Earlier I wrote about how Qatar Airways added a new $100 per segment surcharge for those booked in their excellent Qsuites business class product. Unfortunately it looks like that’s not the only new or increased surcharge we should expect from Qatar Airways in the near future.

Increased fuel surcharges coming to Qatar Airways?

Business Traveller had an interview with Qatar Airways’ CEO, Akbar Al Baker, in Doha this week. During this he made some interesting comments regarding fuel surcharges:

The surcharges, which were introduced as the price of oil rose from $30 per barrel up to a peak of up to $147, added several hundred pounds to the cost of long haul tickets. Now, according to the Chief Executive Officer of the Qatar Airways Group, Akbar Al Baker, they will soon make an unwelcome reappearance when booking flights.

Al Baker said that “As the oil price rises, we will start imposing a fuel surcharge like we used to do when it was high before.”

He defended the practice, pointing out that “When the oil price went through the roof our ticket prices only went nominally up with the surcharge for the fuel. The fuel prices went from 50 to 120 dollars but the ticket prices didn’t go up by two and a half times.”

First let’s do some fact checking here, and then we’ll talk a bit about his defense of the practice.

Qatar Airways *does* impose fuel surcharges

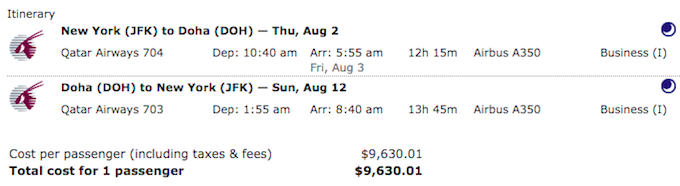

I’m not sure if Al Baker is confused, or what, but Qatar Airways does already impose significant fuel surcharges on the cost of tickets, and they have for as long as I can remember. For example, take the below ticket between New York and Doha in business class:

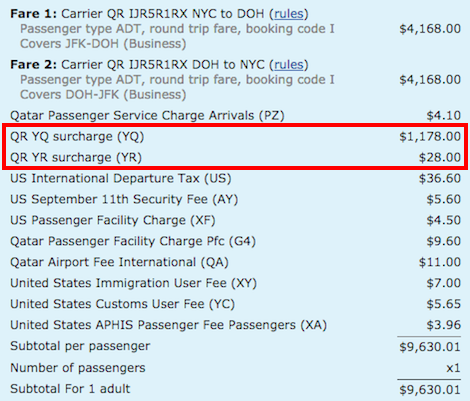

There’s over $1,200 in fuel surcharges on that ticket:

I’m not sure if Al Baker is confused about how fares are structured at his airline, or if he’s suggesting that surcharges will go up even more, but regardless, something isn’t right here.

The incorrect defense of fuel surcharges

What irks me is the way that airline executives defend these fuel surcharges, and it’s not just Al Baker who does that. Let’s look at his justification:

“When the oil price went through the roof our ticket prices only went nominally up with the surcharge for the fuel. The fuel prices went from 50 to 120 dollars but the ticket prices didn’t go up by two and a half times.”

To me there’s just so much wrong with this:

- In 2015, when oil was $30 per barrel, airlines were still adding fuel surcharges, in many cases of over $1,000 roundtrip per ticket; is something really a surcharge at that point?

- Al Baker suggests that when oil went from $50 to $120 per barrel, ticket prices didn’t increase two and a half fold; well of course they didn’t, because on the most basic level fuel accounts for about a third of airline operating costs, so using that logic the increase should only be about a third of that

- Why limit this surcharge to fuel; US airlines have given employees big pay raises, so shouldn’t there be a pilot surcharge, flight attendant surcharge, Biscoff surcharge, etc.?

I’m no economist, but the biggest issue here is that airline executives aren’t honest about how the airline business model works when they justify these fees. The price of airfare has never, ever reflected the cost of providing the service. That’s why the airline industry has had periods of extreme profitability, and periods of extreme unprofitability.

The price of airfare is based on supply and demand, and airlines have a really convoluted way of deciding how much to charge in airfare. It’s the reason that one person sitting on a plane could have paid $100 for their ticket, and the person sitting next to them could have paid $1,000 for their ticket.

Airlines aren’t like other businesses, where you expect that most customers will pay roughly the same.

To suggest that airlines are able to adjust the cost of airfare based on the costs incurred completely undermines the competitive nature and the extreme price discrimination in the airline industry. If the demand for air travel were inelastic then I’d buy into their logic, but virtually any study shows that’s not the case. At all.

No doubt there’s a rough upper and lower limit to airfare pricing. If all airlines are losing a ton of money, airlines will go out of business, supply will decrease, and prices will increase. Conversely, if all airlines are making a killing, supply will increase, and prices will decrease.

When oil prices went up from $50 per barrel to $120 per barrel and ticket prices only increased marginally (as Al Baker says) that wasn’t out of the goodness of airlines’ hearts, but rather because that’s how supply and demand in the airline industry works.

So economists/people with fancy degrees/airline executives, please tell me what I’m missing!

i used to work in the shipping industry, and they do the same. The container lines are particularly imaginative. Examples include, but are not limited, to:

Fuel surcharges (will typically vary based on a formula)

Currency adjustment (as above)

Peak surcharge

Panama/Suez transit

ISPS (security fee)

Cargo handling fee

Storage fee (you typically get a few days of free storage at each port)

Over height

Over...

i used to work in the shipping industry, and they do the same. The container lines are particularly imaginative. Examples include, but are not limited, to:

Fuel surcharges (will typically vary based on a formula)

Currency adjustment (as above)

Peak surcharge

Panama/Suez transit

ISPS (security fee)

Cargo handling fee

Storage fee (you typically get a few days of free storage at each port)

Over height

Over weight

Hazardous cargo fee

Congestion fee (some ports are congested and cause delays)

Documentation fee

Transshipment fee

Special handling fee

Etc, etc

I have actually seen container lines have a negative base price (ie they pay the customer), but the net price will be positive. I can also confirm that any transportation business takes a massive hit when fuel prices go up, hence they need to recover a part of that extra cost somehow.

Airline pricing is a mess

There are so many things that don’t make sense.

It almost always costs more to buy a round trip ticket from A to B, than the exact same round trip ticket from B to A. (Eg flights ex Europe vs ex US)

It often costs less to fly A to B to C... than just A to B (eg hidden ticket strategies)

If I could charge $1,000 to fly...

Airline pricing is a mess

There are so many things that don’t make sense.

It almost always costs more to buy a round trip ticket from A to B, than the exact same round trip ticket from B to A. (Eg flights ex Europe vs ex US)

It often costs less to fly A to B to C... than just A to B (eg hidden ticket strategies)

If I could charge $1,000 to fly to A... But only $500 to fly to B. Then I’d put bigger planes or more routes to A. But not Airlines.

It’s one of many reasons why the LCC airlines are doing so well

Then again, we see stupid pricing everywhere. “Resort fees” and “convenience fees” and “administrative fees”

Don’t even get me started on my cell phone bill or mortgage fees

Ticketmaster showed everyone else the way...

Its 100% PR management. Do we really expect them to say, "Sorry, we are losing a lot of money in other areas, so we want to charge more where we see there is a demand and where we are slightly better than others."

Of course, compared to airlines such as US3 / BA / LH, their Q suites are better and popular - so no wonder they are milking their cash cow.

But...

Its 100% PR management. Do we really expect them to say, "Sorry, we are losing a lot of money in other areas, so we want to charge more where we see there is a demand and where we are slightly better than others."

Of course, compared to airlines such as US3 / BA / LH, their Q suites are better and popular - so no wonder they are milking their cash cow.

But isnt this standard across industries? Apple charging 200-300% for additional storage on iphones, ipads etc. The difference is other industries are transparent in their pricing and airlines try to make it complex to avoid their brand image taking a hit.

Paul qatars most revenue come from oil not gas even though they are one of the largest gas exports in the world

Lucky I mostly agree with your assessment and fuel charges are a joke and I still don't understand why governments are not getting involved in this. However your simple assessment of price assumes free entry to the market but that is not true in the airline industry

Al Baker once said he would...

Paul qatars most revenue come from oil not gas even though they are one of the largest gas exports in the world

Lucky I mostly agree with your assessment and fuel charges are a joke and I still don't understand why governments are not getting involved in this. However your simple assessment of price assumes free entry to the market but that is not true in the airline industry

Al Baker once said he would eliminate fuel charges but the airline didn't so my guess is that he thought Qr eliminated fuel charges back then but revenue management did not. Not sure if he was informed by rm but his comment now might be because of that confusion

@ Matt

“Qatar owns the oil wells”

Qatar doesn’t have oil. Its wealth is based on the world’s largest reserves of natural gas (that’s the invisible stuff, not the petroleum products that American refer to as “gas”).

@Lucky

“If all airlines are losing a ton of money, airlines will go out of business”

Unless they’re the US3, in which case they just pop down to the local court, go through Ch.11, then emerge as if nothing has happened.

If it isn’t a tax angle, besides award tickets, what’s the difference between increasing fares and fuel surcharges.

Raise those prices too much and they'll have alot of empty seats.

I’m and economist, and your assessment is correct. If their fuel surcharge goes up and their prices become less competitive, their revenue and profits would fall.

Btw, it isn’t a tax thing. US federal aviation excise tax is on the entire ticket price, which includes all surcharges and fees that must be paid. Baggage fees don’t attract tax, because they aren’t mandatory.

Dude, you are crazy.

Look up price taker and price setter in economics. And then think how airlines would behave?

Does any of this have to do with taxation? Are the "fare" prices taxed while the "surcharges" aren't? How does this work for US carriers? EU carriers? ME3 carriers? It might make for an interesting post if anyone has information about it.

It really gets me that fuel surcharges never went away when the fuel price was so low and now it’s on the rise again the surcharges will just start to increase, where does it end?!

Qatar owns the oil wells and owns the airline. The surcharges have nothing to do with cost of oil as its wholesale prices for them. It is using fee to makeup in other areas.

There RT Biz class is already $750 more then everyone else ORD-DEL, plus zero award availability. I can't believe they are able to fill there planes given the embargo, lack of codeshares and higher costs then others.