Earlier this summer, I wrote about a somewhat harrowing experience getting stuck in Chicago overnight. While delays at O’Hare are probably more snooze-worthy than news-worthy, the unexpected overnight stay in Chicago did present the opportunity to take advantage of Chase’s trip delay insurance.

While it would have been nice to use this coverage for a slightly more aspirational property than the Bridgeview Inn (like, say, a Super 8), I was able to get the claim approved and closed. Now that I’m out of the woods, I figured it would be worthwhile to share what the experience was like, and what kind of documentation was required.

Trip Delay Coverage – The Basics

In essence, if you book a flight or train ticket with a credit card that offers trip delay coverage and you are delayed for a substantial amount of time (typically 12 hours, or overnight), you are eligible for reimbursement for up to $500 worth of expenses.

Like with all things insurance, there are plenty of rules and caveats involved, so you can head over here if you want to learn more about which cards offer trip delay coverage, and what the terms are.

Filing a claim with Chase

In this particular case, I was flying on United and booked the trip with my United MileagePlus Explorer Card, in order to be eligible for the free checked bag. Given that United credit cards are issued by Chase, I knew that I would be working with their third-party insurance provider, Card Benefit Services.

[omaat-credit-cards title=’Chase cards to consider’ cat=’chase-card-issuer’ count=’16’ rows=’2′ style=’light’]

Unfortunately (for Chase), I’ve worked with Card Benefit Services before, after a pretty rough stint with rental cars last year. This time, I figured I would do things a little differently since I wanted to review the process and see what was allowable. I wasn’t necessarily in a huge rush to get my whopping $179 reimbursed, so I decided to play things a little more loosely in terms of paperwork, just to see what they would or wouldn’t accept.

Needless to say, I learned a few things.

Starting the claims process

While you are required to file the claim within 60 days of the incident, you don’t actually need to get all of your paperwork in until 100 days from the incident. All that to say that it’s worthwhile to open the claim, even if you’re still scrambling to get all of your receipts in one place.

To start the claim, you need your name and credit card number (and to not be a robot):

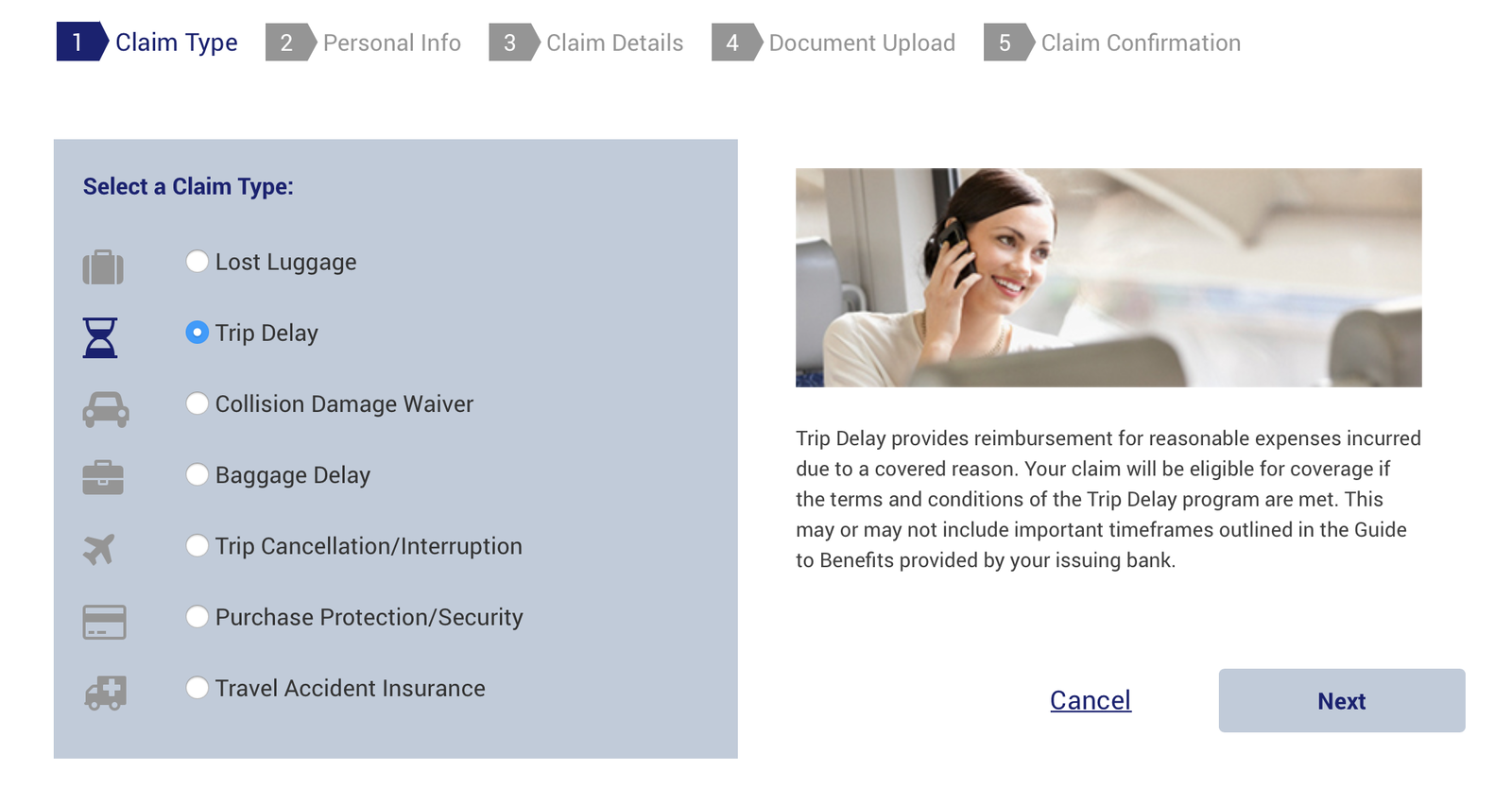

And then you need to select your claim type:

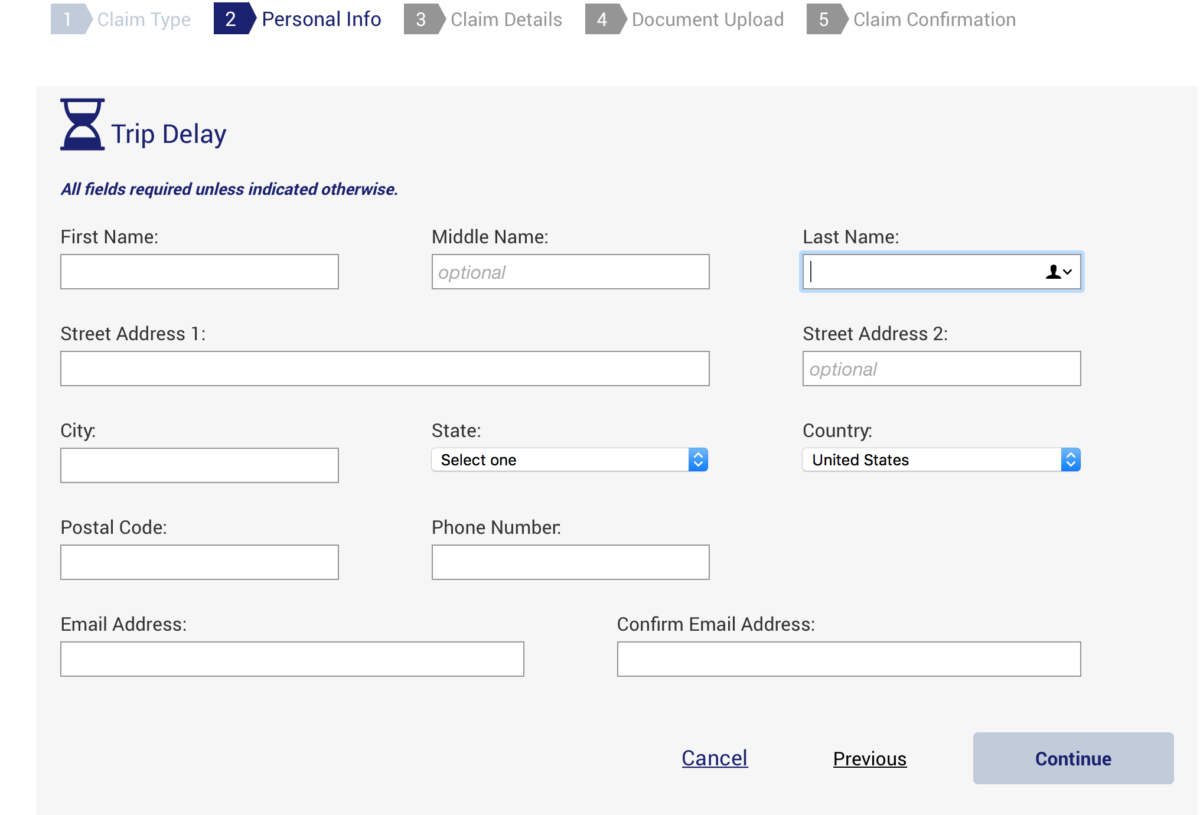

And fill out your contact information:

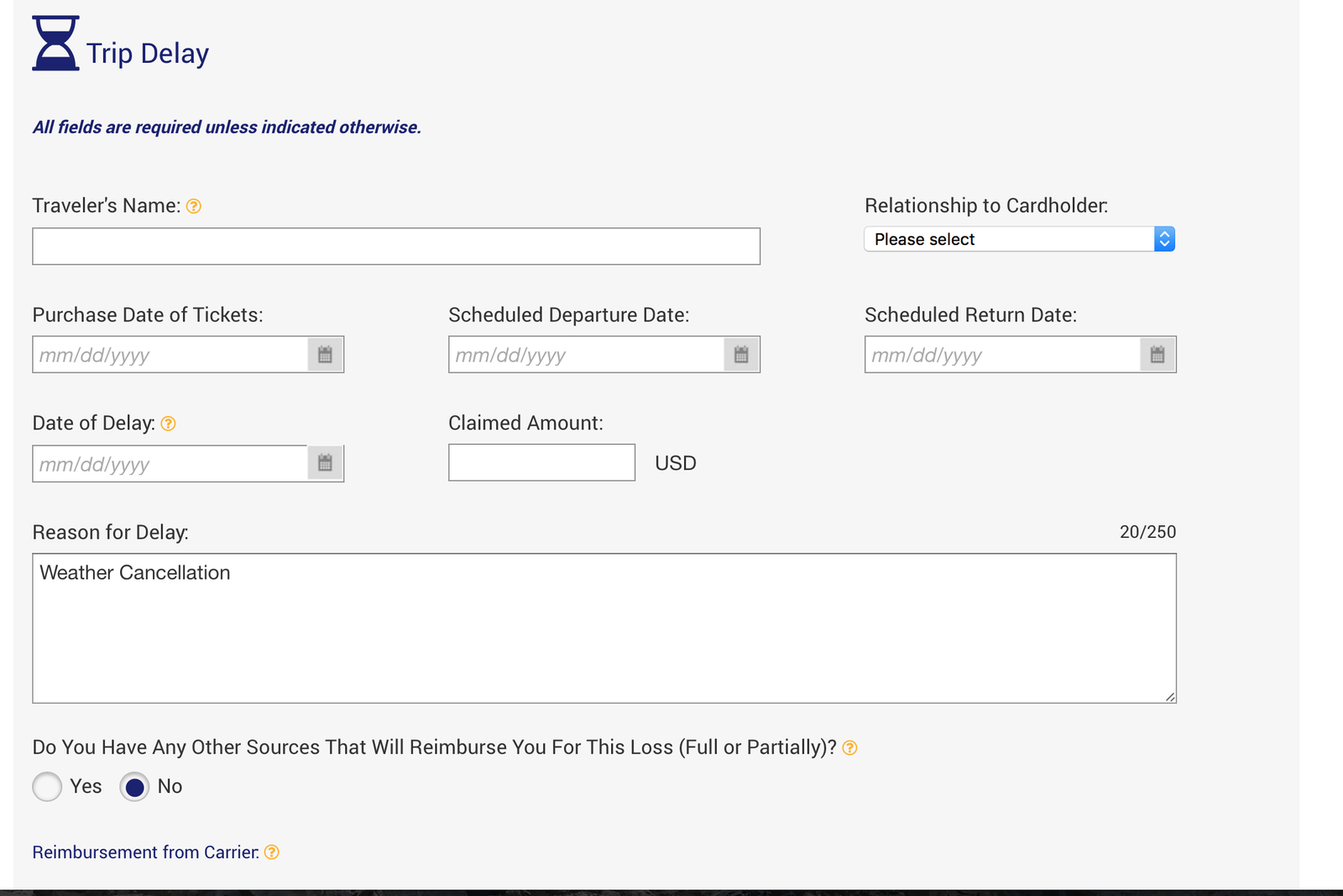

They also require the date of ticket purchase, date of travel, claimed amount (total amount that you spent and are submitting for reimbursement), and the reason for the delay.

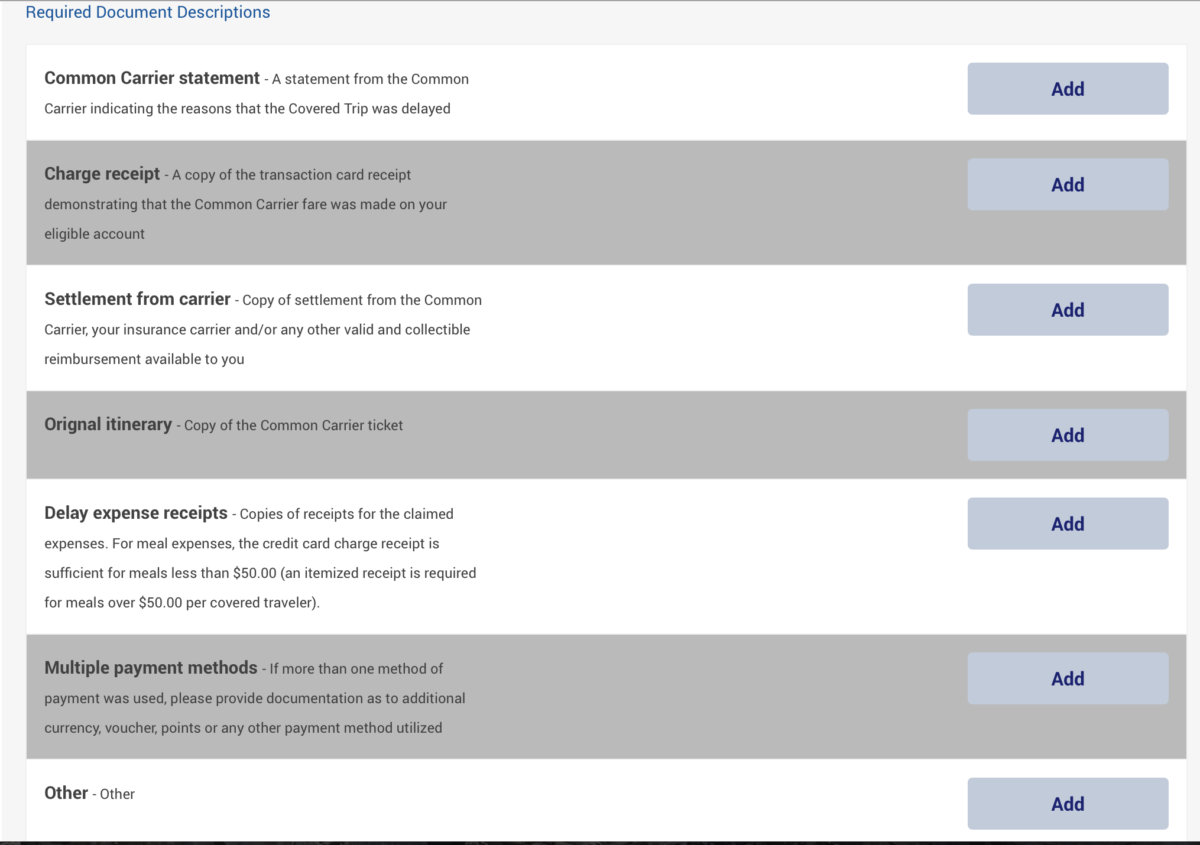

Finally, you’re led to a screen where you can submit the necessary paperwork. This is where it’s easy to get scared away – or at least have your eyes glaze over. But the good news here is that you don’t actually need any of this paperwork in order to submit the initial claim.

You will eventually need all of these documents in order to get the claim approved, but you can always log back in later to upload additional documents

And boy, did I go back in later.

The necessary paperwork

The crux of this process (or any insurance claim, really), is getting the necessary paperwork in. While you don’t necessarily need a law degree to figure it all out, it may appear that way on the surface, and I’m sure that’s by design.

So let’s take a look at each of these items, what I submitted, and what actually worked.

Common Carrier Statement

This first one was probably the trickiest – and took three tries to get right. In essence, the benefits administrator needs some sort of statement from the carrier (in this case, United), verifying the reason for the delay or cancellation.

The easiest way to get this is to request a “Military Excuse” from the gate agent or ticketing agent at the airport, but in this particular case, I wanted to see what would work if I didn’t have a chance to do this.

(Also, Chicago’s rush hour traffic got me to the airport later than I would have liked, so I was a little bit preoccupied by the time I got to O’Hare.)

What didn’t work

When you initially file the claim, you’re only able to upload images through the website, so my first attempt was to simply submit a screen shot of the email stating that the flight was canceled.

Much like me, on the day that I was trying to leave Chicago, that didn’t fly.

The second attempt involved forwarding the email from United that stated that the flight was canceled. This is hard to do when you’re initially filing the claim, but once you’ve filed, you can forward emails to the generic email address with your claim number in the subject line.

Unfortunately, that still wasn’t enough.

What worked

After several rounds of communication with United, I was able to get them to send a statement outlining why the flight was canceled. My phone call yielded absolutely no results, but I was able to submit a request through the “contact us” button at the top of the united.com homepage.

It took them eleven days (as opposed to the posted 72 hours) to respond to my request, but they did send me a statement of cancellation, without any further questions.

In a Microsoft Word document, in case you’re wondering.

Once I got the official document from United on their letterhead and uploaded it on the Card Benefit Services website, that did the trick.

Charge receipt

In order to be eligible for a claim, all or part of the ticket in question must be bought with the card through which you are submitting for reimbursement. Unsurprisingly, they’ll want proof of this in some form or another.

What didn’t work

When I first filed the claim, I uploaded a screen shot of the credit card statement with the airfare charge. Within a couple of weeks, they came back around and stated that the needed a copy of the monthly billing statement that showed the last four digits of my credit card, as well as the charge for the airfare.

What worked

By the time I received this request, my monthly billing statement had closed, so I was able to download the credit card statement from Chase and upload it to their site. I also forwarded the email documenting the initial purchase of the ticket, just for good measure.

Once I got these documents in, they left me alone on this front.

Settlement from carrier

If you are delayed for reasons that are within the airline’s control (mechanical, for example), they may reimburse you for some of your expenses. If that’s the case, you are required to provide proof of what was reimbursed, and the insurance will cover the difference.

In practice, I have no idea how this is enforced, and unfortunately for me at the time (but fortunately when I was submitting the claim later), this wasn’t the case. All that to say that I had no settlement from the carrier to show.

Original itinerary

Or should I say, “orignal” itinerary, if I’m quoting their website directly (scroll back up and you’ll see). I was a little worried about this one, because I had already changed my original flight once due to delays, and my new flight was the one that got canceled.

What worked

My concerns here were unfounded, and in this case, a screen shot of the original itinerary was sufficient.

Delay expense receipts

Naturally, in order to be reimbursed, you have to submit receipts for the expenses incurred. This is probably second nature if you’re traveling for business, but if most of your travel is for leisure, you will want to be careful to save everything in order to save yourself from headaches later.

In this particular case, my only reimbursable expenses were the hotel (all $67.19 of it) and my Uber rides. That said, you’re also allowed to submit for meals, toiletries, medicine, and other “reasonable expenses.”

In hindsight, maybe I missed an opportunity…

What didn’t work

Apparently, the screen shots of my Uber receipts did not go over well, because I received the dreaded email indicating that the receipts provided “did not show the charge for the item(s) claimed.”

What worked

While some clients require that I submit receipts in PDF form (and you can read all about that here), the photograph of my hotel receipt worked just fine here. I forwarded my Uber receipts – the versions with the tip on them – with the claim number in the subject line, and that was enough for the folks at Card Benefit Services.

Multiple payment methods

If you pay for a ticket with points or another form of currency, you are still eligible for trip delay coverage – provided that you pay for the taxes and fees with the card in question. This line item just means that you have to provide proof of all forms of payment before you can be reimbursed.

In this case, my ticket was paid for outright with my Chase card, so I didn’t have to submit anything.

Timeline

Aside from a couple of paperwork submission glitches, which I was expecting, the biggest issue was the amount of time that it took for Card Benefit Services to respond to my requests. While it all eventually got resolved, their promise of being contacted “within five business days” was a little ambitious. Here’s what it actually looked like:

- I submitted my initial claim on June 25th, and received the request for additional information eight calendar days later.

- I submitted the additional paperwork almost immediately, and received the second request for additional information eight calendar days later.

- I finally submitted the last paperwork that they needed, and received the final thumbs-up three weeks later.

United’s slow response to my request for the statement of cancellation caused some delays as well. While that isn’t Card Benefit Services’ fault, it is something to keep in mind if you are in a time crunch to get reimbursed.

All in all, I actually wouldn’t have thought that the timelines were unreasonable if I hadn’t known any better. But their “five business days” statement did feel like a bit of an overpromise.

Final outcome

Once I received the “congrats, we’re reimbursing you” email from Card Benefit Services, I had the choice to receive reimbursement via paper check or direct deposit. I choice the latter option, and once I provided my bank information, I had the money in my account less than 48 hours later.

Not too shabby.

Overall impressions

While the process was a bit of a pain and a bit slower than I would have liked, in the end, I got what I wanted and didn’t have to jump through any major hoops. I imagine that if I had forwarded my initial receipts right away and shown up with a statement from the common carrier in hand, everything would have gotten processed much faster.

So, while I’m not exactly clamoring to get delayed again, it’s nice to know that this is a perk that many cards out there offer – and it’s even nicer to know that it actually works.

Has anyone else used Trip Delay Coverage through Chase or another card provider? How did it go?

We filed a claim through Chase’s Card Benefits eclaim for a severely delayed flight in New Zealand operated by Quantas super discount Jetstar Airline. The claim processing started in February and in May after 20+ different documents were supplied they denied because the airline stated it was lack of personnel, which under the fine print was not a covered reason, cause it wasn’t “technical”. Lesson learned: plenty of escape for insurance to not reimburse, don’t...

We filed a claim through Chase’s Card Benefits eclaim for a severely delayed flight in New Zealand operated by Quantas super discount Jetstar Airline. The claim processing started in February and in May after 20+ different documents were supplied they denied because the airline stated it was lack of personnel, which under the fine print was not a covered reason, cause it wasn’t “technical”. Lesson learned: plenty of escape for insurance to not reimburse, don’t use Chase, don’t fly Jetstar.

Can anybody confirm if travel benefit insurance covers airfare bought through 3rd party? Most of the 3rd parties will use their own credit cards to purchase your plane tickets. Your bank statement will show charges from the travel agency instead of the airlines.

I filed a claim with eclaims form online with card member services for Chase card for their extended warranty coverage for my tv set. It has the standard one year warranty and I bought it with my Chase credit card and the tv quit after two years ten months. The card warranty extends the warranty coverage for up to three years. Card member services people denied my claim the first time and said that I...

I filed a claim with eclaims form online with card member services for Chase card for their extended warranty coverage for my tv set. It has the standard one year warranty and I bought it with my Chase credit card and the tv quit after two years ten months. The card warranty extends the warranty coverage for up to three years. Card member services people denied my claim the first time and said that I need to provide a copy of the Chase card billing (I did) and also a copy of the purchase receipt from BJ's (I did) and it showed the price and date of purchase. Then they told me I had to also provide them an estimate for repair cost and I gave up. I could not find a local tv service shop to give me an estimate for repair. Who repairs tv's today? And they would charge me for an estimate that maybe I would not get reimbursed for anyhow. So they wore me down and I gave up. Too much is demanded and they count on us giving up.

Hi,

I was in Tokyo when Typhoon Hagibis hit on October 12th. My flight back to the states was on October 13th. My flight got cancelled on the 12th prior to the typhoon hitting. I was able to get on a flight on the 14th at 2am so I lucked out in getting home.

I came home and across this blog and saw that I needed an official statement from the airline. I contacted...

Hi,

I was in Tokyo when Typhoon Hagibis hit on October 12th. My flight back to the states was on October 13th. My flight got cancelled on the 12th prior to the typhoon hitting. I was able to get on a flight on the 14th at 2am so I lucked out in getting home.

I came home and across this blog and saw that I needed an official statement from the airline. I contacted Delta through the Contact Us form and got the form that I needed within an hour. I provided everything listed above plus some just to cover all my bases and the only thing I was asked for was the credit card statement reflecting the FX rate. I ended up getting $7 more than I had asked based on the rate. I asked to cover my hotel, lunch and dinner. I had gotten some makeup items but didn't ask for reimbursement on that as it was just added items that I didn't get due to me having to stay another day. I first started this process on October 22nd and I got paid for $263.39 today (November 4th).

Thank you for simplifying the process as to not waste any time. While it may seem like it isn't worth the time if it is less than $250, it really isn't asking for much and took me maybe 15 minutes if that to do this.

Thank you!

I had to cancel a ski trip for myself and three adult children due to sudden medical condition. I filed immediately with card benefit services in Feb, 2022. Since then i have sent in multiple pages of receipts and have made multiple phone calls after very long waits on hold. They insisted I send in a "signed " claim form though nothing like that is on the website. They finall emailed one and I sent...

I had to cancel a ski trip for myself and three adult children due to sudden medical condition. I filed immediately with card benefit services in Feb, 2022. Since then i have sent in multiple pages of receipts and have made multiple phone calls after very long waits on hold. They insisted I send in a "signed " claim form though nothing like that is on the website. They finall emailed one and I sent it back immediately. In early June a representative returned my call 2 days after I called and said all paperwork was in order but they needed to "check with chase that no monies had been paid". I have heard nothing from them since and I checked with Chase and they seemed bewildered that I would get that message from Card Benefit Services but said they had nothing to do with the claim. It is now 5 months and multiple phone calls, email, duplicate documentation sent on their website.

They obviously do not want to settle this claim and hope I will just give up. It is for a significant amount of money for a powder ski trip in Canada. I have been a generally satified Chase sapphire preferred plus all my business purchases were with Chase Credit card for past 20 years and this is my first claim attempt. I guess there is always the legal avenue. Has anyone had to do that? I certainly have no confidence in the cancellation insurance services of Chase! Perhaps explore other cards with far better reputations for settling claims such as Am Express.

I realize this is an old post, but it is still a very helpful one. Has anyone had experience receiving trip delay coverage for a trip booked on a common carrier (in my case Jeju Air) through an online tour agent (Kiwi)? The trip was paid in full with the CSR. Thanks!

Amazingly, two days later after my post above, I get this email:

"We are pleased to inform you that your Trip Cancellation/Interruption Benefit claim has been approved for payment in the amount of $10,000.00. To confirm your preferred payment delivery method, please visit our website by clicking the link below."

Was it intervention by the Chase VIP? The threat to go Small Claims Court? This blog post? Or perhaps just waiting for the slow wheels...

Amazingly, two days later after my post above, I get this email:

"We are pleased to inform you that your Trip Cancellation/Interruption Benefit claim has been approved for payment in the amount of $10,000.00. To confirm your preferred payment delivery method, please visit our website by clicking the link below."

Was it intervention by the Chase VIP? The threat to go Small Claims Court? This blog post? Or perhaps just waiting for the slow wheels of bureaucracy to turn. Whatever the case, I am happy it is finally resolved. I don't think I would have gone to all this trouble for a few hundred dollars and perhaps that is exactly what Card Benefit Services is betting on.

I filed a claim on behalf of my elderly father who has been a Chase customer for more than 25 years. He used his Chase Sapphire card to book a cruise trip along with his wife and grandson costing over $17,000. He refused insurance coverage from American Cruise Lines precisely because he thought he was covered by Chase Sapphire for trip cancellation for medical purposes – at least for $10,000 – as stated in their...

I filed a claim on behalf of my elderly father who has been a Chase customer for more than 25 years. He used his Chase Sapphire card to book a cruise trip along with his wife and grandson costing over $17,000. He refused insurance coverage from American Cruise Lines precisely because he thought he was covered by Chase Sapphire for trip cancellation for medical purposes – at least for $10,000 – as stated in their policy.

Unfortunately, one week before the trip was to begin his cardiologist diagnosed a serious heart problem requiring surgery and ordered that he could not go on the trip. My father cancelled the trip immediately and American Cruise line refused to pay back even a single dime.

I filed a claim on 5/24/2019 with Card Benefit Services (eclaimsline.com) which is the 3rd party that handle claims for Chase. Since then I have submitted more than 10 documents and contacted Card Benefit Services by phone and email numerous times to provide additional data and information to support this claim, including trip costs, doctor’s letter, credit card statements, cruise line denial of coverage, etc. etc. For the last 6 weeks, every time I call, I am told that the matter is “still under review” and that I will hear back in 24-48 hours. This never happens.

I am now concerned that Card Benefit Services is trying to run out the clock on my claim. In the FAQs of the eclaimsline.com website, it says this: “You must submit a completed claim form and supporting documentation within 100 days of the date of the delay.” Aug 31 will be the 100th day since filing the claim. Their strategy seems to be to delay processing until 100 days have passed and then refuse to pay. At this point, my dad, a retired attorney has reached out to a friend who is a regional president with Chase. If this is unsuccessful, I guess we will file a claim in small claims court. Other ideas?

I am absolutely disappointed with Chase claims. I hold a chase sapphire reserve card for the past few years. I booked my round trip tickets using my card with Emirates airlines. When I was in my home country my father passed away which made me to cancel my return trip and rebook a week later, incurring a change fee and the fare difference, all with my Chase card. I thought the loss I incurred will...

I am absolutely disappointed with Chase claims. I hold a chase sapphire reserve card for the past few years. I booked my round trip tickets using my card with Emirates airlines. When I was in my home country my father passed away which made me to cancel my return trip and rebook a week later, incurring a change fee and the fare difference, all with my Chase card. I thought the loss I incurred will be covered under card benefits as listed on their webpage and the PDF available through the web page: https://www.chase.com/card-benefits/sapphirereserve/travel

My change fee was refunded by Emirates. But Chase's claims department denied my claim for the fare difference saying it is an ineligible expense. When I mentioned about how the expense is listed on the website as covered, I was told that the agency who handles the claims are a third party and they don't go by what is on Chase website. I called up Chase customer service, but they denied to help saying they don't handle claims. I feel cheated.

Am I over reacting in this? Does the website not indicate they will cover this expense? Please let me know your thoughts.

I am in process of a claim with Chase for luggage delay. I filed the claim on June 1st and it is now June 27th and I still have not gotten anything back. They did reach out twice in the process to request more information which was immediately provided. The 5 day response time is not accurate. I am currently 7 days in from my last provided info and nothing. I called 2 days ago...

I am in process of a claim with Chase for luggage delay. I filed the claim on June 1st and it is now June 27th and I still have not gotten anything back. They did reach out twice in the process to request more information which was immediately provided. The 5 day response time is not accurate. I am currently 7 days in from my last provided info and nothing. I called 2 days ago and had a extremely rude service agent tell me that it was in process. When I asked for a timeline she said 5 days. Its a joke. I called chase and asked if someone there could help move the claim along. A very nice chase associate tried calling on my behalf. He came back on the line with me and told me that the representative from the claim service did not want to get on the line with me and they were rude to him as well!!!! I asked him to document that in my file so that someone else can see that it was not me being rude to her but her being rude to me and to a chase agent!!!!

I hope i get reimbursed my $477 for my expenses but i am seriously at odds with if this should be advertised as a benefit as it is pulling teeth and very frustrating for customers who have a legit claim and follow all the rules to get the complete run around.

I followed these instructions, step by step. It took two months (mid-March til yesterday), but I got a reimbursement for my overnight hotel stay (flight cancelled due to weather) and a bit of food. Greatly appreciate the information -- it was invaluable.

Hi all,

I have the CSR. I'm wondering if delays cause you to stay overnight and the airline offers you hotel accommodations, do you have to take their offer? For instance maybe you don't want to use the airline's discount hotel or you want one just really close to (or at) the airport. I know the CSR benefit states it covers in excess of what the airline covers, but realistically, do the claims people actually...

Hi all,

I have the CSR. I'm wondering if delays cause you to stay overnight and the airline offers you hotel accommodations, do you have to take their offer? For instance maybe you don't want to use the airline's discount hotel or you want one just really close to (or at) the airport. I know the CSR benefit states it covers in excess of what the airline covers, but realistically, do the claims people actually investigate whether the airline offered you any accommodation?

Thanks!

If you don't have verification from the airline, they won't process your claim. That's just one of the requirements to prevent fraud.

I don't have good experience with them att all.

I have had my bag dellayed. Filed for a Bag Dellayed benefit on December 28th, 2018.

I have received multiple request for additional information and I was providing it to them timely, except airline response... JetAirways from India with pretty bad customer service, as of about two month ago they were supposed to try to contact airline directly or if the airline is not...

I don't have good experience with them att all.

I have had my bag dellayed. Filed for a Bag Dellayed benefit on December 28th, 2018.

I have received multiple request for additional information and I was providing it to them timely, except airline response... JetAirways from India with pretty bad customer service, as of about two month ago they were supposed to try to contact airline directly or if the airline is not responding they are supposed approve the claim due to "irresponsive party". It's a April 4, 2019 (4 mo later) and still nothing. I emailed them today again asking about the status.

I have had another flight delayed for 10 hours and March 4th. I have made a claim for expenses associated with the delayed flight right away, about a month later still asking for additonal documents.

I am planning to switch back to AMEX Platinum Card once my year with Chase Expires.

I remember years ago when I made Dellayed Bag with AMEX, all it took a phone call and I think copy of the receipts...

Chase reimbursement on the other hand is not a good experience. I am switchign back to AMEX Platinum when one year with Reserve expires.

These great benefits with Chase Reserve seem to be just on paper... Just so you understand, travel delay, baggage delay not really Chase Insurance it's outsoursed to Allianze... and it appears they they are too busy to process claims. When it sounds too be too good true....

This is super helpful and saved me lots of hassle. Had MIA to BOS flight that was cancelled due to weather; I spent one night at the MIA airport Marriott and successfully submitted the claim for reimbursement. My experience:

-I requested a "Common Carrier Statement" from American Airlines via their website and had an email reply from them within a few hours. I submitted a .pdf of the email and that worked fine.

-My...

This is super helpful and saved me lots of hassle. Had MIA to BOS flight that was cancelled due to weather; I spent one night at the MIA airport Marriott and successfully submitted the claim for reimbursement. My experience:

-I requested a "Common Carrier Statement" from American Airlines via their website and had an email reply from them within a few hours. I submitted a .pdf of the email and that worked fine.

-My original itinerary was booked 6 months before and the final MIA-BOS leg (that one that was ultimately cancelled) was actually different from the one that I originally booked and thus wasn't in the booking confirmation email that I submitted - this was not a problem at all. I just provided my boarding pass for the cancelled flight and that was sufficient to prove that I had changed the original itinerary.

-The only additional information that was requested from me was a copy of my itinerary or boarding pass for the flight that I was rescheduled on for the next day.

Bottom line - save your boarding passes!

I know this ois an old thread - but wanted to post a followup on my claim experience. We used my wife's hotel associated credit card to pay for the hotel during our delay. For some strange reason the could not seem to understand that she was my wife who was traveling with me. On the fifth enquiry asking about her relationship to me I responded with a rather snarky email telling them they had...

I know this ois an old thread - but wanted to post a followup on my claim experience. We used my wife's hotel associated credit card to pay for the hotel during our delay. For some strange reason the could not seem to understand that she was my wife who was traveling with me. On the fifth enquiry asking about her relationship to me I responded with a rather snarky email telling them they had asked - and I had replied 4 prior times and that if stating that she was my wife of 40 years was not clear enough then please provide and example of the proper wording that would satisfy the question. A week later I received the full amount requested. The whole process took a little over two months (though at least one month was spent going back and forth over the relationship issue).

Thanks for this post. I refunded all my tickets and switched method of payment from SPG AMEX to Chase Visa

Ive used card benefits services for trip delay and rental claims at least a half dozen times. They were always OK with a PDF of emails with UA’s customer service stating the cancelation reason. Also in my experience they are much faster with processing than they were with you and I usually had my check within 30 days of the claim.

The only time I had an issue is when I used ultimate rewards...

Ive used card benefits services for trip delay and rental claims at least a half dozen times. They were always OK with a PDF of emails with UA’s customer service stating the cancelation reason. Also in my experience they are much faster with processing than they were with you and I usually had my check within 30 days of the claim.

The only time I had an issue is when I used ultimate rewards points to book a flight through Chase Travel and so there were no charges on my statement. The adjuster insisted on having me provide something that displayed the last four digits of my card along with the points transaction which the Ultimate Rewards site just would not do. After some back and forth with agents at Chase and Card Benefits I was able to get the website to display the points transaction at the same time as my card number and sent a screen shot which Card Benefits immediately accepted. THe lesson I learned here was never use points to cover the entire cost, leave at least a penny just in case.

@Jud - what airline and what credit card did you file the claim with?

My husband and I were on the last flight out of PHL to ORD back in June. Our flight was cancelled and we immediately booked into the Ritz, took an Uber there, bought a bunch of stuff at Walgreens, ate and drank and Ubered back to PHL the next day. I submitted our expenses with a copy of the flightradar24 page showing the cancellation and they accepted it.

@Andrew - Airport/gate agent lingo for an official document providing the reason for cancelation. You can read more about trip delay coverage here: https://onemileatatime.com/trip-delay-coverage-credit-card/

@Luis - Yes.

@John - Try contacting Card Benefit Services, at eclaimsline.com. Not sure if it'll change your result but at least you are working with the insurance provider directly.

@William and @Boco - you're too kind. I've had a blast in my short time writing here and interacting with you all, and would probably post 5x as much if it weren't for my pesky day job ;)

@Juno - Sounds like a doozy, but it's worth a shot. I don't think that Chase required proof that the hotel was paid for by me, or with the same card that was used to purchase the tickets.

Hi all! Sorry for the delay - apparently, camping in the wilderness and blogging don't always mix! Just wanted to hit a couple of the questions...

@Jordan - It's $500 per person (assuming the tickets were bought on the same card), per claim. I haven't seen any policies capping specific expenses beyond that, but some require you to submit itemized receipts for meals over $50.

I am in mid process of a claim for a delay using Chase's reimbursement. We were flying Qantas from SYD to LAX and transferring to South West flights (using points and companion pass) to the east coast. We were delayed 6.5 hours due to "engineering issues" with their equipment. Card benefit services said the delay must be at least 6 hours in order to qualify for delay benefits. Rescheduled SW flights and when all was...

I am in mid process of a claim for a delay using Chase's reimbursement. We were flying Qantas from SYD to LAX and transferring to South West flights (using points and companion pass) to the east coast. We were delayed 6.5 hours due to "engineering issues" with their equipment. Card benefit services said the delay must be at least 6 hours in order to qualify for delay benefits. Rescheduled SW flights and when all was said and done we ended up paying a second time for the SW flights home. Card benefits told me all" costs associated with rescheduling the SW flights are not covered because that is "trip cancellation" and delayed connections" are not one of the covered reasons. The Qantas customer service agent was borderline rude when asked about reimbursing those costs and told me they would have taken care of us if we were flying Qantas all the way home.

We used electronic (e.g., SW iPhone app) for our boarding passes. I always take screen shots when doing this - but my wife did not. No way to get a copy of a used boarding pass inside the SW app once you take the flight - they magically disappear at some point after they are used. Card Services seemed to accept the screen shots of my boarding passes. However, they asked for copies of my wife's boarding passes (credit card receipts evidently not sufficient). Called SW and they sent me a copy of their records showing my wife boarded the plane - but there's no way to retrieve a copy of the actual boarding pass. I am hoping this will satisfy the claims agent. I'll let you know if this isn't acceptable as evidence to support our claim.

@Steph what is the "Military Excuse" you mentioned in the post?

Experience through Citi on the Premier card for a claim that should have easily been approved left such a bad taste in my mouth. Their benefit administrators wrongfully interpret wording and deny your claim and are very rude to get you to give up. I persisted and got approval that was deemed "in good will", not necessarily them saying the claim was valid, which it was.

What they did was say that even though...

Experience through Citi on the Premier card for a claim that should have easily been approved left such a bad taste in my mouth. Their benefit administrators wrongfully interpret wording and deny your claim and are very rude to get you to give up. I persisted and got approval that was deemed "in good will", not necessarily them saying the claim was valid, which it was.

What they did was say that even though my overall trip was delayed more than 12 hours and required an overnight stay in Chicago, my delay on a common carrier (which they tried to claim was a single plane) from JFK to Chicago was only delayed by 1.5 hours, not 12 hours, so the claim was denied. My 1.5 hour weather delay caused me to miss the last Chicago flight out and get rebooked on the next flight the following day.

So ultimately, weather was the cause of my trip delay. I finally got so frustrated with them trying to say the common carrier meant a single plane that when I reached a higher level supervisor, I asked her if that was true, then why was I not charged four common carrier fares for my round trip flight with a connection? At that point, she approved the claim.

Word of warning

I’ve said this before but...

Trip delay coverage will NOT pay for another flight

We were delayed 12+ hours

Instead of staying in hotel, buying food, etc, I just bought 2 last second one way flights because I had to get home

I submitted claim for around $300/pp x 2 people (can’t remember now)

It would have been cheaper than cabs and food and hotel etc

Chase would not reimburse

I used the Chase Card Benefits (CSP card) to remimburse me for a hotel night and meals a few years ago when a snow storm at home stranded me in Dallas. Like Steph, I tried to submit the airline’s email cancelling my flight as “proof”. Eventually, I figured out that the benefits company required specific communication from the airline.

In AA’s case, go to their Contact Us page and choose “Trip Insurance Verification”as the...

I used the Chase Card Benefits (CSP card) to remimburse me for a hotel night and meals a few years ago when a snow storm at home stranded me in Dallas. Like Steph, I tried to submit the airline’s email cancelling my flight as “proof”. Eventually, I figured out that the benefits company required specific communication from the airline.

In AA’s case, go to their Contact Us page and choose “Trip Insurance Verification”as the topic and “Verify flight cancel/delay” as the subject. https://www.aa.com/contact/forms?topic=TRP#/

It took AA about 3 weeks to respond to me (to be fair, there were a lot of major snowstorms on the east coast that year) and even then it was just a two sentence email stating that flight #xxxx was cancelled due to weather. Once I had that, the claim was processed within days.

I know its by design but I find the requirements around proof of the flight cancellation and payment on your Chase card to be absurd when this is administered through said United branded Chase card.

Yes, per purchased ticket.

Is the limit $500/passenger? So if I'm traveling with my family of 4 and we have a delay, we can be reimbursed up to $2k?

We traveled to Lake Placid from Orlando via Plattsburg on Spirit last year. On the day that we were supposed to fly home, a noreaster snow storm blew through and Spirit cancelled the flight. There was only one flight a day in and out. The next day's flight was cancelled as well. So we incurred two days hotel for 5 of us (3 rooms each night), meals plus toiletries including clean socks and underwear (we...

We traveled to Lake Placid from Orlando via Plattsburg on Spirit last year. On the day that we were supposed to fly home, a noreaster snow storm blew through and Spirit cancelled the flight. There was only one flight a day in and out. The next day's flight was cancelled as well. So we incurred two days hotel for 5 of us (3 rooms each night), meals plus toiletries including clean socks and underwear (we were originally on a two day trip). They reimbursed for everything except the rental car extension (they didn't seem to understand that we were only submitting on the two days of the delay, not the full bill even though we explained that). For five of us, the charges added up to around $1400, so I didn't argue over the extra $40 in rental car fees. The hardest part was getting someone at Sprint to understand that we needed a letter that confirmed they cancelled their only flight back to Orlando from Plattsburg for two days in a row, but had no problem getting the reimbursement once we finally got something from the airline.

I had a situation where my afternoon return flight was canceled and booked another flight with a different airline (Spirit) for later that early evening. And by luck, that early evening flight gets canceled so I ended up taking the last flight out with Southwest.

Since I had to wait at the airport for 6+ hours that turned into 11 hours, I called Chase to see if they covered any expenses due to this delay....

I had a situation where my afternoon return flight was canceled and booked another flight with a different airline (Spirit) for later that early evening. And by luck, that early evening flight gets canceled so I ended up taking the last flight out with Southwest.

Since I had to wait at the airport for 6+ hours that turned into 11 hours, I called Chase to see if they covered any expenses due to this delay. The first person on the phone transferred me to a specialist. She was very nice but kept asking what were the reasons and I said I didn't know as it was not shared or listed as to why.

She proceeded to say that Chase will not cover any expenses. Should I have escalated this further?

My AA flight from Europe was delayed more than 4 hours and our connecting flight with different record locator numbers was cancelled. We had to spend the night in PHL. Complained to AA and the paid us $1200 + hotel cost. And, these were Bus. Class flights that were paid with TY points through Etihad. Point of the story is too always ask if something wrong happens. In the above case with United he may have could gotten better compensation from United.

What's wrong with being a robot?

@Rick, I believe everything you bought except the 400 euro shoes (that you admit that you didn't need) were reasonable. Someone could give good reasons to think that the 400 euro shoes were an abuse pf the policy (albeit an abuse that Amex was willing to accept). The only exception to this that I could think of is if you needed a particularly nice, formal pair of shoes for a business meeting (or wedding or...

@Rick, I believe everything you bought except the 400 euro shoes (that you admit that you didn't need) were reasonable. Someone could give good reasons to think that the 400 euro shoes were an abuse pf the policy (albeit an abuse that Amex was willing to accept). The only exception to this that I could think of is if you needed a particularly nice, formal pair of shoes for a business meeting (or wedding or gala), and because you were traveling you didn't have the opportunity to find more reasonably priced formal shoes.

I had a similar process with Citibank when stranded in San Francisco for one night. After supplying similar information it was immediately approved for the full amount (except tip to taxi driver). It included a night at the Ritz Carlton SF in a Club room and a taxi from Milwaukee to Chicago since that was the only flight we could get. Overall it made a typically stressful event rather enjoyable!

Very helpful post.

However, I agree with a couple of posters that too many blogs (including this one) are happy to read off the list of benefits without actually explaining if the benefits are even feasible to attain.

For example, I was denied a trip delay claim by Citi due to a missed connection, and this was well before the terms officially changed. Suddenly, that benefit went from being worth $200 to costing me time.

This post with accompanying screenshots is very helpful. Thanks Steph!

"I was told by agent to ‘just don’t abuse it.’ " ... and he goes and abuses it...

I once had a delay because of a five hour British ATC failure in the airspace over that part of the world. My flight was grounded at MXP for five hours and arrived too late at JFK to make a connecting flight back to the west coast forcing an expensive overnight stay. The card company denied the claim because I wasn’t able to secure proof of the actual delay from the British ATC even though...

I once had a delay because of a five hour British ATC failure in the airspace over that part of the world. My flight was grounded at MXP for five hours and arrived too late at JFK to make a connecting flight back to the west coast forcing an expensive overnight stay. The card company denied the claim because I wasn’t able to secure proof of the actual delay from the British ATC even though there was documentation to show my flight (and hundreds of others) arrived from EU airports similarly late that day and the media outlets covered the story extensively. After that, I concluded that trip delay coverage was a big gimmick the card companies advertise but don’t have to deliver on. I cancelled the card.

I really enjoy your posts! Very fun and informative. Keep up the great work!

I have spent too much time doing trip delays claims, where if its not $250 or more its not worth it for me. They give you the runarounds and say no 5x before you might get a yes. Its basically insurance so its by design.

Tip: DON’T WAIT to file the claim. We had a large delay on the way to MLE a few years back and decided to try to get reimbursed from Turkish Airlines first. By the time I realized I was getting nowhere the time limit (formerly 30 days; now 60) had passed. Missed out on ~$700 or more of potential reimbursement.

Steph, my AA flight was canceled at CLT due to weather and had to stay over night.

But my ticket was purchased with my Sister's AA miles paid with her CSR card.

My wife's was paid by her AA miles with her CSR card. (Same flight)

However, the hotel was paid under my name.

This would be easier if the hotel was under my wife's name... but would CSR travel delay request under my wife's CSR.. even if it was paid by me?

@Lucky: "In hindsight, maybe I missed an opportunity". You did! When my trip's been interrupted and I know I have a solid case to claim the insurance amount, I aim to max out the limit. This will mean nice meals, staying at a good hotel and maybe even doing some clothes shopping. When my partner missed her connection in DXB due to a late inbound flight, I booked her into the Park Hyatt and she...

@Lucky: "In hindsight, maybe I missed an opportunity". You did! When my trip's been interrupted and I know I have a solid case to claim the insurance amount, I aim to max out the limit. This will mean nice meals, staying at a good hotel and maybe even doing some clothes shopping. When my partner missed her connection in DXB due to a late inbound flight, I booked her into the Park Hyatt and she got about $150 in new clothes reimbursed. When we missed a connection in MNL, we stayed at the nice new airport Marriott and made sure to do dinner at their steak house cause we knew it'd all be covered under the insurance benefit.

Wow. This is where the cards really distinguish themselves. Some providers are just better in terms of ease of using the benefit.

And the bloggers need to do a better job of highlighting the differences in experiences in using benefits with each credit card.

Finally the benefits get watered down or hard to use because asshole gamers are gaming the system to make money from false or incredulous claims. This affects all of us....

Wow. This is where the cards really distinguish themselves. Some providers are just better in terms of ease of using the benefit.

And the bloggers need to do a better job of highlighting the differences in experiences in using benefits with each credit card.

Finally the benefits get watered down or hard to use because asshole gamers are gaming the system to make money from false or incredulous claims. This affects all of us. Just as you would rat out a tax cheat, you should rat out a gamer making false insurance claims as well.

I filed a trip delay claim with Citibank. They replied with a "claim denied" with the reason that I needed to purchase a round trip ticket beginning from my "home" airport. When I asked, they provided a copy of the terms and conditions. The words "round trip" and "home airport" were not to be found. I replied by email and argued my case. After 3 months I was finally reimbursed. Lesson learned: Don't immediately trust the claims department. Keep arguing your case.

I actually didn't have a problem getting the common carrier statement from United a few years back when I had to file one of these. I remember I called and said I had a delay and needed the statement for "insurance purposes". The agent knew exactly what I was referring to and there was the requested email in my inbox the next morning.

Might be a HUCA situation?

Always a treat to read a post by Steph. Besides the helpful content, the jokes and barbs woven in are much appreciated. Please keep posting whenever you can.

I filed a Purchase Protection claim through the same portal last year for a new HP laptop that was damaged when someone spilled water on it. The process was nearly identical, including all of the same delays. I had to contact Card Benefit Services 16 times over the course of 2 months and supply an onerous amount of paperwork. (In addition, I had to visit a computer repair shop in person twice and, when they...

I filed a Purchase Protection claim through the same portal last year for a new HP laptop that was damaged when someone spilled water on it. The process was nearly identical, including all of the same delays. I had to contact Card Benefit Services 16 times over the course of 2 months and supply an onerous amount of paperwork. (In addition, I had to visit a computer repair shop in person twice and, when they couldn't fix it, had to contact HP care 9 times.) All together, the process took around 7-8 hours of my time. With me likewise they repeated the "5 business days" promise only to break it repeatedly. It was almost not worth it for the $700 reimbursement check. For what it's worth, afterwards they sent me a survey asking about my experience. I expressed the same concerns, and explicitly noted that they should not promise a response within 5 days if they cannot live up to that promise. I see my feedback has led to no improvement, not surprisingly.

We made use of the Chase trip delay coverage when my wife was delayed for two days in CLT during a major storm last winter. I agree the process was arduous since they are very particular about what proof they'll accept, but they are fair and generous with what they'll reimburse. They paid out the full $500 covering hotel, Uber rides around the city (not just to/from the airport), all meals including alcohol, and other...

We made use of the Chase trip delay coverage when my wife was delayed for two days in CLT during a major storm last winter. I agree the process was arduous since they are very particular about what proof they'll accept, but they are fair and generous with what they'll reimburse. They paid out the full $500 covering hotel, Uber rides around the city (not just to/from the airport), all meals including alcohol, and other random incidentals. Payment came relatively quickly as a check mailed to the house. This experience has led us to put all flights on the Reserve card just in case we need the protection.

Is there a maximum reimbursable amount for hotels?

I used AmEx's Baggage Delay Protection for my family of 4 on a flight to Europe. I think the policy allowed for $400 per person. These were award seats but I paid taxes with AmEx card. Our bags didn't make connection. So I called AmEx and asked what was definition a 'reasonable purchase' for 'necessities.' I was told by agent to 'just don't abuse it.' So even though I knew our luggage was going to...

I used AmEx's Baggage Delay Protection for my family of 4 on a flight to Europe. I think the policy allowed for $400 per person. These were award seats but I paid taxes with AmEx card. Our bags didn't make connection. So I called AmEx and asked what was definition a 'reasonable purchase' for 'necessities.' I was told by agent to 'just don't abuse it.' So even though I knew our luggage was going to be on the airline's next flight in, I quickly ran up 700-800 Euro in purchases that included toiletries, groceries, a prepaid cell card, and a 400 Euro pair of shoes that I didn't need. Reimbursement process had a few steps but wasn't overly burdensome. Quick reimbursement of all items.

This is a lot to go through for $179, and of course that is by design. Most people will just give up, which is what I have done in the past myself.