Link: Apply now for the TAP Miles&Go American Express Card

Fintech firm Cardless has been doing some really creative stuff in the credit card space. The company is partnering with TAP Air Portugal and American Express to launch a new co-branded credit card, which I’m sure will interest many.

In this post:

Details of the new TAP Air Portugal credit card

Cardless and TAP Air Portugal have announced the launch of the TAP Miles&Go American Express Card in the United States. The card has a $79 annual fee, and offers some creative perks. Let’s go over all the basics of the card. If you fly with TAP Air Portugal with any frequency, then the perks offered by the card should come in handy.

TAP Miles&Go credit card welcome bonus

Through the end of November 2023, the TAP Miles&Go Amex Card is offering a welcome bonus of 60,000 miles after spending $2,500 in the first 90 days you have the card, if you apply before November 30th. That’s a respectable bonus with a reasonable spending requirement. After that, the bonus is expected to change to 40,000 miles, so if you’re interested, you’ll definitely want to apply early on, as the introductory bonus is 50% better.

Note that while American Express is the processing network for the card, this isn’t a traditional American Express card, in the sense that it wouldn’t have the same application restrictions as you’d usually find on Amex cards (in other words, it wouldn’t count toward the Amex five credit card limitation, or any other traditional Amex card restriction).

TAP Miles&Go credit card rewards structure

The TAP Miles&Go Amex Card offers anywhere from 1-3x miles per dollar spent, as follows:

- Earn 3x miles on TAP Air Portugal flight purchases

- Earn 2x miles on rideshare, rental cars, and hotels

- Earn 1x miles on all other purchases

There’s another cool incentive to spend money on the card. Specifically, spending on the card will count toward status, as you’ll earn one status mile for every five miles earned from spending on the card, up to 10,000 miles per year. This will count toward TAP Miles&Go status, as well as toward earning Star Alliance Silver or Gold status.

For what it’s worth, TAP Miles&Go Silver status ordinarily requires 30,000 status miles to earn (or 20,000 status miles to renew – meaning you could renew your statusfrom spend on the TAP Miles&Go card alone), while TAP Miles&Go Gold status requires 70,000 status miles to earn (or 50,000 status miles to renew).

While I wish it weren’t uncapped, this could be useful for anyone who is close to earning status in the program. TAP also has a unique feature whereby you can convert bonus miles into elite miles, to qualify for a higher tier. For example, with the program you can convert a maximum of 20,000 redeemable miles into 10,000 elite miles.

TAP Miles&Go credit card perks & benefits

The TAP Miles&Go Amex Card offers some useful perks if you fly TAP Air Portugal with any frequency. Specifically, card members receive:

- Preferred boarding on TAP Air Portugal flights — this can come in handy for ensuring that you can get overhead bin space for your bags

- Two TAP Premium Lounge access passes per year, valid for the lounge at Lisbon Airport (LIS) — if you pass through Lisbon Airport, lounge access is a great perk

- Two extra checked bags per year — the cost for checked bags varies with TAP depending on the market you’re traveling in, but this can potentially save you a significant amount

If you can take advantage of those perks, they should easily justify the card’s annual fee on an ongoing basis.

TAP has a modern fleet, big US network

It’s logical to see TAP Air Portugal launching a credit card in the United States, for a couple of reasons.

For one, Portugal has become an incredibly popular travel destination, including among Americans. The country has a lot to offer and is for the most part quite a good value compared to many other destinations in Europe. So whether you’re looking to visit Lisbon, Porto, Duoro Valley, or any of a countless number of other destinations, the country has a lot of beauty, and amazing food and drinks. I’ve enjoyed my visited to Portugal, and hope to return again soon.

TAP Air Portugal is also very much capitalizing on Portugal’s tourism boom. The airline has significantly expanded its network to the United States in recent years, using its modern Airbus A330-900neos and Airbus A321LRs. TAP’s destinations in the United States now include Boston, Chicago, Miami, New York, Newark, San Francisco, and Washington.

With these new aircraft, the airline has also introduced much improved inflight products. In business class, TAP has flat beds on both the A330-900neos and A321LRs, with most seats having direct aisle access. In economy, many enjoy the A330-900neo, given the 2-4-2 layout, as the pair of seats by the windows are about as good as it gets in economy.

One other great thing about TAP is that the airline pretty consistently has competitive fares, in both economy and business. The airline even allows stopovers, where you can add a stopover of one to 10 days in Portugal enroute to another destination, when booking a roundtrip ticket. That’s a great opportunity to visit multiple destinations on a single ticket, without breaking the bank.

The basics of the TAP Miles&Go loyalty program

What can you expect from the TAP Miles&Go frequent flyer program? TAP is in the Star Alliance, so the mileage currency isn’t only useful for travel with the Portuguese carrier, but also for travel on partner airlines. The airline also has some non-Star Alliance partners, including Azul, GOL, and Emirates.

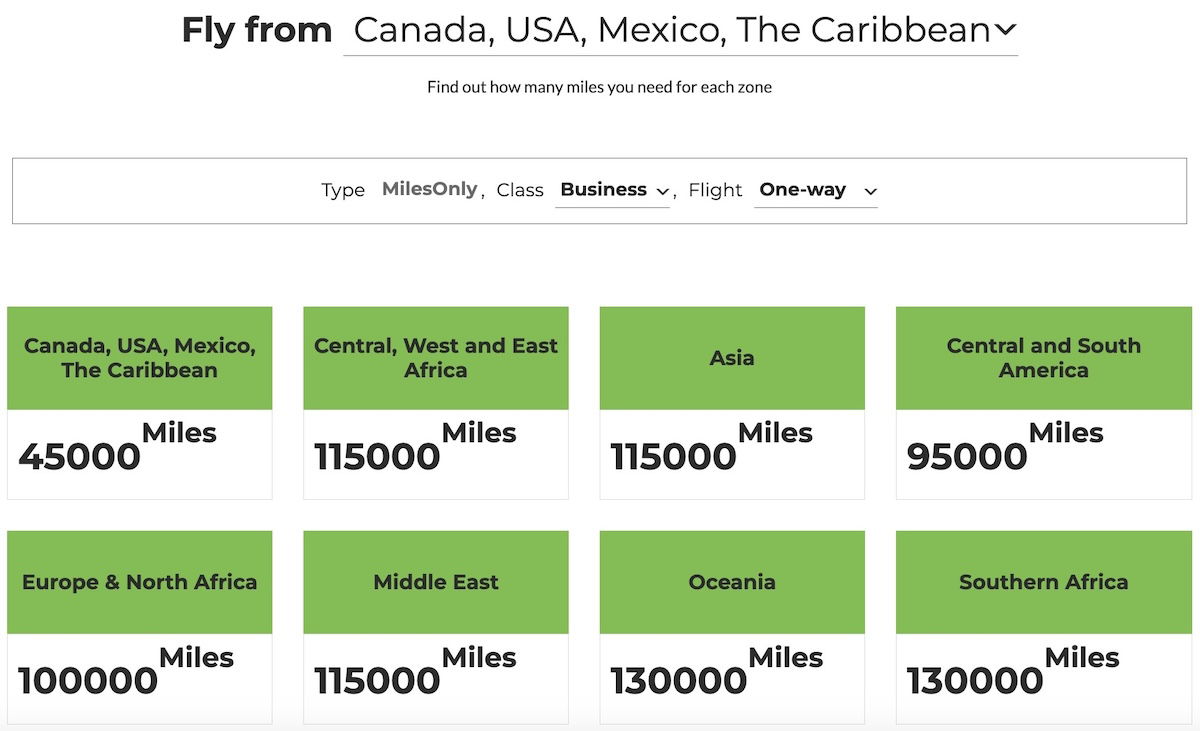

You can find the TAP Miles&Go award chart here, by selecting your origin, the class of service you want to travel in, and whether you’re looking to travel roundtrip or one-way. Just to give you an example of award pricing, below is how much TAP Air Portugal charges for awards on partner airlines when in business class when originating in North America.

As you can see, some of these redemption rates are better than others. For example, I’d consider 100,000 miles for business class to North Africa to be quite decent, and 115,000 miles for business class to Asia, Central, West, and East Africa, to be quite good as well.

A few more things to note about TAP Miles&Go awards:

- In some cases, TAP will have access to different award availability than other partner programs, and generally only economy and business is bookable through Miles&Go, and not first class; furthermore, on Emirates, business class awards aren’t possible anymore either

- TAP Miles&Go has carrier imposed surcharges on some partners, but not others; in my experience, you can redeem Miles&Go miles without surcharges on Air Canada, All Nippon Airways, Azul, Copa, Emirates, Ethiopian Airlines, EVA Air, LOT Polish Airlines, Scandinavian Airlines, and United, among others

- In terms of fees associated with the program, changing the date or time of an award ticket is subjected to a €50 fee, while redepositing an award ticket is subjected to a €120 fee, and must be done at least 24 hours before departure

- For award travel on partner airlines, one stopover is permitted on a roundtrip

Bottom line

Cardless has partnered with TAP Air Portugal to launch a new co-branded card in the United States. The card has a reasonable $79 annual fee, and offers a solid welcome bonus, some useful perks if flying with TAP, and the ability to even earn elite status partly through spending.

This card is definitely more niche, but if you fly TAP with any frequency, it could be worth picking up.

Decided to try this card as have several trips to Portual/EU in the near future and I actually quite like TAP's transatlantic business class service.

I tried a couple of transactions on giftcards.com and they were declined. Kind of odd: "Transactions may be declined for a variety of reasons...For this transaction, the reason for the decline is because we do not allow purchases of gift cards."

Can anyone let me know the first 6 digits of the card number its called a BIN = Bank Identification Number please thanks

I was thinking of picking up the card but don’t have any intermediate travel needs on TAP. One think to keep in mind is the expiration:

“TAP Miles&Go are valid for three (3) years from date of collection, except when otherwise specified.”

"Note that while American Express is the processing network for the card, this isn’t a traditional American Express card, in the sense that it wouldn’t have the same application restrictions as you’d usually find on Amex cards (in other words, it wouldn’t count toward the Amex five credit card limitation, or any other traditional Amex card restriction)."

Thank you! Of all the bloggers I've read so far who are writing about this card, so far...

"Note that while American Express is the processing network for the card, this isn’t a traditional American Express card, in the sense that it wouldn’t have the same application restrictions as you’d usually find on Amex cards (in other words, it wouldn’t count toward the Amex five credit card limitation, or any other traditional Amex card restriction)."

Thank you! Of all the bloggers I've read so far who are writing about this card, so far you are the only one to address this point, which was the first question I had about it.

Well, I applied two hours ago and got instant denial ☹ The application process was annoying as it required to submit pics (via cellphone) of your id and a selfie! Reason for the denial: "Number of months since the most recently opened credit card account." Even with a credit score of 820 as stated on the denial letter via email. Last card I opened was the Barclays American AAdvantage Aviator Mastercard on 9/1/23.

I wonder if you have a security alert in your credit report or something. I was approved and didn't have to upload an ID or selfie. (And I've already added it to my Google Wallet and used it for a first charge.)

Thank you Chris. I called Cardless to confirm and they told me they do ask for pic of ID and selfie on some cases...not sure why I was selected. I did get an email offer from TAP Miles&Go to join the waitlist for the card like three weeks ago for an additional 5,000 bonus miles; maybe they wanted to make sure it was actually me who had pre-reserved this offer They said I can reapply in 45 days.

Just a terrible run airline! It’s up for sale again but as usual the government is asking to keep a controlling stake lol what a joke! They can’t run it on their own and they want to sell it but still have a say on how it run, fake state aid as usual. They should’ve just let the JetBlue founder keep the airline and it would’ve been better now he competes with them to Brazil with azul lol

The problem isn't TAP but Cardless.

PSA: Cardless has a tendency to backtrack on benefits with many cards they launch. From discontinuing a card to devaluing their benefits.

Gary even took their money and guarantee (like Tim Dunn?) that their launch card doesn't count towards 5/24. He forgot to say it would get 5/24 a few months later.

Tim Dunn was a long time Delta employee, who's happy to use his real name in online comments.

I'd lean more towards "I'm still part of the team!" near mental illness than "They're still paying me!", but ¯\_(ツ)_/¯.

Wait so TAP charges 100k one-way from the US to Europe/North Africa and you find that to be a decent rate? That doesn't sound like a good rate at all - even United is still cheaper than that