JetBlue TrueBlue has just rolled out its newest promotion on purchased points. The program has gotten much more aggressive with these sales in recent times. This has the potential to be a good deal, so let’s cover the details.

In this post:

Promotion on buying JetBlue TrueBlue points

Through Monday, June 9, 2025, JetBlue TrueBlue is offering a bonus on purchased points. Different accounts may be targeted for different offers. You’ll have to log into your TrueBlue account to see what you’re eligible for. The highest I’ve seen is a 125% bonus, which kicks in as long as you buy at least 10,000 points in one transaction (pre-bonus).

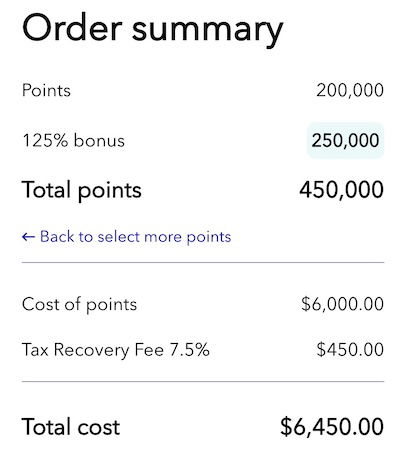

JetBlue lets you purchase up to 200,000 points per calendar year, before any bonuses. If you were eligible for a 125% bonus, you could purchase a total of 450,000 points (including 250,000 bonus points) for $6,450, which is a cost of 1.43 cents per point.

Is buying JetBlue TrueBlue points worth it?

Selling points can be huge business for loyalty programs. Many loyalty programs generate tens of millions of dollars in revenue annually by selling points directly to consumers. This can be a win-win for both programs and customers.

But generally speaking, that’s not something that works too well for revenue based frequent flyer programs. Now, there are still some situations where this could make sense, so let’s consider a couple of scenarios.

If you’re redeeming for travel on JetBlue, each TrueBlue point will typically get you at most 1.5 cents toward the cost of a JetBlue ticket, and that’s on the very high end. Personally I value TrueBlue points at 1.3 cents each. So you’re not really going to come out too far ahead here, if at all, by buying points and then redeeming toward a JetBlue fare.

One other thing to keep in mind is that JetBlue TrueBlue has gotten much better about adding redemptions on partner airlines in recent times, including on Hawaiian Airlines, Qatar Airways, TAP Air Portugal, and Japan Airlines.

There are some good deals to be had on partners, particularly on Japan Airlines and Qatar Airways. For example, a one-way business class award from the United States to Japan starts at 64,000 points, while a one-way business class award from the United States to Qatar starts at 70,000 points.

At this acquisition rate, that’s quite a good deal. The catch is that award availability can be tough to come by, and on top of that, connections will cost you extra. Still, at least there are now some circumstances where buying TrueBlue points could be justifiable, which I’d say wasn’t the case before.

Furthermore, for whatever reason, JetBlue TrueBlue seems to have access to more Qatar Airways award space than American AAdvantage, which is another reason to consider accruing TrueBlue points.

Bottom line

JetBlue is selling TrueBlue points with up to a 125% bonus, an opportunity to buy points for as little as 1.43 cents each. I’d only buy JetBlue points with a specific use in mind. There’s value to be had in some situations, such as if you have a particular Japan Airlines or Qatar Airways award you want to book, and there’s availability.

Anyone plan on buying JetBlue TrueBlue points with a bonus?

There are currently no responses to this story.

Be the first to respond.