Promo: If you’re new to InKind, follow this link to get $25 off your first dining experience of $50+

There are all kinds of ways to maximize your return on dining, from using the right credit card, to taking advantage of airline and hotel dining programs. Along those lines, nearly a year ago I started using an awesome app that can save you money on dining.

Since then, I’ve consistently used this at least once or twice per week for dining out, and have had nothing but great experiences. I can’t believe it took me so long to download this app, so I want to recap my experience, for anyone who may not be familiar with this app.

Long story short, I find this to be significantly more rewarding than your typical airline or hotel dining program, with the caveat that it has a smaller network of restaurants. It’s also super straightforward to use, and has virtually no restrictions in terms of when you can dine, what you can order, etc. I love the simplicity of it. Separately, I also shared my experience using the Seated dining app.

In this post:

What is the InKind dining app?

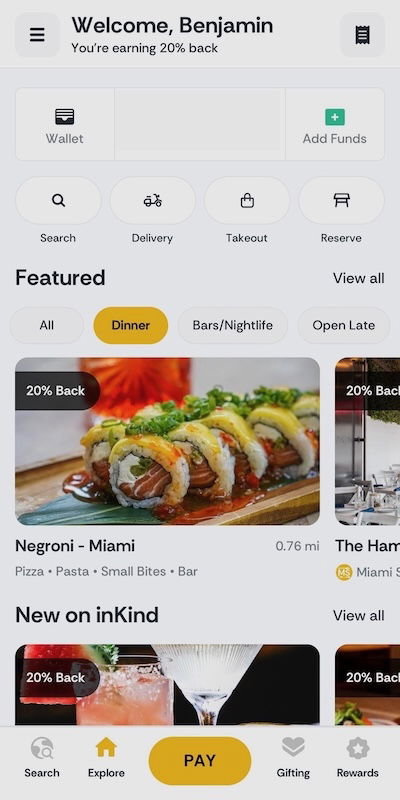

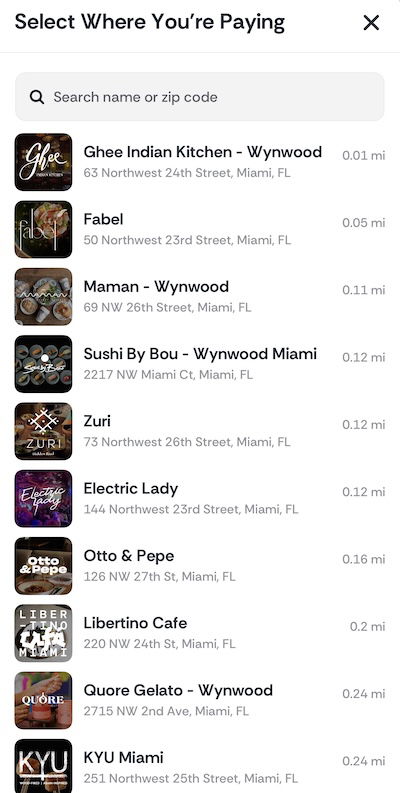

On the most basic level, InKind is a free app that offers a 20% discount (or more) at over 3,750 restaurants around the United States. The participating restaurants are primarily in major cities, from Chicago, to Los Angeles, to Miami, to New York, to San Francisco. So if you live in a smaller market, unfortunately this app probably isn’t for you, unless you’re traveling.

What impresses me about InKind is that the restaurants on the list are actually largely high quality and popular, unlike with many other dining rewards programs, which basically try to incentivize you to eat at crappy restaurants.

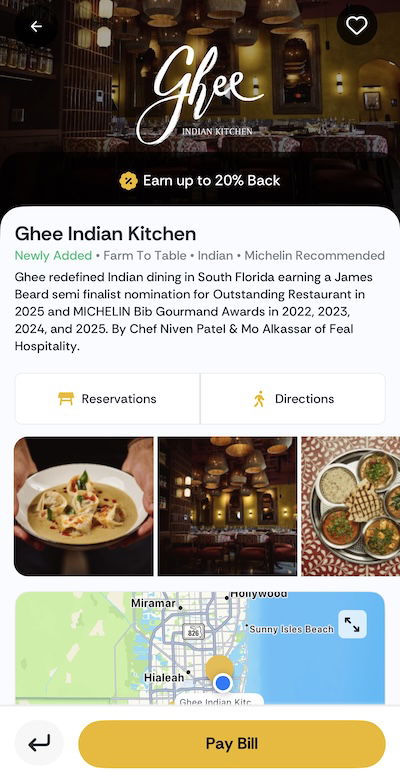

For example, I live in Miami, and several of the restaurants participating on InKind are ones I’d frequent anyway, from Chug’s Diner, to Ghee, to KYU, to Maty’s, to Michael’s Genuine, to Otto & Pepe, to Phuc Yea, just to name some. Even some of the more popular “clubby” restaurants are on the list, ranging from Sparrow Italia to Casa Madera.

I also find it interesting that InKind’s business model is different than that of most other dining rewards programs. With most other dining rewards programs, the dining network simply takes a percentage of the bill in exchange for offering guests rewards for using a particular credit card.

InKind, meanwhile, seems to work more closely with restaurants, and has a different business relationship, whereby it provides financing to restaurants. The idea is that ordinarily when private equity firms invest in restaurants, they take a huge stake. Instead, InKind provides capital to restaurants, in exchange for dining credits.

It’s a very interesting business model. Obviously I can’t speak to it from the perspective of a restaurant owner, but I appreciate the concept that InKind is going for. The company isn’t simply skimming a percentage off each transaction under the guise of sending new diners to restaurants, but it’s a closer partnership than that (which is also why the restaurant network is smaller).

How does the InKind dining app save you money?

There are so many ways that the InKind app can save you money for dining at a participating restaurant. At a minimum, you should look at it as receiving 20% off your bill, though potentially you can get a much better return than that. Let me go through each of the ways you can save.

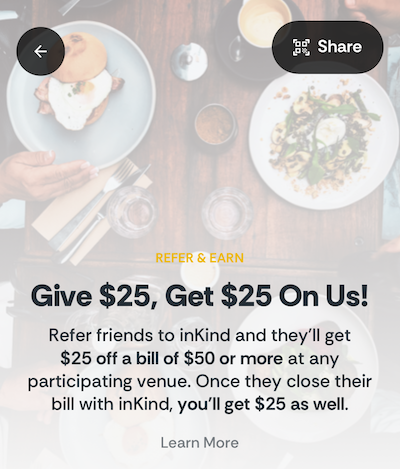

Get a $25 refer a friend credit on your first meal

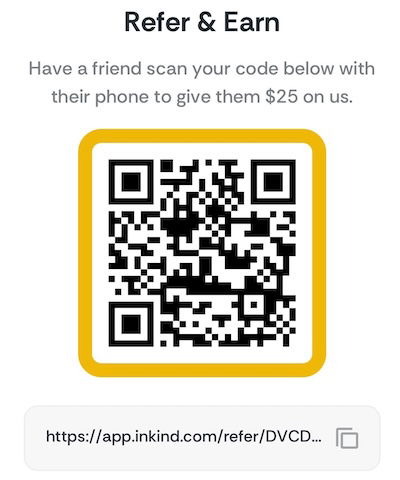

InKind has a refer a friend program. When you’re referred by an existing user, you’ll get $25 off a bill of $50 or more, to use at a participating restaurant. Similarly, the friend who refers you can get a $25 credit as well (or sometimes even more, if there’s a limited time offer).

You can find my refer a friend link here, and others are welcome to leave their link in the comments section as well.

Get 20% off at InKind restaurants

If you’re going to pay with your card linked to your InKind account, then you can always receive 20% off your meal, with no maximum savings. That 20% back comes in the form of credits you can use toward future dining at InKind restaurants.

Note that you don’t receive the 20% back on tips, fees, or portions of the bill covered by discounts or paid with InKind Cash. This credit expires two months after the calendar month in which it’s earned. So if you earn credit on September 15, it would be valid through November 30. The oldest accrued credit is always used first for redemptions.

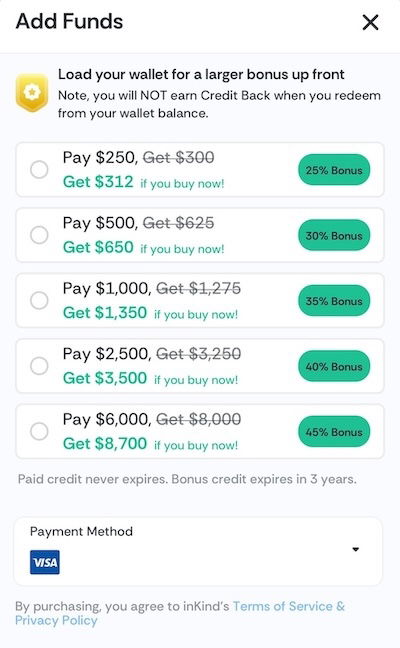

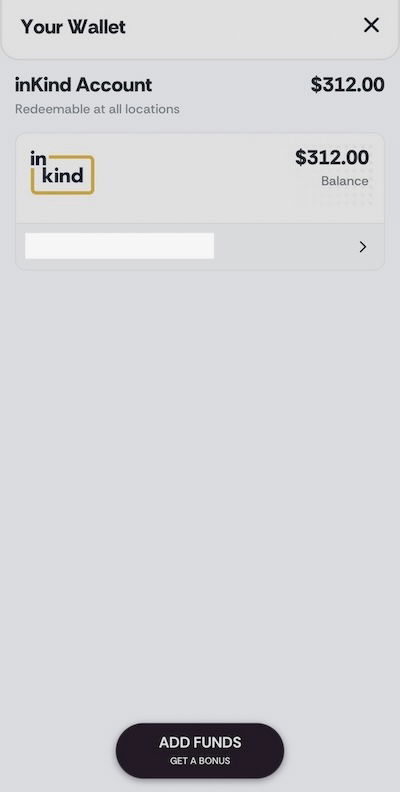

Buy InKind Cash at a discount

The InKind dining app also lets you purchase InKind Cash at a discount. The exact offers vary over time, but in my account I’ve seen the opportunity to buy a $312 InKind dining credit for $250, or an $8,700 dining credit for $6,000. As you can tell, this offers anywhere from a 25% to 45% bonus.

If you go this route, then you won’t earn the 20% back, but instead you potentially get a larger discount. Of course you should only use this if you frequent restaurants that are part of the InKind network, so I don’t recommend taking advantage of this if you’re just trying out the app.

For example, I decided to buy the $312 credit for $250, since I know I’ll spend that at participating restaurants.

Often there are additional promotions where you can buy credits with an even higher percentage bonus or discount, so keep an eye out for that. The base credit purchased never expires, while the bonus credit purchased this way expires after three years.

Pay $9.99 per month for InKind Pass

While the standard version of InKind is free, there’s also InKind Pass, which costs $9.99 per month. This comes with one primary advantage. Specifically, you get $50 off a $150+ meal once per month. I’d argue this is primarily worth it if you otherwise spend at least $150 per month (in a single transaction) at a restaurant participating in the program.

The only thing to keep in mind is that you don’t get 20% back on the $150 in spending, as you’d ordinarily get $30 back. So the incremental savings aren’t that huge.

Keep an eye out for other InKind promotions & offers

Beyond the above, InKind often has other promotions you can take advantage of, so it’s worth keeping an eye out for those. For example, sometimes there are promotions with Amex Offers and SimplyMiles, which can be stacked with the above.

Furthermore, InKind often emails members with targeted and other limited time promotions. For example, I’ve had offers for an extra 10% back if I make two InKind transactions at the same restaurant within a month, or targeted promotions for larger savings at specific restaurants.

If you go directly to the website of a participating InKind restaurant, you may also see a pop-up offering savings of a certain amount for dining at that restaurant. The catch is that this can’t be combined with the refer a friend offer, so while it can at times be lucrative, it doesn’t offer the same flexibility.

Lastly, Costco often sells InKind credit at a discount. Typically you can buy $100 in InKind credit for $69.99, and sometimes it’s even cheaper than that.

How does the InKind dining app work at restaurants?

All of that sounds great, but what’s it like using the InKind dining app at when you’re actually at the restaurant? Is there confusion from the servers? Do they roll their eyes? Well, that’s what delights me the most about the experience.

When using InKind to pay, you don’t need to make a reservation in any particular way, there are no restrictions on what days or times you can dine, and you don’t even need to let the server know when you’re seated that you’ll be paying with InKind.

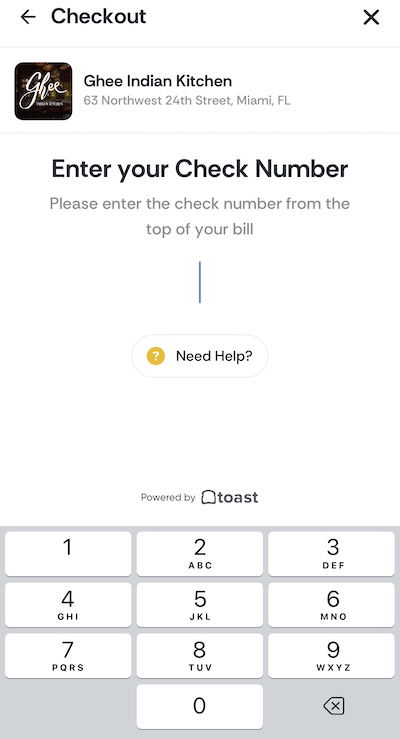

There’s not even any confusion, since you actually pay the bill on your end, without even interacting with the server. That’s because all InKind restaurants use the Toast platform for payments, so it’s all connected pretty nicely on the backend.

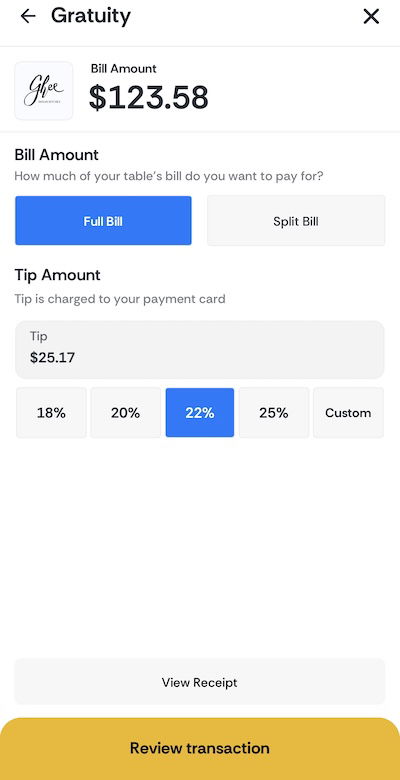

For example, my most recent InKind meal was at Ghee Indian Kitchen. At the conclusion of the meal, I was presented with a check, so I pulled up Ghee Indian Kitchen on the InKind app…

…and then clicked the “Pay Bill” button.

The app asked to enter the check number, which was clearly visible on the check.

I was then asked how much I wanted to tip. Note that the gratuity will always be charged to your card on file, and will not be taken from any balance you may have.

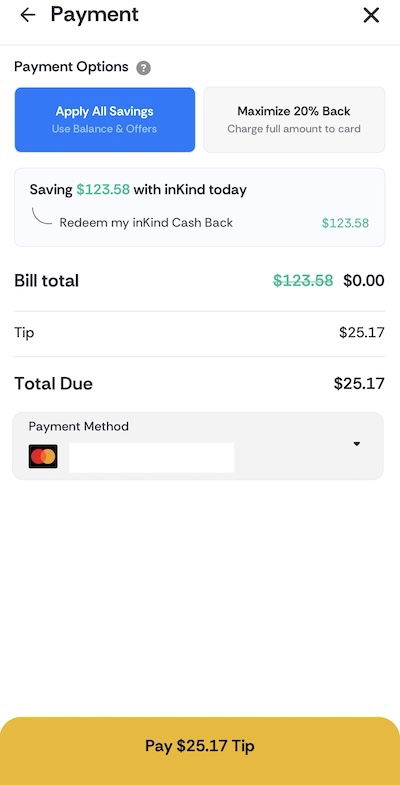

I had two options for how to pay. I could either use my existing InKind balance (which I acquired with a 35% bonus), or I could pay with my linked credit card, and receive 20% back, in the form of InKind credit.

I competed that all on my phone, and a minute later our server showed up, and said we were all set, without me even having to mention that I paid through InKind. It honestly couldn’t have been more seamless, and that matches every experience I’ve had with InKind.

Since I had purchased the credit for 35% off, I ended up saving around $43 on the $123.58 total. Alternatively, if I had gone for the 20% back, I would’ve received around $25 in credit to use toward a future dining experience.

Which credit card should you use with InKind?

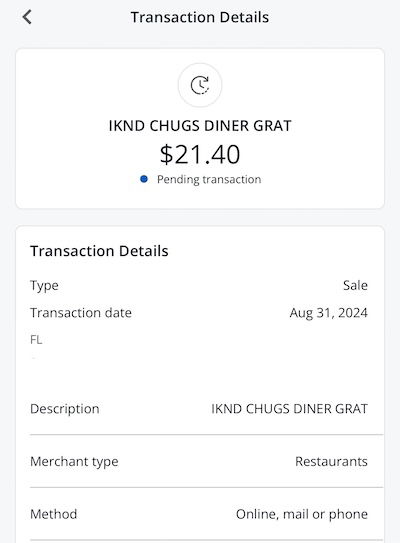

Another great thing about InKind is that all purchases are categorized as dining for the purposes of credit card rewards, based on my experience. So whether you’re paying for your meal with a linked card or buying InKind credits, I’ve always had InKind purchases earn me credit card bonus points for dining.

I recommend using a card that maximizes your return on dining spending, as you don’t have to forgo any credit card rewards by using this program.

Bottom line

Several months back I used the InKind dining app for the first time, and I’ve been using it consistently ever since. Personally, I like this a lot more than most of the dining rewards programs out there. While InKind doesn’t have the largest network of restaurants, I find them to overwhelmingly be good quality.

With InKind, you can save at least 20% every time you dine at a participating restaurant. Unlike some other dining programs, there are no restrictions on when you dine, and there are no reservations requirements.

The best part is that you can save way more than 20%, by using a refer a friend link, taking advantage of the additional once monthly savings, and even by buying credits in advance.

If you live in a major city that has restaurants you like that participate in InKind, then using the app is a no-brainer. There are several restaurants on the list that I frequent, so I use this consistently.

If you’ve used the InKind dining app, what was your experience like?

Here’s my referral: https://app.inkind.com/refer/Y63PURGE

I’ve been using the app since it launched. I recommend buying credit at Costco online for 60-70% off and then you can stack it with the $25 off $50 referral offer.

Thanks to anyone who uses my referral!

I’m a big fan of InKind and as a business owner, I use it for a lot of business meals (easy in Chicago since Bar Mar is in it and everyone loves that (expensive!) place).

I especially appreciate that the client/potential client has no idea I’m essentially getting a coupon off.

Here’s my link if anyone else is signing up:

Join inKind and you'll get $25 to spend at amazing restaurants! https://app.inkind.com/refer/1WU88BZ0

This is a great application and they just need to keep building out their network .

The way how InKind works - for restaurants that received funding from InKind, they give InKind 2x amount in dining credit, which get redeemed by diners and paying back the loan. This benefits the restaurant since they get funding upfront, and the payback is in food and beverage sales, not hard cash. It's the same model for Rewards Network, where they hand out miles for dining, in exchange for a loan to the restaurant or...

The way how InKind works - for restaurants that received funding from InKind, they give InKind 2x amount in dining credit, which get redeemed by diners and paying back the loan. This benefits the restaurant since they get funding upfront, and the payback is in food and beverage sales, not hard cash. It's the same model for Rewards Network, where they hand out miles for dining, in exchange for a loan to the restaurant or marketing cost.

From InKind side, they arbitrage and sell these dining credits, and that's how they are able to offer the 30% discounts and earn the difference.

Rishdatar is much better than Ghee, if you haven't tried it already.

100%

I've been using this app for nearly a year and love it. The savings are incredible. I still don't understand how they make money, but that's not my problem; I save several hundred dollars a month using this app.

So you don't get 20% back, rather you get some InKind points that are "worth" the equivalent of about 15% of spend (since tax and tip don't count) that you have to track, manage etc. etc.?

And am sure you have to agree to get spammed as well?

No thanks. The whole thing looks like a scam.

Give me 15% in cash credit to my credit card and now we're talking.

@Mary I do not think it is a scam. It may work like Bilt and when investors start to think about lack of ROI then the economics of it may change. Yet, there may be more to it on how they make money and we are not aware of it. Also, for countless restaurants, credit card companies, and Costco to participate in this it shouldn’t be an app to rip you off.

For some, the range of cuisine and geographic footprint can be challenging.

That's a bit of an understatement- we're talking something that's only available in one country.

I live in a small city with one very good restaurant that participates in the InKind program. We’ve really enjoyed the app, and as noted if you purchase Costco gift cards it’s a slam dunk. Fortunately this restaurant is also on the Resy network so we get the Amex Gold credit when paying the tip. With the various discounts I couldn’t see how it works for the restaurant, but the owner told me that it...

I live in a small city with one very good restaurant that participates in the InKind program. We’ve really enjoyed the app, and as noted if you purchase Costco gift cards it’s a slam dunk. Fortunately this restaurant is also on the Resy network so we get the Amex Gold credit when paying the tip. With the various discounts I couldn’t see how it works for the restaurant, but the owner told me that it had funded her renovation and expansion, and she was happy with InKind.

Here's my referral link for anyone interested -- we both get $25 to spend at amazing restaurants! https://app.inkind.com/refer/ILA6FDCN

Feels like the 2025 version of Groupon. Something tells me this doesn’t end well for the restaurant.

...Nor for those who use the app and front-load "Value". Borderline scam.

Sheesh, why does everyone always hate on everything?! If you dont feel InKind is something you can benefit from then dont use it! I've been a user for almost two years, when AmEx basically gave free membership. Initially it didnt have a lot of restaurants and I barely used it, but recently they've added a bunch of restaurants in NYC and Ive maximized it to the fullest. Must've spent over 3k in the last few...

Sheesh, why does everyone always hate on everything?! If you dont feel InKind is something you can benefit from then dont use it! I've been a user for almost two years, when AmEx basically gave free membership. Initially it didnt have a lot of restaurants and I barely used it, but recently they've added a bunch of restaurants in NYC and Ive maximized it to the fullest. Must've spent over 3k in the last few months already. Whenever GC's go on sale at Costco or when InKind runs a 40% promo, I'll load up. Dining out in NYC for a family of 4 easily $200+ tab. Ill take any discounts I can! I dont see a ton of value with their membership though, they need to add more value to it imo.

likely BK in 6 months. unit economics don't work. VCs will stop funding losses. I wouldn't prepay a penny. You will be an unsecured creditor in BK

Wow, must be huge commissions. Longest, most detailed OMAAT article I've ever seen.

We cook from scratch at home, unless traveling and then only upscale with legitimate stars.

@ upstater -- Longest article you've seen here? :p It's not even 2,000 words, that's nothing by my standards, compared to most of my reviews. And I write about InKind because I use it constantly and love it, and I use the refer a friend program, just like anyone else.

Face it, you clearly dont cook from scratch every day and eat at the finest restaurants when you arent cooking from scratch- you peasant! Lol- just started using the app yesterday and this did help my understanding more of it.

That's my point. Upscale without even needing the stars, practically none.

@upstater So, this article was helpful for you since you admit that you do dine out when traveling so you can surely think about using this app when you frequent a restaurant listed on InKind. Also, you must be new to OMAAT since it was not that long since even Tim Dunn and DCS write longer comments than this article. If you think Ben does get commission for this writing piece then why don’t you...

@upstater So, this article was helpful for you since you admit that you do dine out when traveling so you can surely think about using this app when you frequent a restaurant listed on InKind. Also, you must be new to OMAAT since it was not that long since even Tim Dunn and DCS write longer comments than this article. If you think Ben does get commission for this writing piece then why don’t you pay him not to write these articles to help Ben fund his living expenses.

Even in big cities, NYC in my case, most restaurants are either crap or too far apart to make the app worthwhile. I have tried and given up very quickly. They haven't reached the critical mass which would make them useful.

I would not call Danny Meyer or Jose Andres restaurants crap, and they participate in InKind.