Figuring out how to value frequent flyer miles is tricky business. Most people have a vague concept of what a mile is worth to them, but if you press them on it, they don’t really know how they arrived at that number. Worse yet, if you start to question them about how they earn or redeem miles, their past behavior is likely to tell a very different story.

I’m not going to tell you how you should value your miles, and honestly, nobody else can tell you that either. (Though you can see how Ben values his miles here.) Last year I wrote a detailed series about how to determine the value of your miles, but there have been lots of questions lately as to how to know whether or not something is a good deal, so it seems a refresher is in order.

By examining how you earn and spend miles, we can hopefully establish some bounds around where your real valuation lies.

The idea here is to calculate the redemption value of a couple of awards and then analyze what this behavior says about how you value your miles.

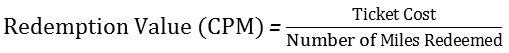

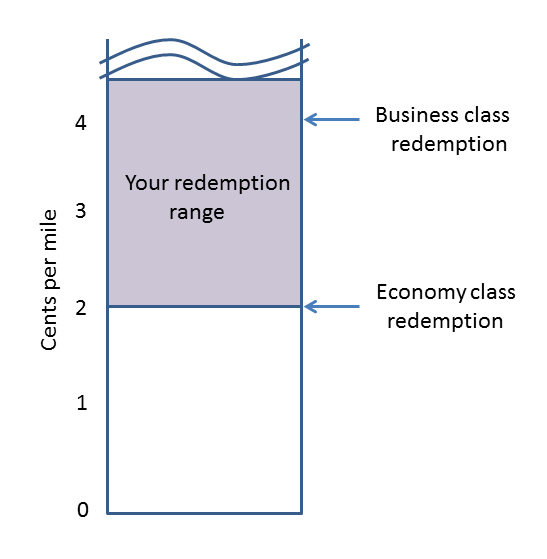

Here’s the formula we’ll use:

In general, a higher redemption value is better than a lower one, because that means you were able to replace a lot of cash with each mile.

The CPM then is a figure of merit for just about every redemption imaginable. You can use it to calculate how much cash your award replaced on anything you redeem your miles for, be it travel or toasters.

- If you redeem 25,000 miles for a $500 domestic economy ticket, you redeemed your miles at 2 cents per mile (CPM)

- If you redeem 120,000 miles for a $4,800 international business class ticket, you would have gotten 4 CPM

Neither of those redemptions is right or wrong, but they do tell us something about how you value miles.

Look at it this way:

The range of redemption values is obviously huge so there’s no real upper end to the redemption graph. On the top end, I’ve personally redeemed around the 16 CPM range for a business class award that had multiple stops. On the low end, you can certainly redeem miles for far less than 1 cent, like if you choose that toaster, for example.

So you redeemed for a business class award at 4 CPM, but you also made an economy booking at 2 CPM. Clearly you’re willing to take 2 cents for each of your miles — the fact that you got 4 cents once is just a bonus.

But this just tells us what you’re willing to accept from someone (the airline in this case) who wants to buy your miles from you. You accepted 2 cents, but you might have accepted less.

Would you really buy that ticket?

At this point, some of you are no doubt saying to yourself, I would never redeem for a domestic economy award, so I’m going to say that I value my miles at 4 cents each.

The problem is that you might have behaved differently if you didn’t have the miles and were forced to pay cash for that business class seat. Would you really have paid $4,800 for it? If so, you can stop reading here, knowing that you do indeed value your miles at 4 cents.

For the rest of us, we might end up paying for economy instead. Or heck, some of us might not even take the trip. That means that we don’t actually value our miles at 4 cents because when push comes to shove and we’re asked to pony up the price in cash, we chicken out and cry Uncle.

Are you really prepared to pay cash for this?

Are you really prepared to pay cash for this?If that’s the case, then all we know is that you’re willing to accept a 4 CPM redemption of your miles. You can’t value them at more than that or else you wouldn’t have booked the award, but you may in fact well value them quite a bit lower.

By determining if you are ready, willing, and able to book exactly the same trip using cash, you can determine the most you could value a given mile or point.

If you want more analysis on how to determine your redemption value, see this post.

It is a commonly held belief that miles and points are free to obtain.

Some people think that the airline, the credit card, or maybe even some shopping portal just gave them the miles, so therefore they don’t come with a cost. Even though it may seem like it, most of these miles aren’t really free. They either took some effort to obtain or there was a choice to earn cash instead, so there was a trade-off. The fact that you chose to earn miles instead of cash — or not at all — says a lot about how you value your miles.

Truth be told, this is probably what leads to sub-par award redemptions. It’s like asking if money grew on trees, would you spend it differently?

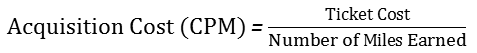

Consider these five ways to earn miles:

- Purchasing miles

- Mileage running (very rare these days)

- Credit card spending (excluding generous sign-up bonuses)

- Doing “silly stuff” (portals, surveys, etc.)

- Normal flying

Regardless of the method, each mile earned has an acquisition cost, be it in time, money, opportunity cost, or the actual purchase price of a mile:

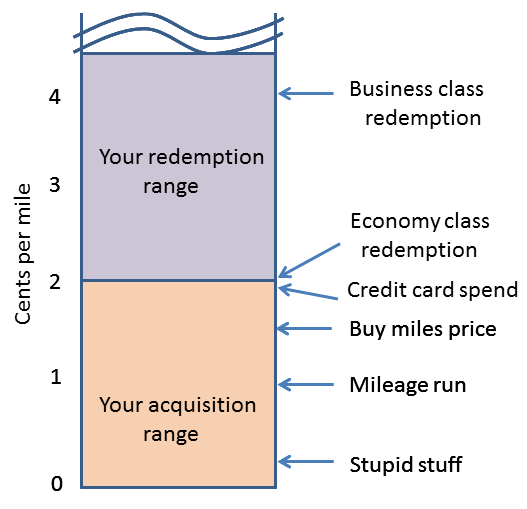

Once you know your acquisition cost, you can add that data to the graph we made earlier.

Although the graph sort of doesn’t have an upper bound because you can sometimes get some crazy high redemption values, the lower bound is 0 because nobody pays you to take miles. At least not normally.

Interestingly, the most expensive miles in your frequent flyer account may have come from credit card spending — miles you probably thought were free. (Again, I’m not counting sign-up bonuses).

Thinking about how much time and money you put into earning miles can give you a lower bound on how you value them — you clearly value them at more than your paid to acquire them, or you wouldn’t have acquired them in the first place.

See this post for more details on how to determine the acquisition cost of each method.

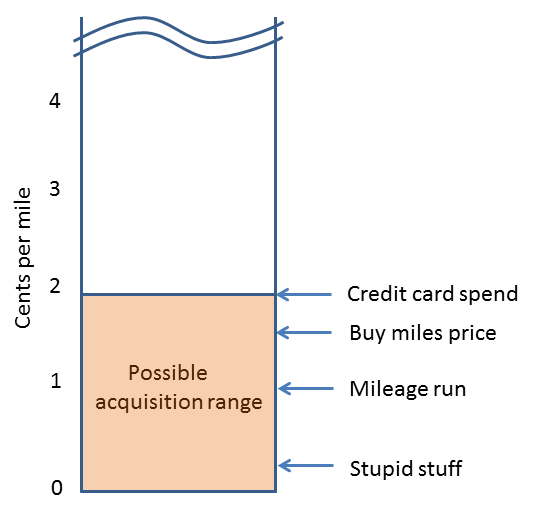

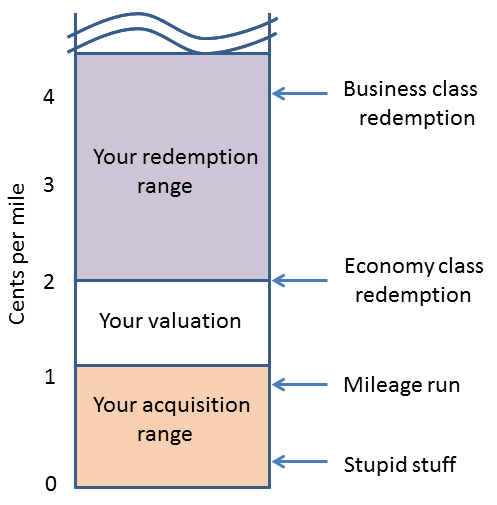

Prior to now, I’ve talked about redeeming and earning separately in order to develop the framework. Now let’s put them together.

The lower bound of the redemption range was determined by the lowest rate at which you were willing to redeem miles. In the example, that turned out to be 2 cents per mile (CPM) based on the economy ticket. The upper bound on the acquisition range was then the highest price you were willing to pay for a mile. That was also 2 cents since you were using a mileage earning credit card instead of a cashback card.

Well, if you’re willing to redeem miles as low as 2 cents, and you’re willing to buy miles at 2 cents, then you must therefore value your miles at exactly 2 cents. There’s no middle ground. There’s no wiggle room. There’s no range of possibilities. Based on your hypothetical behavior that we assumed for this example, your personal mileage valuation is 2 cents. End of story.

Buying and selling miles at the same rate doesn’t make a lot of sense, plain and simple, but a lot of people do it.

You want to have a gap between the rate at which you earn and redeem. That means that if you are ready, willing, and able to pay for premium cabin travel, then you may well value miles at well above 2 cents each. That’s great. But that means that you should not be using miles for lower value redemptions.

If you’re willing to accept a 2 cent or less redemption, you should want to be earning miles at much less than that. That means most of the purchase mile opportunities are out the window, and you should even think long and hard about whether you should be putting regular everyday spend on a mileage earning credit card after you’ve met the minimum spend.

You can’t have it both ways.

In other words, no matter whether you like to redeem for high CPM awards or low, aim for a gap between the rate at which you buy and sell:

Knowing this number will guide your mileage redemptions, and help you focus on the acquisition opportunities that make sense for your travel goals. There are trade-offs to consider, and having a plan for your miles will help you to be as efficient as possible.

See this post for more about determining your valuation.

Bottom Line

Valuing your miles is a very subjective process. Everybody has different opportunities to earn miles and different preferences for redeeming them and that will influence their personal valuations. Those valuations may also vary over time as earning and redemption patterns change, or as your pile of miles grows larger and larger.

The most important rule is that you want to get more value out of redeeming them you paid to acquire them. I know, that seems utterly obvious, but you might be surprised at how many people violate that premise without even realizing it. Just as with investing, the idea is to have a plan and stick with it.

How do you determine the value of a mile?

I agree with you Donna. It used to be *much* easier to find "front of the plane" "Saver" rewards. These days - my preferred airline is Delta - and my preferred hub is Atlanta (I fly out of JAX). So you can pretty much forget about anything approaching the old Saver rewards in terms of miles. I'm looking at perhaps 200k miles minimum RT to Europe or Asia. Note that I could get "cheaper" flights...

I agree with you Donna. It used to be *much* easier to find "front of the plane" "Saver" rewards. These days - my preferred airline is Delta - and my preferred hub is Atlanta (I fly out of JAX). So you can pretty much forget about anything approaching the old Saver rewards in terms of miles. I'm looking at perhaps 200k miles minimum RT to Europe or Asia. Note that I could get "cheaper" flights hubbing through another city. Like Detroit. Or JFK. Or flying 2 stops instead of 1. But I'm at an age/point in life where I want to go exactly how I want to go. Note that one advantage of Atlanta to me is it has numerous flights to JAX daily - whereas other hub airports might have only 1 or 2. So I'm often looking at connections through those hubs that are super short - or super long. Nothing that's "just right".

I thought Travis' analysis was really good. I had been starting to think along the lines he suggested a while back. And will probably modify my behavior. First to go will be my United Visa card. Which I don't use very often. Only for Costco and a couple of doctors these days. Think I'll be better off with a cash back card. Perhaps the Fidelity 2% card. I only have a few UA miles left. Not enough for much of anything. Wonder if anyone is thinking of doing the same/similar?

@Zym -- your math is wrong as your acquisition cost is at least 2% since you can always get 2% hard cash from the fee-free Citi "double cash back card": https://www.nerdwallet.com/blog/credit-cards/citi-double-cash-credit-card-review/ [limited to US expenditures given the thievery of a 3% foreign purchases fee].

@Donna -- agree. My last American miles redemption was to Europe (155,000 miles) and had to both shorten my vacation by one day and pay $885.30 in cash to AA since...

@Zym -- your math is wrong as your acquisition cost is at least 2% since you can always get 2% hard cash from the fee-free Citi "double cash back card": https://www.nerdwallet.com/blog/credit-cards/citi-double-cash-credit-card-review/ [limited to US expenditures given the thievery of a 3% foreign purchases fee].

@Donna -- agree. My last American miles redemption was to Europe (155,000 miles) and had to both shorten my vacation by one day and pay $885.30 in cash to AA since they only showed availability on BA (wonder why!) and not on the exact dates I have off. Based on the cost for the same exact flights, even on my preferred dates, at the same moment (including $400 AARP discount) I only got 1.89 cent of value per AAdvantage mile used, which seems to be typical after the devaluations and the new business class pricing strategy.

Bottom line: if over the last years I had been using a Citi Double Cash Back Card instead of the AAdvantage one for my regular spending, I would have both saved money and had an extra day of vacation.

Lesson learned: no more Citi AAdvantage card for me (cash is king!)

I love this guide, Travis. A very rational, disciplined approach to valuation. Sometimes I look at bloggers and travelers who have valuations that are completely unreasonable or out of this world.

In addition, another factor is how much OTHER people value points. There is a black market. If you overvalue, or undervalue your points, they can be up for grabs.

Those international business class redemptions for 120,000 miles are becoming very scarce to the places I wish to travel. Clearly, no matter how you do the math, the lack of SAAver awards has forced the value of a mile down, down, down.....

I'm starting to shift my focus toward hotel points and away from the airlines.

Along these lines, I had a funny situation related to points valuations when I traveled to Nice, France recently.

I told my girlfriend we were going to Nice and that we were going to stay in an amazing Hyatt with Diamond status. She got excited. Then I went to go look to book it. It was 25,000 points. That's a lot of points, I thought, but for a $500 room, why not!? Then I looked...

Along these lines, I had a funny situation related to points valuations when I traveled to Nice, France recently.

I told my girlfriend we were going to Nice and that we were going to stay in an amazing Hyatt with Diamond status. She got excited. Then I went to go look to book it. It was 25,000 points. That's a lot of points, I thought, but for a $500 room, why not!? Then I looked at the rates -- they had just had a terrorist attack and rooms were only $250.

I started to change my thinking. Only a penny a point for Chase UR?! That's crazy. I can't redeem Hyatt points like that. So I should pay cash. A much better deal with cash.

Then I thought about it some more. The Chase points I obtained without incurring any out of pocket cost -- I got them through negative cost MS. Paying $250/night would be pretty painful.

But maybe that's how much rooms in Nice cost, I thought.

Then I found a breakfast inclusive rate at the AC Hotel Nice (basically a Marriott version of a Holiday Inn) for $92/night. I could save $640 cash and spend that money on other aspects of the trip, like meals out. So I did the AC Hotel. No ocean view, not a lavish palace hotel. My girlfriend checks in, she seems happy.

A day later, she says, a bit mockingly: "I thought you wanted to come here so you can use up all your points?!" She had a good point.

Then I look at my credit card statement later. I have a $370 charge from the AC. (That's the room rate multiplied by four nights.) It stung a little. I have all these points, which I got FOR FREE, and here I am PAYING hundreds of dollars of my own post-tax hard-earned money to get a hotel. It felt like there was no way to win.

After that, we flew to Mallorca and stayed at the Park Hyatt. The room rates were 1,000 euros/night, and we paid 20,000 Hyatt points instead, getting "5 cents a point" (sort of). As for my girlfriend, she really enjoyed the Park Hyatt Mallorca.

For me, I think the key part of this is the acquisition cost. Then it is simply looking at whatever redemption you use miles for and decide if it is a good value or not. For instance, if my acquisition cost is 1.5 cents/mile, and I redeem for a biz award at 115K, then I just 'paid' $1725 for the ticket. Is that a good value for a N. America/Europe biz round-trip? Maybe - it...

For me, I think the key part of this is the acquisition cost. Then it is simply looking at whatever redemption you use miles for and decide if it is a good value or not. For instance, if my acquisition cost is 1.5 cents/mile, and I redeem for a biz award at 115K, then I just 'paid' $1725 for the ticket. Is that a good value for a N. America/Europe biz round-trip? Maybe - it is up to the individual. Generally, I would say yes. For me, collecting miles allows me to travel in premium cabins at a discount.

And remember that the opportunity cost of acquisition via CC spend is always 2CPM because you are foregoing 2% cashback.

Andyandy

Travis, I truly enjoyed reading your analysis. However, you should probably mention that your discussion is largely under the assumption of market efficiency.

Now, at least over her in Europe, this is not the case. There are routes with intense competition and others with a monopoly situation. Let's compare (a) ZRH-DUS and (b) ZRH-LUX or -BRU. Route (a) is operated by three airlines (AB, LX, EW a with LX and EW both part of the...

Travis, I truly enjoyed reading your analysis. However, you should probably mention that your discussion is largely under the assumption of market efficiency.

Now, at least over her in Europe, this is not the case. There are routes with intense competition and others with a monopoly situation. Let's compare (a) ZRH-DUS and (b) ZRH-LUX or -BRU. Route (a) is operated by three airlines (AB, LX, EW a with LX and EW both part of the LH group) and also enjoys a train connection which takes slightly longer than the flight, but is well doable. Route (b) is the virtually distance, but operated exclusively by LX (not even their group partner SN operates) and train connections take a full day! The result is that (a) sells for about 200 USD rt (cheapest eco), 300 USD (mid tier), 500 USD (flex eco) and 800 USD (business) - which represents a liquid market. On (b) however, the fares are about 800 USD (cheapest), 900 USD (mid), 1400 USD (eco flex) and 800 USD (biz; not typo!). Clearly no market situation, but a monopoly. The biz anomaly on (b) can be explained that it is mainly used by civil servants not allowed to fly business even if it's cheaper ...

But back to the value of miles: Obviously (a) and (b) earn the same mileage and redemption ticket come at the same price expressed in miles. The economical behaviour is the pay the ticket cash on (a), but redeem miles on (b).

TLDR. But this is very FMesque.

Nice.

@Kieran -- Sorry to disappoint you, but what your comment betrays is your cluelessness. I have no problem with this take on the "value" of miles, which is based on correct math sprinkled with the inherent subjectivity of deciding whether paying with cash or points would be better, the result of which deliberation gives an indication of how much one thinks a mile is worth...

G'day.

@Kieran +1

The buy miles price really should be *above* the credit card spending price. The credit card acquisition cost of an airline mile is probably around 2 cents depending on exactly what kind of spend we're talking about. Most programs will charge much more than that if you want to buy miles.

Let's do a simple example using Delta miles: For a purchase that doesn't qualify for any bonus category, let's assume that your choices are...

The buy miles price really should be *above* the credit card spending price. The credit card acquisition cost of an airline mile is probably around 2 cents depending on exactly what kind of spend we're talking about. Most programs will charge much more than that if you want to buy miles.

Let's do a simple example using Delta miles: For a purchase that doesn't qualify for any bonus category, let's assume that your choices are to either use a Delta AmEx and earn 1 mile per dollar or to use a 2% cash back card. So your cost to acquire a mile through nonbonused credit card spending is 2.0 cents per mile. The cost might be lower or higher for bonused spending. If you're going to buy a Delta ticket, you might be able to charge that to Chase Sapphire Reserve (at 3 points per dollar) or to Delta Amex (at 2 points per dollar). The Chase Sapphire Reserve points can effectively be redeemed for cash at 1.5 cents each if you redeem for a travel expense charged to the card, so those 3 points are worth 4.5 cents per dollar. So in that scenario, if you decided to use your Delta card to earn the miles, your marginal cost to earn those miles was 2.25 cents per mile.

The cost to *buy* miles directly from Delta is 3.5 cents per mile -- much more than any of the numbers above. Although there are sometimes promotions that might bring it down in the range of credit card spending, in general, the cost to buy a mile will be much more than the cost to acquire a mile through credit card spend.

Countdown until DCS comes on here and acts like a complete tool bag. It's nighttime in Asia, so I will say we'll hear his dumb routine in about 4-5 hours.

My credit card spend miles are actually under a cent a mile for acquisition. I don't buy things that I wouldn't buy anyway, so my only cost is the opportunity cost of getting cash back on another card. This is generally 1%, as I'll use a cash back card when they have bonus categories. Therefore I'm getting either 1 or 3 miles for an opportunity cost of 1 cent, bringing the average acquisition cost down...

My credit card spend miles are actually under a cent a mile for acquisition. I don't buy things that I wouldn't buy anyway, so my only cost is the opportunity cost of getting cash back on another card. This is generally 1%, as I'll use a cash back card when they have bonus categories. Therefore I'm getting either 1 or 3 miles for an opportunity cost of 1 cent, bringing the average acquisition cost down to less than a cent per mile.

Since you have so many cards, I'm sure you probably allocate your spend efficiently over different bonus categories on various cards, so I would be amazed if you were paying over a cent per mile for credit card spend.

Maybe you are counting the yearly fee in there? I usually tend to think of that as a purchase price for all the benefits that come with a card, so the benefit of earning miles would only cost a portion of that, not very much at all when spread across a full year of spend.

This changes over time as well. I currently can't fly often for leisure, kids keep me at home. And 4 kids makes redeeming for premium class travel either very hard or at least very expensive in miles. So it makes more sense for me to, currently, use my miles toward more family travel. Redeeming Skymiles for a short domestic trip will end up saving me only a little bit of money but a lot of...

This changes over time as well. I currently can't fly often for leisure, kids keep me at home. And 4 kids makes redeeming for premium class travel either very hard or at least very expensive in miles. So it makes more sense for me to, currently, use my miles toward more family travel. Redeeming Skymiles for a short domestic trip will end up saving me only a little bit of money but a lot of time. Flying ~2 hours each way saves me ~14 hours in a car plus an overnight in a hotel. So while I don't necessarily put a $ amount to my miles and points I still understand their value to me. When my kids are grown or at least old enough to care for themselves at home I'll value things differently.

Consider these five ways to earn miles:

* Purchasing miles

* Mileage running (very rare these days)

* Credit card spending (excluding generous sign-up bonuses)

* Doing “silly stuff” (portals, surveys, etc.)

* Normal flying

Add...

* Complaining (But airlines have figured this out now, thank goodness)

* Transfers (Hotel points to miles)

Your equation is wrong. In reality, the value of the mile is the actual cost one would...

Consider these five ways to earn miles:

* Purchasing miles

* Mileage running (very rare these days)

* Credit card spending (excluding generous sign-up bonuses)

* Doing “silly stuff” (portals, surveys, etc.)

* Normal flying

Add...

* Complaining (But airlines have figured this out now, thank goodness)

* Transfers (Hotel points to miles)

Your equation is wrong. In reality, the value of the mile is the actual cost one would spend if traveling to that destination, no matter what class of service that person redeems. Thus if you spend $1K to Hong Kong, but fly business class, the number of miles used is valued at $1K, whether it is 70K miles or 160K+ miles. What the airline receives as compensation for the use of those miles is not relevant to the traveler......they just sit in the seat, acting like their sooooo smart. lol