Link: Apply now for the Bank of America® Premium Rewards® credit card with 60K bonus points

The Bank of America® Premium Rewards® credit card is an intriguing cash back card. If you don’t have any other banking relationship with Bank of America, then this is just a pretty average cash back card.

However, if you participate in the Bank of America Preferred Rewards program, this has the potential to be one of the world’s most lucrative credit cards, as you can earn up to 2.625% cash back on everyday spending, which is unrivaled.

In this post I wanted to take a closer look at the Bank of America Preferred Rewards program, since there are understandably a lot of questions about how that works.

In this post:

Bank of America Premium Rewards Card basics

To start, let’s cover the very basics of the $95 annual fee Bank of America Premium Rewards Card, since it’s important in the context of why you should care about the Preferred Rewards program:

- The card is currently offering a best-ever welcome bonus of 60,000 points after spending $4,000 within the first 90 days; that’s worth $600 cash back

- The card offers 2x points on dining and travel and 1.5x points on all other purchases; points can be redeemed for one cent each

- What makes this card exceptional is that if you participate in the Bank of America Preferred Rewards program, you can receive up to a 75% bonus on your credit card rewards; you’ll then earn the equivalent of 3.5% cash back on dining and travel and the equivalent of 2.625% cash back on all other purchases

- The card offers a $100 annual airline incidental statement credit, which is the easiest way to justify the $95 annual fee on the card, in my opinion; for mental accounting purposes, I consider this card to really cost nothing to hang onto

- The card offers a $100 statement credit toward TSA PreCheck or Global Entry once every four years

Essentially the value proposition here is that many may appreciate the bonus of 60,000 points, worth a $600 statement credit. On top of that, if you can have $100K or more in assets with Bank of America and/or Merrill (this could include a SEP-IRA or 401k), then this card offers an industry leading cash back return on everyday spending.

Read a full review of the Bank of America Premium Rewards Card here.

What is Bank of America Preferred Rewards?

Many banks have premium banking programs for those who keep assets with them, including Chase Private Client and Citigold. Bank of America’s version of this program is called Preferred Rewards, and it offers additional rewards to those who keep assets with Bank of America and Merrill.

To qualify for the Bank of America Preferred Rewards program, you need to have at least $20,000 in combined deposits with Bank of America and/or Merrill, as that qualifies you for the Gold tier. However, to really maximize the value of the program, you’ll want to have $100,000 in assets with Bank of America and/or Merrill, so that you qualify for the Platinum Honors tier. On an ongoing basis, eligibility is based on your three month combined average daily balance.

Perks of the Bank of America Preferred Rewards program include improved credit card rewards, reduced fees, increased interest rates on deposits, more lucrative mortgage rates, and more. For me the most interesting aspect of this program is the improved credit card rewards, so that’s what I’ll be focusing on.

What counts toward Bank of America Preferred Rewards?

The first logical question is what balances count toward the Bank of America Preferred Rewards program deposit requirement. So here’s what you should know:

- In order to be eligible for Preferred Rewards, you must have a Bank of America checking account; it’s fine if that account only has $100 in it, but you at least need to have an account open, since that’s what triggers the extra rewards

- Your eligibility for Preferred Rewards is based on your combined balance in a Bank of America deposit account and/or a Merrill investment account; the entire amount doesn’t have to be in one account

- If you’re eligible, there’s no cost to participate in the Preferred Rewards program

If you have the cash, it goes without saying that you shouldn’t park $100,000 in a Preferred Rewards account just to get elevated credit card rewards. After all, you’re potentially missing out on much higher interest rates with other banks. For example, I’d much rather have a Bask Bank account if I have money sitting around, given the interest offered.

But that’s why it’s important to call out that you should be able to do this with a pretty low opportunity cost, potentially. For example, with Merrill Edge, you can potentially qualify for the Preferred Rewards program in the following ways:

- If you trade your own stocks, Merrill Edge lets you do this, and that balance counts toward the requirement

- Merrill Edge has advisors, should you want them to invest on your behalf

- You can transfer your managed retirement account to Merrill Edge, whether it’s a traditional or Roth IRA

I’m only recommending people participate in the Preferred Rewards program if they can do so at a minimal cost. That should be easy for some, and less easy for others.

Bank of America Preferred Rewards tiers & benefits

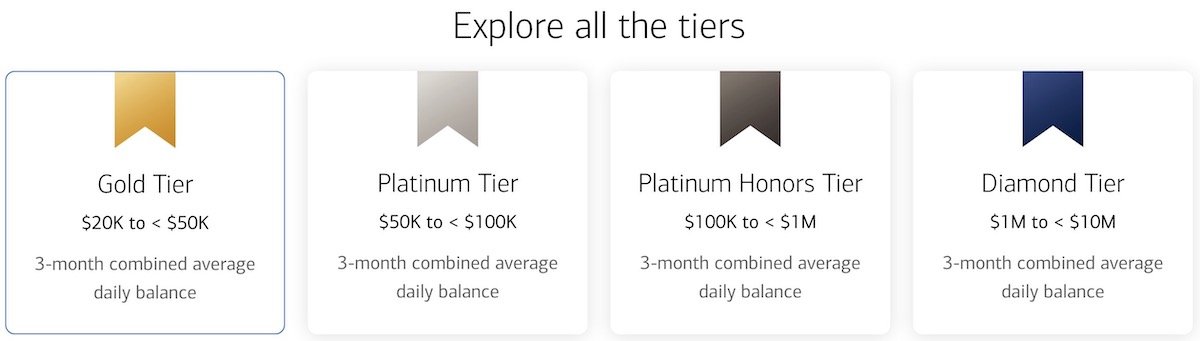

The Bank of America Preferred Rewards program has four published tiers, based on your combined average daily balance:

- The Gold tier is for those with $20,000-49,999 in eligible balances

- The Platinum tier is for those with $50,000-99,999 in eligible balances

- The Platinum Honors tier is for those with $100,000-999,999 in eligible balances

- The Diamond tier is for those with $1,000,000-9,999,999 in eligible balances

Each tier comes with some benefits that include interest rate discounts on auto loans or home equity, a reduced origination fee on a mortgage, an interest rate booster on a Bank of America Advantage Savings account, and more. While that all sounds great, often you’ll still get better rates with another bank, so I don’t necessarily think it’s worth making decisions based on that.

However, what I specifically want to focus on is the boosted credit card rewards. The Bank of America Preferred Rewards program offers bonus rewards for your credit cards:

- The Gold tier offers a 25% credit card rewards boost

- The Platinum tier offers a 50% credit card rewards boost

- The Platinum Honors tier offers a 75% credit card rewards boost

- The Diamond tier offers a 75% credit card rewards boost

The sweet spot is with the Platinum Honors tier, where you start earning a 75% credit card rewards boost.

This applies to credit cards with Bank of America rewards currencies, meaning that co-branded cards, like the Alaska Airlines Visa Signature® credit card (review) and Alaska Airlines Visa® Business card (review), are excluded. Furthermore, this applies to rewards earned based on your ongoing spending, so you wouldn’t receive that same boost on the sign-up bonus, for example.

Is the Bank of America Preferred Rewards program worth it?

Let me acknowledge that most people don’t have $100K sitting around to necessarily put into a new account, so it goes without saying that this won’t be for everyone. However, there are also many people who do have $100K sitting around or invested, and they’re probably missing out on quite a bit of cash back by not using the Preferred Rewards program in conjunction with the Bank of America Premium Rewards Card.

With that in mind, a few thoughts:

- The Preferred Rewards program really gets lucrative with over $100K in assets, given that this is where the 75% credit card rewards bonus kicks in

- You absolutely shouldn’t just park $100K in a Bank of America checking account earning a fairly low interest rate just to qualify for the 75% credit card rewards bonus

- The point at which this really becomes a sweet spot is if you have $100K that you can transfer to Bank of America with limited opportunity cost; this could be best done with Merrill Edge, and could be useful whether you trade your own stocks, have an individual retirement account, etc.

If you can qualify for the Platinum Honors tier, the Bank of America Premium Rewards Card can earn you 3.5% cash back on dining and travel, and 2.625% cash back on everything else. Earning 2.625% cash back on your everyday spending is a pretty incredible return, and something that a lot of people should probably consider.

Bottom line

Preferred Rewards is Bank of America’s premium banking program. What’s most exciting about this to me is that if you qualify for the Platinum Honors tier (which requires $100K in deposits), you can receive a 75% credit card rewards bonus.

This means that if you have the Bank of America Premium Rewards Card, you’d be looking at earning the equivalent of 2.625% cash back on your everyday spending, which is truly unrivaled. You’ll want to make sure you reach the Platinum Honors with as little opportunity cost as possible, though, and I think the Merrill Edge program is the ideal way to do that.

What’s your take on the Bank of America Preferred Rewards program?

Although 2.65% cash back is good, I think I would still prefer 2x back in transferable points with something like the Venture X. However if you are this stage maybe you don't as many points anymore

I'm personally leaning more towards cash these days. Prices of goods go up and down. Heck, Tesla's cars have varied by at least 10%, eggs are affordable again and economy ticket prices move up and down based on demand.

Meanwhile, the depreciation game never stops when it comes to airlines or hotels. And programs are getting less reliable about issuing promised benefits.

Transfers are overrated. Flat 2.625 on everything is unbeatable. The article fails to address the true power of platinum honors.

You can get the 1,2,3 card that gets boosted to 1.75, 3.5, 5.25%.

There is the standard 1,2,3 VISA and there is also the susan G Komen 1,2,3 and if you were an early adotper you have the 1,2,3 MASTERCARD. Thats 3 cards at 5.25% of the category you choose.

I usually have them...

Transfers are overrated. Flat 2.625 on everything is unbeatable. The article fails to address the true power of platinum honors.

You can get the 1,2,3 card that gets boosted to 1.75, 3.5, 5.25%.

There is the standard 1,2,3 VISA and there is also the susan G Komen 1,2,3 and if you were an early adotper you have the 1,2,3 MASTERCARD. Thats 3 cards at 5.25% of the category you choose.

I usually have them all set at online shopping. Booking flights online, hotels online all count towards the 5.25%. No other card beats that.

I have the Venture X aswell. Its a great card for the price but the points are always worth less than straight cash unless there is a rare discount on an offseason trip.

The Bofa rewards ecosystem has netted me way more return than any system I've joined.

(i have the AMEX Plat, Chase Sapphire Reserve, and Venture X for reference).