Link: Apply now for the American Express® Green Card

The American Express® Green Card (review) is one of the most lucrative Amex cards for earning points. In this post, I want to take a look at everything you need to know about applying for this card, and getting approved.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

In this post:

Why you should apply for the Amex Green Card

The Amex Green Card has a $150 annual fee, and potentially offers quite a bit of value. The card has a welcome offer whereby where you can earn 40,000 bonus Membership Rewards points after spending $3,000 within the first six months.

Beyond the welcome offer, this is one of the best cards for earning Amex Membership Rewards points. It’s incredibly rewarding for spending, as it offers 3x points on dining, travel, and transit, all with no caps and no foreign transaction fees. On top of that, the Amex Green Card offers up to $199 in CLEAR® Plus credits annually (enrollment required), which can help offset the annual fee.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Green Card eligibility requirements

Many people may be wondering what it takes to get approved for the Amex Green Card and earn the welcome offer, so in this post, I’d like to share the main things to consider before applying for the card, to try to figure out if you’re eligible.

Anecdotally, I find Amex cards to be among the easiest to be approved for, and I also appreciate how Amex will often warn you during the application process if you’re not eligible for a welcome offer. So let’s go over some of the main considerations.

Amex Green Card “once in a lifetime” rule

Amex has a “once in a lifetime” rule, whereby you typically can’t earn the welcome offer on a particular card if you’ve had that exact card before. So don’t expect that you’ll be eligible for the bonus points offer on the Amex Green Card if you’ve had this card before. Anecdotally, a “lifetime” might be defined as seven years after you’ve closed a particular card, but that’s not a published policy.

Amex Green Card Gold & Platinum restriction

In addition to the “once in a lifetime” rule, there’s an additional restriction on the Amex Green Card to be aware of. Specifically, you’re not eligible for the welcome offer on the card if you currently have or have had the Amex Gold Card or the Amex Platinum Card.

However, the inverse isn’t true. That’s to say that if you have the Amex Green Card, you’re still eligible for the welcome offers on the Amex Gold Card and Amex Platinum Card. So if you’re just getting started, there’s something to be said for picking up this card first, and then later picking up the other cards.

Amex Green Card doesn’t count toward five card limit

Amex generally limits people to having five credit cards from the issuer at any given point, and that includes both personal and business cards. The good news is that this only includes credit cards, and not hybrid cards. Fortunately the Amex Green Card is considered a hybrid card, so it wouldn’t count toward that limit. That’s fantastic for those who are otherwise maxed out with the Amex credit card limit.

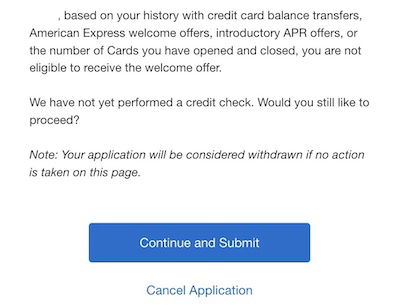

Amex Green Card application pop-up warning

Nowadays Amex has a pop-up warning, whereby you will receive a message during the application process if you’re not eligible for the welcome offer on a card. This message typically states that this is “based on your history with credit card balance transfers, American Express welcome offers, introductory APR offers, or the number of Cards you have opened and closed.”

It’s possible to get this warning even if you meet all the other eligibility requirements of this card. Clearly there’s some formula in place in the background that restricts who is eligible for welcome offers, beyond the generally accepted rules.

I’ve heard of plenty of people getting this pop-up message even if they’ve only ever had a couple of Amex cards. So unfortunately you wouldn’t be eligible if you got this message. And while it’s frustrating, don’t take it personally.

The great thing is that if you get this message you can cancel your application, and then there will be no credit pull, so this is about as low risk as applications get. I appreciate that Amex warns you of this prior to approving a card.

Amex Green Card credit score recommendation

There’s not a consistent rule as to what credit score you need to be approved for the Amex Green Card, as credit score is one of only many considerations when being approved for a card. In general, I’d recommend having a credit score in the “good” to “excellent” category if you’re going to apply for this card.

Personally, I probably wouldn’t apply if my credit score were under 700, and ideally, I’d hope to have a credit score of 740 or higher. That being said, people with scores lower than that have been approved, and conversely, people with scores higher than that have been rejected. There are lots of factors that go into approval — your income, your credit history, how much credit Amex has already extended you, etc.

See this post for more on how credit scores work, and how they’re calculated.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Green Card approval FAQs

To answer a few more of the frequently asked questions when it comes to Amex Green Card approval…

Is it hard to get approved for the Amex Green Card?

Anecdotally I find Amex cards to be among the easiest to get approved for. Of course that won’t be the case across the board, but I find that there’s not an issuer that more consistently approves people for cards than Amex.

How long does it take to get approved for the Amex Green Card?

Approvals on Amex cards could be instant, they could take a few days, or they could take a couple of weeks. In my experience Amex has more instant approvals than any other card issuer. However, if you get a decision pending notice, don’t worry, you could still very well get approved.

What is the minimum credit line for the Amex Green Card?

There’s not a specific minimum credit limit you’ll get on the Amex Green Card, as this depends on a variety of factors, like your income, your total available credit, etc.

Which credit bureau does Amex pull from?

If you apply for the Amex Green Card, there’s not a single credit bureau that Amex always pulls from. It could be Equifax, Experian, or Transunion, depending on a variety of factors.

Is it bad for your credit score if you get denied for a card?

What are the negative impacts of applying for a credit card and getting denied? The only downside is that there’s a new inquiry on your credit file, which could temporarily ding your score by a few points. While everyone’s situation is different, personally I wouldn’t consider that to be a big issue, as losing a few points temporarily shouldn’t have major implications.

Meanwhile getting approved for the card and using it responsibly could have a very positive impact on your credit score, by improving your total available credit, history of on-time payments, credit utilization, etc.

Also keep in mind that if you get a pop-up warning about not being eligible for the welcome offer, then you can always cancel your application, and there won’t even be an inquiry.

If you get denied for the Amex Green Card, can you apply again?

You sure can. If you’ve gotten denied for the Amex Green Card in the past, you could apply again. Just because you get denied once doesn’t mean you’ll be denied again, especially if aspects of your credit worthiness have improved (for example, if your credit score went up, if you’ve applied for fewer cards recently, etc.).

Are other Amex cards easier to be approved for?

Anecdotally I find most Amex cards to be pretty easy to get approved for. The Amex Green Card has the additional benefit of being a hybrid card in terms of approval, so it doesn’t count toward the five card limit that other cards would be subjected to.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Bottom line

The Amex Green Card is one of the best Amex cards for everyday spending, and it’s an often overlooked product. Best of all, anecdotally, I find this card to be quite easy to be approved for.

The biggest potential “catch” is that you may get Amex’s pop-up warning telling you that you’re not eligible for the welcome offer. If that’s the case, you can always withdraw your application, and there will be no credit pull. Hopefully, the above answers the question of who is eligible for the Amex Green Card. If anyone has any other questions on Amex Green Card approval, please let me know.

What has your experience been with being approved for the Amex Green Card?

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

There are currently no responses to this story.

Be the first to respond.