibly give you. he tries to tell me that there is no proof i paid for the flex service for both tickets. i mean he was a moron who couldnt read through basic paperwork but i digress. i literally had to walk the rep through it, and the conversation went something like this:

"do you see where i highlighted their policy stating that wizz flex applies to all passengers included in the booking with wizz flex"

"yes"

"do you see where i sent you an invoice that has the names of two passengers, and the part of the invoice with the wizz flex fare is highlighted showing i paid for it"

"yes"

"then why are you telling me there is no proof i paid for it?"

"because it doesnt say that the flex was for two passengers on this invoice"

"again...do you see where it says wizz applies to all passengers in the booking"

"yes"

"do you see where i highlighted their fees for you, and it says wizz flex costs 10 british pounds per passenger"

"yes"

"do you see in the invoice that i paid a total of TWENTY pounds for this service that is on the same invoice as the prices of the tickets"

"yes"

"then do you think, we can therefore draw the reasonable conclusion, that if i bought the two tickets, and flex is ten per passenger, and the invoice says i paid 20 after the price of the two tickets, that the flex must therefore apply to both tickets on the invoice"

"uhhh..."

i was tearing my damn hair out. they issued a "temporary" charge back but after reading this I am not confident that despite my case being clearly laid out that they are in the wrong, that they will eventually side against me. i think im switching to amex... what i have noticed about chase is that for fraud or a stolen/lost card, they will automatically give you back the money. when you are disputing an unfair purchase or are ripped off for any reason, don't expect them to have your back. like someone earlier said im assuming they have some sort of protection with the former as opposed to the latter.

Never use a Chase CC for any purchase over $40.00. ALWAYS pay in cash. After charging several hundred thousand dollars in the last 9 years (No disputes) and a card member since 1991 - The Dispute department personnel were 'Fan girls' of the Merchant and treated me very badly. Therefore, from now on, it's Cash Only for me. Because once a merchant has your card on file and you're doing an a monthly CONTRACT -...

Never use a Chase CC for any purchase over $40.00. ALWAYS pay in cash. After charging several hundred thousand dollars in the last 9 years (No disputes) and a card member since 1991 - The Dispute department personnel were 'Fan girls' of the Merchant and treated me very badly. Therefore, from now on, it's Cash Only for me. Because once a merchant has your card on file and you're doing an a monthly CONTRACT - it means NOTHING to Chase Dispute. Oh, and breach of Contract ? Increasing your rate and NOT even informing you! Also means a NOTHING. Lastly, provide a Copy of the Agreement ? THEY WOULDN'T GIVE ME ONE !!! Because they scratched out the Original total that I signed for. Then they immediately change area of topic and continue lecturing you. True Story, I'm sorry to say.

Ann just read your post and am extremely disheartened. I had the same thing happen to me today with Hermes ... ordered a pair of shoes they came damaged and I IMMEDIATELY sent them back... today they notified me that they would be shipping them back to me. I called Chase today and filed a dispute, but I am not that hopeful. I've always had an American Express and this is my first Chase card and I am setting myself up to be disappointed.

Thanks all for sharing your experiences... currently embroiled in a dispute with Chase and merchant (Selfridges.com). Despite picture evidence the merchant sold me a damaged pair of shoes and refused to accept my return, Chase has continued to side with merchant. In fact, I shipped back the shoes to the merchant, only to have them send it right back to me! This has been a frustrating experience that I feel would never happen with AmEx....

Thanks all for sharing your experiences... currently embroiled in a dispute with Chase and merchant (Selfridges.com). Despite picture evidence the merchant sold me a damaged pair of shoes and refused to accept my return, Chase has continued to side with merchant. In fact, I shipped back the shoes to the merchant, only to have them send it right back to me! This has been a frustrating experience that I feel would never happen with AmEx. This Sapphire Reserve card is not all it's cracked up to be :( Any tips and guidance really appreciated.

i've taken to the phone with Chase but it is difficult to talk with a human and then you have to answer weird questions k=like what is the square footage of my house?? I built it and know the answer but they said my answer was wrong.nuts the bank branches can be helpful unlike Bof A branches!!!

absolutely horrible. I went down because of it to a regular chase from Reserve and will not be switching all to AMex plat. You can not compare the service

I've had many disputes with Chase. Two memorable ones (where Chase was of absolutely NO help) was with a shell of a shell of a shell of a shell company in Las Vegas. I learned this after I made the cosmetics purchase and tried to return the unopened non-delivered item. The company lied about it being lost and lied about it being FED-EX's fault. The product itself, I discovered later caused skin damage and the...

I've had many disputes with Chase. Two memorable ones (where Chase was of absolutely NO help) was with a shell of a shell of a shell of a shell company in Las Vegas. I learned this after I made the cosmetics purchase and tried to return the unopened non-delivered item. The company lied about it being lost and lied about it being FED-EX's fault. The product itself, I discovered later caused skin damage and the company was under investigation by the State Dept. as being part of the Israeli Mafia. Chase did nothing to help. I managed only to get 1/2 my purchase price back when I threatened the company directly. I should have gone further but got tired of the nonsense because I had to deal with a Nevada company from NY.

The other memorable experience where Chase did nothing was when I purchased a luggage product that broke. They farm out their insurance to different entities that Chase Customer Service knows nothing about. Different people at Chase said it was refundable and I went from department to department in their insurance branches and accomplished nothing. Chase does not want to help the consumer except when there is Credit Card theft. Laws must be tougher there or they actually lose money.

I like the idea of sending a lawyer letter in an earlier comment. Will have to try that in the future.

An

I also just called them all the way in Hong Kong and they sent a letter to my house in he US explaining the next steps. All I had to do was attach the receipt with the disputed charge and they accepted it days later. It wasn't that hard imo, but the charge was also super small (< $5).

I just called them. Taken care if with no issues. Online is not always better.

Fortunately, like you, I seldom find the need to dispute a charge. However, Fifteen years ago, I had the horrible experience trying to dispute a charge with Chase for a product. I refused to accept No from their representatives. It was a nominal amount of money involved, $30.00, but no where did it say this was bible music- Vegie Tales. My kids were grown at that point, I had no idea what Vegie Tales were....

Fortunately, like you, I seldom find the need to dispute a charge. However, Fifteen years ago, I had the horrible experience trying to dispute a charge with Chase for a product. I refused to accept No from their representatives. It was a nominal amount of money involved, $30.00, but no where did it say this was bible music- Vegie Tales. My kids were grown at that point, I had no idea what Vegie Tales were. I had purchased from one of those carts in the mail for a gift when traveling to Las Vegas, for an Orthodox Jewish Family. They were horrified, as was I. I wanted to reverse the charges. The representative informed me I had to go back to the point of purchase which would cost more than the item. I was persistent and finally my complaint escalated to someone of authority. She reversed the charges and said VISA and MasterCard at that time were under different rules than AMEX. As for her personal purchases, she uses AMEX. The vendor did not accept AMEX and I was forced to use VISA. Since then I do everything possible to avoid using a VISA or MasterCard. Reading reviews from this site, there are many good values and sign up bonuses. I have several AMEX cards, but one Chase VISA. At my age, I prefer to be proactive and look for the least amount of grief even if the cost is a bit more. AMEX values their card members and I’m known for saying, “Next to my husband, with whom I’m married to for 42 years, I am married to AMEX”. I’ve been an AMEX member for over 30 years and have several of their cards.

@Marcy my two cents is that you would be out of luck going through the dispute process. I'm sure the storage contract has a waiver of liability, and the bank isn't going to try and figure out the nuances of the law. However, your homeowners insurance (or renters) would likely cover such damage (although, depending on your deductible it might not be worth it). Alternatively, depending on the value of the loss, you might consider...

@Marcy my two cents is that you would be out of luck going through the dispute process. I'm sure the storage contract has a waiver of liability, and the bank isn't going to try and figure out the nuances of the law. However, your homeowners insurance (or renters) would likely cover such damage (although, depending on your deductible it might not be worth it). Alternatively, depending on the value of the loss, you might consider consulting with a lawyer or taking the storage place to small claims court (a contract waiving liability may not hold up if there is obvious landlord negligence, such as a leaking roof).

@Derek what Lars said. For a small business, it's almost certainly easier/cheaper to go with a plan that charges flat fees (eg, square's 2.75%), at which point the size of the transaction is irrelevant. If most transactions are small, the cash handling fees from your bank would be just as painful and one theft would make clear the benefits of credit cards.

As you say, Lucky, the process and resolution with Chase is NOT AMEX easy. In fact, I sense they want to wear us down by making the entire process so miserable, tedious, & time consuming we’ll finally give up entirely.

I disputed a $35 charge a couple months ago ($35 out of tens of thousands dollars of charges!). Yes, I received a service but was absolutely NOT what was agreed upon. After 2 Chase...

As you say, Lucky, the process and resolution with Chase is NOT AMEX easy. In fact, I sense they want to wear us down by making the entire process so miserable, tedious, & time consuming we’ll finally give up entirely.

I disputed a $35 charge a couple months ago ($35 out of tens of thousands dollars of charges!). Yes, I received a service but was absolutely NOT what was agreed upon. After 2 Chase reviews & Chase contacting the merchant, Chase decides the service was received (their out), & found my charge “valid.”

I finally had to turn around & wear the merchant down for a credit. Chase “contacts” a merchant but isn’t firm. And when the merchant didn’t answer the phone the second time, Chase put it all back on me to resolve. Or they put on their calendar to contact back in a week which can drag on to a month.

AMEX is results-driven whereas Chase only goes thru the motions with ineffective reps.

The absolute worst part of having my top travel card (CSR) with Chase. Stuff is simply going to happen, & they are an extremely weak partner. I appreciate AMEX even more in this regard after dealing with Chase.

I just dumped my US Diners card. I got no help from their dispute department. They would not even start the dispute. Finally the car rental company manager refunded me for a large incorrect charge. Took months, that would have been easy, if they just started the process.

@derek

As a small business owner I do appreciate your thoughtfulness of not wanting to charge small amounts on credit cards.

However, things have changed. Many small businesses use systems like Square for credit card processing and they charge a flat 2.75% on every transaction, even Amex, even if it is just 50 cents.

Cash on the other hand also comes at a cost which many tend to forget: bank fees for accepting...

@derek

As a small business owner I do appreciate your thoughtfulness of not wanting to charge small amounts on credit cards.

However, things have changed. Many small businesses use systems like Square for credit card processing and they charge a flat 2.75% on every transaction, even Amex, even if it is just 50 cents.

Cash on the other hand also comes at a cost which many tend to forget: bank fees for accepting cash deposits and providing change coins and cash and, more importantly, theft. With credit cards there is zero theft to the cash register of the business.

So personally, I would prefer my business to be paid 100% through credit cards and I don’t think it is necessary with the majority of merchants, even small ones, to not use your card for small transactions.

That's my biggest quarrel with car rentals nowadays - especially in Dubai, because of Salik road toll: usually no documentation / receipt about those being added to the CC after car return. They just show up and if a significant amount, need to be inquired and verified on your own accord. With many subsequent rentals, it's sometimes almost impossible to see which charge results from a certain rental. Though, upon request, I've recently been able...

That's my biggest quarrel with car rentals nowadays - especially in Dubai, because of Salik road toll: usually no documentation / receipt about those being added to the CC after car return. They just show up and if a significant amount, need to be inquired and verified on your own accord. With many subsequent rentals, it's sometimes almost impossible to see which charge results from a certain rental. Though, upon request, I've recently been able to get a printout of these toll gates and the corresponding prices at car return - it was still not an automatic documentation, though.

Apart from that and even though it never came to it for me: careful driving on Sheikh Zayed Road between Dubai and Abu Dhabi, there is quite a number of stationary radars ;)

I rented a car in Abu Dhabi recently and AVIS charged me two days after the rental ended for alleged traffic violation. I was not sent a notice, nor a copy of the fine, nor did I have the chance to dispute the charge albeit their contract says I have 10 days to do so. The just charged my credit card. I informed them of the situation but refused to refund me while I was protesting the fine, so I open a dispute with chase. Will see where it goes...

My experience with a fraudulent charge on my Chase card was easy to deal with as I just simply called them. They took the info and all went well. I had also contacted the merchant from the number on my statement and let them know I was taking this action. Got credited and a new card from Chase within a matter of days.

Lucky we would like your suggestions RE: our situation. Thank you.

We rented a medium sized U-Haul storage unit with our Chase United Mileage Plus credit card for four months. We were given first month free. We had stacked our boxes filled with our belongings while we searched for a home to buy. Most of our home contents were in long term storage as a benefit from new employment.However, clothing, kitchen items, and (oops.. some framed art and photos and antique sterling silver placement for eight...

We rented a medium sized U-Haul storage unit with our Chase United Mileage Plus credit card for four months. We were given first month free. We had stacked our boxes filled with our belongings while we searched for a home to buy. Most of our home contents were in long term storage as a benefit from new employment.However, clothing, kitchen items, and (oops.. some framed art and photos and antique sterling silver placement for eight plus additional ss serving utensils in leather case all in large tupper-ware container..UNLABELED). When husband went to bring things back to our temp apt when he had free time there was water on floor and an obvious leak from a spot on ceiling. Many items including leather case for sterling silver. The next day , almost ironic, we received a letter from owner of this UHaul site, stating prices were going up and that they provided safe, secure and DRY rental units. I called Chase and contested the price we paid 130 per month, as they did not provided DRY units and this was the only one available. I included pictures of some damaged personal items. After three weeks we received a letter stating they contacted the owner who stated we received the storage as promised and chose NOT to purchase their insurance; therefore, our request for refund as promise of DRY rental unit was WET and ruined our stored items; therefore purchase was not as promised.

Chase stated they denied our refuted charges as we denied their insurance purchase.

We could not believe this decline as whether or not we chose to purchase insurance had nothing to do with the false advertisement of providing DRY storage units and that replacement of our items would be practically impossible in the case of our sterling silver and framed art/photos. Especially, the provided in a stated letter that they guarantee safe,secure and DRY storage which we did not receive with our purchase on our Chase United Airline Visa.

Two years ago a B&B owner in the south of France miss-keyed a €250 charge as €2550 and I caught it immediately. The owner had trouble trying to reverse the charge and the process took over an hour and his machine finally produced receipts showing the credit and a new charge for €250. A few days later, I looked on my account online and discovered that the original charge of €2550 was never credited and...

Two years ago a B&B owner in the south of France miss-keyed a €250 charge as €2550 and I caught it immediately. The owner had trouble trying to reverse the charge and the process took over an hour and his machine finally produced receipts showing the credit and a new charge for €250. A few days later, I looked on my account online and discovered that the original charge of €2550 was never credited and actually posted, along with the new €250 charge. I phoned Chase from France and emailed them a photocopy of the various receipts and I was contacted online a few days later that it was being handled. By the time I arrived home, a few weeks later, the charge had disappeared from my online account and I had a letter in my mail showing that the problem had been resolved. Couldn’t have been easier.

It does not seem much different from disputing a transaction with other credit card providers, so unless you are being paid by Chase to report on this, I am not sure why it is even an article. Furthermore, when you have a common occurrence (e.g. if you are double charged or if you don't recognize the charge, etc) then using the forms online is fine, but often times if there is a long and involved...

It does not seem much different from disputing a transaction with other credit card providers, so unless you are being paid by Chase to report on this, I am not sure why it is even an article. Furthermore, when you have a common occurrence (e.g. if you are double charged or if you don't recognize the charge, etc) then using the forms online is fine, but often times if there is a long and involved explanation to deal with the online forms are useless. Also, they have required fields that may not apply in all situations.

I've had over 15 disputes filed with Chase in the last few years. Every single one has gone through with no requests for susequent documentation. Several for DCC. Partial disputes with restaurants over shady pricing (the steak was per kilo) or customer service failures when food has been botched. A bus card that coded as a cash advance. A SIM card from Slovenia that failed to roam in Italy.

A lot of businesses in...

I've had over 15 disputes filed with Chase in the last few years. Every single one has gone through with no requests for susequent documentation. Several for DCC. Partial disputes with restaurants over shady pricing (the steak was per kilo) or customer service failures when food has been botched. A bus card that coded as a cash advance. A SIM card from Slovenia that failed to roam in Italy.

A lot of businesses in Europe etc fail to appreciate how easy it is to dispute a transaction without chip and pin implying stronger customer liability.

@debit, what I mean is the small business has to pay Chase or other banks higher commissions when you use a rewards card. High enough to pay all of the rewards. This is how Chase uses extortion against small business. They say "you must pay for all these rewards and you cannot refuse those cards unless you refuse all credit cards".

Keys to disputing a charge with Chase successfully: use an Amex in the first place.

Combined with the fact that the onus of proof lies with the customer in Visa’s merchant agreement as opposed to AMEX, who owns the charge and can yank the money back, Chase is HORRIBLE at disputed. Even with FULL DOCUMENTATION and the EXACT wording of documents signed by the merchant, Jamie Dimon’s super rude assistant REFUSED to respond and credit the charge as she promised.

I disputed a charge with Chase by phone and was successful. The most remarkable customer service I have ever received from a credit card company when effecting a dispute was with Capitalone. We bought a snowblower from our local Sears store and when my husband tried to start it up, nothing happened. I asked the store to pick it up as it didn’t fit in our car and they said “no” so I rented a...

I disputed a charge with Chase by phone and was successful. The most remarkable customer service I have ever received from a credit card company when effecting a dispute was with Capitalone. We bought a snowblower from our local Sears store and when my husband tried to start it up, nothing happened. I asked the store to pick it up as it didn’t fit in our car and they said “no” so I rented a truck and returned it for repair. When the repair service called to say it was ready, I complained that a new machine shouldn’t behave like that. He said it wasn’t new it was a refurb. After calling Sears managers several times to get a refund and getting no success, I disputed the charge with Capitalone. The customer service agent was gracious with me and dogged with Sears. We spent hours on hold together and got to know one another while waiting for the Sears person who finally relented and refunded my card.

Totally agree. Have both Chase and Amex cards, and though it’s a rare occurrence for me to dispute a charge, Amex makes it FAR easier to do so.

Had a terrible time with Citi disputing a charge in Italy. A shop overcharged me by 150 euros and refused to refund any of the payment. We negotiated a price and when he charged my card he charged the original price he was asking. Instead of stressing about it and ruining the day I was going to dispute the charge when I got back. Citi basically said I was lying and refused to do anything....

Had a terrible time with Citi disputing a charge in Italy. A shop overcharged me by 150 euros and refused to refund any of the payment. We negotiated a price and when he charged my card he charged the original price he was asking. Instead of stressing about it and ruining the day I was going to dispute the charge when I got back. Citi basically said I was lying and refused to do anything. Citi said I needed proof he over charged me. I asked if I should have had him sign a document stating he overcharged me before I left the shop and the person said "yes, or next time use cash". I asked for a manager, same answer. I had 3 cards with them and cancelled everything that day. I will never use Citi again. Chase has been great with the few disputes I have had.

I never waste time with Chase or a couple of other Credit Card companies with their dispute process. I own a $20 a month legal plan which includes letters from the Provider law firm.

I've used it for over 20 years.

1. I call Chase and ask for the address that my attorney needs to address a dispute to. (Primarily so they note my file of my dissatisfaction)

2. I have the...

I never waste time with Chase or a couple of other Credit Card companies with their dispute process. I own a $20 a month legal plan which includes letters from the Provider law firm.

I've used it for over 20 years.

1. I call Chase and ask for the address that my attorney needs to address a dispute to. (Primarily so they note my file of my dissatisfaction)

2. I have the lawyer send the demand letter for credit for the dispute.

3. I have the lawyer cc the consumer protection division of the attorney generals office of my state every time.

4. I pay an extra $10 to have sent certified mail to Chase or any other Bank with whom I have a dispute.

5. I usually have credit within 10 - 14 days every time and an apology letter - and I don't have to put myself in the box of chase and their cumbersome bogus dispute "procedures".

So far I have never had to dispute a charge with Chase as I will use Amex Platinum for any transactions with questionable vendors.It’s worth a minor loss of points.

Still can’t beat AMEX for customer service.

I've never had a problem with Chase. Twice I came back from Mexico and my Marriott card must've been hacked because there were several fraudulent charges. I called Chase, they expedited new cards to me, then asked me which transactions were invalid. They sent me an email with all the data I told them on the phone, I verified it, done deal!

Yeah Chase is utterly incompetent with disputes. I had a car rental agency abroad charge my CSR for gas even though I gassed up the car before returning. Thankfully, I saved the receipt from the gas station. While the agency looked into it, I initiated a dispute with Chase to ensure I wouldn't autopay for the transaction. Initially, the agent I spoke with started complaining that they couldn't just reverse the charge since it was...

Yeah Chase is utterly incompetent with disputes. I had a car rental agency abroad charge my CSR for gas even though I gassed up the car before returning. Thankfully, I saved the receipt from the gas station. While the agency looked into it, I initiated a dispute with Chase to ensure I wouldn't autopay for the transaction. Initially, the agent I spoke with started complaining that they couldn't just reverse the charge since it was a foreign transaction (it is a travel card, surely they should expect some foreign transactions in there...), but eventually initiated the dispute.

Then a few days later, as Scott Cate said above, Chase sent a letter asking me to provide all the same info again, which I did. Then around 10 days later they sent me a letter asking me to provide the answer to the question 'Did the merchant share their cancellation policy with you ahead of time?' Perhaps only Jamie Dimon can understand the relevance of this question to my dispute. I was about to reply saying 'this question has nothing to do with my dispute' when the car rental agency finally gave me a refund for the gas charge, so I went ahead and canceled the dispute.

You'd think they'd handle disputes on their most premium card a little better than this but I guess not

I've found Chase's business and personal checking account disputes a lot easier than their credit card dispute process. My checking account disputes (both biz and personal) always resolve in 30 days. The two credit card charges I had to dispute took 6 months for the first and the second, after 8 months, still isn't formally closed, although I've received a temp credit.

Totally agree with the letter comment. It happened to me while on a long trip as well. Why they do not just send a secure message I will never know. In the end I gave up since they asked for letters from similar vendors in Vietnam when I complained about service not as described. I was long gone from Vietnam by the time I saw the letter.

Chase is awful to deal with for disputes. I wouldn’t be surprised if they side with the vendor. Just be prepared to fight.

My experience is same as JoeMart. Chase is the worst when it comes to disputes. I booked a flight with an OTA and they failed to remit payment to an airline and I had no ticket at check in. I got an email from the airline as evidence and Chase still ruled in favor of the OTA. I was only able to resolve it because Elliot.org stepped in to help me and the OTA refunded my money.

Why didn't you just call them? That's what I do.

I'm in the middle of my first ever dispute with Chase. Just so you're aware, please expect a printed letter to arrive in 3-5 days asking you for all the same information again. including dates, amounts, receipts, etc. This is especially painful for me as I'm in the middle of a long trip. Nowhere near as easy and as online + automated as Amex.

you can't do business with these shady people. Your first issue was taking that car - the second, giving them your credit card. Please don't be so trusting. When it smells like sh-t, looks like sh-t, it usually is sh-t.

Are you serious? What does that mean?

"We should be aware that the cash back comes from the skin of the small business. Chase and other banks tell small businesses “you must to accept all cards, even the rewards cards, and it is YOU who will pay the rewards….if you don’t, we’ll yank your contract to take all credit cards….you should thank us that we don’t offer a 50% cash back reward"

what's your recourse if Chase loses your payment? if you have to cancel your lost check and your bank charges a fee for cancelling checks, would Chase at least reimburse the fee?

Other than routine double charges or delayed refunds (which are usually sorted out once Chase sends a chargeback query to the vendor), I've had two chargebacks with Chase.

The first was with SpiceJet, the Indian LCC. I paid extra at booking on a DXB-BOM flight to reserve an exit row seat. At checkin however, they had allocated my pre-paid seat to someone else because "they were traveling in a group and requested to sit together"....

Other than routine double charges or delayed refunds (which are usually sorted out once Chase sends a chargeback query to the vendor), I've had two chargebacks with Chase.

The first was with SpiceJet, the Indian LCC. I paid extra at booking on a DXB-BOM flight to reserve an exit row seat. At checkin however, they had allocated my pre-paid seat to someone else because "they were traveling in a group and requested to sit together". I kicked up a huge fuss at the airport but to no avail - I had to fly in another seat. Subsequently wrote to their customer service to ask for a refund as per the contract of carriage (which specifically said there would be a refund provided if the pre-paid seat was not provided), but they refused to refund me on the grounds that the seat I was re-accommodated in was also a chargeable seat. I disputed with Chase and attached copy of the CoC. Chase ruled in my favour and no further issues.

The second one was with a hotel in Nairobi and dragged out for the better part of a year. I had a prepaid reservation but due to a flight delay I arrived after midnight, so the hotel had cancelled my reservation and insisted on charging me again at check-in. I spoke to the manager in the morning and he voided the second transaction and provided me with a receipt. The transaction then disappeared from my statement and I didn't think further about it. I was then recharged for the same amount in a card-not-present transaction about 6 weeks after I had stayed. I contacted the hotel and was told that the manager had voided the transaction "in error" so the new charge would stand. I disputed the charge with Chase and a back-and-forth ensued for about 2 months as Chase requested additional documents multiple times. Fortunately I had the copies of all the physical receipts and my correspondence. Eventually, Chase ruled in my favour on the chargeback (it is now 4 months since the original charge). Two months later (6 months after the original charge), I found that the hotel had charged me yet again but this time for an amount with the decimals reversed (eg. $120.87 was charged as $120.78). Once again, I wrote to the hotel but they refused to respond beyond saying that their policy was not to respond to customers who had initiated chargebacks. I then disputed with Chase again and they initially removed the charge. However, 2 months down the line (viz. 8 months after the original stay) they ruled that the re-re-recharge was valid on the basis that it was a cancellation charge for a no-show and citing the hotel's cancellation policy. I could not re-dispute the charge, so I spoke with a supervisor via phone and they opened up a new investigation. Another month later, the charge was reversed again (now 9 months since the original stay). However, a month after that the hotel ONCE AGAIN ran a card-not-present transaction, which I disputed once again online. This time Chase just provided me with a credit for the amount immediately as a "goodwill gesture" and closed the case rather than go through this over again. Took just short of 11 months and I've not only never used that hotel again but also convinced our company's travel desk to book away from there so they have lost far more business than the cost of a single room night.

So yeah, Chase eventually comes through although it can take a while.

If it is a small business, I recommend not being a nasty customer and seek resolution with the small business first. This is because if you complain about a charge, the small business gets a fine, even if you withdraw the complaint. Allow the small business an opportunity to correct the situation.

Also, if it is a small business, consider not charging a tiny amount. If you charge $1, the majority of that will go...

If it is a small business, I recommend not being a nasty customer and seek resolution with the small business first. This is because if you complain about a charge, the small business gets a fine, even if you withdraw the complaint. Allow the small business an opportunity to correct the situation.

Also, if it is a small business, consider not charging a tiny amount. If you charge $1, the majority of that will go to the bank, which isn't very nice to the business.

We should be aware that the cash back comes from the skin of the small business. Chase and other banks tell small businesses "you must to accept all cards, even the rewards cards, and it is YOU who will pay the rewards....if you don't, we'll yank your contract to take all credit cards....you should thank us that we don't offer a 50% cash back reward"

With that said, I use credit cards for airline tickets and hotels but not small purchases from small businesses.

I've had decent experiences with disputing my charges with Chase tho I encountered the same somewhat backward process Lucky mentioned in filing the dispute.

To be honest, I was a lil surprised I was successful with my disputes and I think the main reason why I was successful with them was because Chase probably never heard back from the merchant I disputed the charges with.

One dispute was a check in baggage fee...

I've had decent experiences with disputing my charges with Chase tho I encountered the same somewhat backward process Lucky mentioned in filing the dispute.

To be honest, I was a lil surprised I was successful with my disputes and I think the main reason why I was successful with them was because Chase probably never heard back from the merchant I disputed the charges with.

One dispute was a check in baggage fee at the gate from EasyJet that I was really upset with and another was with a sports league I joined that didn't offer the services promised. I think I was most surprised that I was successful with the baggage fee dispute even tho I explained that I was basically forced into paying the fee at the gate by a pushy gate agent (not surprising seeing as they're budget airlines). I won the sports league one and that I wasn't as surprised with winning as I had trouble reaching the company that ran the sports league so I figure that Chase was probably unable to reach them as well.

I would say even if you don't think you would win a dispute, it never hurts to try.

My experience with Chase was being told their policy is to accept the merchant’s response as valid unless I could prove beyond reasonable doubt with written legallly acceptable legible documents the merchant promising to remove the disputed charge.

The easiest way to get to the chase dispute process is to go to the secure message screen. In the selection box, there is an option for a dispute. After you select that, it sends you to the rest of the steps that Lucky described.

I just had to do this last week. Like you Lucky, it seems like I only have to dispute charges every few years, so the process is always a bit rusty.

I had a really bad experience with Chase after booking a flight on Air Berlin in September which was cancelled while they were in the process going BK. They were not officially yet and I thought the fact I paid for services not delivered would result in them not holding me accountable. Was not a ton of money (~$120 flight from BCN to DUS) but disappointing to say the least