I’m not sure what to make of this, though it sure is strange. Is someone just playing a trick on me, or is this part of a larger problem? I first wrote about this situation around a month ago, but it has now happened to me again, though in a slightly different way…

In this post:

My first suspicious credit card situation

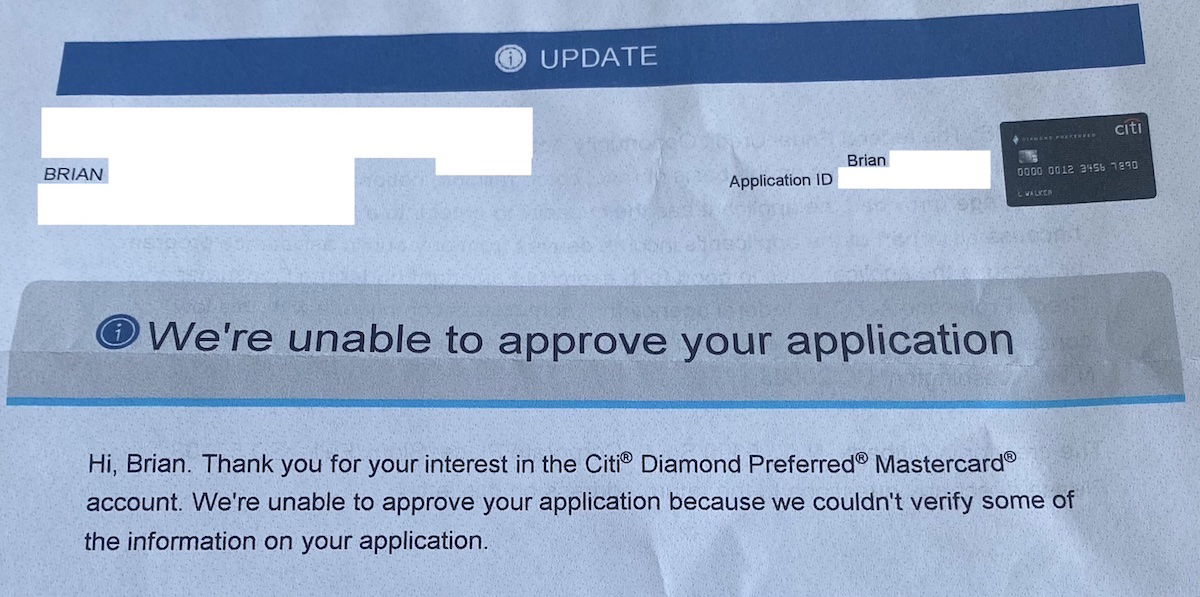

In early April, I got a phone call from Citi, asking to speak to someone with the exact same middle initial and last name as me. However, his first name was Brian, while my first name is Benjamin (interestingly both start with “B”).

I was confused, and explained the above to the agent. The other thing is that I have a distinctive last name, and I know that no one with the name she asked for exists. The agent thanked me for my time, and that was it. I thought that whole situation was weird, but didn’t put much more thought into it at the time.

Then around a week later, I received a letter in the mail with a credit card rejection for the Citi Diamond Preferred Mastercard. The letter stated that the rejection was because Citi “couldn’t verify some of the information” on the application.

There’s only one thing — I never applied for this card, and it was once again addressed to Brian (with the same middle initial and last name), rather than me.

My second suspicious credit card situation

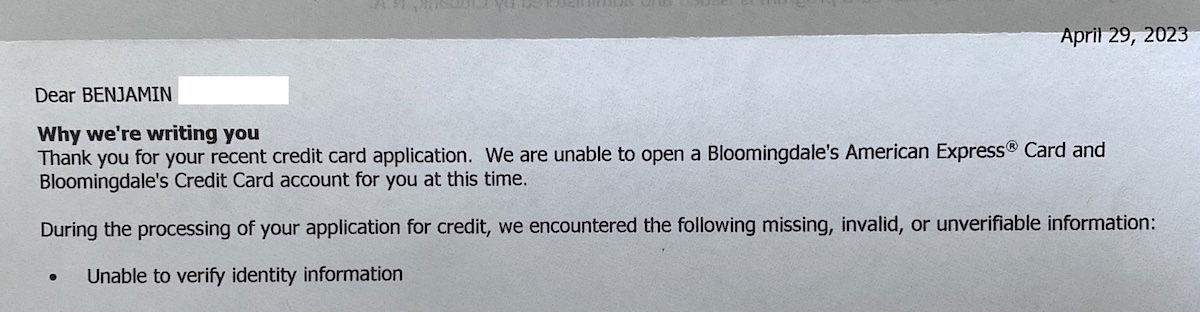

I wrote about the above situation about a month ago, but now there’s a further update. I just received a letter in the mail for my application for the Bloomingdale’s American Express Card. I got rejected for the card, on the grounds that they were “unable to verify identity information.”

I’m sure you can guess what I’m about to say next — no, I didn’t apply for a Bloomingdale’s American Express Card. This rejection letter is the first notice I received about my alleged application.

I’m not sure what exactly to do here?

Obviously I could call up Citi and American Express regarding this, but I’m not sure what that would accomplish? Once they realize I can’t verify whatever details were put on the application, they won’t be able to talk to me about the account, never mind that they likely won’t have any information to share.

I would imagine that what’s going on here is somewhere between a practical joke and an attempt at identity theft. Over the past 15+ years of blogging, I’ve had a countless number of people try to screw around with me. This ranges from people canceling my airline tickets, to people ordering room service on my behalf while at a hotel. It’s one of the reasons that nowadays I usually write about my travels after the fact. I’m not sure why people do this, exactly, but… I’ve gotten used to it.

But this situation is kind of odd, because I’m not sure I get the motive. There were no inquiries on my credit report for either of these applications, so it doesn’t look like this person has actually managed to steal my identity in any sort of meaningful way. So that makes me think that it’s more a weird practical joke than anything else.

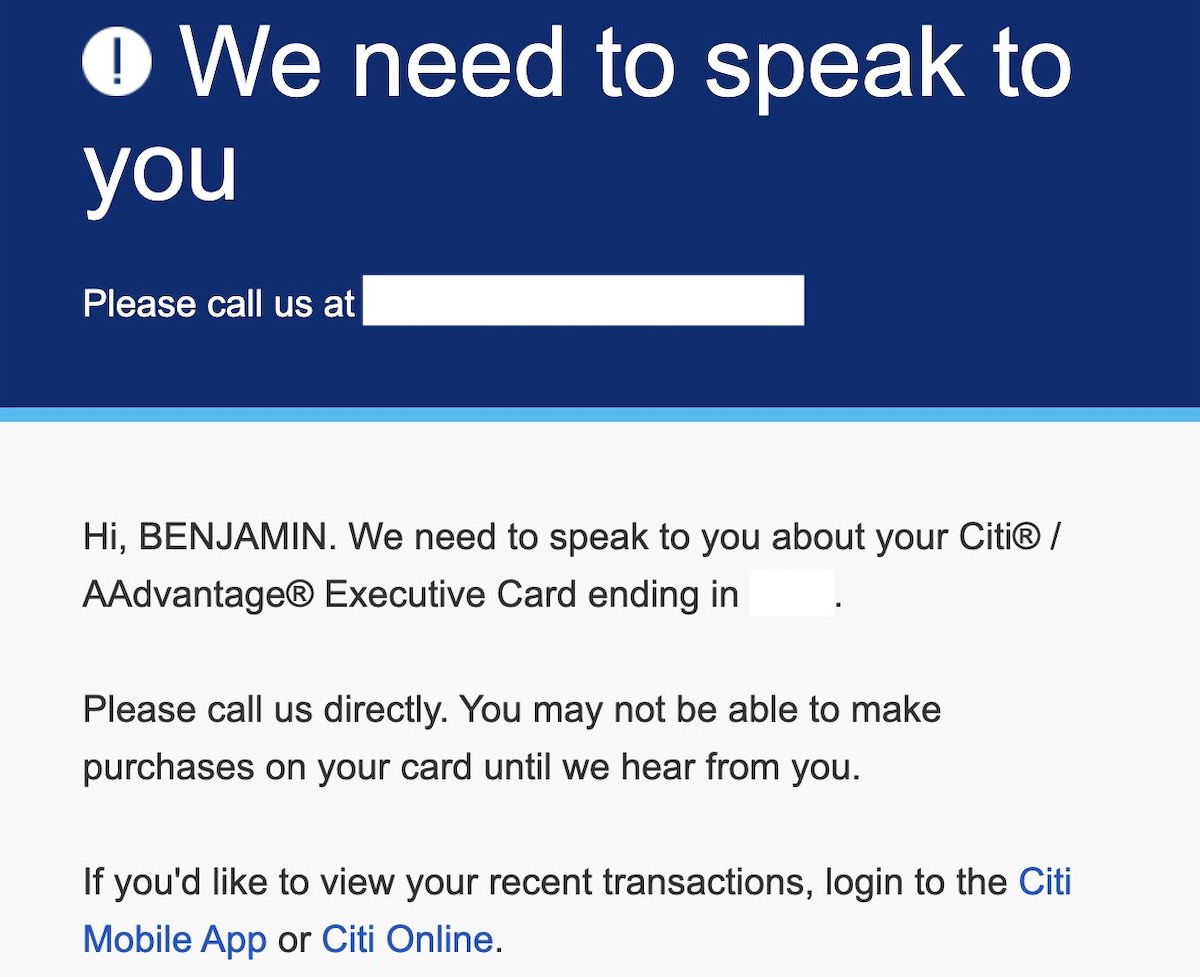

The only other thing worth mentioning is that I’ve had some odd fraud-related situations in the past several weeks. For one, my AAdvantage account was shut down and replaced by a new account, due to alleged unauthorized access (though no details beyond that were shared with me).

Furthermore, I had a fraud alert on a Citi card, where I was told that Citi had identified that someone had allegedly tried to call in as me, but couldn’t make it through the automated system. However, this person didn’t actually attempt to make any purchases, or necessarily have access to my account info.

I continue to closely monitor my credit, use two factor authentication, track my points balances, etc. I’m not sure if there’s anything I should be doing beyond that, as I don’t think there’s a lot of action I can take here.

I know many people would suggest that I should probably freeze my credit. However, that seems like a headache, and I’m not sure what that would accomplish, exactly:

- There’s nothing suggesting that anyone has stolen my social security number, based on the rejections being due to lack of available information, and no new credit inquiries showing on my credit report

- In other words, freezing my credit wouldn’t actually change anything compared to what’s happening now; I could keep getting rejection letters for cards I never applied for

- While I realize freezing credit falls in the category of “better safe than sorry,” it’s kind of an annoying thing to do if you’re like me, and apply for credit cards with some frequency

Bottom line

I’ve dealt with credit card fraud in the past. If someone tries to make a $500 purchase at Kohl’s in Irvine, that’s easy enough to fix, because it’s obvious fraud that’s easy to identify, the charges are removed, and a new card can be issued.

But this is a bit different, as it’s hard to know what exactly is going on…

What would you do in my situation?

My son has had this same thing happen several times now from more than one place. Basically we have ignored it as a scam because we don't know what to do. How do we know if the phone number on the letter isn't the frauds number?

from another article - but I've seen many over the years

Fraudsters create synthetic identities and it’s easier to do it than most people would imagine. They’re creating a person financially or digitally that doesn’t exist, new identities using a combination of real data and fabricated information.

Social security numbers are easy for people who know what they’re doing. Prior to 2008 social security numbers weren’t randomized, and there’s still an algorithm used to...

from another article - but I've seen many over the years

Fraudsters create synthetic identities and it’s easier to do it than most people would imagine. They’re creating a person financially or digitally that doesn’t exist, new identities using a combination of real data and fabricated information.

Social security numbers are easy for people who know what they’re doing. Prior to 2008 social security numbers weren’t randomized, and there’s still an algorithm used to create these numbers.

Social security numbers that get targeted most are ones infrequently used — those of children and the elderly — he recommends freezing the credit file of your children.

Everyone’s data is out there. Using social security numbers, dates of birth, and mother’s middle name for validation has become worthless, after the Equifax breach but even before.

Here’s how a phantom borrower is born. The scammer creates their fake identity, gets a fake ID and decides what social security number to use. They go into a store, say Target, and they’re offered a credit card at checkout. The clerk at the store isn’t looking for fraud, they’re incentivized for getting the application.

read the rest or do a search - https://viewfromthewing.com/paypal-shares-people-committing-fraud-looks-like-fraud/

Besides freezing credit, you should also put a fraud alert notice on your credit , so a new lender has to call the number listed in the fraud alert when opening a new line of credit.

It's likely attempted identity theft. No doubt your information has been leaked by careless companies (hello T-Mobile with 5+ MAJOR data breaches recently...!!). It's highly likely that your details were shared on the dark web and people are trying to use the details. This is all a result of the careless that "take security very seriously...blah...blah...blah" but do little to actually fix problems. They just give the standard (now largely useless) 2 years of free...

It's likely attempted identity theft. No doubt your information has been leaked by careless companies (hello T-Mobile with 5+ MAJOR data breaches recently...!!). It's highly likely that your details were shared on the dark web and people are trying to use the details. This is all a result of the careless that "take security very seriously...blah...blah...blah" but do little to actually fix problems. They just give the standard (now largely useless) 2 years of free monitoring. These companies have no incentives to actually fix the problems as fine are pennies and they are not liable for any issues that people like us have to deal with.

Now, as for fixing this, I hope you find the way. Please DO keep us updated with a follow up posting. This is something that many of us will suffer at some point. It's almost guaranteed at some point with all of the breaches that have happened and continue to happen.

It clearly appears somebody is trying to use your identity to apply for credit, so keep a close eye on it. The call you got may have been the perpetrator himself trying to get more information out of you. Freezing your credit would cause you more trouble than it’s worth, but you should inform all your credit card companies to be aware as it appears somebody is using your name and address to apply for...

It clearly appears somebody is trying to use your identity to apply for credit, so keep a close eye on it. The call you got may have been the perpetrator himself trying to get more information out of you. Freezing your credit would cause you more trouble than it’s worth, but you should inform all your credit card companies to be aware as it appears somebody is using your name and address to apply for credit and advise them you are not applying for any additional cards with them at this time.

Make sure you file with the IRS. Once they have a social security number they can file fraudulent returns for refunds. I now file with a PIN number that the IRS sends out every year.

Floridians are allowed to sign up for IP PIN regardless of any identity theft.

Agree with the comment about blogging about it. Some things you just can't discuss here or could make the situation worse. If it is the case of stolen identity, you will need to report it to the police and apply for new credit cards, etc. If this is a one-off, then I suggest calling Citi and Amex to cancel the cards and to ensure it will not affect your credit score. If you keep the...

Agree with the comment about blogging about it. Some things you just can't discuss here or could make the situation worse. If it is the case of stolen identity, you will need to report it to the police and apply for new credit cards, etc. If this is a one-off, then I suggest calling Citi and Amex to cancel the cards and to ensure it will not affect your credit score. If you keep the cards open then you could be liable for the charges and explain that you did not make those charges. Good luck.

This happened to my Mom. She received a letter of a credit card application to Express that was rejected. I researched the name in the letter and found an address to this person 30 miles away. But this person had no social media. It's an attempt of credit fraud. This way the person receiving the rejection letter would call the number in the letter to say "no one by that name lives at this address"...

This happened to my Mom. She received a letter of a credit card application to Express that was rejected. I researched the name in the letter and found an address to this person 30 miles away. But this person had no social media. It's an attempt of credit fraud. This way the person receiving the rejection letter would call the number in the letter to say "no one by that name lives at this address" only to have the person on the other end of the phone ask you to provide your actual information.

Do you or did you have tmobile? If so, they probably do have your SSN.

T-Mobile is a favorite for opening fraudulent accounts. When my info was stolen, they must have tried 10 times at least to open T-mobile accounts + they then get phones shipped to drop address.

Someone tried to apply for a PPP loan with my information in 2020. I had credit alerts set up with Experian and was notified in real time and was able to call and stop it. At the very least you should set up alerts with the 3 credit bureas.

I went a step further and pay Experian and TransUnion a combined $60 a month to be able to lock and unlock my credit from my phone or computer. As an aside TransUnion allows you to lock Equifax.

You're wasting your money. By law, all bureaus now allow you to freeze/unfreeze for free via the web.

Make sure your 2FA is not tied to your public or personal phone number that you use on all other sites. I had someone call into T-mobile and sim swap me. I got super lucky that I caught it quickly. If they have your main phone number, they can reset your main email and then it is game over.

Having worked for Citi Cards and AMEX branded cards. The first thing looked at is your SSN, and if the initials and surname match it goes onto next step of a credit search.

I have a similar problem as there is a Doctor with exactly the same initials and surname as me.

Your identity is being stolen I would try and get your SSN changed to include your first name, second initial, then...

Having worked for Citi Cards and AMEX branded cards. The first thing looked at is your SSN, and if the initials and surname match it goes onto next step of a credit search.

I have a similar problem as there is a Doctor with exactly the same initials and surname as me.

Your identity is being stolen I would try and get your SSN changed to include your first name, second initial, then surname. That will be what is sent to credit reference agencies.

Also, try and get all your cards issued showing this the the credit reference agencies will record your payment profiles that.

In addition, you can put a Notice on your credit reports BUT THIS WILL STOP YOU GETTING AUTOMATICALLY ACCEPTED.

Try the initial and you will have to push. However, if you explain they should understand.

If you need further help contact me.

Your competitor website uses made up surnames for their John and Sebastian team. Maybe that's to avoid some of the envy based fraud. You should contact the fraud department of that bank to discuss the issue.

I had strange things with citi last week. Wife has 800 credit scores across the board. Less than 1% utilization, most cards have 20k plus limits. They rejected her for a citi card and said her credit score was 6,789 out of 10,000. Yep not even a valid score. She called for reconsideration and the agent didn't seem to even understand the score is invalid. She said "I see you don't carry but 1% balance,...

I had strange things with citi last week. Wife has 800 credit scores across the board. Less than 1% utilization, most cards have 20k plus limits. They rejected her for a citi card and said her credit score was 6,789 out of 10,000. Yep not even a valid score. She called for reconsideration and the agent didn't seem to even understand the score is invalid. She said "I see you don't carry but 1% balance, citi wants to see you carry a 1.5% balance. None of this makes sense so we will call in again with someone that actually knows what they are taking about.

I have had the exact set of circumstances as you in the last 2 months. I froze all my credit bureau accounts (there are actually 5 not 3).

If you contact the suspicious credit applications, they will remove the hard credit pull off of your file and any adverse rejection entries.

I also proactively changed all of the passwords on my main personal and work emails, and put two factor identification on my major accounts.

...I have had the exact set of circumstances as you in the last 2 months. I froze all my credit bureau accounts (there are actually 5 not 3).

If you contact the suspicious credit applications, they will remove the hard credit pull off of your file and any adverse rejection entries.

I also proactively changed all of the passwords on my main personal and work emails, and put two factor identification on my major accounts.

Finally, I spent the money with a credit and identity monitoring service to try to keep ahead of this.

This is the world we live in. Its quite tedious to deal with all of this.

identity monitoring service is the best for some peace of mind. Make sure to get police report and do the credit freezes. I put a statement on my credit bureaus that ANY application required a phone call to me at my phone number. I think I had dozens of calls early on.

Use a password manager (a credible one, like 1Password, not LastPass, which has had so many security issues). Freeze your credit file when you're not applying for a card.

I am not sure if they've already automatically done a hard pull, but if they did, I imagine a prankster can just mass apply and get you a bunch of hard pulls, which would cause trouble for your legitimate applications for a while.

I work in data security. To add to what’s been said, you should also be using a password manager such as 1Password if you aren’t already. Bit of a pain to get setup and change all your passwords, but having a different password to every website minimizes the damage a breach at any single site can do. You just have to memorize a new password/passphrase which isn’t viewable by the PW manager. Apple and Google...

I work in data security. To add to what’s been said, you should also be using a password manager such as 1Password if you aren’t already. Bit of a pain to get setup and change all your passwords, but having a different password to every website minimizes the damage a breach at any single site can do. You just have to memorize a new password/passphrase which isn’t viewable by the PW manager. Apple and Google have their own free versions but they’re harder to use and less interoperable than the third party ones you pay 3 bucks a month for.

Data breaches happen every day and organizations go to great lengths to avoid disclosing them. Ransomware-phishing attacks are commonplace and companies often pay a ransom in exchange for an unenforceable promise from the attacker not to share any data it has obtained. Breach notification is hit-or-miss so you might not know that your data was involved in a breach. Given these facts, plus the letters you’re getting, plus the fact that you’re a public figure, plus the fact that you have a zillion financial accounts, there’s a good chance your SSN or other PII has somehow been exposed and you just don’t know about it. A credit freeze is a good option and worth the small headache.

Ben, think about it . . . how did the issuer know to what address to send the rejection letter? Someone has your address. Is your mailbox easily accessible?

I thought this too at first, Lee--inside job from someone close to him like a building or postal worker. However if that were the case wouldn't they be pulling the letters/denials/approvals with the wrong name out of his mailbox so he wouldn't be aware? So I don't think it's that.

That leaves a number of other possibilities, one being that whoever is doing this just has a last name and address, but nothing else...

I thought this too at first, Lee--inside job from someone close to him like a building or postal worker. However if that were the case wouldn't they be pulling the letters/denials/approvals with the wrong name out of his mailbox so he wouldn't be aware? So I don't think it's that.

That leaves a number of other possibilities, one being that whoever is doing this just has a last name and address, but nothing else like SSN or even first name.

I haven't worked in this field in a number of years now but I am 99% sure if they have SSN correct, then it would show as an inquiry on the credit file, regardless of the first name mismatch.

Additionally, with the first name wrong, this doesn't seem like a legit attempt to get an approval at all. Perhaps decades ago companies wouldn't check first name variations for credit, but they do now.

Whoever is doing this could be still be in the early phases of trying to break into Ben's info and are hoping for a miracle? Or maybe someone made a quick buck by saying I'll sell you someone's info but then giving only the last name and address correct? That's reaching, but this world is crazy.

Otherwise none of this really makes sense from any other perspective besides trying to be annoying or funny, which is dumb, as I am sure that individual/group would be breaking a number of laws in the process.

So yes, confusing situations and I think the freezes are warranted. Glad it was an easy experience to place them.

But, if the culprit sees the rejection on the computer, they don't need to obtain the rejection letter. Just the card if approved.

Re "this world is crazy"

Right, everyone "knows" the world is crazy (which always "conveniently" means the world/OTHER people, usually the governing authorities, are crazy but not they themselves, of course). Yet, curiously, no one typically offers an good explanation on why the world is crazy.

Have you ever wondered WHY the world is crazy?

How do you explain it intelligently?

Do you have a coherent explanation for the craziness of the world...

Re "this world is crazy"

Right, everyone "knows" the world is crazy (which always "conveniently" means the world/OTHER people, usually the governing authorities, are crazy but not they themselves, of course). Yet, curiously, no one typically offers an good explanation on why the world is crazy.

Have you ever wondered WHY the world is crazy?

How do you explain it intelligently?

Do you have a coherent explanation for the craziness of the world that makes sense (religious fantasies are obviously excluded because they only "make sense" and are "valid" to fantasy lovers but never to reality-based truth-seekers)?

Wouldn't the recognition of the underlying cause(s) of this craziness be instructive in terms of HOW we should tackle it to manifest real change out of the craziness?

The WHOLE big picture (not just a part of the big picture) that makes up the human condition, that explains the craziness of the world (if you ever genuinely wondered WHY it is that the world is crazy), that describes human conduct over millennia is the hegemony of the 2 married human pink elephants in the room (and has never been on clearer display than with the deliberate global Covid Scam atrocity) — see “The 2 Married Pink Elephants In The Historical Room –The Holocaustal Covid-19 Coronavirus Madness: A Sociological Perspective & Historical Assessment Of The Covid “Phenomenon”” ... www.CovidTruthBeKnown.com (or https://www.rolf-hefti.com/covid-19-coronavirus.html)

Isn't it about time for anyone to wake up to the ULTIMATE DEPTH of the human rabbit hole --- rather than remain blissfully willfully ignorant and play victim like a little child?

"Separate what you know from what you THINK you know." --- Unknown

The ruling gang of criminals pulled of the Covid Scam globally via its WHO institution because almost all nations belong to it. If you're in the US go to https://sovereigntycoalition.org and sign the American Sovereignty Declaration to #ExitTheWHO and follow their prompts to contact your representatives and tell them to work for their constituents instead of the mega psychopaths in power.

@Lucky

I think you had a lot of good advice the last time you post this. Did you follow any of them?

You can place a fraud alert on your credit file. This way credit issuers must reach out to you first before they open an account under your name.

How do you place a fraud alert?

Same thing happened to me few days ago, a week after getting this letter got approved without calling. Mine was AA card.

Just some friendly advice: if this is in fact someone doing this just to mess with you, please don't blog about it further. You'll just be giving fuel to their fire. I hope your situation gets resolved easily!

Your SSN is compromised, you need to report your identity theft to one of the 3 credit bureaus, report it to the Federal Trade Commission (can be done online) and constant Social Security Administration.

"Your SSN is compromised"

No evidence of that has been presented by Ben.

Similar thing happened to me last summer - someone applied for a BofA card with a different first name (starting with the same letter) and the same last name. I froze my credit and it hasn’t happened again.

You should consider freezing your credit - it’s fairly easy to freeze/unfreeze these days.

Here's what I did after identity theft a few years ago and I suggest you do the same:

Freeze or lock your credit with all three credit bureaus immediately. It will take half an hour tops and is well worth the peace of mind.

Also, make sure you get a notification after every credit card expense. Yes, I know it's ridiculously annoying but I sleep better at night knowing, and I caught unauthorized expenses (i.e....

Here's what I did after identity theft a few years ago and I suggest you do the same:

Freeze or lock your credit with all three credit bureaus immediately. It will take half an hour tops and is well worth the peace of mind.

Also, make sure you get a notification after every credit card expense. Yes, I know it's ridiculously annoying but I sleep better at night knowing, and I caught unauthorized expenses (i.e. credit card fraud) instantly a couple of times.

I also check my bank balance and activity daily. A routine I do every morning.

"Also, make sure you get a notification after every credit card expense. Yes, I know it's ridiculously annoying but I sleep better at night knowing, and I caught unauthorized expenses (i.e. credit card fraud) instantly a couple of times.

I also check my bank balance and activity daily. A routine I do every morning."

Either you have a *very* simple credit life, or you have *way* too much time on your hands.

Totally disagree. You have time to fix what fraud can do to your credit? Let it happen and then your response will agree. I check every day including while traveling internationally.

I have plenty of automatic alerts if things that are out of our normal use pattern happen.

Receiving a text on *every* charge? That's insane. The Doubt family makes dozens of charges a day.

Checking charges *every* day? I check weekly and my wife still thinks I have OCD.

Finding a compromised card in a day vs. in 2-6 days? The hassle level between those two time periods is almost identical. I've had plenty of...

I have plenty of automatic alerts if things that are out of our normal use pattern happen.

Receiving a text on *every* charge? That's insane. The Doubt family makes dozens of charges a day.

Checking charges *every* day? I check weekly and my wife still thinks I have OCD.

Finding a compromised card in a day vs. in 2-6 days? The hassle level between those two time periods is almost identical. I've had plenty of cards compromised, and in no situation was it noticeably worse if it was a few days ago vs yesterday.

I set up alerts for credit card purchases over a certain dollar amount, and for foreign purchases. For my ATM cards, I get a notification whenever they're used *at all*, because I rarely use them.

Or maybe I am efficient and can get things done quickly.

Two minutes to go to the bank's website and check

A quick glance after every cc notification

I had something like this happen to me recently as well. First, it was someone trying to open a Macy's card in my name, and I caught it in time, and I called Macy's. Second, was someone opened a Bank of America checking account in my name late last year. Since I didn't bank with them, I only found out through a over draft charge notification. So, I went into a branch and spoke with...

I had something like this happen to me recently as well. First, it was someone trying to open a Macy's card in my name, and I caught it in time, and I called Macy's. Second, was someone opened a Bank of America checking account in my name late last year. Since I didn't bank with them, I only found out through a over draft charge notification. So, I went into a branch and spoke with their fraud department while in the branch, and got it resolved. They told me to add an alert on chexsystems, so whenever someone opens an account I will get a notification.

Or just freeze your credit reports and none of that would have happened.

wrong - I had fraud alert on all bureaus. They still were able to open an account with a jeweler - and proceeded to file a change of address. Thankfully I got the change of address notification in the mail. I called and asked why it was approved with the fraud alert - on hold - came back + said I was absolutely correct - there was a fraud alert - and someone had screwed up. Thankfully the credit card had not been mailed yet. So fraud alerts are not perfect.

A fraud alert is NOT the same as a frozen credit report. Your experience is precisely the reason why one should opt for freezing one's credit, not simply placing a fraud alert, if one suspects ongoing fraudulent activity.

Won't help you with a bank account, they use a different system from the credit bureaus.

If I had to guess, this is less of a narrowly directly practical joke and more likely just basic ID theft where you happened to be part of a general data breech but some information that was stolen and possible sold was not complete and whoever is applying is just doing it in large batches to try to get small wins.

Logical, but I bet it's even less sophisticated than that.

They've got Ben's name (sometimes!) and address. That sounds more like dumpster diving than "data breech".

Interesting points about freezing credit. When you unfreeeze your credit, can you immediately apply for cards without issue? And what's the best way to freeze your credit? If anyone has a favorite resource, I'd love to learn more...

Just go into your 3 credit bureau accounts and freeze the credit. Very easy, and just before you apply go in and unfreeze.

It's immediate and you can set how long you want it un-frozen for.

You can just use the native Equifax, Experian, and Transunion websites. All 3 allow you to freeze and unfreeze credit scores for free with just a basic account. My practice is to keep all 3 bureaus frozen unless I am applying for a card. If I want to apply for a card, I unfreeze (aka thaw) all 3 bureaus for one day only (only takes 5-10m), wait 5-10m (just to ensure that the thaws have...

You can just use the native Equifax, Experian, and Transunion websites. All 3 allow you to freeze and unfreeze credit scores for free with just a basic account. My practice is to keep all 3 bureaus frozen unless I am applying for a card. If I want to apply for a card, I unfreeze (aka thaw) all 3 bureaus for one day only (only takes 5-10m), wait 5-10m (just to ensure that the thaws have gone through), and apply for the card. Then, the next day all of my scores are refrozen, and I've (hopefully) got a new card on the way.

Yup, that's what I do as well

My experience is that just before applying for a new card unlock your credit report(s) then apply. Then I wait for an hour or so and re-lock the account. It’s never been an issue doing it this way, and fraud on my credit has been so far been nonexistent.

My credit has been frozen for years. When I am ready to apply for a new card or a loan such as a car loan, I go on all three credit bureau apps or websites and temporarily unfreeze them for a day or so. No one should be able to open a loan or credit account. The lift is instant. I feel like it's the easiest way to protect against identity theft. Good luck!

Hi Ben,

Yes you can apply right away. I bought a new car last month and forgot to unfreeze my credit report. At the dealership, they said they couldn't access my report and told me what credit bureau they'd pull from. Logged into that credit bureau account, unfroze my report (for just one day) and then let the salesman know. Less than 5 minutes later they had verified my credit info.

A small hassle...

Hi Ben,

Yes you can apply right away. I bought a new car last month and forgot to unfreeze my credit report. At the dealership, they said they couldn't access my report and told me what credit bureau they'd pull from. Logged into that credit bureau account, unfroze my report (for just one day) and then let the salesman know. Less than 5 minutes later they had verified my credit info.

A small hassle to set up, but so worth it. It's great peace of mind knowing I don't have to worry about someone opening credit cards, taking out loans etc.

“ I know many people would suggest that I should probably freeze my credit. However, that seems like a huge headache”

What? My comment on the earlier story that you obviously had your credit reports frozen was mistaken!

How is it a headache? I can unfreeze my 3 reports in 5 minutes.

How is freezing your credit report a pain ? It takes a minute or so to unfreeze if you know you’re applying for something.

I have all my reports frozen and only a handful of times has it been a pain. But speaking from experience, it’s a real hassle to get fraudulent inquiries removed.

I freeze all my accounts. Initially, getting it set up is a small hassle but worth it for piece of mind someone can’t create a credit account under my information. Unfreezing is simple and you can unfreeze for any amount of time. If you know you are going to apply for a credit card, go to the 3 credit bureaus and you can unfreeze for one or two days then your account is automatically frozen again.

You do need to set up accounts with each of the major credit bureaus but beyond that freezing/unfreezing as needed is quite easy and fast. As others have already stated seems like a very wise move.

I do the same. It's a minor pain but worthwhile.