For the most part, business credit cards didn’t used to be as rewarding as personal credit cards. However, over the past several years that trend has changed significantly. Presumably this is because card issuers see the amount of potential in this space, especially since a lot of businesses put a significant amount of spending on credit cards.

For those new to business credit cards, picking the right product can be a daunting task. In this post I wanted to share the thought process I recommend going through in deciding which business credit card to get. There are quite a few factors to consider, so let me address a few of those points.

In this post:

Do you want to earn points or cash?

In general, you’ll be rewarded for your business spending in one of two ways — either with cash back, or with some sort of points currency. I’d say this is probably the biggest thing to decide upfront, because these are obviously very different ways of getting rewarded.

Some businesses like earning cash back that they can put back into their business. Meanwhile others prefer earning points rewards, either so they can use those points to pay for some business travel they’d take anyway, or to actually take the time to plan a great vacation.

For example, if you want to earn cash back, it’s tough to beat the Capital One Spark Cash Plus (review), which offers 2% cash back on all purchases, with no caps. In conjunction with other Capital One credit cards, like the Capital One Venture Rewards Credit Card (review), rewards can even be converted into Capital One miles.

If you are going to earn a points currency through credit card spending, I highly recommend using a card that accrues a transferable points currency. These are points that give you a lot of flexibility, as they can typically be transferred to a variety of airline and hotel partners, or in some cases can even be redeemed toward the cost of a travel purchase.

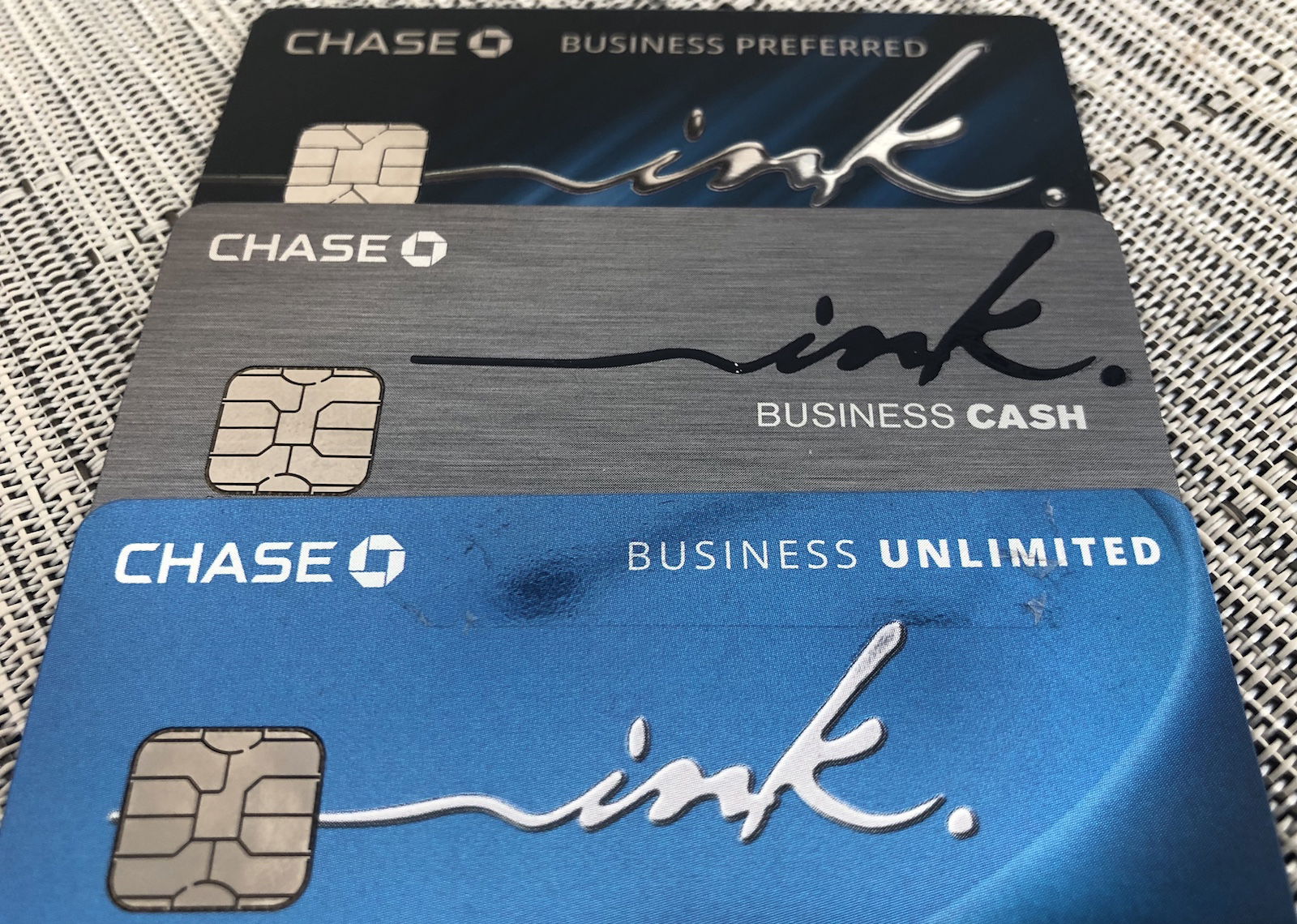

For example, the Ink Business Preferred® Credit Card (review) has a generally great value proposition, and offers points that can be transferred to about a dozen airline or hotel partners through Ultimate Rewards, or can be redeemed for 1.25 cents each toward a travel purchase through the Chase Travel Portal.

Alternatively, the Capital One Spark Miles for Business (review) and Capital One Venture X Business (review) offer 2x Capital One miles per dollar spent. Capital One miles can be redeemed for one cent each toward the cost of a travel purchase, or can be transferred to over a dozen airline and hotel partners, mostly at a 1:1 ratio.

Are you willing to pay an annual fee?

Once you’ve decided how you want to be rewarded, the next step is deciding if you’re willing to get a credit card with an annual fee. I know a lot of people are hesitant to get cards with annual fees, though if you spend any sort of significant amount on credit cards, I’d highly recommend it.

Why? Cards with annual fees are likely to have much bigger welcome bonuses (which can offset annual fees), are more likely to have no foreign transaction fees, and are more likely to have better bonus categories (and earn you more points or cash back), etc.

But don’t worry, even if you’re not willing to pay an annual fee, there are still some good options out there. For example, The Blue Business® Plus Credit Card from American Express (review) has no annual fee (Rates & Fees) and offers 2x Membership Rewards points on the first $50,000 spent every calendar year (1x after that). This makes it one of the best cards for everyday spending.

As an alternative, the Capital One Spark Cash Select (review) has no annual fee and offers 1.5% cash back, all with no foreign transaction fees. This is probably the best “one size fits all” no annual fee business travel rewards card that also has no foreign transaction fees.

If you’re looking for cash back, the no annual fee Ink Business Unlimited® Credit Card (review) offers 1.5% cash back (though you can potentially do better with that card — more on that below).

What categories do you spend most in?

Credit cards offer bonus categories, where you can earn 2-5x points for spending in select categories. Getting a credit card that has bonus categories that coincide with your business’ spending patterns can make a huge difference.

To give some examples of cards that offer big bonus categories on spending:

- The Ink Business Preferred® Credit Card has a $95 annual fee and offers 3x points on travel, shipping purchases, internet, cable, and phone services, and advertising purchases with social media sites and search engines (on the first $150,000 in combined purchases per account anniversary year)

- The Ink Business Cash® Credit Card (review) has no annual fee and offers 5x points on office supply stores, internet, cable, and phone services, and 2x points on gas stations and restaurants (on the first $25,000 in combined purchases per account anniversary year)

- The American Express® Business Gold Card (review) has a $375 annual fee (Rates & Fees) and earns 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. You will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Categories include:

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

In my opinion, those are the three business cards with the best bonus categories, though as you can see, there are potentially significant differences between them.

Spend a lot on dining? One card offers 4x points in that category, while the others offer 1x points. Spend a lot at office supply stores? One card offers 5x points in that category, while the others offer 1x points.

Are you willing to get multiple cards?

I know a lot of people are hesitant to get more than one credit card, even though I think that’s a big missed opportunity. So when considering which business credit card is best, I’d recommend trying to decide whether you’re comfortable getting more than one card or not.

This can impact which card makes the most sense, since if you’re getting just one card, you’re going to want for it to be really well-rounded.

But if you’re willing to get two cards, there are so many more opportunities. For example:

- If you’re thinking of getting the Ink Business Preferred® Credit Card for the no foreign transaction fees, airline and hotel transfer partners, 3x points in select categories, cell phone protection plan, etc., there’s huge value to complementing that with the Ink Business Unlimited® Credit Card, which offers 1.5x points on all purchases; then you could use the Ink Preferred for the 3x points categories, and the Ink Unlimited for all non-bonused purchases so you’re earning 1.5x points per dollar spent, and then you can pool points

- Similarly, if you’re thinking of getting the American Express® Business Gold Card, I’d recommend complementing that with The Blue Business® Plus Credit Card from American Express; you can take advantage of the 4x points categories on the Gold Card, and then put your first $50,000 of spending every calendar year that wouldn’t be eligible for a bonus on the Blue Business Plus, so you earn 2x points, and then you could pool points

Do perks matter to you?

So far the focus has been on maximizing the points you can earn with your business credit card, and that’s for good reason, since that’s where you’ll get the most value.

However, some businesses may be focused on getting cards with perks instead. This could come in a few different forms. For example:

- The Business Platinum Card® from American Express (review) has a $695 annual fee (Rates & Fees) and offers a $200 annual airline fee credit, access to Amex Centurion Lounges, a Priority Pass membership, access to Delta Sky Club® when flying Delta same day, Gold elite status, and much more (Enrollment is required for select benefits)

- The Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, and Ink Business Unlimited® Credit Card, all offer primary collision damage waiver coverage on car rentals when renting for business purposes

- The Ink Business Preferred® Credit Card offers an incredible cell phone protection plan

- Depending on the industry you are in and where you may have to travel, it could be worth considering a card with no foreign transaction fees

These are all perks that everyone is going to value differently, so you need to decide what’s most important for your business.

Do you need credit card financing?

Whether we’re talking personal or business credit cards, in general, I recommend only using credit cards if you’re going to be able to pay off your balance in full each month. While you can finance credit card charges, the interest rates are typically very high, and will more than negate any rewards you might earn.

However, some businesses are growing and could use some financing, in which case there are some credit cards offering 0% financing as an introductory offer. If that’s something that could be useful to you, that’s not a bad option.

- Earn 5% Cash Back at office supply stores

- Earn 5% Cash Back on internet, cable TV, mobile phones, and landlines

- Car Rental Coverage

- $0

- Earn unlimited 1.5% cash back on all purchases

- Car Rental Coverage

- Extended Warranty Protection

- $0

- 2% cash back up to $50k then 1%

- Access to Amex Offers

- No annual fee

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

In a bind that could be a useful feature to take advantage of. Just make sure you pay that off before the rates go up.

Which business card is best?

As you can see, there are lots of different factors to consider here, and there’s no “one size fits all” answer. However, for someone just getting started with credit cards, I’d say the following are my general thoughts on the best place to start:

- If you want to earn cash back for your business, get the Capital One Spark Cash Plus; the card offers unlimited 2% cash back with no foreign transaction fees, plus a $150 bonus when you spend at least $150,000 on the card per year, and these rewards can even be converted into Capital One miles

- If you want to earn points and want to take advantage of bonus categories, get the Ink Business Preferred® Credit Card; the card offers 3x points in select categories, and offers car rental coverage, cell phone protection, and more

- If you want to earn points and want a card that’s ideal for everyday spending, consider the Capital One Venture X Business (review); the card offers 2x miles on all purchases, and has lots of perks that help offset the annual fee

- If you’re put off my annual fees, pick up The Blue Business® Plus Credit Card from American Express; the card offers 2x Membership Rewards points on the first $50,000 spent annually (1x after that), and I value each point at 1.7 cents, meaning I think the return is worth 3.4%

Bottom line

There are so many great business credit cards nowadays, so there’s no “one size fits all” answer as to which card is best. As outlined above, there are certainly some cards that are better than others, and also some cards that just about anyone can’t go wrong with, in my opinion.

Personally I think the Capital One Spark Cash Plus is a particularly compelling cash back option, while I think the Ink Business Preferred® Credit Card and Capital One Venture X Business are particularly compelling points options.

Ultimately which card is best comes down to what you value most — is it the best card bonus categories, perks, financing, or something else?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: American Express® Business Gold Card (Rates & Fees), The Blue Business® Plus Credit Card from American Express (Rates & Fees), and The Business Platinum® Card from American Express (Rates & Fees).

there are many cards out there from other banks that are not mentioned...