Link: Learn more about the IHG One Rewards Premier Credit Card

The IHG One Rewards Premier Credit Card (review) is a popular hotel credit card, and for good reason — it’s worth getting for the excellent welcome bonus, and it’s worth keeping for the long term perks. In this post, I’d like to look at nine reasons to consider the $99 annual fee IHG Premier Card, as this is the ideal time to apply. In no particular order…

In this post:

Welcome offer of 175K bonus points

At the moment, the IHG Premier Card is offering a limited time welcome bonus where you can earn 175,000 IHG One Rewards bonus points after spending $5,000 within the first three months. As a point of comparison, previously the card offered a bonus of up to 140,000 points, so this is quite a bit better.

For what it’s worth, I value IHG One Rewards points at 0.5 cents each, so to me, this bonus is worth $875. This is a great bonus for this card, and while there are bigger card bonuses out there in general, this is a card that you actually want to keep in the long run.

Anniversary free night certificate

Arguably the single best benefit of the IHG Premier Card, which more than justifies the ongoing annual fee, is the anniversary free night certificate. This certificate can be redeemed at an IHG property retailing for up to 40,000 points per night, which covers a vast majority of IHG properties around the globe.

You can also use points to top off a free night certificate, in order to redeem at a more expensive property. For example, you could book a hotel costing 60,000 points per night by redeeming the free night certificate plus 20,000 points.

I’ve gotten lots of value with this free night certificate. For example, I’ve stayed at the InterContinental Phoenicia Beirut, InterContinental Johannesburg Airport, and Kimpton EPIC Miami using free night certificates, all without having to top off these awards. In each case, a night would have otherwise cost $250+.

Fourth night free on award redemptions

The other best perk of the IHG Premier Card is that it offers a fourth night free on award redemptions. If you stay for four consecutive nights on an award redemption, then you only have to redeem points for the first three nights.

This is an awesome perk, since it can be used an unlimited number of times (you can even use it to book multiple rooms at the same hotel, and you can even use it at Six Senses properties). If you usually redeem points for stays in increments of four nights, this is like getting 25% off all your redemptions. This is a fantastic perk.

IHG One Rewards Platinum status

Just for having the IHG Premier Card, you get IHG One Rewards Platinum status, which is valid for as long as you have the card. IHG One Rewards Platinum status includes the following perks:

- Room upgrades, subject to availability (including potentially to suites)

- A 60% bonus on base points

- Early check-in and late check-out, subject to availability

- A welcome amenity

- Access to award night sales throughout the year

- The ability to earn Milestone Rewards, which could get you club lounge access, confirmed suite upgrades, and more

IHG One Rewards Diamond status with spending

While the IHG Premier Card offers Platinum status for being a cardmember, you can earn Diamond status when you spend $40,000 on the card in a calendar year. This is IHG’s top tier elite status, which includes legitimately valuable perks. Among other things, Diamond members receive a 100% points bonus and free breakfast.

If you stay at IHG properties with any frequency, it could be worth going out of your way to earn this status.

Up to $50 in United TravelBank Cash each year

The IHG Premier Card offers up to $50 in United TravelBank Cash each calendar year:

- Each calendar year you receive one $25 United TravelBank Cash deposit around January 1, and another around July 1

- Deposits made between January 1 and June 30 expire on July 15, and deposits made between July 1 and December 31 expire on January 15

- You must complete one-time registration to receive this benefit

If you fly United with any frequency, then this is like $50 worth of travel on United per year.

Global Entry, TSA PreCheck, or NEXUS credit

For some, this will be valuable, and for others, it won’t offer much value. The IHG Premier Card offers a statement credit when you use your card for a Global Entry, TSA PreCheck, or NEXUS enrollment fee, up to once every four years.

This is a nice perk that could easily get you more value than the annual fee.

Valuable rewards for spending

The IHG Premier Card has a potentially solid value proposition for spending money on the card, as follows:

- The IHG Premier Card offers 10x points on IHG spending, 5x points on travel, gas stations, and dining, and 3x points on other purchases

- The IHG Premier Card offers a $100 statement credit plus 10,000 bonus points if you spend $20,000 on the card in a calendar year

- As mentioned above, the IHG Premier Card offers Diamond status if you spend $40,000 on the card in a calendar year

I definitely think there’s something to be said for spending either $20,000 or $40,000 on the card per year, to take advantage of those incremental perks.

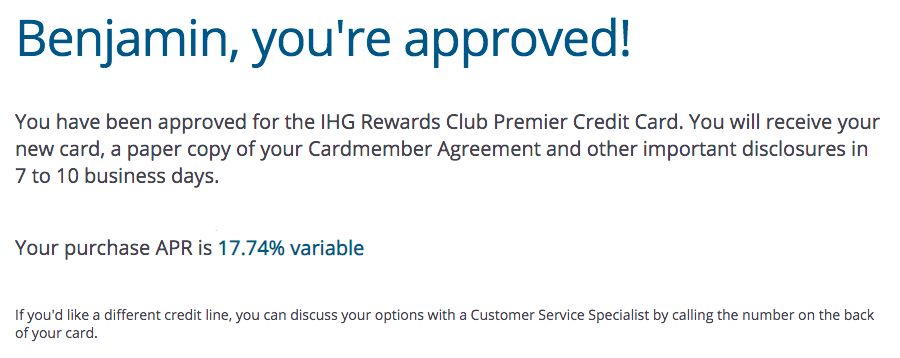

Anecdotally easy approval

Historically Chase is one of the tougher issuers with which to get a card approved. The IHG Premier Card has all the standard Chase approval restrictions, and this card is subjected to the 5/24 rule.

However, anecdotally many report that the IHG Premier Card is easier to get approved for, and that also matches my experience, as I got instantly approved when I applied (and I don’t remember the last time prior to that where I was instantly approved for a Chase card).

It’s my understanding that Chase has different approval requirements for some co-brand cards, depending on the customer base the card is targeting, and it sure seems like the IHG Card is among the easiest of the travel rewards cards to get approved for.

Assuming you’ve otherwise struggled to be approved for Chase cards (while still being under 5/24, etc.), then this could be a good card to consider.

Looking for a business credit card?

If this card sounds intriguing but you’re instead interested in a business card, there’s good news — the IHG One Rewards Premier Business Credit Card (review) is also an option. The card has an excellent welcome bonus, and very similar perks to the personal version of the card.

Best of all, you’re eligible for both of these cards, so you could pick up both the personal and business version of the card to really maximize your perks.

Bottom line

The IHG Premier Card is a useful hotel credit card that just about everyone who is eligible should have, even if they’re not otherwise IHG loyalists. If you’ve been considering applying, now is the ideal time to do so, given the offer that’s currently available.

Personally, I’d get the card for the anniversary free night certificate alone, though there are potentially valuable benefits beyond that, including the fourth night free on award redemptions, IHG Platinum status, $50 in United TravelBank Cash, etc.

If you’re looking for a business card instead, consider the IHG Premier Business Card, which has equally good perks.

If you have the IHG Premier Card, what has your experience been like?

Not sure if you’ve seen this, but IHG gutted the business rewards points transfers, and significantly lowered the cap for diamond transfers. Sucky move.