In May 2024, Qatar Airways and Cardless launched co-branded credit cards in the United States. There’s quite a bit of value to having one of these cards, with benefits including everything from elite status, to reward fee waivers.

I wanted to provide an update, as we’ve just seen new best-ever offers rolled out on these cards, making it the ideal time to apply. Let’s go over the details of these cards, and discuss if they’re worth it — I think there’s potentially huge value to be had here.

In this post:

Qatar Airways’ credit cards in the United States

Qatar Airways and Cardless offer two personal credit cards in the United States, including the Qatar Airways Privilege Club Visa Signature Credit Card and Qatar Airways Privilege Club Visa Infinite Credit Card.

For those not familiar, fintech firm Cardless has been doing some creative stuff in the credit card space. What makes Cardless unique is how quickly it’s able to launch new cards. Cardless can launch products faster and with lower startup costs than with other issuers, so it has allowed co-brand card portfolios to be introduced that might not otherwise be economically viable with one of the “big” players.

Before we get into the details, I wanted to reflect on how it’s interesting that Qatar Airways is partnering with Cardless on these cards.

Qatar Airways uses Avios as its rewards currency, and there are currently three Chase co-branded credit cards in the United States that earn Avios, comprised of the Aer Lingus Visa Signature® Card (review), British Airways Visa Signature® Card (review), and Iberia Visa Signature® Card (review). Keep in mind that Avios can be transferred between programs.

While it wasn’t a given that Qatar Airways would also launch a card with Chase, that’s what I would have expected by default. What’s noteworthy is that Chase hasn’t launched many co-branded travel credit cards in recent years, and seems to be heavily focused on both its Ultimate Rewards ecosystem, plus its partnership with United. So I wonder if Chase wasn’t interested in working with Qatar Airways, if Qatar Airways wanted to try something different, or what…

Anyway, let’s take a look at the details of these cards. Let me note upfront that one quirk with Cardless is that you can typically only be approved for a single card with the issuer, so you’ll want to pick the card you apply for carefully (Cardless also has an avianca lifemiles card portfolio).

Qatar Airways Privilege Club Visa Signature Card details

The Qatar Airways Privilege Club Visa Signature Credit Card is the more basic of the two cards, and has a $99 annual fee. Here’s what you can expect in terms of the card details:

- The card offers a year of Privilege Club Silver status upon being approved, with perks like oneworld Ruby status, a 25% tier bonus, priority check-in and boarding, an extra baggage allowance, and more

- The card has a rewards structure of 4x Avios on Qatar Airways spending, 2x Avios on restaurant spending, and 1x Avios on all other spending

- The card offers two Qpoints for every $2,000 spent on the card, offering an opportunity to earn elite status with Qatar Airways Privilege Club

- The card offers reward fee waivers for Privilege Club awards on Qatar Airways metal, which can save you up to $300-600 on roundtrip Qatar Airways awards, with certain spending requirements

Qatar Airways Privilege Club Visa Infinite Card details

The Qatar Airways Privilege Club Visa Infinite Credit Card is the more premium of the two cards, and has a $499 annual fee. This is the first Visa Infinite product issued in the United States for a non-US airline, so that’s a pretty cool development. Here’s what you can expect in terms of the card details:

- The card offers a year of Privilege Club Gold status upon being approved, with perks like oneworld Sapphire status, a 75% tier bonus, priority check-in and boarding, lounge access an extra baggage allowance, and more

- The card has a rewards structure of 5x Avios on Qatar Airways spending, 3x Avios on restaurant spending, and 1x Avios on all other spending

- The card offers 150 Qpoints upon approval, plus two Qpoints for every $1,500 spent on the card, offering an opportunity to earn elite status with Qatar Airways Privilege Club

- The card offers reward fee waivers for Privilege Club awards on Qatar Airways metal, which can save you up to $300-600 on roundtrip Qatar Airways awards, with certain spending requirements

- The card offers Visa Infinite perks, like concierge service, rental car privileges, and more

Qatar Airways credit card welcome offers

Both of these cards are currently offering improved welcome offers for applications between November 15 and December 31, 2024.

The lower annual fee Qatar Airways Privilege Club Visa Infinite Credit Card:

- Has a welcome bonus of up to 60,000 Avios — earn 30,000 Avios after the first transaction, and an additional 30,000 Avios after spending $5,000 within the first 90 days

- Previously the card had a welcome bonus of up to 40,000 Avios — earn 20,000 Avios after the first transaction, and an additional 20,000 Avios after spending $3,000 within the first 90 days

The higher annual fee Qatar Airways Privilege Club Visa Signature Credit Card:

- Has a welcome bonus of up to 80,000 Avios — earn 40,000 Avios after the first transaction, and an additional 40,000 Avios after spending $5,000 within the first 90 days

- Previously the card had a welcome bonus of up to 50,000 Avios — earn 25,000 Avios after the first transaction, and an additional 25,000 Avios after spending $5,000 within the first 90 days

In addition to the increased threshold bonuses, the cards are both also offering double Avios on dining and all other eligible categories now through the end of 2024.

Picking up this card keeps becoming more compelling.

How the Qatar Airways reward fee waivers work

One new perk of the two Qatar Airways credit cards is that they offer reward fee waivers:

- This applies to the carrier imposed fees that Privilege Club charges on Qatar Airways awards, which can total up to $300 on a roundtrip economy ticket, or up to $600 on a roundtrip business or first class ticket

- This benefit provides a full waiver of these fees, in the form of a statement credit after the flight

- In order to unlock this benefit, you need to spend $15,000 on the card in the first year, or $25,000 on the card in subsequent years

Qatar Airways is known for having one of the world’s best business class products, and the best way to book these awards is through an Avios currency, since other partners don’t have access to the same amount of space. If you value the ability to redeem on Qatar Airways, I’d say there’s merit to putting spending on these cards.

Just to do some basic math, a roundtrip Qatar Airways business class award from the United States to places like the Maldives comes with $400-500 in fees. If you could get those refunded for spending $15,000 or $25,000 per year on the card, I’d consider that to be an excellent value, assuming you can pull off the spending. That also doesn’t even account for the Avios you’d earn.

My take on Qatar Airways’ USA credit cards

It’s exciting to see how Cardless is evolving its co-brand airline portfolios. For one, it’s fun that there are two different cards, including a Visa Infinite Card, which is rare.

These cards have big sign-up bonus, solid rewards structures, and it’s particularly cool how you can earn elite status and get a refund on reward fees, which is something I wish we’d see on more foreign co-branded airline cards.

In particular, I like how the premium version of the card offers Qatar Airways Privilege Club Gold status for a year, which is the equivalent of oneworld Sapphire status. That’s a great incentive to pick up the card. Not only does this offer perks for travel on Qatar Airways, but it also offers valuable benefits on other oneworld airlines.

For example, oneworld Sapphire members with Qatar Airways could access all oneworld Sapphire lounges within the United States, even when traveling on domestic flights. If you had this status, you could access American Flagship Lounges on wholly domestic itineraries, which is a tempting opportunity.

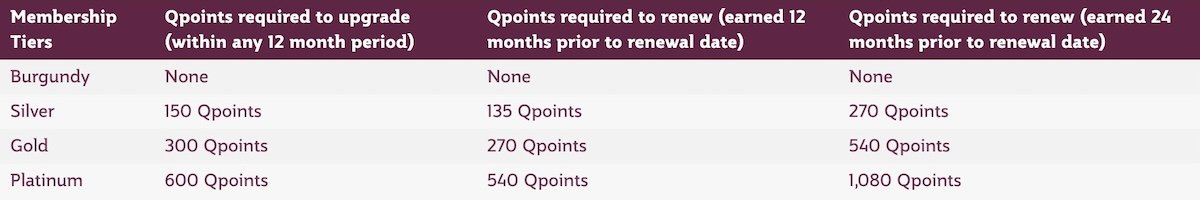

What’s the value proposition like of earning status on an ongoing basis? As mentioned above, you can earn two Qpoints per $1,500 spent on the premium version of the card, which comes out an average of one Qpoint per $750 spent. Below you can find the Privilege Club elite requirements, which differ based on whether you’re qualifying or renewing.

At the rate of earning one Qpoint per $750 spent:

- Privilege Club Gold status would require $225,000 in spending to upgrade, or $202,500 to renew

- Privilege Club Platinum status would require $450,000 in spending to upgrade, or $405,000 to renew

Those requirements are definitely on the steep side, though perhaps at the margins (in addition to crediting flights to Privilege Club), some people might find this to be worthwhile.

Personally I think the much more compelling spending thresholds are reaching the $15,000 or $25,000 amounts in order to get a reward fee credit. If you’d otherwise redeem on Qatar Airways, that could save you hundreds of dollars in one go, and there’s no limit to how often you can use it.

Bottom line

Qatar Airways and Cardless are partnering on co-branded credit cards in the United States. There are two cards — a $99 annual fee Visa Signature Card, and a $499 annual fee Visa Infinite Card. These are some well rounded cards, and the most intriguing perks are the ability to earn elite status and get reward fee credits.

In particular, I think many may be interested in getting the more premium version of the card, to be able to earn oneworld Sapphire status for a year. Then I think spending money on the card could make sense, in order to get access to refunds on the carrier’s reward fees.

What do you make of these Qatar Airways & Cardless credit cards?

Is the Lounge access for you & partner if you are Gold ($499.00 version) One would hate to tell the partner you wait outside while I feast?

I got one with the 50K SUB but got the awards I wanted. One advantage as Gold is free meet and escort service in Doha

“ In order to unlock this benefit, you need to spend $15,000 on the card in the first year, or $25,000 on the card in subsequent years” for the award fee waivers. Is this calendar year or card membership year?

So is OMAAT still getting paid from Cardless or it's affiliates?

Almost every Cardless posts have comments about eligibility, discontinued cards, and reduced benefits.

OMAAT is not addressing this?

Yeah Cardless seems wack af. They have very weird approval process and it seems like you can only ever get one card from them.

Thanks for the review - This is very tempting. I am moving to Singapore and will be flying Qatar fairly frequently for trips to Europe and back stateside. May be a stupid question, but I assume it being a VISA branded card, it should be accepted worldwide (for the most part)?

I'd consider this card if not for the stories I've read about people with great credit scores being denied. Wondering if they have something like Chase's 5/24 rule.

Consensus says Cardless has a 1/forever rule.

They provide a good service.