At the beginning of the month, the Amex Membership Rewards program introduced a lucrative transfer bonus. I’d like to post a reminder of this, as it will be expiring shortly, and has the potential to be a phenomenal deal. I just took advantage of this speculatively, and I imagine others may want to as well.

In this post:

Transfer points to Flying Club with a 40% bonus

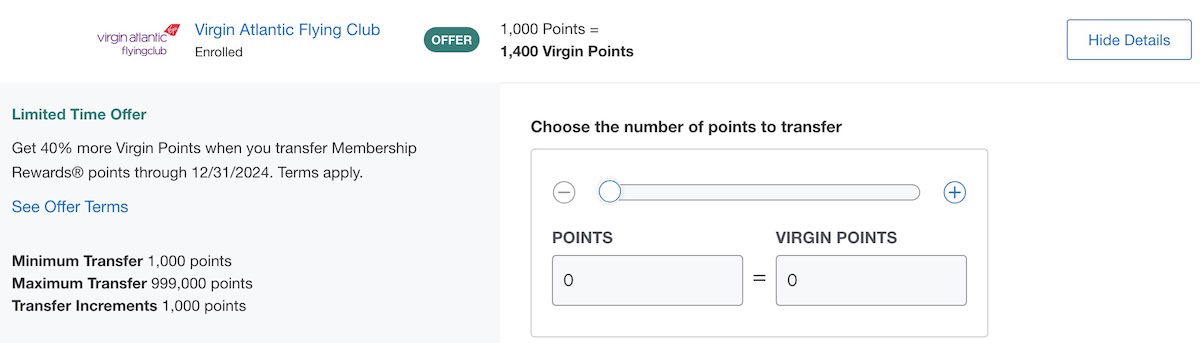

The American Express Membership Rewards program in the United States is offering a 40% bonus on points transfers to Virgin Atlantic Flying Club. This promotion is valid for points transfers through Tuesday, December 31, 2024.

Ordinarily points transfer at a 1:1 ratio (in 1,000 point increments), while through this promotion you’d get 1,400 Flying Club points for every 1,000 Membership Rewards points transferred.

For context, Amex seems to offer a transfer bonus to Virgin Atlantic Flying Club two or three times per year. So far this year we’ve seen a couple of 30% transfer bonuses, so a 40% transfer bonus is even better than usual, and not one that we’ve seen for quite some time.

- 4x points at restaurants worldwide, on up to $50,000 in purchases annually

- 4x points at U.S. supermarkets, on up to $25,000 in purchases annually

- 3x points on flights booked directly with airlines or through amextravel.com

- $325

- Access to Amex Offers

- Redeem Amex Points Towards Airfare

- $375

- Earn 5x points on flights purchased directly from airlines or through Amex Travel (up to $500k/year)

- $200 Annual Uber Credit

- Amex Centurion Lounge Access

- $695

- Earn 1.5x on purchases of $5,000 or more in a single transaction on up to $2MM per calendar year

- Redeem Points For Over 1.5 Cents Each Towards Airfare

- Amex Centurion Lounge Access

- $695

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

Should you transfer Amex points to Virgin Atlantic?

Virgin Atlantic is definitely a frequent flyer program with more niche redemption opportunities. In addition to being able to redeem Flying Club points for travel on Virgin Atlantic, there’s also good value to be had for redemptions on Air New Zealand, All Nippon Airways, and Delta.

With Flying Club having recently moved to dynamic award pricing, there are actually better value redemption opportunities on Virgin Atlantic than ever before. For example, you can book Upper Class across the Atlantic starting at just 29,000 points one-way, and that doesn’t even factor in the transfer bonuses. I consider this to be one of the best award sweet spots out there.

Beyond that, Virgin Atlantic has several airline partners, some of which are more lucrative than others. See my guide to the best uses of Virgin Atlantic Flying Club points. Personally this is an offer that I’ve taken advantage of with a speculative transfer, since I know I’ll get use from these points eventually, and I might as well get a 40% bonus.

For what it’s worth, Virgin Atlantic Flying Club points don’t expire, with no activity required to keep them alive.

Bottom line

At the moment, Amex is offering a 40% bonus when you transfer points to Virgin Atlantic Flying Club. This is definitely more of a niche program, but with a specific use in mind, there’s a lot of value to be had.

With the 40% bonus, award travel on Virgin Atlantic will be an even better value. There’s also lots of value to booking on partners, ranging from SkyTeam airlines, to Air New Zealand, to All Nippon Airways.

Do you plan on taking advantage of this Amex transfer bonus to Virgin Atlantic Flying Club?

I took advantage of this a few weeks ago for Latam, which I often forget is a partner. Not the most exciting redemption, but a good value nonetheless. And easy to book through VA's website.

Virgin points are great if you want to fly to London, Edinburg, or Manchester, or economy class to other cities. Very, very difficult to get business class to other non UK cities. I am sorry that I had taken advantage of one of the offers to buy points. very frustrating.

Maybe before the rewards changes this *might* have been true, but it's certainly not true anymore. Award availability is wide open across the board, including some decent saver rates (i.e., London to Barbados on Upper Class for 41k)

https://www.virginatlantic.com/reward-flight-finder

On a somewhat related note, Virgin is FINALLY making the switch from 787 to 339neo on SEA-LHR, starting Sunday March 30th 2025.

Yes it's a very overdue change considering they were inferior to their own JV partner and direct competition from BA, both of which have much better hard product.

Now it finally makes sense to book VS out of SEA.

The real question is when they fix their 787s.

Yeah I'm really excited for SeaTac in 2025. Delta One Lounge and a non-compromised VS business class experience.

BA still has to step up their Seattle game a bit, though. The plane swap situation (and relatively high fees vs Virgin) is making them less appealing.... if they could consistently get 787-10s and 777-300s then we'd be in the perfect spot, especially with the fancy new AS lounge on the horizon.

I am flying upper class for 32k from LHR to BOS on the 339neo. Can't wait!

I live in the United Kingdom is this offer open to me?

Yes, if you are USA expat with a USA AMEX Membership Rewards-earning credit card.

Do the transferred points expire? do you need to use them by a certain date?

"For what it’s worth, Virgin Atlantic Flying Club points don’t expire, with no activity required to keep them alive."

Does it make sense to do this if i am traveling from US to Europe? and are there expiration dates in the miles once they become virgin red miles?

What is the best way to search partner availability? Would like to see if any Asia flights are available for May 2025 but Virgin’s calendar doesn’t show this

It's been a while since I logged into VS. Searched for close-in awards from SFO and LAX. No business (of course), but a decent economy fare, assuming I like transferring throw CDG.

In my experience, you're doing your points dirty if you transfer them from Amex.

Sorry, SFO and LAX to TYO.

Virgin new changes are a definite plus. We just booked 2 tickets BOS to LHR for 10,500k plus $109 each in premium economy. Definitely worth a speculative transfer.

It's great for short routes in Europe.

Farewell ITA.

Anyone know if T-14 NH J is still blocked? Without that I don't have much reason to transfer to VS.