I’m not exactly sure what to make of this, so I’m simply passing this on for anyone who wants to look into it more, as I don’t plan on taking advantage of this myself (I think).

In this post:

Buy $150 hotel gift cards for $100

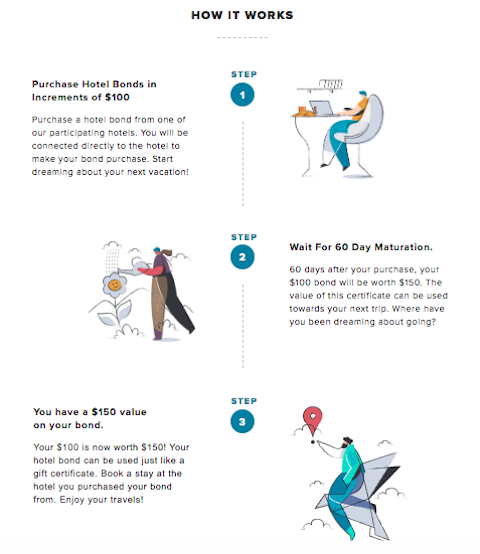

The website buynowstaylater.com is selling “hotel bonds.” As the initiative is described:

As the hotel industry faces unprecedented challenges due to coronavirus (COVID-19), we encourage travel enthusiasts from around the world to help support our hotel friends through a “hotel bonds” initiative: Buy Now, Stay Later.

With this you:

- Can purchase a “hotel bond” from a participating hotel in increments of $100; apparently you’ll be connected directly to the hotel to make your purchase

- Wait 60 days for maturation, at which point each $100 “hotel bond” will be worth $150 to be used towards your next stay at that hotel

There are hundreds of participating hotels around the world, ranging from independent hotels to chain hotels. In each case you’re purchasing a “bond” directly from a hotel, and not for a particular hotel group.

There are brands on the list like Aloft, Andaz, DoubleTree, Element, Embassy Suites, InterContinental, Marriott, Radisson Blu, etc.

You simply submit a form online an then within 24 hours the hotel will allegedly get back to you with more details. At some hotels there are limits on how many “bonds” you can buy, and there maybe expiration dates, which vary by property.

I keep putting the word “bond” in quotes because this is very much not a bond by the traditional definition. It seems weird to use that terminology when you’re essentially just selling discounted gift cards that you have to wait 60 days to redeem.

Is this “hotel bonds” opportunity worth it?

I’ve written before about how I think many travel brands could be doing a better job creatively generating revenue. With so many companies having liquidity issues, there are lots of win-win promotions that could be offered.

In general I’m really supportive of this concept. Many individual hotels are small businesses, and they need our support right now.

That being said, while the promotion sounds great on the surface, I have some reservations:

- I wish this were being run directly by a hotel group, rather than through a third party

- I wish this wasn’t just valid at individual properties, with varying limits, expiration dates, etc.; at the same time, I recognize that it’s the individual hotels that need the liquidity

- There’s quite a bit of risk here, because it’s very possible that some individual hotels may go out of business

- I’m a little confused by the purpose of the 60 day “maturity” (other than further trying to market these as “bonds”), because in many ways you’d assume they’d want you to stay ASAP, given how low hotel occupancy is

Bottom line

There’s a website facilitating hotels selling “bonds” where you can pay $100 and then receive a $150 hotel gift certificate in 60 days. If you frequent a hotel on the list then it can’t hurt to fill out the form and get in touch with the hotel to find out the expiration dates, limits on how many “bonds” you can buy, etc.

Personally I think I’ll sit this one out, as much as I’d like to support individual hotels.

What do you make of this hotel bonds opportunity?

(Tip of the hat to LoyaltyLobby)

So how many investors have fall for this unlicensed broker.

Looking back, this is quite a pity.

For investing in a failing piece of real estate.

When marketing agencies try to get creative and sell it, we got some "bond" impostor.

When banks try to get creative and sell it, we got the subprime mortgage crisis.

Very much like a junk bond you are a taking a risk that in 60 days it won't be worth the paper it's printed on.

Dan if a hotel wants to get cash in now then they could drop their rates!

Its not a very impressive list. Ben did you even look?.

There are only 7 countries in Europe Listed . Only one hotel listed in each of France, Spain and Italy. No UK, Germany, Nordics or Netherlands,

Canada - nothing in British Columbia.

Australia - one hotel.

Japan - nothing.

@Sean

;) SEC ;)

@DaKine

Not zero.

From what I read the "bond" prospectus it is advertised as a "60 day term, 300% coupon bearer bonds".

If they guarantee the hotel rate will remain the same as now may be, what about after couple months they jack up the hotel nightly rate then people are screwed.

"Is there a commission for each bond sold?

There is no commission. The creators of the program are not taking any fees. 100% of the cost of the bond goes directly to the hotel."

The website traces back to a company called "Lion & Lamb Communications". It seems the company's target customers are the independent hotel owners instead of consumers like us. That's why the whole thing is not carried out with any hotel groups

Too much risk. If a hotel wants me to part with cash *now* and accept the risk that comes with that, I'd need two things:

1. These things would have to be valid at any hotel in the chain if the hotel itself goes poof.

2. I want *way* more return than what they're offering... as in 2x to 3x face.

A bond has an interest rate... so this seems to be in the ballpark.

It is either a zero coupon bond. Or as you are indicating, one sold at a discount to face value.

Just watch. If the room "costs" less than $150, the hotels will keep the overage. They're never going to leave the extra on account toward your next stay.

It's good until the 3rd party selling this to you from their garage goes chapter 11...59 days from now.

Jordan Belfort selling these?!?

50% for a 2 month loan is like an annualized 300% interest rate. All of these hotels can borrow money much cheaper than that.

Ben,

This seems ripe for investigation by the Federal Trade Commission, the SEC and/or FBI and/or local law enforcement at the very least.

Not saying anything about it’s legality, just that some of those agencies might

take an interest just to protect the traveling (or not yet) public.

I think things like this are great in concept, but this is a non-starter for me in terms of execution.

First off, the only reason I book internationally branded properties is because their loyalty programs bring me benefit. Even if I knew what my future travel looked like, I wouldn't buy into a property that's in no way special while also setting myself up to bypass my loyalty benefits.

Secondly, I'm not comfortable...

I think things like this are great in concept, but this is a non-starter for me in terms of execution.

First off, the only reason I book internationally branded properties is because their loyalty programs bring me benefit. Even if I knew what my future travel looked like, I wouldn't buy into a property that's in no way special while also setting myself up to bypass my loyalty benefits.

Secondly, I'm not comfortable with the level of risk. I'd be (relatively) happy to inject funds into a multi-property group, with confidence that at least some of the properties would survive this, especially if I could do so confident that I'd enjoy my status perks and points accrual when I eventually stayed.

So, basically, hotel groups...meet me halfway. I know you've got liquidity issues and I know I'll stay again sometime in the future, but don't make helping you out a one sided deal.

@ Ben -- I have a bridge for sale if anyone is interested.

so how do you logistically issue a "gift card" valid only in one hotel and not the entire chain?

These are the same people who charge me $35/ night to send/receive faxes, make unlimited local phone calls and print my boarding pass! LOL! The sins of the past are going to determine who survives and who doesn't. Those properties never (willingly) got my money before....now they want help from me?....yeah right@

Yep! Jay Powell has 2.5 T new printed money on hand ready for junk bonds.

Didn't even list New Mexico under USA. So no Hyatt Tamaya Resort or Hilton Buffalo Thunder.

Junk bonds...hmm they should just call up Jay Powell, Fed will buy all of them!!

I also see the company offering this scheme is taking a “deferred commission”, so you’re essentially buying these through a third party travel agency. I’d only support this to a hotel directly.

no way

Does anyone know how these purchases code in terms of bonus categories?

Thanks.

They have Mexico listed under Central America - can’t be trusted.

I'm assuming the maturation prevents people who know they will be staying now buying these discounts instead of paying full price. The goal is to get liquidity into the hotels, but doing that actually defeats the purpose.