Link: Apply now for the United Quest℠ Card

Chase and United Airlines have a co-brand credit card agreement for both personal and small business cards. The United Quest℠ Card is a unique card in the portfolio, and I’d argue that it’s potentially the all-around most lucrative. In this post, I wanted to take an in-depth look at the card.

In this post:

United Quest Card Basics For April 2024

The United Quest Card is incredibly well-rounded, and while the card has an annual fee, it should be easy to justify based on the incredible perks.

United Quest Card Bonus Of 60,000 Miles

The United Quest Card is offering a welcome bonus of 60,000 MileagePlus bonus miles plus 500 PQP after spending $4,000 within the first three months. This is a solid welcome bonus — I value MileagePlus miles at ~1.1 cents each, so to me, those miles are worth ~$660.

Note that you’re eligible for this offer even if you have other United co-brand credit cards. The only people who aren’t eligible for the United Quest Card are those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months. The typical Chase application rules apply, including the 5/24 rule (though that’s not consistently enforced anymore).

United Quest Card $250 Annual Fee

The United Quest Card has a $250 annual fee, and there’s no cost to add additional authorized users. For some context as to how that fits into United’s co-brand personal card portfolio:

- The United Gateway℠ Card (review) has no annual fee

- The United℠ Explorer Card (review) has a $95 annual fee, waived the first year

- The United Club℠ Infinite Card (review) has a $525 annual fee

As you can see, the United Quest Card has the second-highest annual fee, though I’d argue it also has the annual fee that’s easiest to recuperate consistently, thanks to the easy-to-use perks, which I’ll cover below.

United Quest Card Rewards Structure

The United Quest Card has no foreign transaction fees and offers the following return on spending:

- Earn 3x miles on United purchases

- Earn 2x miles on all travel and dining purchases

- Earn 1x miles on all other purchases

While other cards are compelling in the travel and dining categories, those are some of the broadest bonus categories I’ve seen on a co-branded airline credit card. If you want to earn status with United MileagePlus, the United Club Quest Card can help.

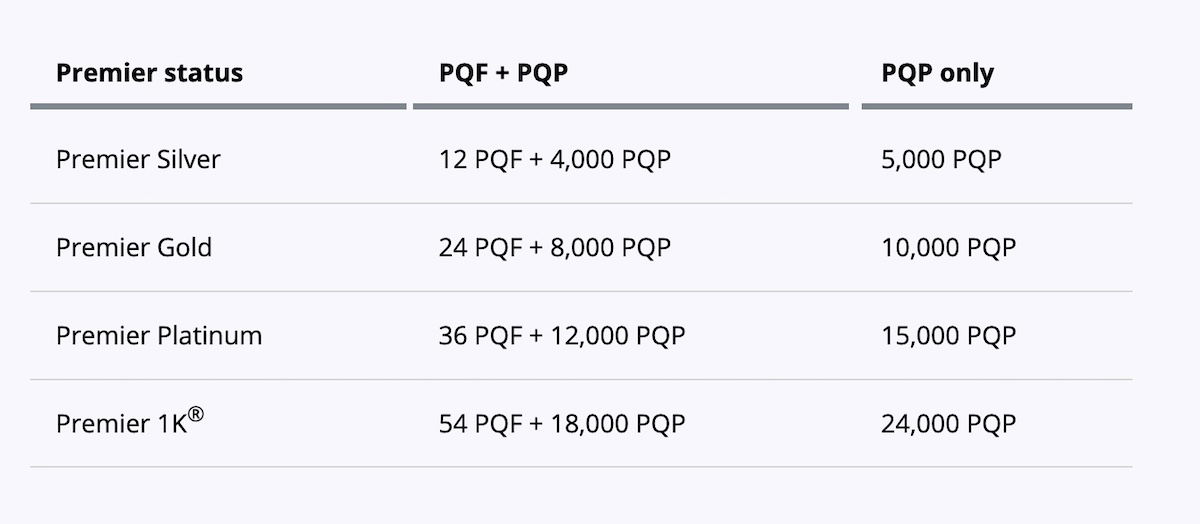

The card offers 25 PQPs for every $500 spent on purchases, up to a maximum of 6,000 PQPs per year. Below are the MileagePlus elite requirements for 2024.

Valuable Purchase & Travel Protection

One of the perks many people look for in credit cards is good protection for purchases. The United Quest Card has some great coverage in that regard. While you’ll want to consult the card benefits guide, the United Quest Card offers perks like:

- Trip cancelation & interruption insurance

- Trip delay reimbursement

- Baggage delay insurance

- Lost luggage reimbursement

- Auto rental collision damage waiver

- Purchase protection

- Extended warranty protection

United Quest Card Benefits & Perks

Airline co-branded credit cards are primarily about the perks, and the United Quest Card most definitely doesn’t disappoint. Let’s go over the card’s perks, starting with the two unique benefits that I find to be most compelling and which will most quickly justify the $250 annual fee.

$125 Annual United Airlines Credit

The United Quest Card offers a $125 annual United credit, which should be worth close to face value to anyone who considers this card:

- Receive a statement credit when you use your card for United purchases, up to a maximum of $125 per anniversary year

- Qualifying purchases include airline tickets purchased from United and purchases through United of seat upgrades, Economy Plus, inflight food and beverages, Wi-Fi, baggage service charges, and other United fees

- The statement credit will be posted to your account on the same day as your United purchase

Anniversary Award Flight Credits (Up To 10,000 Miles)

The United Quest Card offers an anniversary award flight credit of up to 10,000 MileagePlus miles:

- Automatically receive 5,000 miles back in your MileagePlus account after taking an award flight booked with your miles up to twice annually

- The award itinerary must include at least one United-operated flight and must include the primary cardmember on the reservation

- These miles will be deposited in your account within four weeks of each cardmember anniversary

If you redeem miles on United with any frequency, that should get you 10,000 miles yearly. Between that and the $125 annual United credit, I’d argue the annual fee is already more than offset.

Free First & Second Checked Bags

If you ever check bags, having the United Quest Card can get you a free first and second checked bag for you and one companion on the same reservation. The primary cardmember just needs to pay for the ticket with their card and be one of the travelers. This is a value of up to $320 per roundtrip ticket (assuming two people are checking two bags roundtrip).

Priority Boarding

As the primary cardmember on the United Quest Card, you can receive priority boarding for you and your companions on the same reservation for United Airlines operated flights. Many people want to board early to be able to secure overhead bin space, so this is a perk that I know many cardmembers value.

25% Savings On Inflight Purchases

You can save 25% on inflight purchases on United Airlines if you have the United Quest Card. This will come in the form of an account statement credit, and applies for purchases of beverages, food, and Wi-Fi.

Complimentary Upgrades On Award Tickets

If you have elite status with United Airlines, you’re eligible to receive space-available upgrades in most short-haul markets when booking a revenue ticket. However, if you have the United Quest Card, you’re also eligible to receive elite upgrades when traveling on award tickets, which is a nice additional perk.

TSA PreCheck Global Entry, Or NEXUS Fee Credit

The United Quest Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee to your card, and it will automatically be reimbursed.

Nowadays, quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. They just have to use your credit card to pay, and you’ll automatically receive the statement credit.

Complimentary DoorDash DashPass

The United Quest Card offers a year of complimentary DoorDash DashPass. This offers unlimited delivery from all kinds of restaurants with $0 delivery fees and lower service fees on orders of $12 or more.

You have to activate your subscription by December 31, 2024, and it’s then valid for 12 months. After that period, you’ll be automatically enrolled in DashPass at the current monthly rate, though you can always cancel.

Is The United Quest Card Worth It?

I think the United Quest Card is United’s best value credit card for someone who flies United at least a few times per year and redeems miles sometimes as well.

While the card has a $250 annual fee, the $125 annual United credit should lower the “real” annual cost to $125. Then if you redeem miles for United-operated flights at least twice per year, you’re getting 10,000 additional miles. Based on my valuation of United miles, I consider that to be a $130 value.

At that point, you’ve already gotten more value from the card than the annual fee, and that doesn’t account for perks like free checked bags, upgrades on award tickets, savings on inflight purchases, and much more. On top of that, there’s the card’s excellent welcome bonus, which gets you a lot of value shortly after getting the card.

So yeah, I think this card is worth it, but how does the value proposition compare to United’s most popular credit card?

United Quest Card Vs. United Explorer Card

Many people may be trying to decide between the United Quest Card and the United Explorer Card. I think the United Quest Card is the better choice, but let me provide a quick comparison.

The advantages of the United Explorer Card are the following:

- The United Explorer Card has a $0 introductory annual fee for the first year, then $95, compared to a $250 annual fee on the United Quest Card

- The United Explorer Card offers two United Club passes annually

However, virtually everything else about the United Quest Card is either equal or significantly better:

- The United Quest Card offers an annual $125 United credit, which the United Explorer Card doesn’t offer, and that should be worth face value to most

- The United Quest Card offers up to 10,000 MileagePlus miles back each year on award redemptions, which the United Explorer Card doesn’t offer

- The United Quest Card offers two checked bags free, while the United Explorer Card offers only one checked bag free

In the long run, the United Quest Card is more compelling because of the additional perks that should help offset the annual fee for a vast majority of savvy consumers.

The only consumer who should consider the United Explorer Card is someone who values the United Club passes but doesn’t redeem miles at least twice per year for United-operated flights.

Bottom Line

The United Quest Card is the most compelling card in the Chase & United lineup. While the $250 annual fee sounds high on the surface, the $125 annual United credit should get you half of that value back right there. Then there’s the up to 10,000 miles you can earn per year when redeeming miles, along with other ongoing benefits.

If you’re looking for a United card with strong perks and an annual fee that’s easy to justify, this is definitely the card to consider.

If you want to learn more about the United Quest Card or want to apply, follow this link.

I have the Quest card and love it. I had the Explorer card in the past and was never able to gain entry into the United Club with the 2 free passes given.