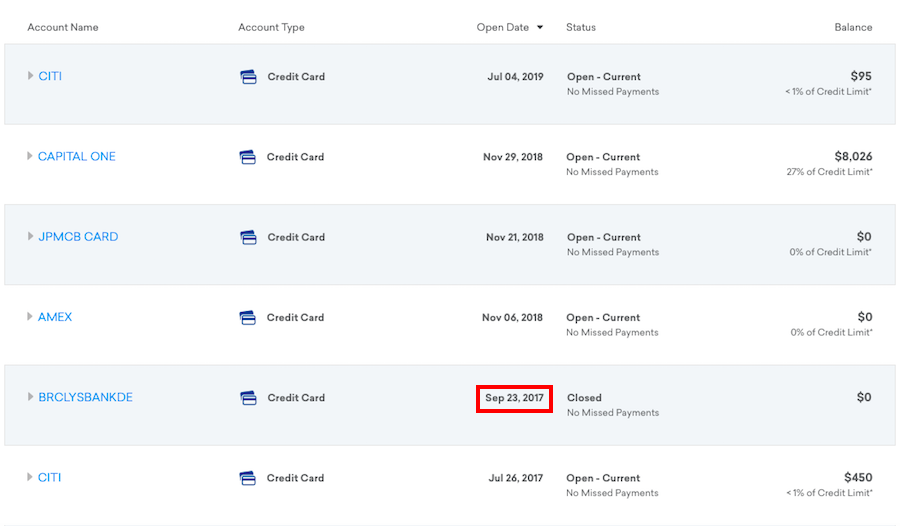

A few days ago I wrote about how to check your 5/24 status, which also prompted me to check my own 5/24 status.

As it turns out, five new cards are showing on my credit report in the past 24 months, and as of September 23, 2019, I’ll be under the five-card limit once again (though in reality, I’ll wait until October 1, 2019, to apply for anything).

This means I’ll be eligible to apply for Chase cards once again. For me, this is a reason to hold off on any card applications, as I really want to get the IHG One Rewards Premier Credit Card.

Realizing how close I was to being under the 5/24 limit also made me want to look up what Ford’s 5/24 “status” was, and suffice to say that I was surprised.

Ford’s 5/24 status

I had assumed Ford was somewhere around the limit, though after looking up his situation, he’s actually at 2/24 at the moment. Wow!

I was always under the impression that one of the biggest advantages of being in a relationship was access to another Social Security Number for the purposes of credit card applications. Well, boy have I failed him/me/us!

So it’s time to change that…

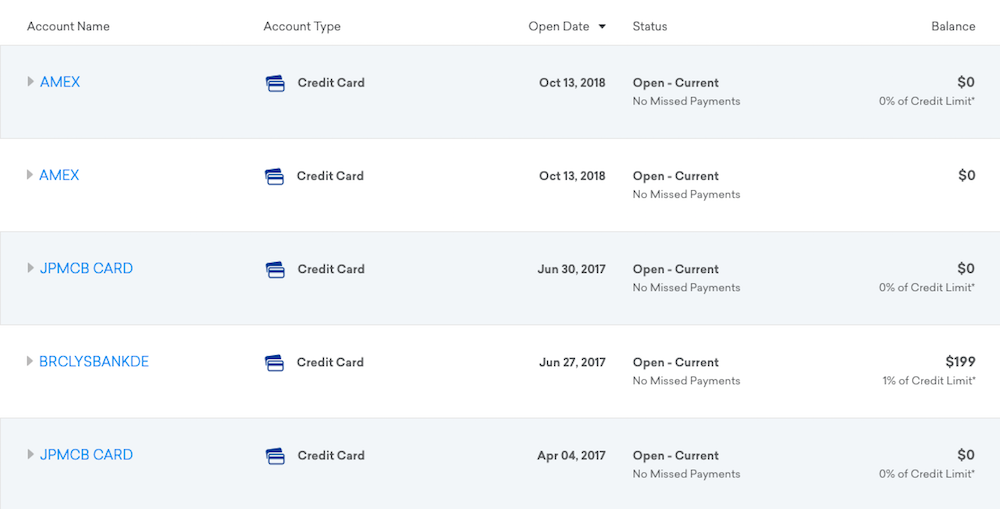

What credit cards Ford has

I’ve written about the credit cards that I currently have. Ford has a variety of cards:

- He has some cards that I don’t have

- He is an authorized user on some of my cards

- He is the primary user on some of the same cards that I have

Here are the cards that he has that I don’t have:

- The American Express® Gold Card (review), which he got last year, and offers 4x points at restaurants worldwide (on up to the first $50,000 in purchases per calendar year and then 1x)

- The Chase Sapphire Preferred® Card (review), which he has had for years, since before he met me (I, of course, asked him about what credit cards he has on our first date, as one does); while he’s also an authorized user on my Chase Sapphire Reserve® Card (review, the Sapphire Preferred is his go-to card for shopping purchases I’m just better off not seeing 😉

Which credit cards should I get him?

That’s a bit of background, though what cards should Ford get at this point?

Ford doesn’t have any of the three awesome “Ink” cards, which I consider to be among the best business credit cards. There’s a huge advantage to applying for these first, since they won’t count as further cards towards the five-card limit.

The timing of this is actually perfect, because it just occurred to me that he’s using the Marriott Bonvoy Business® American Express® Card (review) as his primary business credit card, and it’s certainly not the card I’d recommend using for everyday spending.

With that in mind, my thought is that he should first apply for the three Chase Ink cards, which are fantastic complements.

Ink Business Cash® Credit Card

Ink Business Cash® Credit Card

So my plan is to have him:

- First apply for the Ink Business Preferred® Credit Card, which has a huge bonus and is the most well-rounded business card out there

- After waiting about 30 days, apply for the Ink Business Unlimited® Credit Card, which has a great bonus, no annual fee, and offers 1.5x points on all purchases

- After waiting an additional 30 days, apply for the Ink Business Cash® Credit Card, which has great bonus, no annual fee, and offers up to 5x points in select categories

As you can see, this is very much a “slow and steady” approach towards credit card applications, though I also think it’s the right move. This means that by November he’d have all three Ink cards (if all goes as planned), and he’d still be at 2/24.

I’m still trying to decide what makes the most sense for him beyond that, though one thing is for sure — the Ink Business Preferred is the best place for him to start.

Anyway, if nothing else this post is a reminder to make sure you’re not only managing your own credit card strategy, but also the credit card strategy for your family/significant other. Goodness knows they need your help!

Bump. I have the same question as I started a similar Ink strategy last week and trying to figure out the best approval strategy for multiple Inks. Does chase not have an algorithm that gets suspicious with multiple cards opened for the same business?

Will the 3 business cards be opened using the same business i.e. same social security number/EIN?

Naturally US centric, but a lot of folk don’t live there. Asia is a huge market and loads of folks resident there who simply use other dominant local and regional/ international banks and product cards there.

Local banks regularly get top billing for products and service ( internationally),and that’s the ones folk use so perhaps some inclusion along with hotel and other issued cards here into your articles?

If you take Asia as...

Naturally US centric, but a lot of folk don’t live there. Asia is a huge market and loads of folks resident there who simply use other dominant local and regional/ international banks and product cards there.

Local banks regularly get top billing for products and service ( internationally),and that’s the ones folk use so perhaps some inclusion along with hotel and other issued cards here into your articles?

If you take Asia as a market- it’s massive, young and the spending capacity is rising fast.

@Eskimo

@Lucky

I found this post from Luck which explains things:

https://onemileatatime.com/chase-ink-business-cash-card-review/

@Eskimo

Thanks for that clarification. Not at all clear from Lucky's post that one needs to jump through those hoops to get the points versus the cashback.....

@Wayne

$500 cashback = 50k points but it's not straightforward, you need to transfer the cashback to a points card. Go read around a bit more exactly how that works.

80k + $500 + $500 = 180k

@ Lucky

@ Shawn

Lucky says the following:

"With that in mind, my thought is that he should first apply for the three Chase Ink cards, which are fantastic complements. Furthermore, altogether the cards offer welcome bonuses of 180,000 Ultimate Rewards points, which is incredible."

So, my question is about the three cards Lucky is advertising. When I click on the three links, the first one provides the expected 80K sign up bonus.

...

@ Lucky

@ Shawn

Lucky says the following:

"With that in mind, my thought is that he should first apply for the three Chase Ink cards, which are fantastic complements. Furthermore, altogether the cards offer welcome bonuses of 180,000 Ultimate Rewards points, which is incredible."

So, my question is about the three cards Lucky is advertising. When I click on the three links, the first one provides the expected 80K sign up bonus.

The other two do not so far as I can tell....

Lucky? what am i missing????

@Lucky, I would have Ford sign up for all three Ink cards and also the Amex Blue Business Plus card, which is the card Ford should be using to spend since it gets 2x MR points on every purchase up to $50,000.

We know the Ink sign up bonuses are great, but does Ford spend in those categories? Is it worth holding onto the Ink Preferred if he already has access to a Sapphire Reserve? He's already got his 3x travel/dining.

I think this post missed out on an opportunity to discuss holding cards for perks. A great "Player 2" strategy is award nights for hotel cards.

2x Chase Hyatt

2x Hilton Aspire

2x...

We know the Ink sign up bonuses are great, but does Ford spend in those categories? Is it worth holding onto the Ink Preferred if he already has access to a Sapphire Reserve? He's already got his 3x travel/dining.

I think this post missed out on an opportunity to discuss holding cards for perks. A great "Player 2" strategy is award nights for hotel cards.

2x Chase Hyatt

2x Hilton Aspire

2x Amex Bonvoy (formerly 'SPG')

2x Amex Bonvoy Brilliant

2x Amex Bonvoy Business

2x IHG

That's 12 free nights for you and your significant other each year.

I'm amazed that someone can be a "credit card expert" and have their spouse at 2/24. all these deals that your write about as being so good and can't miss- you didn't even sign up your husband for!! so how good were they really....

It would be far more interesting to look at whether or not your typical user (which you and Ford are not) who earns a living working for someone else (and thus can’t really benefit from the buisness cards like a self employed person can) is better off splitting their spend or focusing on a single flexible currency.

For example should Our person above (who let’s say makes 125k annually) put his dining spend with...

It would be far more interesting to look at whether or not your typical user (which you and Ford are not) who earns a living working for someone else (and thus can’t really benefit from the buisness cards like a self employed person can) is better off splitting their spend or focusing on a single flexible currency.

For example should Our person above (who let’s say makes 125k annually) put his dining spend with Amex at 4pts or accept 3pts going with chase because that is where their “general spend” goes.

Clickbait 101

@wayne. If you have a sapphire card, that $500 is in turn 50k UR points.

I have to agree that the credit card offers are very repetitive, but they also alienate all of the readers outside of the USA. Most other countries have different offers available (and some like in Europe have none at all) and other countries also have very different credit history/ score requirements (eg I don't need a credit card from 18 in Australia to end up with a decent credit score).

I still say don't try to be under 5/24 as you are missing out on a ton of almost equal offers to Chase. Loving my 12/24 status, Amex, Citi and Barclays!!!

I lol'ed at "i asked about his cc's on our first date, as one does." Good stuff.

Lucky--

No kidding---we've gotten a lot of value from US Bank's Radisson Rewards card......5x for all purchases, free night certificate and 40k points just for renewing the card....then stay at a gorgeous Radisson Blu in Europe (or Asia, or Africa....)....it's not a "tier one" card for us, but we do use it and we do find great value by looking for smart redemptions. We've been treated very well with the included Gold status.....give it a think.

@Lucky:

Ink Business Unlimited - I go to the link and I see $500 cash back after $3k spend in first 3 months. How am i missing the 50K bonus you cite?

@Lucky, Without getting too far into personal details, I’d be curious to see a post (or comment) about the strategies you and Ford take (if any) when it comes to how you both (as a household) divvy up category spend (e.g. does one of you vie for the grocery category?, do you split potential category spend awards evenly or each pick a points currency {MR, UR, TYP...} to pursue?, etc.)

I’d also be curious to hear household spend strategies from other readers.

This was useful to me. Thanks for the post. I am still trying to figure out 5/24 after screwing it up early - business cards don't count as one of the 5, but if you are 5/24 you cant apply for one.

I'm not 100% clued in to the credit card points game, but your list doesn't show the Chase Hyatt card, even though you love the Hyatt frequent guest program. I was going to sign up for the Hyatt card based on you liking Hyatt. What do you recommend?

Question if you already have the Ink Business Preferred are you more likely to get the no annual fee ink business cards?

Seems like a lot of Ink cards to be approved for in short time frame, but I suppose you have reasons to believe it’s feasible. I’m still not trying to get under 5/24, and assuming that eventually I’ll run out of other attractive cards to apply for and will go under 5/ 24 by default, but it hasn’t happened yet. But those are appealing Ink bonuses, for sure!

@Sam - just going for the sign up bonuses - user in this case will likely not spend a ton of on going spend on the card.

Also I don't really understand the strategy. There is not a single spend category besides "shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines" where these cards are actually dominant. In every single other category some other card is better. This business services category seems pretty niche. How much does Ford spend there? Enough to warrant two additional cards? Is there a single instance where Preferred trumps...

Also I don't really understand the strategy. There is not a single spend category besides "shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines" where these cards are actually dominant. In every single other category some other card is better. This business services category seems pretty niche. How much does Ford spend there? Enough to warrant two additional cards? Is there a single instance where Preferred trumps Business Cash? (even in that niche category, it is just 3x points v. 5x).

Why do you recommend the Chase Ink Unlimited over the Amex Blue? I get it if you spend far over $50K in non-bonus spend but beyond that it doesn’t make sense to me.

@Sam I generally don't mind these articles, but they've become pretty repetitive lately. When the "strategy" is to apply for every possible UR earning Chase card out there, at the exclusion of everything else, it loses my interest. If there was something new and/or creative here, it would be different.

Wow! What a deal! And what a Fun! I should check my & hubby’s status, although I think I’m still over Latest one an Amtrak for trips to NYC! :-)

These posts are boring and strain your credibility with readers. I know you need some sops to your credit card overlords, but maybe reduce the frequency of them?