The Citi ThankYou program is one of the major transferable points currencies. There are lots of ways to redeem Citi ThankYou points, from transferring them to one of Citi’s airline partners (my preferred use), to redeeming them toward the cost of travel, to redeeming them for gift cards and statement credits.

One common point of confusion is whether you can transfer Citi ThankYou points to others. In this post I wanted to explain the rules associated with that — this includes transferring points to other ThankYou accounts, and transferring ThankYou points to frequent flyer accounts in other peoples’ names.

In this post:

Which credit cards earn Citi ThankYou points?

First for some background on which cards earn ThankYou points (to differentiate this from Citi cards earning American AAdvantage miles, etc.):

- The Citi Strata Premier® Card (review) and Citi Prestige Card (no longer open to new applicants) are the two primary cards earning “full” ThankYou points, which can be transferred to Citi ThankYou airline partners; the Citi Strata Premier Card is especially compelling, and has great bonus categories, a $100 annual hotel credit, and more

- The no annual fee Citi Rewards+® Card (review) earns Citi ThankYou points, but they can only be transferred to Citi ThankYou airline and hotel partners in conjunction with either the Strata Premier or Prestige

- The no annual fee Citi Custom Cash® Card (review) earns Citi ThankYou points, but they can only be transferred to Citi ThankYou airline and hotel partners in conjunction with either the Strata Premier or Prestige

- The no annual fee Citi Double Cash® Card (review) earns Citi ThankYou points, but they can only be transferred to Citi ThankYou airline and hotel partners in conjunction with either the Strata Premier or Prestige; this is one of my favorite cards for everyday spending

Can you transfer Citi ThankYou points to others?

Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou all have different policies when it comes to transferring points to accounts of other members.

In some ways, Citi has the most generous policy. Citi lets you transfer ThankYou points to the ThankYou account of any other ThankYou member. There’s no need for that member to have the same address, to be an authorized user, to be a family member, or anything else. You can transfer your points to virtually anyone with a ThankYou account, as long as you’re not selling or bartering your points.

There are some restrictions to be aware of, though:

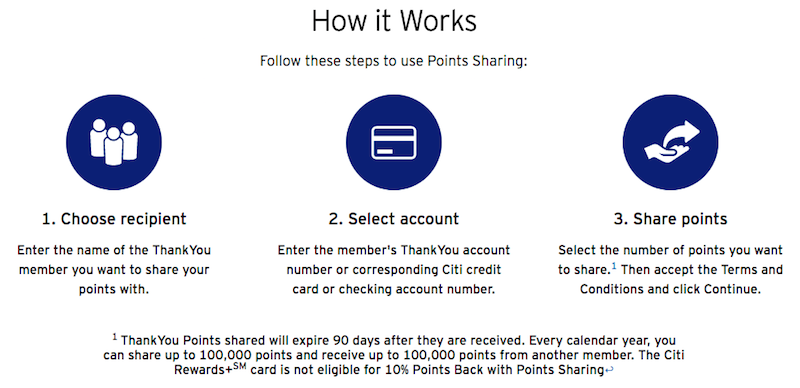

- You can transfer at most 100,000 ThankYou points to another ThankYou member per calendar year (that limit is total, rather than to just one person)

- Each ThankYou member can receive at most 100,000 ThankYou points per calendar year

- Shared points expire 90 days after they’re received, so the member you transfer points to will have a limited amount of time to redeem them; when the member goes to redeem points, those expiring soonest will automatically be pulled first

- The recipient of shared points can’t share those same points with another member

- The Citi Rewards+ Card offers 10% of your points back for the first 100,000 points redeemed every year; sharing points with another member wouldn’t qualify as an eligible activity for these purposes (so you wouldn’t get 10,000 points if you shared 100,000 points with another member)

- You can even transfer Citi ThankYou points earned on cards like the Citi Double Cash Card to others that have cards earning “premium” ThankYou points

Note that the 90 day policy on shared points expiring is different than the 60 day policy on points expiring after an account is closed.

Is there a cost to transfer Citi ThankYou points to others?

Nope, within the limits that exist there’s no cost to transfer Citi ThankYou points to others. You can’t beat free points transfers!

How do you transfer Citi ThankYou points to another member?

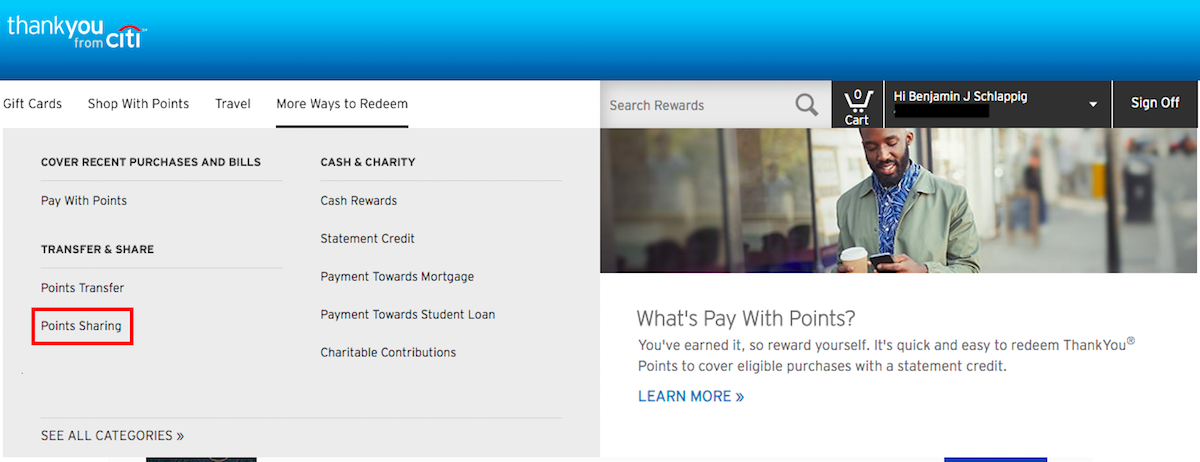

The process of transferring ThankYou points to another member is quite easy. Just log into your ThankYou account, and then along the top column click on “More Ways To Redeem” and then “Points Sharing.”

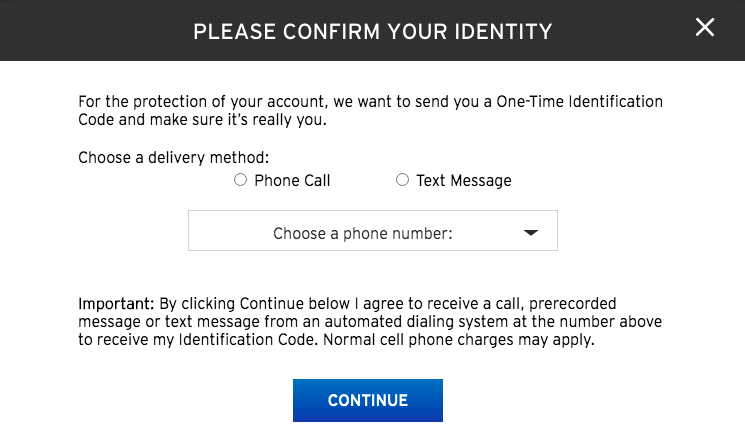

You’ll then typically have to verify your identity, by receiving an identification code by phone or text.

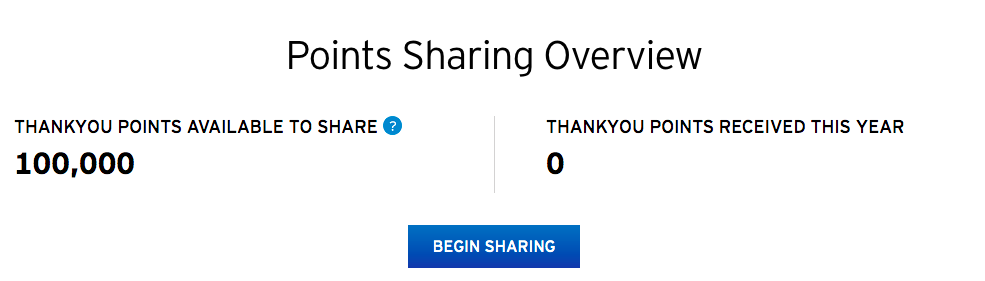

The next page outlines how the process works.

It will also indicate how many points you’ve transferred so far this year, and how many more you can transfer.

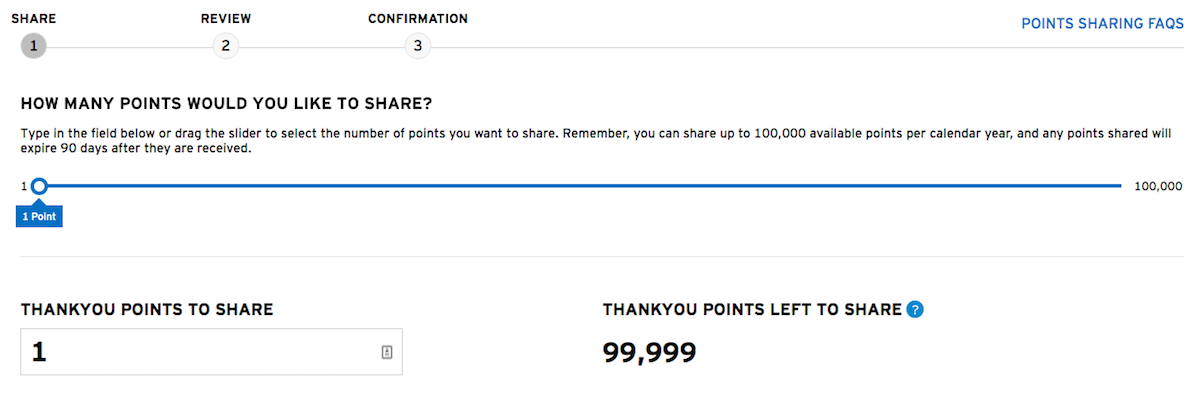

You have the option of sharing exactly as many points as you’d like (you don’t even have to transfer in increments of one thousand).

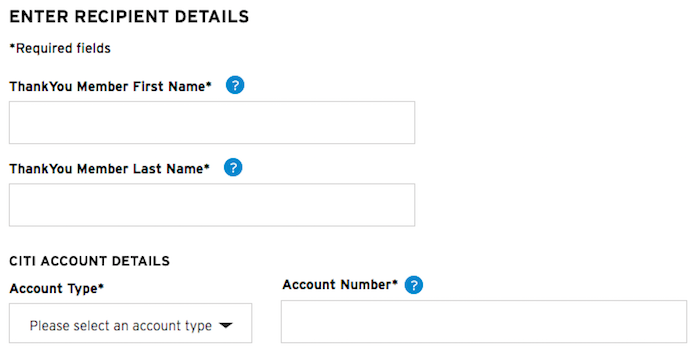

To transfer you’ll need the recipient’s name and account number (either credit card number or ThankYou account number).

From there the process is quick, and the points should transfer instantly.

Can you transfer Citi ThankYou points to someone else’s frequent flyer account?

You can transfer Citi ThankYou points between ThankYou accounts (within the above parameters), but what about transferring ThankYou points into a frequent flyer account of someone other than the account holder?

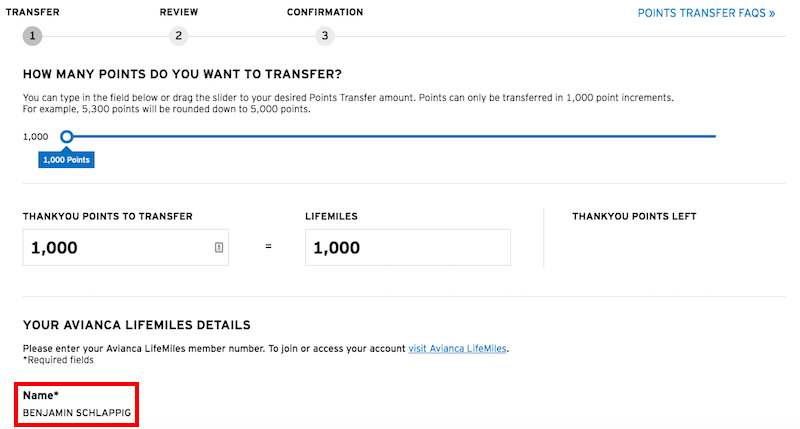

This unfortunately isn’t possible, as you can only transfer ThankYou points to an account in the name of the cardmember. When you go through the process of transferring points to someone else, you’ll see that your name is already filled in, and all you can do is fill in your frequent flyer number.

If you do want to transfer ThankYou points into someone else’s frequent flyer account, you’d want to first transfer points to their ThankYou account, and then they can convert the points to a partner program of their choice.

Should you transfer Citi ThankYou points to someone else?

In many ways, Citi ThankYou has my favorite policy when it comes to the transferability of any of the major points currencies. Being able to transfer 100,000 points per year to any other Citi ThankYou member is awesome.

When can it make sense to take advantage of this feature?

- If transferring points to someone else would allow them to transfer points to a frequent flyer program, and as a result have enough points for a redemption

- If you plan on closing a Citi ThankYou card and don’t know what to do with the points, transferring points to a friend or family member could make sense (as long as they can redeem them quickly)

- If you only have a card like the Citi Rewards+ Card but a friend has the Citi Strata Premier Card, transferring points to them could allow you to transfer those points to a frequent flyer program, which would otherwise not be possible

Bottom line

There are pros and cons to the Citi ThankYou system of sharing and transferring points:

- You can share up to 100K Citi ThankYou points with any other ThankYou member, even if you’re not related, though they do expire after 90 days

- However, you can’t transfer Citi ThankYou points to anyone else’s frequent flyer account

The Citi Double Cash Card is one of my go-to credit cards for everyday spending, so I rack up quite a few ThankYou points. Personally I prefer to transfer these points to ThankYou airline partners, as that allows me to maximize their value. But for those closing down an account or with a smaller balance, transferring to other members could make a lot of sense.

If you’ve transferred Citi ThankYou points to others, what was your experience like? How do you feel about Citi’s policy?

Multiple agents with Citi are telling me I can't transfer shared points to partner airlines/hotels. They also can't point out the "policy" that states why.

I have a Citi Double Cash but my husband has the Citi Premier. I'm planning a trip without my husband and was hoping to book the Choice hotel with his points. He will not be present. I can take his card with me.... we live at the same address.... would checking in be a problem?? Can anyone help? I can transfer TYP to my acct but I noticed that my choice points transfer would be...

I have a Citi Double Cash but my husband has the Citi Premier. I'm planning a trip without my husband and was hoping to book the Choice hotel with his points. He will not be present. I can take his card with me.... we live at the same address.... would checking in be a problem?? Can anyone help? I can transfer TYP to my acct but I noticed that my choice points transfer would be 1,000 TYP = 1,500 Choice hotel points whereas 1,000 TYP with premier card = 2,000 Choice hotel points when transferred...... SOS

Ben - a person can’t transfer Custom Cash points with only that card, but if they also have either/both a Rewards+ or Double Cash card can they combine the CC with either/both of those & then transfer (w/o a Prestige or Premier)? Thank you

I called citi and they said you can transfer custom cash points to double cash.

Another point to keep in mind is that you cannot transfer thankyou points earned from custom cash spending to another user.

One thing to consider before closing your Citi Premier or Prestige is that you won’t be able to transfer the points to any Air or Hotel partners after closing since you need an active TY account even though you have 90 days. You can only redeem TY points for a gift card in those 90 days. I had almost 70k points at account closing and was waiting for a transfer bonus thinking I have 90...

One thing to consider before closing your Citi Premier or Prestige is that you won’t be able to transfer the points to any Air or Hotel partners after closing since you need an active TY account even though you have 90 days. You can only redeem TY points for a gift card in those 90 days. I had almost 70k points at account closing and was waiting for a transfer bonus thinking I have 90 days to transfer but couldn’t and even after talking to multiple citi reps, I couldn’t transferred my points to airlines so I reopened my account and then transferred the points.