Before I get too deep into this post, let me note that:

- I’m no expert on stocks; rather I’m writing about this topic because it’s related to an aspect of the travel industry, and I find it to be interesting

- This isn’t an attempt to give any financial advice of any sort, and I don’t own any Hertz stock, for that matter (though I sure wish I had bought some last week, I guess)

- While some love to argue that the stock market pretty directly reflects the economy, I’ve never viewed it that way, and most definitely don’t view it that way at this point; I find the current state of the stock market to be puzzling at best

In this post:

Travel stocks have rallied the past week

Virtually all travel stocks have performed exceptionally well in the past week, and many travel stocks have been up around 100%. For example, American Airlines’ stock has gone from $10.50 on May 29 to $20.31 yesterday.

The stock increases have been pretty consistent across airlines, cruise lines, hotels, etc. This reflects consumer sentiment improving when it comes to travel. Despite everything going on in the world (and in particular in the US), more people seem ready to travel sooner rather than later.

Personally I feel like the markets aren’t terribly rational. Just as these stocks perhaps dipped down a bit too far when the crisis first happened, this also seems like an overreaction.

Travel brands are so far from a recovery. Margins in much of the travel industry are razor-thin, so even the improvements we’re seeing now won’t return companies to anywhere close to profitability.

In the case of airlines, we’re now seeing flights about 15% as full as they were during the same period last year. Even if we see a recovery to 75%, that would still represent airlines losing money. That doesn’t even account for all the additional debt that airlines have taken on.

Anyway, I digress…

There has been nothing quite like Hertz stock, though

While most travel stocks have performed well the past week, Hertz stock is in a league of its own.

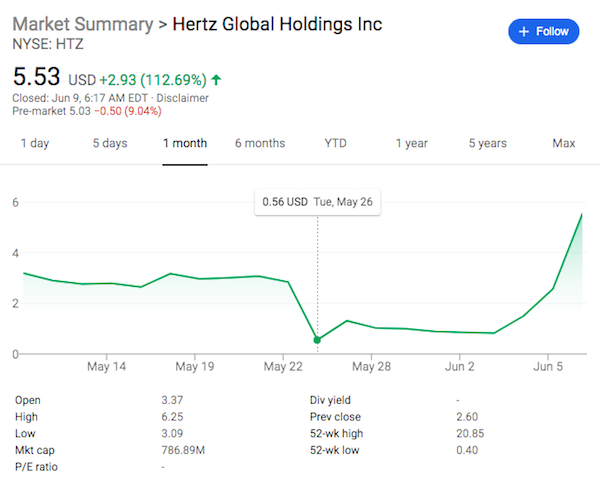

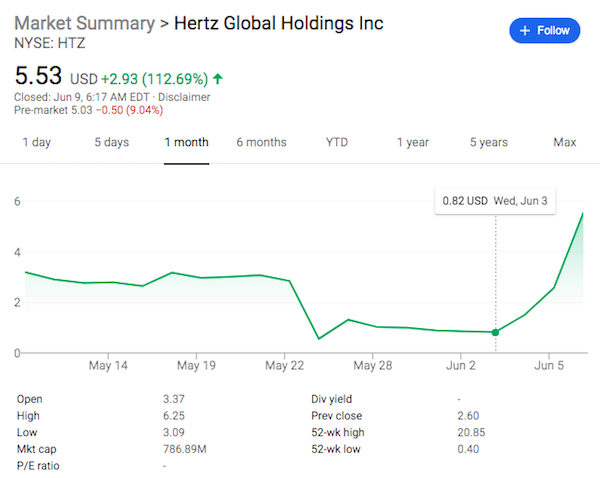

Hertz filed for Chapter 11 bankruptcy on Friday, May 22. When the markets reopened after Memorial Day (on Tuesday, May 26), Hertz stock was at $0.56.

Now somehow Hertz stock is at $5.53, as it has increased in value by over 500% in three days:

- The stock was up 84% last Thursday

- The stock was up 71% last Friday

- The stock was up 113% yesterday

Beyond that:

- The stock has now increased in value nearly tenfold since May 26

- The stock price is now roughly twice as high as it was on May 22, before Hertz filed for Chapter 11 bankruptcy

- The stock price is now the highest it has been since mid-April

Bottom line

Travel stocks have done particularly well the past week, though even so, Hertz has been an outlier. The stock has increased tenfold since the company filed for bankruptcy, and I remain really confused…

Congrats to those who decided to buy Hertz stock after the company filed for Chapter 11… I guess?

AMC the new hertz

@Eskimo

Not blaming Robinhood per se, just the magnitude of retail investors that have been drawn to that platform due to its simplicity and no-fee structures. Millions of customers with a few thousand dollars to invest each equates to a lot of money in aggregate. Definitely enough to drive volatility in the short-term, particularly if most users aren’t tracking or analyzing key business metrics that correlate with long-term profitability.

That, plus I use E-Trade and...

@Eskimo

Not blaming Robinhood per se, just the magnitude of retail investors that have been drawn to that platform due to its simplicity and no-fee structures. Millions of customers with a few thousand dollars to invest each equates to a lot of money in aggregate. Definitely enough to drive volatility in the short-term, particularly if most users aren’t tracking or analyzing key business metrics that correlate with long-term profitability.

That, plus I use E-Trade and Fidelity, so I certainly don’t want to blame myself...he he . I took my entire 2020 travel budget and invested it in various travel stocks (RCL, UAL, AAL, etc...) at the end of March and I’m already up $25,000, so I’m not complaining! When travel bounces back, I’ll just buy my way into first class instead of keeping my fingers crossed for upgrades as a 1K million miler on United. Even if they all magically go bankrupt, I figure I had planned to part with that money anyway.

@Scott

@Roger

One thing I don't understand is why is Robinhood is being blamed for this in 2020. Before that I understand because of no fee trading. Today most major (and better) broker gives free trade too.

I admit, I did bunch of day trades on RH when it was the only major no fee broker. When the major ones offer free trades my day trades on RH is over.

But then again,...

@Scott

@Roger

One thing I don't understand is why is Robinhood is being blamed for this in 2020. Before that I understand because of no fee trading. Today most major (and better) broker gives free trade too.

I admit, I did bunch of day trades on RH when it was the only major no fee broker. When the major ones offer free trades my day trades on RH is over.

But then again, one of my Uber driver with was on RH buying some biotech company I never heard of :). He got 3 stars cause he was on his phone trading during my ride.

It is a pretty funny little bit by Lucky. Yes stock analysis is not your expertise and by most of the comments here the commenters should definitely rely on professional financial advice. With regards to Hertz I believe that Sixt is sniffing around at taking over their North American operation and that buy out may explain stock movement.

I would also suggest reading up on the phenomenon known as "short squeeze." Lots of people betting against the stock price can actually drive it up.

Scott has it right. Three words: Robinhood Retail Investors.

They‘ve done the same thing with USO, DTO, LK, Chesapeake Energy, etc.... Massive, speculative buying of dirt cheap stocks hoping to make a quick buck short selling or day trading. Sorry, couldn’t stop at just three words.

@Santastico the market may be pricing in a V-recovery, but the economy is objectively not reflecting that anticipation. After over a decade of practically 0% interest rates the US has managed to eek out a measly 2.5% GDP annualized. The economy was running on the fumes of cheap credit long before COVID struck. What we're seeing in the market is the flight to yield fueled by continued cheap credit. The Fed is making the problem...

@Santastico the market may be pricing in a V-recovery, but the economy is objectively not reflecting that anticipation. After over a decade of practically 0% interest rates the US has managed to eek out a measly 2.5% GDP annualized. The economy was running on the fumes of cheap credit long before COVID struck. What we're seeing in the market is the flight to yield fueled by continued cheap credit. The Fed is making the problem worse by simply kicking the can down the road. The debt fueled economy goes back to the early 80s and what we're seeing is the last gasps of this debt cycle. We might see 5000 in the S&P, but it won't be a healthy rally and the worst is to come when central banks run out of ammo. Either the debt unwinds or we inflate our way out of it. The former will cause a global recession boarding on depression, the latter will see the end of American monetary hegemony.

Check out this article on Bloomberg News. It's the Robinhood Investors.

https://www.bloomberg.com/news/articles/2020-06-09/hundreds-of-thousands-tiny-investors-swarm-to-insolvency-stocks?srnd=premium&sref=oDakOCQE

you jinxed it, Lucky ;)

Thank you readers Pat and Eskimo for your explanation. I learned a lot. @Eskimo: Yes, UA did extend my 1K status for another year although it didn't matter much anymore. After UA announced to change of its frequent flyer to revenue-based last November, I decided not to fly with them anymore and will credit its flights to another partner should I have to.

@Joseph N.:

No one is blaming Trump for Hertz's stock price or for irrational stock market gains. Rather, the first comment just points out that the Fed's actions benefit Trump. Whether that effect is intentional or not is not mentioned.

"My best “for dummies” comparison for this unexplained phenomenon is TP."

That might be the worst analogy I've ever heard.

Good grief

You're no expert? Ok, well, I am. The stock market directly reflects the economy _in the long run_.

In the short run, the market is ruled by "momentum." That is the hope to sell at a higher price to a bigger fool, and right now the market is bursting with big fools. The explanation is that simple.

I did have to laugh at the commenter who tried to blame it on Donald Trump. Oh boy, do I have a bridge (or at least some tulip bulbs) to sell to that fool.

Have a look at what the Norwegian Air stock has been doing since they agreed to the government bailout conditions.

@rob

"it’s just a byproduct of people’s lack of understanding basic finance?"

Part of it yes. But even financial experts still lose money.

Unfortunately Finance 101 isn't required to invest.

My best "for dummies" comparison for this unexplained phenomenon is TP.

You don't need that many TP. “Markets aren’t terribly rational”

Yet you are fighting over TP. "manipulation"

Yet you are overpaying for TP. "priced beyond rational"

Yet you are...

@rob

"it’s just a byproduct of people’s lack of understanding basic finance?"

Part of it yes. But even financial experts still lose money.

Unfortunately Finance 101 isn't required to invest.

My best "for dummies" comparison for this unexplained phenomenon is TP.

You don't need that many TP. “Markets aren’t terribly rational”

Yet you are fighting over TP. "manipulation"

Yet you are overpaying for TP. "priced beyond rational"

Yet you are stockpiling TP. "wealth transfers"

Yet TP is out of stock. "wealth transfers"

There’s nothing nefarious, manipulative or irrational happening with TP either, just a byproduct of people’s lack of understanding how much you need to wipe your a**?

:)

@Gene: Don't look back. Look forward. The market couldn't care less for the "error" on the job report. The fact is that this pandemia was overblown and the economy is on a V shape recovery. Many people said that would be the case and the markets are showing that. Regarding companies going bankrupt, just read today's article on CNBC: https://www.cnbc.com/2020/06/09/the-hot-new-thing-to-make-your-stock-pop-go-bankrupt.html

Carl Icahn sold his millions of Hertz shares at 72 cents per share. That's because he is a pro and knows it is going to zero. The run in the stock to $5 are day traders who were looking for a low priced stock to play the recovery they saw happening in the airlines and cruise lines and thought the low price of Hertz was a sign that it hadn't had its recovery stock rebound yet. They will lose their money.

@Gene

I'm not going to point fingers at the error, and I know someone would try to do that and make it a political point out of it.

I'm saying in the simplest form, regardless of the error, unemployment is still lower than expected. Isn't really much lower is still lower. It was not expected for May to be better than April but it is better.

Don't get me wrong, if you go look at...

@Gene

I'm not going to point fingers at the error, and I know someone would try to do that and make it a political point out of it.

I'm saying in the simplest form, regardless of the error, unemployment is still lower than expected. Isn't really much lower is still lower. It was not expected for May to be better than April but it is better.

Don't get me wrong, if you go look at my past comments, I do criticize this administration a lot. But this just isn't it.

@Former UA1K (<--- Didn't UA extended status)

You are betting (not gambling) that Hertz equity won't be wiped out. Can be many reasons such as more cash injections, favorable restructuring plan, some equity take over etc. But that doesn't mean it will not go to zero. It is too early to even consider as strategic betting, at least not for equity holders. Still have high chance to get wiped out.

"I’m no expert on stocks"

You should've ended your post there. Between the post and the comments, it's unbelievable how people that don't understand even the most basic tenets of stock price valuation talk so matter-of-factly about it.

"Markets aren't terribly rational", wealth transfers, stock price manipulation, airline stocks priced beyond rational etc.

Is it at all possible.... and I'm just spitballing here..... that there's nothing nefarious, manipulative or irrational happening here, and that...

"I’m no expert on stocks"

You should've ended your post there. Between the post and the comments, it's unbelievable how people that don't understand even the most basic tenets of stock price valuation talk so matter-of-factly about it.

"Markets aren't terribly rational", wealth transfers, stock price manipulation, airline stocks priced beyond rational etc.

Is it at all possible.... and I'm just spitballing here..... that there's nothing nefarious, manipulative or irrational happening here, and that it's just a byproduct of people's lack of understanding basic finance?

@Former UA1K The price of stocks, like everything else, is driven by supply and demand. If a Trader A is willing to sell stock at $5.53 a share, and Trader B is willing buy stock at $5.53 a share, the stock will trade at that price. If nobody wants to sell their stock at that price, they'll wait until there's a buyer willing to pay at a higher price. If nobody wants to buy a...

@Former UA1K The price of stocks, like everything else, is driven by supply and demand. If a Trader A is willing to sell stock at $5.53 a share, and Trader B is willing buy stock at $5.53 a share, the stock will trade at that price. If nobody wants to sell their stock at that price, they'll wait until there's a buyer willing to pay at a higher price. If nobody wants to buy a stock at that price, they'll wait until there's a seller willing to dump their shares at a lower price

Long story short: nobody knows where any stock is headed. Pricing is always based on what people think the demand for the stock is going to be in the future.

This article made me laugh. From the writing to the analysis.

Thank you for the much needed smile!

I don't have much experience in stocks, and need to learn from all of you. Using the Hertz's example, let's say when the stock was $0.56/share. How could we tell if the stock will recover and go up? How does one know it is not going down and down to zero? Yes, if one considers to gamble for fun with some cash, that's okay. However, investing in penny-stock like Hertz at that time, please explain to me more. Thanks all!

@ Eskimo -- But, unemployment isn't really much lower than expected, The numbers reported last week were an "error". Gee, I wonder who ordered up that error? Have you not read this?

@Alonzo

You know what you said doesn't make sense, especially selecting Hertz as an example.

"greatest wealth transfers in history" sound just like those click bait stock manipulators.

So what are you pumping strategy for today and tomorrow? I'll join in.

I'm making lots of money from all these irrational 'bet' just like you.

The stock market has nothing to do with the health of the economy. What you all have witnessed is one of the greatest wealth transfers in history in the past 90 days. There are tons of names that have risen well over 100%, Hertz is just one select name. If you thought the world was over and hid in your home watching nothing but CNN, you missed out handsomely on a truck load of money.

To the various points made, the same can be said for AAL. They were trading ~$26-27 on a typical day in early March before the impacts of Covid19 fully hit the market. So now they're back to ~$20 with a still bleak-by-comparison outlook? Manipulation of the market and people erroneously "jumping on the bandwagon" are causing these types of wild stock swings. If you can gamble on it correctly, there sure is a lot to...

To the various points made, the same can be said for AAL. They were trading ~$26-27 on a typical day in early March before the impacts of Covid19 fully hit the market. So now they're back to ~$20 with a still bleak-by-comparison outlook? Manipulation of the market and people erroneously "jumping on the bandwagon" are causing these types of wild stock swings. If you can gamble on it correctly, there sure is a lot to be made, but I don't think any of us can interpret these fluctuating values as a fair interpretation of the near-/mid- term travel market.

Meh - it is easy to explain Hertz and the stock market. People stuck at home have run out of things to watch on Netflix and have turned to day trading. Hertz is the new Tiger King!

Just because Hertz filed for bankruptcy doesn't mean their bankruptcy proceedings are complete; far from it. When a company goes bankrupt its stock basically has to go to zero, because stockholders are the last to see any money that's remaining after liquidation (creditors and vendors with outstanding invoices get first dibs).

I think the Hertz stock is up because traders are betting that Hertz won't complete their bankruptcy proceedings. If we get a V-shaped recovery,...

Just because Hertz filed for bankruptcy doesn't mean their bankruptcy proceedings are complete; far from it. When a company goes bankrupt its stock basically has to go to zero, because stockholders are the last to see any money that's remaining after liquidation (creditors and vendors with outstanding invoices get first dibs).

I think the Hertz stock is up because traders are betting that Hertz won't complete their bankruptcy proceedings. If we get a V-shaped recovery, Hertz might be able to get new loans to stay afloat and enjoy the recovery. How to finance their way out of this is ultimately up to shareholders, and shareholders would probably prefer anything that doesn't send the stock to zero.

The people buying the stock now, at $5.53 in the middle of bankruptcy proceedings, are taking a *very* real risk of it going to zero. If the company doesn't go bankrupt and the stock continues to rise, that would be the current buyer's payout.

@raksiam

LOL, Motley Fool is the grand master of manipulation. They are the clickbait and tabloids of stock investments. I'm not suggesting their articles are fake news, but with many of these "advice" they have hidden agendas.

Too soon to comment on HTZ going to zero as restructuring plan isn't public yet. But if you do believe them, I suggest you short HTZ all in. (Motley Fool probably does have a short position too, hahahaha)

...@raksiam

LOL, Motley Fool is the grand master of manipulation. They are the clickbait and tabloids of stock investments. I'm not suggesting their articles are fake news, but with many of these "advice" they have hidden agendas.

Too soon to comment on HTZ going to zero as restructuring plan isn't public yet. But if you do believe them, I suggest you short HTZ all in. (Motley Fool probably does have a short position too, hahahaha)

BTW, maybe the market will turn red today. ;)

@Gene

@Lune

While I agree something is very wrong here. Fed or Trump isn't the blame here.

It's people who buy stocks now are acting irrational to up right moronic.

It's the greed that drives these stocks now.

Hertz or airline stock are now moving and priced beyond reality.

With unemployment lower than expected, that means people still have jobs but they don't have much to spend. You can't go on...

@Gene

@Lune

While I agree something is very wrong here. Fed or Trump isn't the blame here.

It's people who buy stocks now are acting irrational to up right moronic.

It's the greed that drives these stocks now.

Hertz or airline stock are now moving and priced beyond reality.

With unemployment lower than expected, that means people still have jobs but they don't have much to spend. You can't go on vacation, you can't spend on leisure, and best of all you can't go to casinos.

What do people do with the unspent money? Media is telling us hey stocks are booming, people are doubling money in a week. People with little knowledge of investing, pours money into stocks.

the stock market reflects what investors think the economy will do in the future, not what's happening right now. That said, I did read a Motley Fool article yesterday that suggested Hertz will eventually go down to zero and this is essentially stock manipulation by people looking to make a quick buck. Drive the price up, then cash out before it crashes. The stock market is like a big casino

Next time Wall St. Asks for a bailout because their activities are vital to Main St. I hope we throw this example in their face and ask them how wall St in any way reflects the actual economy.

@ Ben -- This is a great example of what is so wrong with our economy wright now. This type of insanity is the consequence of moronic Fed actions, which have propped up anything and everything except actual human beings not named Donald Trump.