Well here’s a change that I’m not happy to see (thanks to Jay for flagging this)…

Amex Pay With Points 35% rebate will be more restrictive

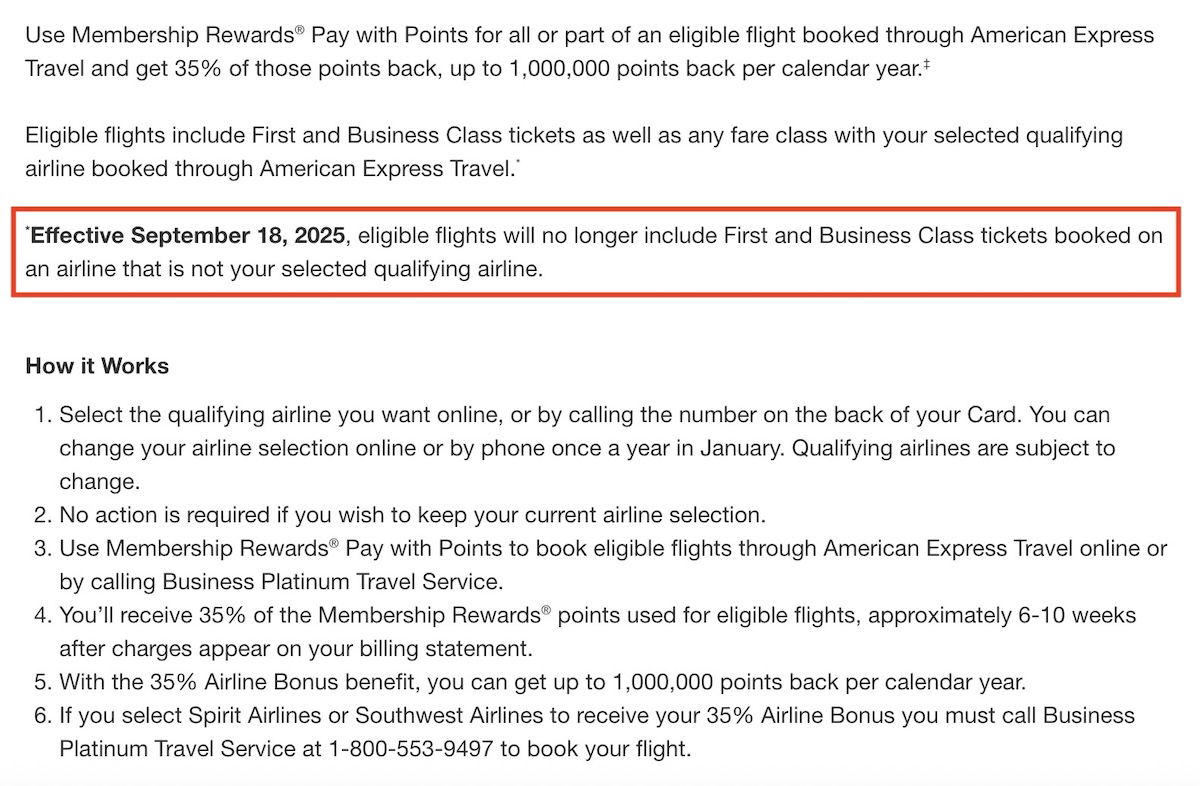

As of September 18, 2025, the Amex Business Platinum has changed its 35% Pay With Points rebate, for the worse. selects for their airline fee credit)

With this change, the Pay With Points rebate no longer applies to first and business class tickets on any airline, but instead, only applies to your designated US airline.

For those who have no clue what I’m talking about, let me provide a bit more detail. Amex’s Pay With Points feature lets you book flights using Membership Rewards points, typically at the rate of 1.0 cents of value per point. That’s not a great deal, at least based on my valuation of points.

But this is where the Amex Business Platinum has historically been useful. Cardmembers have received a 35% rebate on Pay With Points bookings for select airfare, which has offered up to 1.54 cents of value per point. This doesn’t just apply to the points earned on this specific card, but instead, applies to all Membership Rewards points linked to your account (so you could redeem all your Amex points this way, including those earned on other cards).

The major limitation was that you could only receive that rebate for first or business class airfare, or for your designated airline. Now that has changed, so that it only applies to your selected US airline. I frequently used Amex points for first and business class tickets on international carriers, so I’m sad to see this change.

On the plus side, at least this feature is sticking around on the designated airline. So if you fly one US carrier frequently, you can still get good value with Amex points this way.

Bottom line

As of September 18, 2025, the Amex Pay With Points 35% rebate with the Amex Business Platinum has changed. The rebate no longer applies to first and business class tickets on all airlines, and will instead just apply for tickets on one designated US airline. I’m sad to see this change, as it’s a benefit I frequently used.

What do you make of this Amex Business Platinum 35% Pay With Points rebate being adjusted?

Wouldn't it be great if we got a "We Listened" reversal on this one? It would require us cancelling now, rather than waiting for renewal months from now.

Cancelled the moment I read this. The rep noticed my Member Since '85. I reported this is the reason, as well as the utter hopelessness of the Centurion Lounge benefit, which is almost zero to me, without a guest, or with a queue. Too much work chasing the coupons. I'll get my lounges from Priority Pass and VISA.

The original rebate was 50%, and that was the reason I originally accepted an Amex business platinum card. Dropping it to 35% made it worse than transferring Membership Rewards points to miles, in most cases. Now they want to make it even harder, as devaluations of miles have made transfers worth less. Overall, the point is to reduce the value of customers' inventory of MR points. Whether or not that reduced obligation to "members" (customers)...

The original rebate was 50%, and that was the reason I originally accepted an Amex business platinum card. Dropping it to 35% made it worse than transferring Membership Rewards points to miles, in most cases. Now they want to make it even harder, as devaluations of miles have made transfers worth less. Overall, the point is to reduce the value of customers' inventory of MR points. Whether or not that reduced obligation to "members" (customers) is directly recognized under GAAP, ultimately every lost dollar of value to to customers is gained profit for Amex.

This is the first Amex card I ever got.. corporate card in 1995. Among cards with fees, I’ll be down to the personal platinum and the Hilton Aspire and I’m sure the latter will be gone soon. When Blue for bizness changes, that will go away too. Time to use my points. Pretty soon we may favor Durbin.

This benefit is the only reason I hold both the personal and business platinum cards. This likely changes the dynamic.

Just cancelled the biz Plat after 12 months and a 250k welcome bonus. This was the primary benefit I actually missed…

…poof, it’s gone, so zero regrets.

Just cancelled the biz Plat after 12 months and a 250k welcome bonus. This was the primary benefit I actually missed…

…poof, it’s gone, so zero regrets.

Never thought I’d say this but Cap One card actually looks pretty interesting about now. CM for 40 years and no notice??? Amex, you really really suck

Screw you Amex. Not even a grandfather period a la Chase? I’m done.

This must be the major change that they were planning to announce.

Brutal. On top of Chase UR points nuked for cruises? Beyond brutal!

The CSR 1.5x and Platinum 1.35x (used to be 1.5 and already devalued) are the only things useful to me other than lounge access. Maybe all these cards have run out of gas except for people who travel constantly and it's worth it for lounge access alone. We make 3-4 round trips a year.

I will admit I don't use the feature that much. I mostly transfer to airlines. But I put spend on the cards know that I could. Seems like that would be exactly what they want?

They want you to carry a balance and not use a lot of the coupons.

You can’t carry a balance on an Amex biz card….

Yes you can, I have a $50K "pay over time" option on my Biz Plat

I used this quite often. Probably going to nuke the card when the renewal comes up this fall.

Incredible how greedy these issuers are getting right as we walk into a global recession

Makes perfect sense. Small-medium business spending is going to contract before personal spending does. So they are preemptively hedging on increased demand. Financial institutions don't play fair, they play smart. Or try to, at least.

Wow very disappointing I loved having this as a backup when I couldn’t find a good transfer partner redemption for a trip. Biggest reason I’ve held onto this card for years

Sad? You truly have a breathtaking gift for understatement at times. This is impressively awful. In one move, Amex is destroying the vast majority of the non-coupon book value of the Business Platinum card. With this move there's almost no reason to keep the card for huge swaths of cardholders. I've already cancelled my and my wife's personal Platinum cards. Now the Business Platinum will be out too.

All the blogsters will underplay this... (re: they won't bite the hand that feeds them. Reverse is true as well - Over hype / pump anything that will benefit them. It's ALL business $$$ my friend)

Agree. This is devastating

That sucks. With the difficult redemption environment i was basically using the 35% pwp as a backup plan.

4x gold card bonus spend stacked with 35% pwp = easy 5.4 cents per dollar... plus the airline miles.

your math is incorrect FYI. 35% rebate equates to 1.54cpp. so if you're earning 4x points thats 6.2% return

that how I always thought of it. now definitely cancelling.

This one hurt. Used this quite frequently.

The other coincidence is timing of this right next to rumor of higher tier AMEX card being floated the other day.

Almost all cards and loyalty programs are utter tosh now.

and Dell credit also dropping from $200 every 6 months to $150 for the full year effective July 1st. Cancelling my Biz Plat before August renewal.

All the no coincidence blogger announcementemts feel like a coordinated effort to numb our expectations.

Ugh. This kills the last major value point for the card. With miles transfers nerfed by "dynamic" award pricing, the rebate was the last way to easily and reliably get >1cpp in value.

In all honestly, this week seems to mark the end of an era in terms of a style of credit card spend and redeem. Basically to get any outside value, you have to redeem via travel partners, or earn through credit card portals.

sick bro...