No, it’s not because I’m single. 😉 This is actually something I’ve been thinking about for a while, and I can’t quite figure out why I feel the way I do. I’m curious to hear what you guys think.

On a post yesterday, reader Mitch asked the following:

@Lucky, when are you getting married? Any honeymoon plans to write about?

As some of you may remember, I got engaged last May. I caught Ford totally off guard and planned a trip to Paris (one of his favorite cities, which we hadn’t yet been to together) and Montenegro. Selfishly I was proud of myself for pulling this off as a complete surprise, since that’s usually something I’m awful at. While I hope that there are a few traits about me that Ford likes, I think my ability to surprise people isn’t one of them.

Aman Sveti Stefan in Montenegro, where we went on our engagement trip

We’re getting married this September

We’re getting married in late September, which we’ve known for a while. No, we’re not having a big wedding, but rather just a small family ceremony in a place that’s special to us. I know everyone is different in this regard, though personally the thought of a wedding ceremony is something that makes me incredibly anxious and uncomfortable. Add in the cost and effort required, and both of us are fine with not having one.

Really we’re viewing this as a good opportunity to get the whole family together, because who knows how many more times an entire family can all be together in one spot.

Why we’re not planning on having a honeymoon

I know this seems extremely backwards, and I keep going back and forth on this. You’d think the most exciting thing about getting married would be the honeymoon, especially as someone who is into travel and points. We could plan an epic round the world journey in first class using points. However, our wedding is only five months away, and I haven’t actually looked at any award availability. Actually, we’ve both agreed we’d rather just not have a honeymoon.

Why? It’s hard to put into words, but I guess what it comes down to is that I feel like a honeymoon is a lot of pressure. We’re ridiculously, outrageously fortunate to travel as much as we do. I couldn’t be more grateful for the “job” I have, and that flying around the world in first class and staying at some awesome hotels is part of that.

To me the concept of a honeymoon is to do something super-duper special that’s once in a lifetime, where you take off two weeks and do something you’d otherwise never do.

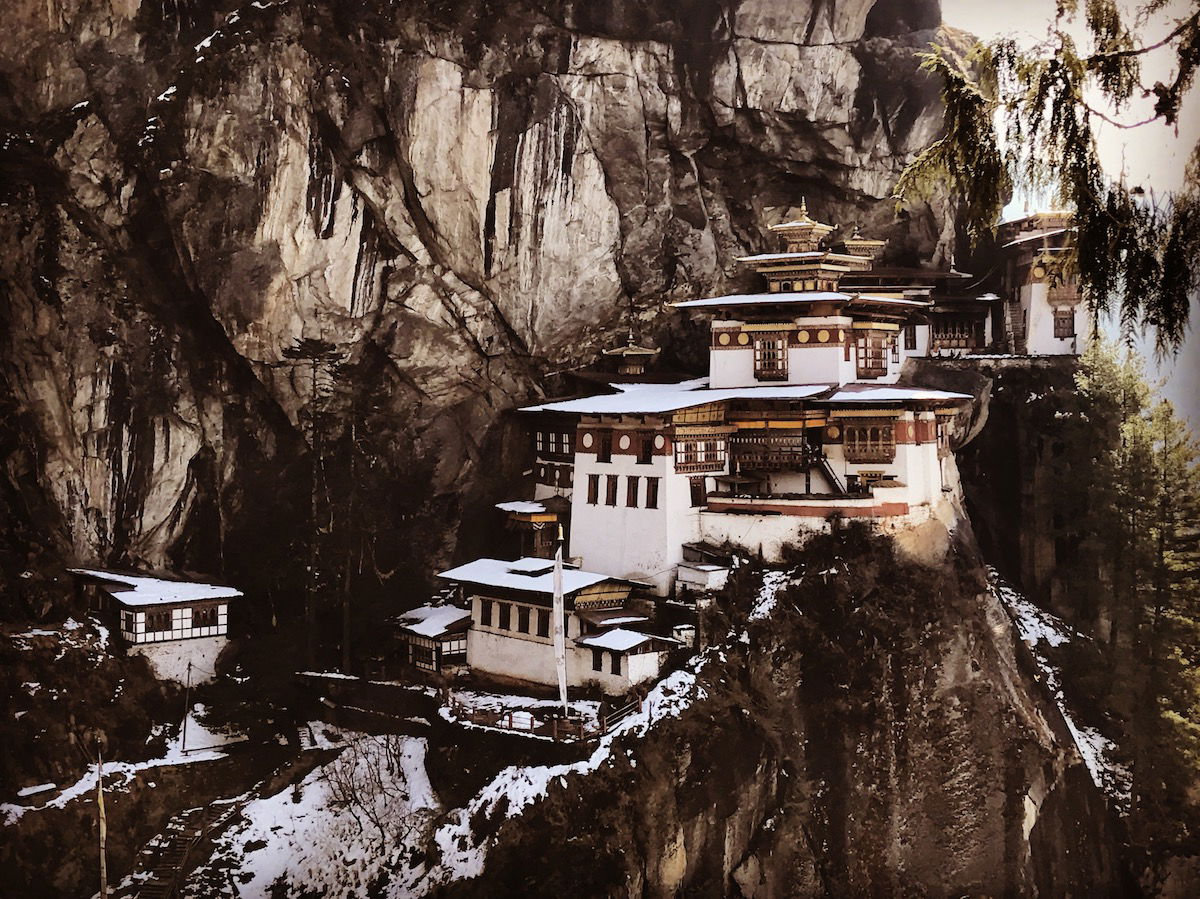

Like I said, we get to go to some amazing places. In the past two years (or so) we’ve been to Bhutan, Easter Island, Longyearbyen, Hawaii, Italy, Montenegro, the Maldives, and the Seychelles (where I’m writing this from), just to name a few of my favorite memories. We have an amazing time no matter where we go, and I can’t help but feel like a “formal” honeymoon would be setting us up for disappointment.

We visited Bhutan last year, and loved it

Don’t get me wrong, there are so many things we still want to do, but I feel like if any one of them is designated as the honeymoon, then the expectations I’ll set in trying to pull off a trip like this will be so high that it is likely to lead to disappointment. If a honeymoon is as awesome as every other trip we take, is it really that “special?”

I hope nobody takes this the wrong way. I love going places with Ford, and we’ve had so many memorable trips. I just feel like the challenge here is that we’ve taken so many trips together, and all of them have been special in their own way. Maybe what we could do to make it truly special is to actually take a week off and just spend it with one another, since we’re always working while traveling (which we don’t mind one bit, of course, since that allows us to do what we do).

Not to be crass, but perhaps the mental block I’m having isn’t totally unlike those who choose to “wait until marriage,” and in their mind they’re building something up to be this great thing for years and years. When it happens, it’s not necessarily bad, it’s just not as amazing as they were expecting, because how can something live up to the expectations people had?

I’m curious what you guys think about this, especially those of you who have been on honeymoons. Are we crazy for planning on skipping this specially designated trip? For those who think we are really missing out, where should we go? The one thing that comes to mind is some sort of safari, as we still haven’t ever done that…

I absolutely agree with your point of view on the matter. If I were in your shoes, I would feel exactly the same way as you Lucky.

I’m leaving this comment a bit late - 2020 in comparison to your 2018 article! However, I had a covid style wedding which I loved in the end as it was intimate with just family - as I can plan something separately with friends anyway. For me the intimacy was special as I’m usually otherwise always a friends group gatherer. I also feel exactly the same as you - I’ve travelled loads with my partner...

I’m leaving this comment a bit late - 2020 in comparison to your 2018 article! However, I had a covid style wedding which I loved in the end as it was intimate with just family - as I can plan something separately with friends anyway. For me the intimacy was special as I’m usually otherwise always a friends group gatherer. I also feel exactly the same as you - I’ve travelled loads with my partner beforehand so wasn’t blown away with the idea of a honeymoon label, unless it was something very unique than one of our usual travel adventures and indulgences. But nice to know I’m not alone!

I think the honeymoon should be a break from your everyday life. If your everyday life is to travel to exotic locations, do the opposite. Maybe a week at home, just enjoying each other and your home city?

Hey, consider this. A honeymoon was all about a getaway without the rest of the world watching, to celebrate a marriage. However, in this day and age and due to your lot in life, I can think of any number of ways to do that and it does not have to involve "travel" for yourselves. It could be as simple as hiring the most incredible sushi chef to do a dinner of a lifetime and...

Hey, consider this. A honeymoon was all about a getaway without the rest of the world watching, to celebrate a marriage. However, in this day and age and due to your lot in life, I can think of any number of ways to do that and it does not have to involve "travel" for yourselves. It could be as simple as hiring the most incredible sushi chef to do a dinner of a lifetime and that is your memorable moment. Or bring 25 kids (or whatever number) from the Make A Wish foundation to their favorite destination, or donate a dream honeymoon to a real honeymoon couple in some sort of contest, or just donate miles and points to a wedding registry. I think because you have this wonderful life full of amazing trips and people in it, that maybe making someone's else's memory can be your honeymoon and start that as a pay it forward tradition. In any event, do MAKE A MEMORY to celebrate your marriage, it just does not have to be traditional. Hope that helps.

Dude, its all to do with what Ford & you want. If constant travel is getting you down book a week long homestay / AirBNB near where you live, and just lounge around, read a book, smoke some wacky backy (only if its legal).

Honestly who gives a shit what anyone does on their honeymoon. As long as you and Ford are both happy with your choice, go for whatever strikes your fancy.

PS. KEEP OFF ANY POSTS TILL YOUR HONEYMOON IS OVER

Congrats to you both again!!!!

I think a 'honeymoon' is something most people look forward to, as they don't get to travel too often, so it's just what they need. However, you guys travel so freaking much, an ideal holiday is probably just a week at home, lounging on the sofa watching Netflix, LoL.

I hope you take a honeymoon just so that we all get another awesome travel report!

Hey Lucky, so many good ideas here, I wish you were allowed to hit “Like”.

But I am going to come at this from an angle no one else has mentioned. First of all, I agree with the few that said you HAVE to have a honeymoon, but for a very different reason than what was mentioned, that I will get in to in a bit. I also agree with everyone that says you should...

Hey Lucky, so many good ideas here, I wish you were allowed to hit “Like”.

But I am going to come at this from an angle no one else has mentioned. First of all, I agree with the few that said you HAVE to have a honeymoon, but for a very different reason than what was mentioned, that I will get in to in a bit. I also agree with everyone that says you should go off the grid, not work. You said yourself all the great places you’ve been you were working, so a true honeymoon for you would be for both of you to go somewhere special (I did the African safari too, an it was amazing) and just spend time with each other, and nurture your new marriage. After all, that is the primary reason for a honeymoon. To Love.

Now, why do you have to have a honeymoon? As an early 40something gay man, I realize I’m a bit older than you, but things were so much difffent when I got married, only 5 short years ago. Back then, it was only legal in 5 states, and most people were still put off by the idea of two men marrying, I remember at our reception in Manhattan (which was very fancy, and yes, a huge waste of money) as I was giving a speech to all of our guests, I pointed across to the Hudson River which our room had gorgeous views of, and explained that when my husband and I crossed that river, we were technically no longer married (New Jersey had not passed marriage equality yet.) Most of our guests, who were not well-versed in the civil rights journey of our community, were horrified by the thought that our newly minted marriage was only as good as the stare we traveled to, and that visual I offered up everyone was surreal, even to us.

It’s now 5 years later, and a lot has changed. But that change wouldn’t have happened if it wasn’t for the thousands of people that faught tirelessly for years, marching in the streets, donating money, and changed the hearts and minds of their friends and family, elected officials and the American public. I was part of that fight, and I still am. The point I am making here is that an entire generation of people have faught for your right to marry, and it didn’t come easy. You need to celebrate the fact that you CAN marry, and you should to enjoy and experience all of the parts that come with it, traditions and all. For most of our history it wasn’t possible for our community to go on a true honeymoon. Don’t waste the opportunity you have been given that so many of us faught so tirelessly for. We travel a lot, but it’s still our favorite trip, because it was a celebration of our relationship, our right to marry, and the one that meant the most.

And if that Jewish guilt doesn’t work, then how about this: a few years from now, you will immensely regret not taking some time off from your day-to-day lives to spend time with your new spouse. Just plan something simple, something romantic, and no work!

I promise you, you will thank me for it.

My partner and I are getting married next year on Maui. Since it is a destination wedding (and not the cheapest place to visit), we don’t feel the need for a honeymoon. The wedding on Maui is sort of like a honeymoon. Plus, we also travel a ton during the year so like you don’t need another trip just so we can say we went on a honeymoon.

Not sure where you are getting...

My partner and I are getting married next year on Maui. Since it is a destination wedding (and not the cheapest place to visit), we don’t feel the need for a honeymoon. The wedding on Maui is sort of like a honeymoon. Plus, we also travel a ton during the year so like you don’t need another trip just so we can say we went on a honeymoon.

Not sure where you are getting married, but I have one idea to consider...stay home and don’t work. Since you travel so much do the exact opposite and just do nothing but watch Netlix and chill :)

I am really happy so many have answered this very personal question. I'm with you - a honeymoon trip is definitely a take it or leave it decision. I know so many that have spent many thousands of dollars on a ceremony and honeymoon and my only thought is "why didn't you buy a place to live, or invest it?" I would suggest you reserve some amount of time to be together, shut down the...

I am really happy so many have answered this very personal question. I'm with you - a honeymoon trip is definitely a take it or leave it decision. I know so many that have spent many thousands of dollars on a ceremony and honeymoon and my only thought is "why didn't you buy a place to live, or invest it?" I would suggest you reserve some amount of time to be together, shut down the laptops and just be a couple, whether it's on the road or your own living room, with no commitments and no schedule.

You may want to align with Ford. He has an opinion (vote?), I believe

Congratulations, all the best to you, guys!

Why not go to a beach like PV? Get off the grid and enjoy each other. Get some sun and ocean or go to PSP and just have some stress free fun. Or travel someplace and really see the places you go.

My husband and I got married last November. I stress out easily about little things, imagine my stress level planning a wedding. The wedding ended up being awesome. We held it in a hangar at the Commemorative Air Force Museum in Camarillo, CA with 100 of our closest friends and family members. After that we needed a calm chill out honeymoon, so we went to our favorite resort in Hawaii, the Mauna Kea Resort, to...

My husband and I got married last November. I stress out easily about little things, imagine my stress level planning a wedding. The wedding ended up being awesome. We held it in a hangar at the Commemorative Air Force Museum in Camarillo, CA with 100 of our closest friends and family members. After that we needed a calm chill out honeymoon, so we went to our favorite resort in Hawaii, the Mauna Kea Resort, to relax and unwind for a week. It was such a great get away. Maybe choose a place you both love to just get away for a few days to relax. Then plan a big trip for next year that's special to you both.

Roadtrip... no airports!

I completely agree with your stance on the situation. I would feel the exact same way as you Lucky if I were in your shoes.

Weddings and honeymoons are huge wastes of precious capital (money) that your average couple really can't afford. Glad you're having a small wedding. Forget the honeymoon. Put that money towards a home down payment, college fund (if you want kids), or some other asset that ideally has a good chance of appreciating in value.

Rent a cottage in Muskoka. Hire a chef for it. No blogging, keep us in the dark forever. Promise yourself that nothing about it needs documenting and Unplug. Ignore the price, do something that isn't available to the Points world. Take a special vacation to that other world, where suckers pay full price and sometimes feel fully satisfied, or even "Lucky".

Sir Henry Royce (of Rolls-Royce) said "The quality remains long after the price is...

Rent a cottage in Muskoka. Hire a chef for it. No blogging, keep us in the dark forever. Promise yourself that nothing about it needs documenting and Unplug. Ignore the price, do something that isn't available to the Points world. Take a special vacation to that other world, where suckers pay full price and sometimes feel fully satisfied, or even "Lucky".

Sir Henry Royce (of Rolls-Royce) said "The quality remains long after the price is forgotten." Substitute "memories" for "quality" and you're on to something.

All above commenters are right about the central point in this topic: the important thing is that you and Ford take the time to focus on each other. You can't do that if you have WiFi. You can't do that if your iPhone is in the same building with you. You can't do that if you're planning to report on the experience. This is almost going to be a difficult challenge for both of you, but so so worth it. Make the memory. That's what travel is for, that's what you peddle on the blog. It's vital to living and you/we are supposed to be the clever ones who've learned this lesson.

Your love for each other is the most important thing in your lives. It's way more important than your blog. Go, begin building it. don't skip this opportunity.

You've all the wisdom and support a person could ever want, right here in the Comments.

Take a weeek or so off the Grid, and spend some time with Ford. You are totally right, in that booking a “honeymoon” will set you up for disappointment. Take a week away from work, unplug - and enjoy. Doesn’t matter where you go really

Go on a road trip--no flying--on Route 66 or down the west coast. Take a long time travelling. Leave the laptop at home. Don't plan where you're going to stay, just drive up to small places and ask if there is vacancy.

Have a week off, no miles&points, maybe no Internet/electricity (depending how well you could keep away from Internet without that being enforced). I would suggest some remote part of Himalaya for example as you already are at beach destination.

The only safari I’ve done was in Tanzania’s Ruaha Park as part of volunteer service. It was amazing, and the memories of it along with volunteering are something really special. Have you ever considered volunteer service as part of a honeymoon, in a destination that offers something you want to see/do anyway?

I love the idea of someone else planning the trip. I love trip planning but it can be stressful, add that on top of the wedding and its a lot of work. I had several friends who basically took additional days off of work after the wedding to chill; given that they took a few days before the wedding, this was about a week off. So, they then had a real honeymoon (or typical vacation)...

I love the idea of someone else planning the trip. I love trip planning but it can be stressful, add that on top of the wedding and its a lot of work. I had several friends who basically took additional days off of work after the wedding to chill; given that they took a few days before the wedding, this was about a week off. So, they then had a real honeymoon (or typical vacation) later in the year. I thought this was a great idea as you aren't overloaded with planning all at once and have some time for your finances to improve (even if you are doing a simple wedding, you will have some above average costs).

Your current life is more amazing than 99% of people's honeymoons! Not sure how you would make a honeymoon special given how much you travel...

As you get older, you'll realise that family only comes together for 2 occasions. Marriages and deaths. Perhaps you could spend your honeymoon visiting family instead?

Hello from the Seychelles as well @Lucky! There is a trending theme from a lot of the comments on taking a week to unplug, spend time with Ford, and not work. I resoundingly agree with this sentiment. Going through the planning and execution of a wedding is stressful so think of the honeymoon as your time to decompress and spend time with the love of your life. Recommend that you and Ford stay in the...

Hello from the Seychelles as well @Lucky! There is a trending theme from a lot of the comments on taking a week to unplug, spend time with Ford, and not work. I resoundingly agree with this sentiment. Going through the planning and execution of a wedding is stressful so think of the honeymoon as your time to decompress and spend time with the love of your life. Recommend that you and Ford stay in the US without shifting time zones, shut down all electronics, and enjoy life for a week or two without the blog lense.

Hi Lucky! First off, congrat’s! I’m so happy for you guys! I think the most important thing is for you two to do whatever you want since it’s your special day. Personally, I like the idea of a low key wedding, but would probably want to plan something amazing for a honeymoon since I don’t travel the world for a living. But for you guys, just hanging low with each other sounds like it would...

Hi Lucky! First off, congrat’s! I’m so happy for you guys! I think the most important thing is for you two to do whatever you want since it’s your special day. Personally, I like the idea of a low key wedding, but would probably want to plan something amazing for a honeymoon since I don’t travel the world for a living. But for you guys, just hanging low with each other sounds like it would be perfect. Anyway, have a blast with whatever you have planned and thanks for sharing all your experiences with me over the past few years!

Perhaps keep it simple, somewhere close, for just a couple of days... no more than a couple hours flight or drive... somewhere you guys could just relax, have no plans, do nothing, maybe like a cabin/house on the coast of Oregon or in Big Sur, Carmel, something like that.

Congrats!

A honeymoon is what you make of it. In other words, you define it on your terms. Every day could be a honeymoon if you saw it that way.

Staying home and cooking a meal together could easily be a honeymoon as much as staying in some luxe 5* resort and dining at 3* Michelin restaurants.

Do something you haven’t done before! Get out there and experience life. Take flying lessons maybe. And most importantly,...

A honeymoon is what you make of it. In other words, you define it on your terms. Every day could be a honeymoon if you saw it that way.

Staying home and cooking a meal together could easily be a honeymoon as much as staying in some luxe 5* resort and dining at 3* Michelin restaurants.

Do something you haven’t done before! Get out there and experience life. Take flying lessons maybe. And most importantly, as many above commented, disconnect. Your loyal readers can wait.

People put way too much emphasis on wedding ceremonies and honeymoons...but in reality - it's what comes a-f-t-e-r that counts the most...be it vacations, trips or just life together...I would have a modest ceremony and no honeymoon to speak of...but take all the best and most wonderful trips after that, when there is no pressure to have it "just perfect"...most fairy tales end with a wedding, but the best ones only begin with the wedding...

Also, people treat you differently when you’re on your honeymoon. Perks and good wishes galore!

Spend a bit of undocumented alone time together. It doesn’t matter where or how. My husband hadn’t traveled before me so I stood him in front of a giant world map and asked him where he wanted to go. Your future husband has traveled (although I do think you could both do with seeing and doing a little more in the places you visit) so maybe your alone time doesn’t need to be somewhere out...

Spend a bit of undocumented alone time together. It doesn’t matter where or how. My husband hadn’t traveled before me so I stood him in front of a giant world map and asked him where he wanted to go. Your future husband has traveled (although I do think you could both do with seeing and doing a little more in the places you visit) so maybe your alone time doesn’t need to be somewhere out there. The key is to take a bit of time to stop and enjoy each other in a way you don’t normally get to do, away from your life’s regular distractions and obligations.

My two cents.

I had to add to my previous comment. if you are conventional enough to get married, you are probably conventional enough to cherish a honeymoon. Think long term, and it's not about doing anything special or grandiose. HAL 9000 from 2001: A Space Odyssey seemed to grasp that. Orbiting the fifth planet from the sun, its last "thoughts" were about a bicycle built for two. Go for it Dave... I mean Ben.

I'd go on a road trip without an itinerary. My rules would be no interstate highways, never drive more than 300 miles a day, no laptops, cell phone without Internet access, no gps, use maps.

I've done trips similar to this to the west coast with a pick up camper. We set a final destination before we start but that is all that is planned. I've been all over the United States and Canada on...

I'd go on a road trip without an itinerary. My rules would be no interstate highways, never drive more than 300 miles a day, no laptops, cell phone without Internet access, no gps, use maps.

I've done trips similar to this to the west coast with a pick up camper. We set a final destination before we start but that is all that is planned. I've been all over the United States and Canada on driving vacations. My trips are usually 3 or 4 weeks. The joys of being retired. Some days we would be lucky to travel 100 miles because of seeing things that were interesting. Like bungee jumping, zip lining, a hiking trail that was interesting. Or even a shopping center that was calling to me. West Edmonton Mall and Mall of America are two that ended up being a all day affair.

Gorgeous news; but remember a lavish wedding and honeymoon does not a marriage make!

Congrats Lucky!

Most important of all, congrats to you and Ford on a big commitment that a lot of gay couples won’t or can’t make. Do it your way and forget tradition, convention, social pressure, etc. etc. Have fun!

My husband and I got married in Vancouver, BC way before it was OK anywhere here in the states. We gathered some close friends and family and had a ball in Vancouver. We had our civil ceremony...

Most important of all, congrats to you and Ford on a big commitment that a lot of gay couples won’t or can’t make. Do it your way and forget tradition, convention, social pressure, etc. etc. Have fun!

My husband and I got married in Vancouver, BC way before it was OK anywhere here in the states. We gathered some close friends and family and had a ball in Vancouver. We had our civil ceremony surrounded by plants and flowers in the Bloedel Conservatory in Queen Elizabeth Park and wined and dined our way through the night. No honeymoon!

The actual ceremony was really stressful to me, too! Our honeymoon was by no means our most epic trip (we did Cannes and Nice), but having a relaxing, fun trip immediate after making it through the wedding was really special.

Gald to see a fellow classmate, Ford, is entering the next chapter of his life…It’s gonna be a special moment no matter where you guys end up going. What’s setting the trip/staycation apart is the celebration of the next chapter in your life and appreciation of each other’s companionship Congratulations to you boys!

My husband and I never went on a honeymoon. We had neither the money or the time. We just celebrated our 50th wedding anniversary. In that 50 years we have traveled to many wonderful places, but never under the duress of a "forced march" which is what most honeymoons are.

So, do what you want to do when you want to do it.

Your definition of honeymoon is based on average Joe who goes to all-inclusive resort once a year and consequently splurges on “exotic” honeymoon trip.

Your own definition of honeymoon should not focus on “taking a trip” or “exotic”, but you two owe it to yourselves to make it special for your own selves. I know it sounds like blasphemy, but dedicating time to each other (no connectivity, no taking notes for blog, complete disconnect and...

Your definition of honeymoon is based on average Joe who goes to all-inclusive resort once a year and consequently splurges on “exotic” honeymoon trip.

Your own definition of honeymoon should not focus on “taking a trip” or “exotic”, but you two owe it to yourselves to make it special for your own selves. I know it sounds like blasphemy, but dedicating time to each other (no connectivity, no taking notes for blog, complete disconnect and focus on relationship) is what would constitute “special” for your lifestyle. Similar to cash dedication of average Joe for “usual” honeymoon that showcases the presumed marital dedication, the pledge of time from yourself would make the your honeymoon extra special dedication for you two. And you don’t have to go anywhere. Just lose the laptop and the phone for a week.

Hey @MatthewPolenzani!

Either you have the same name as the greatest tenor of our time, you are using the name of the greatest tenor or our time or you are the greatest tenor of our time. Right when I saw your post I was listening to Matthew Polenzani sing this line from the Lyric Opera of Chicago broadcast of Werther: "Un autre est son époux! Un autre est son époux!"

Matthew Polenzani says:

...

Hey @MatthewPolenzani!

Either you have the same name as the greatest tenor of our time, you are using the name of the greatest tenor or our time or you are the greatest tenor of our time. Right when I saw your post I was listening to Matthew Polenzani sing this line from the Lyric Opera of Chicago broadcast of Werther: "Un autre est son époux! Un autre est son époux!"

Matthew Polenzani says:

April 22, 2018 at 1:59 pm

Ben, this post is why this is the best travel blog. Thank you for sharing your life with us knowing that haters will come out of somewhere to say something negative about the most mundane posts.

I think you answered your own question, you guys should go on a safari. Go to singita sabi sand. A first safari is life-changing for anyone who can appreciate what he's seeing, it will be very unlike anything you've experienced if you guys have never been. singita is kind of the aman of the safari world, and sabi sand is the original, and probably still the best, luxury big-five safari, it's the proper way to...

I think you answered your own question, you guys should go on a safari. Go to singita sabi sand. A first safari is life-changing for anyone who can appreciate what he's seeing, it will be very unlike anything you've experienced if you guys have never been. singita is kind of the aman of the safari world, and sabi sand is the original, and probably still the best, luxury big-five safari, it's the proper way to do your first safari, the game viewing is astonishing. Go June-August if you can wait, that's when it's winter in South Africa and the temperature is perfect and game viewing best because the vegetation is less dense.

Maybe go somewhere that's not so points associated and go somewhere peaceful and quit and just spend time together. This resort is amazing I have stayed their several times and is one of the most beautiful places in the world it is on one of the best beaches in the world very close to several beautiful wineries and restaurants where some of the best wine in the world is made. There are also the most...

Maybe go somewhere that's not so points associated and go somewhere peaceful and quit and just spend time together. This resort is amazing I have stayed their several times and is one of the most beautiful places in the world it is on one of the best beaches in the world very close to several beautiful wineries and restaurants where some of the best wine in the world is made. There are also the most beautiful hiking trails around the beach and resort. And its part of Small Luxury Hotels Of The World (and there is Wi Fi if you need it).

http://www.smithsbeachresort.com.au/

Singita Boulders and Mombo, with a short detour to Victoria Falls. That should cover your requirements. So expensive, and without points opportunities, that you will have felt it to be special and unique within your context.

I second the road trip proposed by KahunnaTravel upthread. My husband and I drove nearly the same itinerary two years ago, and we agree this was one of our best trips ever. Stunning scenery, lovely people, cool animal viewing, and talking to one another was pretty spectacular. Loved it....

Lucky don't get married! Trust me, your relationship has DIVORCE written all over it!

I did a lot of travelling with my wife before marriage, but a honeymoon is special no matter where you go. The trip will always be remembered as a honeymoon. That makes it stand out from all the other travel. You’ll remember the details of a honeymoon for decades when all the trips to Bhutan and the Maldives (which you’ll probably visit umpteen times in your line of work) have kind of faded.

Take Ford on another AA EXP longhaul mileage run and call it a honeymoon trip ;)

There are definitely special resorts you can go to that will blow SPG, Hyatt, Hilton of the world out of water. Heck, these places make Mandarin and Four Seasons seem barely adequate. Try the Brando, North Island, or Laucala. They are eye watering expensive but the experience you will receive dwarfs anything you can get with points. Amanpulo is another option. Since you are in LA, the easiest option would be go to the Brando....

There are definitely special resorts you can go to that will blow SPG, Hyatt, Hilton of the world out of water. Heck, these places make Mandarin and Four Seasons seem barely adequate. Try the Brando, North Island, or Laucala. They are eye watering expensive but the experience you will receive dwarfs anything you can get with points. Amanpulo is another option. Since you are in LA, the easiest option would be go to the Brando. I would get a private jet and fly to Tahiti. Then take the Brando plane to the Brando. There’s a reason why celebs flock there... oh, and Obama too.

Did a Safari in Southern Tanzania (Selous/Ruaha & Zanzibar) ... also did 5 nights in Mauritius (where I know you've been) and loved the whole trip. Its definitely more off the beaten path than the South African camps (or Kilimanjaro/Kenya for that matter) but very luxurious and the game/nature was spectacular with hardly any other humans around. Highly recommend Nomad Tanzania if you go the Safari route.

I concur. It's also why I don't want a wedding either.

Oh I’m so pleased that the comments aren’t filled with snarky junk. Congratulations to you both. There’s a common thread here: Do *something* but keep it simple and lovely. Romance does not require a grand gesture!

Thanks for talking about your plans Lucky! So happy for both of you, and your logic for not wanting to plan one trip in particular makes great sense.

Virgin Galactic to space?

I get where you're coming from - you travel a lot, so any miles and points trip wouldn't really be that different. Why don't you try a kind of travelling you haven't done before? One that involves no work/blogging for a week (gasp!), where you stay at an independent hotel rather than a chain, and perhaps explore a place that you wouldn't end up going while trying to review airlines? A remote cabin somewhere or...

I get where you're coming from - you travel a lot, so any miles and points trip wouldn't really be that different. Why don't you try a kind of travelling you haven't done before? One that involves no work/blogging for a week (gasp!), where you stay at an independent hotel rather than a chain, and perhaps explore a place that you wouldn't end up going while trying to review airlines? A remote cabin somewhere or a safari, perhaps, as other people have suggested. Try travelling differently than you usually do!

@Lucky

I’m also getting married in September, and my soon to be wife and I have been all over the world in ~luxury (thanks to my traveling job and tips from you).

It was hard to figure out something special to do, but we ultimately decided to do “that” safari in Africa that we’ve been talking about for years. We will spend our first week in Seychelles and are beyond excited!

I’ve never written back but have a PIV on this. As an American Airlines Conceirge Key I plan vacations to be at HOME! I suspect you’re feelings are similar. When you travel every single week a vacation is NOT to! Maybe plan a STAYcation honeymoon???

I suggest you take a cruise instead of flying somewhere. You never review cruises, so you won't be operating in your normal "work space". Take a cruise from London to New York. Or a Mediterranean cruise. It will give you a new perspective on travel and it will distinguish your honeymoon as something very different to what you do every other day

Honeymoon is a MUST!

Take a nice cruise - love the idea above for a TATL crossing. Splurge on a luxury line/cabin. Go to Disney! Take a train across Canada. I honeymooned on a cruise around Hawaiian islands. In my humble opinion you should do something involving a different mode of transportation. Get married on a ship and have friends/family cruise with you.

Maybe a cross country drive across the United States to see parts of the here you've never seen before since you're usually out of the country.

Totally agree with you!

Of course we got married at city hall. Every trip we take is like a honeymoon (it's just the two of us, and we take lots of fabulous award trips). Maybe one day we'll have a real ceremony and renew our vows, but it will probably just be another wonderful vacation for us. :)

OMG all compliments so far! Congratulations to you boys. My partner snd I would recommend a unique thing that you do together, like the Aranui on it’s run through French Polynesia or a game lodge in South Africa. Done both not for the honeymoon but to experience something unique different together is a bit special. All the very very best

So are you waiting until marriage??? ;)

I think you should do a reverse honeymoon: stay at home for a week!

Go to greece!

First and foremost huge congratulations to Ford and you! It is indeed a fantastic moment in your lives! I wish you both all best. May it be the best wedding to you and your families. This is big step for you both. I am happy for you two as you are opening a new chapter in your lives.. a great new one!.

It is indeed a good question regarding how often you have travelled with...

First and foremost huge congratulations to Ford and you! It is indeed a fantastic moment in your lives! I wish you both all best. May it be the best wedding to you and your families. This is big step for you both. I am happy for you two as you are opening a new chapter in your lives.. a great new one!.

It is indeed a good question regarding how often you have travelled with Ford around the world in various fantastic destinations. How can you top all that for your honeymoon? Believe it or not..for me..it does not matter where you go or how luxurious you planned it or not (this is really coming from me!), important is you are together and you are both happy!

I can even image how often you both just took your hands together while travelling the world and it was the best moment! So do you need something luxurios or expensive or outrageously ..Nope..just enjoy every moment from now onwherever you go and make a lot memories which you will cheerish your whole lifetime!!

A natural honeymoon for you guys would be to spend 1-3 weeks doing nothing in one place to decompress and enjoy the lives you are building together. While in one place, can be sloth like it does not have to be that way. For example create massage side trips, restaurant exploration, museums......

Basically “travel in”. After that you both will be ready to hit the road and maybe an awesome opportunity presents itself as a pop-up honeymoon anyways.

Cheers and congrats

Congrats!

We enjoyed our honeymoon so I would recommend doing something... anything really. So long as its fun

I can think of one idea.

Let another person determine whole trip. Give them a full authority, and you will just follow (unless it is totally unfounded.) A specialized luxury travel agent, or even your OMAAT team member may be suited.

Get away from the pressure (where to go/award availability/which hotel to stay at/etc.), just let others do it, and just enjoy with Ford.

And of course, do not work, except for a casual blogging.

Don't miss out on a honeymoon!!! Do it!

A honeymoon the next day after the wedding can be tiring. Do what Prince William did. He had a honeymoon very soon after the wedding but not the next day. Consider planning a trip within 2-4 weeks of the wedding. Do it. Do not delay.

It doesn't have to be the greatest trip of mankind or the greatest trip of your life. It just should be a...

Don't miss out on a honeymoon!!! Do it!

A honeymoon the next day after the wedding can be tiring. Do what Prince William did. He had a honeymoon very soon after the wedding but not the next day. Consider planning a trip within 2-4 weeks of the wedding. Do it. Do not delay.

It doesn't have to be the greatest trip of mankind or the greatest trip of your life. It just should be a pleasant trip.

Make the deadline within 30 days of the wedding, not open ended. If it turns out to be 42 days because of award availability, that is ok.

I haven't read all of the comments here, but there seems to be a common themeamong the ones that I have read. Go somewhere quiet and nearby for a week or so, and devote that time to each other.

AND DON"T REVIEW ANY PART OF THE TRIP. DON'T WORK IN ANY WAY ON YOUR HONEYMOON. DON'T EVEN BRING A COMPUTER. It doesn't have to be a trip of a lifetime, but getting away from...

I haven't read all of the comments here, but there seems to be a common themeamong the ones that I have read. Go somewhere quiet and nearby for a week or so, and devote that time to each other.

AND DON"T REVIEW ANY PART OF THE TRIP. DON'T WORK IN ANY WAY ON YOUR HONEYMOON. DON'T EVEN BRING A COMPUTER. It doesn't have to be a trip of a lifetime, but getting away from home will help you focus on each other instead of falling in to the trap of working a bit or doing house/garden work.

My honeymoon was just Inn-hopping for four nights as we drove a leisurely loop around the south-west portion of Nova Scotia. (We lived in Halifax at the time). We took five days to go 600 km. It was a great trip.

How about an aerial safari?

https://www.huffingtonpost.com/jacada-travel/11-of-the-most-stunning-aerial-safaris-in-africa_b_7017320.html

I was in the same position. My wife and I have been to some great places and hotels in the past. So for the honeymoon I had to go over the top. And honestly, just get around the fact that points won’t get you there. In fact, planning a honeymoon on points is very limiting and hard to pull. We ended up going to Mauritius with stopovers in Istanbul and Abu Dhabi. I did use...

I was in the same position. My wife and I have been to some great places and hotels in the past. So for the honeymoon I had to go over the top. And honestly, just get around the fact that points won’t get you there. In fact, planning a honeymoon on points is very limiting and hard to pull. We ended up going to Mauritius with stopovers in Istanbul and Abu Dhabi. I did use points for the flight back since I could book Etihad apartment for two - and that in fact DID blow her away. But the two hotels we stayed at - Four Seasons Anahita Beach Villa and Jumeirah Etihad Towers (Club Level) could not be booked with points. So I splurged - and honestly paying cash for once did make the thing feel very special. Needless to say, the trip was a success and my wife was very happy.

If you’re worried about the pressure of having to one-up any other trip, then just decide on a peaceful, relaxing week (or weekend) at home together. Let Tiffany run the blog and just try to disconnect for a while and spend time together. The point of the honeymoon is more to just spend time together rather than doing something super crazy, at least in my opinion.

My honeymoon ~12 years ago (next month) was what gave me the travel bug - we went to Sandals Negril and ignoring work trips we've been to the Caribbean about ~20x and Europe ~10x with 6 more trips already booked/planned over the next two years. It was a very special trip for my wife and I, and really has defined our marriage - but its different for you being you travel everywhere all the time...

My honeymoon ~12 years ago (next month) was what gave me the travel bug - we went to Sandals Negril and ignoring work trips we've been to the Caribbean about ~20x and Europe ~10x with 6 more trips already booked/planned over the next two years. It was a very special trip for my wife and I, and really has defined our marriage - but its different for you being you travel everywhere all the time and in very nice accommodations! So I say if you want to do a honeymoon, do so, if not don't. THe pressure to make it "insane" for you all might even make an A-list celeb blush since you already are world travelers. Nothing else maybe go to a mountain house for a long weekend and hire catering. Something I don't think you do very often, relaxing, and a bit of a getting away from traveling. Do what makes you happy is my two cents!

There are some great suggestions here, and I agree with planning something that's not part of your usual points and miles routine:

- antarctica

- road trip (FL to northeast, perhaps)

- cruise (such as a trans-Atlantic crossing, even as a positioning trip)

Basically, anything to have (more) special time with Ford that you can uniquely look back to and remember years from now.

The honeymoon is an archaic heterosexual tradition. Trust me, you don’t need it ...

I think you should rent a cabin in the woods (Canada) and go fishing. I dare you!

LOL

Congratulations!

My two cents: it's your life, your marriage. Do what makes you and your spouse happy. Go, or don't. Big trip, small getaway, staycation, or none.

And guess what - if you decide to do nothing, you're still allowed to change your mind (allowing that that might mean some last minute crazy booking - but what a great blog post that would make after the fact)!

Congrats Ben & Ford! Maybe just block off time after the wedding, and let the travel winds blow where they may based on last minute award availability. Worst case scenario there is no where you want to go = staycation with your new husband! :-)

Agreed. Honeymoon is an outdated concept, from a time when people were generally poor and didn’t usually travel. The wedding was then an excuse for once in your life spend money on an unnecessary trip. The other factor was that people lived under one roof with three generations and didn’t really have a space at home to do you know what. For someone like you, Lucky, the real honeymoon today would be to just stay...

Agreed. Honeymoon is an outdated concept, from a time when people were generally poor and didn’t usually travel. The wedding was then an excuse for once in your life spend money on an unnecessary trip. The other factor was that people lived under one roof with three generations and didn’t really have a space at home to do you know what. For someone like you, Lucky, the real honeymoon today would be to just stay at home for one week and go only where you can walk. I bet you have not done that for ages.

Make it memorable. Charter a private jet and go somewhere special for a few days.

Why don’t you either have a week-long staycation, because a normal and routined life is more exceptional for your two, go on a roadtrip (because that is where you can really connect) or even more exciting and outlandish, a week-long hiking trip, like the Everest base camp trek, the Inca trail, hiking in Patagonia or New Zealand, just to completely disconnect from the world and let it just be you two

You might be...

Why don’t you either have a week-long staycation, because a normal and routined life is more exceptional for your two, go on a roadtrip (because that is where you can really connect) or even more exciting and outlandish, a week-long hiking trip, like the Everest base camp trek, the Inca trail, hiking in Patagonia or New Zealand, just to completely disconnect from the world and let it just be you two

You might be surprised at the exhilaration and bonding such a trip can do

After eighteen years of marriage and many fun and successful trips the biggest disaster of a trip we ever had was Paris this year. Why? Because we decided it was “special” and it was our anniversary and things went downhill from there. So everything that went wrong was a horrible problem with our “special” trip. Mind you, we travel several weeks a year together. Happily. We fought the entire week. Don’t put that kind of...

After eighteen years of marriage and many fun and successful trips the biggest disaster of a trip we ever had was Paris this year. Why? Because we decided it was “special” and it was our anniversary and things went downhill from there. So everything that went wrong was a horrible problem with our “special” trip. Mind you, we travel several weeks a year together. Happily. We fought the entire week. Don’t put that kind of pressure on your relationship. Enjoy your wedding. Go somewhere fun later, after you have a little time to relax. And if you ever change your mind you can always have a honeymoon. No one will stop you. But do what seems right.

Road trip!!! I travel and fly a lot for business and pleasure, stay in upper end hotels, etc. So when my wife and I got married we decided on a domestic road trip precisely because it was different. We also settled on a part of the country we had never been to before and would likely not ever get to if we didn't do it then. So we flew into Billings, MT, picked up a...

Road trip!!! I travel and fly a lot for business and pleasure, stay in upper end hotels, etc. So when my wife and I got married we decided on a domestic road trip precisely because it was different. We also settled on a part of the country we had never been to before and would likely not ever get to if we didn't do it then. So we flew into Billings, MT, picked up a rental car, and went and saw a piece of America ("1 mile at a time"). Drove to Rapid City (Badlands, Mt Rushmore, Devil's Tower, Wall Drug, Minuteman Missile Museum National Park) and marveled at the Big Sky then went by our windows. Next on to Cooke City, MT via US 212 with a stop @ Little Big Horn and crossing over Bear Tooth Pass. From there into Yellowstone in time for the spring Buffalo calving and moving onto Grand Teton. Then up to Boise and over to Missoula and Glacier National Park. Stayed in Hamptons, Motel 6, and Best Western. There are no upmarket SPG or Hyatt properties in this "neck of the woods" (and I do mean woods). Over 3000 miles went on the car before we dropped it off back in Billings 14 days later. Ate local, saw minor league baseball games, and ...... learned to talk to each because there was no in-flight entertainment or lie-flat seats. So if you and Ford do decide to do a "honeymoon" (where did that name come from anyway), and you want to do something different, consider a domestic road trip. We've NEVER have regretted ours. Oh, and best wishes you two.

Lets face it you go on holiday all the time - and you can pretty much afford to go wherever you want whenever you want, one way or another. Which you know is great. Well done. But it's no big deal for either of you to either plan or have a honeymoon. If you do have a honeymoon don't review any of the elements of the trip here. Start as you mean to go on and keep your private life privado.

Well, I waited until marriage (no condescending quote marks needed), and I didn’t find it to be too much pressure, nor a disappointment. And neither did my bride.

The “enlightened” can be so intolerant sometimes.

Here's my advice:

-pick somewhere you have been before (no temptation to take photos or write a review)

-leave the camera at home

-farm out your blog so you aren't writing anything for a week (you have plenty of competent writers at this point)

-keep yourself within a few hours of home so jet lag/first class cabins/lounges aren't part of the equation

And I misread your statement on "waiting", doesn't have to do with committement I see.

The one thing I’d add to the suggestions of doing something that is otherwise not attainable with any sort of points currency, of which there are a plethora of off the beaten path, albeit super luxury and unique places to stay, is to remove the blogger mindset from all aspects of the trip. As it is now, while you travel the world at your discretion, the itinerary and each aspect of your journey- from airport...

The one thing I’d add to the suggestions of doing something that is otherwise not attainable with any sort of points currency, of which there are a plethora of off the beaten path, albeit super luxury and unique places to stay, is to remove the blogger mindset from all aspects of the trip. As it is now, while you travel the world at your discretion, the itinerary and each aspect of your journey- from airport lounge to flight and hotel satisfaction- seems to be viewed and experienced (with photos, review notes, etc.) with the blog in mind. It could be refreshing to take a full trip for the sole purpose of personal enjoyment and spending time with each other, without thinking about documenting anything at all for the blog.

Two things I forgot;

!) Congratulations! I've been married almost 40 years and it's great!

2) Forgot to add I agree about the simple wedding.

The fancy wedding isn't really about the two of you, it's about guests and folks childhood fantasies. I don't see a linkage between fancy wedding and honeymoon;

I think you are making a big mistake.

This is a very special time; the pressure you are making is all internal.

You travel all the time and you work all the time, how is that like a honeymoon all the time.

It's a time that you devote exclusively to one another. It can be just a week or even a long weekend. It doesn't have to be exotic if it isn't appealing to...

I think you are making a big mistake.

This is a very special time; the pressure you are making is all internal.

You travel all the time and you work all the time, how is that like a honeymoon all the time.

It's a time that you devote exclusively to one another. It can be just a week or even a long weekend. It doesn't have to be exotic if it isn't appealing to you. Do something that you unplug.

I have been to Kauai 20 plus times since our honeymoon. I still remember it as very special. You hopefully only have this one opportunity (i.e., no divorce).

Maybe there is some truth to your associating it with a lack of committment by your analogy to putting off marriage.

You could easily just do a long weekend at a spa destination in the US. Doesn't have to be exotic or far or expensive. It ahs to be about the two of you.

Congratulations to you both! Who cares if it is a honeymoon or not, but definitely go on Safari sometime. Knowing your tastes I'd recommend King's Camp in South Africa. It has more luxorious touches than some of the more famous camps. For example, meals are made to order rather than a buffet, and there are less than 20 people staying there at one time.

A honeymoon at its core is allowing two folks

Just married to enjoy an in between space of settling down from wedding hullabaloo and yet not dealing with the inevitable day to day business of daily life. I encourage you to consider something tranquil...a breathing space that does not have to involve thousands of dollars or points, but does Allie for some privacy, a little giddiness, and opportunity of recognizing the person you just...

A honeymoon at its core is allowing two folks

Just married to enjoy an in between space of settling down from wedding hullabaloo and yet not dealing with the inevitable day to day business of daily life. I encourage you to consider something tranquil...a breathing space that does not have to involve thousands of dollars or points, but does Allie for some privacy, a little giddiness, and opportunity of recognizing the person you just sealed a deal with. Give yourself that space. And congratulatios.

Maybe take a trip that's the antithesis of what you'd normally do? Drive instead of fly, and rent a beautiful home and stay for 2 or 3 weeks. That way your brain won't be in work mode where you're thinking of the review you'd write. Don't run from attraction to attraction or country to country. Go to the Farmer's Market and buy things to cook together. Pick a region like California and take day trips...

Maybe take a trip that's the antithesis of what you'd normally do? Drive instead of fly, and rent a beautiful home and stay for 2 or 3 weeks. That way your brain won't be in work mode where you're thinking of the review you'd write. Don't run from attraction to attraction or country to country. Go to the Farmer's Market and buy things to cook together. Pick a region like California and take day trips up and down the coast. Or maybe someplace like Newport, RI. Or hike to the Havasu Falls. Or rent a yacht and sail around the Caribbean, though the Mediterranean might be better that time of the year! Tons of ways to step out from the norm and have an adventure together that stands out from all the other trips.

I'm another member of the "colossal waste of money" camp. My wedding was perfect: got out of bed, quick shower, bowl of shredded wheat & a banana, metro to the courthouse, quick ceremony, off to the gym.

Honeymoon? Pffft.

Having said that, my love of travel was born from a honeymoon. My mother's parents decided that they wanted to see the American Wild West for their honeymoon in 1913. They went all out:...

I'm another member of the "colossal waste of money" camp. My wedding was perfect: got out of bed, quick shower, bowl of shredded wheat & a banana, metro to the courthouse, quick ceremony, off to the gym.

Honeymoon? Pffft.

Having said that, my love of travel was born from a honeymoon. My mother's parents decided that they wanted to see the American Wild West for their honeymoon in 1913. They went all out: first class cabin from Hamburg to New York aboard the steamship Imperator, followed by a lovely pullman car on a transcontinental train from NY to San Francisco via Chicago.

As a boy, I was enthralled by my grandfather's vivid recollections of that three month long honeymoon. How exciting and adventurous travel was back then!

Lucky, if you do decide to go on a honeymoon, how about going old school and making it an adventure? Transatlantic crossing by ship (a freighter that carries passengers, perhaps?) followed by the Trans Siberian railroad from Moscow to Vladivostok (or Beijing).

I totally understand what you are saying. I was much younger when I got married and I wanted the big wedding and we had an amazing honeymoon in Sicily (before points I cashed out my parents Ultimate Rewards for cash towards a flight. Cringe.) At the time, we were young, semi-poor and it felt like a once in a lifetime trip. This was 10 years ago, so there was limited wifi connectivity and we had...

I totally understand what you are saying. I was much younger when I got married and I wanted the big wedding and we had an amazing honeymoon in Sicily (before points I cashed out my parents Ultimate Rewards for cash towards a flight. Cringe.) At the time, we were young, semi-poor and it felt like a once in a lifetime trip. This was 10 years ago, so there was limited wifi connectivity and we had no cell phone service. We really just focused on each other. Today, I'd skip the big wedding, but still take that trip. We travel a lot, not like you and Ford do, but we still talk about that trip. I second the idea of taking a trip unlike anything you do. I don't think it matters where you go so much, but disconnect from technology, take a few days off from blogging and just focus on each other wherever you want it to be. Of all the exotic places we've gone, our favorite trip was renting a remote cabin in Asheville in a national park. We had no Wifi, cell serve, it was just us and our dog. After a long day of hiking, we'd sit in the hot tub on the porch and cook dinner together. That's a long way of saying you are right and wrong at once. Don't feel pressure to take a big first class, around-the-world points extravaganza honeymoon. Do, do something out of the ordinary together and take some time to just enjoy being married. Congrats!

How about do a trip without flying first class nor 5-Star hotel? How about take train to the east coast or to Canada? I’ve heard travel with train can be quite an experience, plus you can get a feel of the old days travel by train.

You can do short trip from LA to Vancouver, or LA to Chicago...

First of all congratulations again ! I completely understand where you're coming from. When I got married to my partner, the thought of a "traditional" marriage made both of us cringe so we just decided to get both families and some friends together for a nice afternoon and evening, without all the usual fluff. We cooked ourselves for all of them, and it was wonderful.

We did decide to go on a honeymoon, but...

First of all congratulations again ! I completely understand where you're coming from. When I got married to my partner, the thought of a "traditional" marriage made both of us cringe so we just decided to get both families and some friends together for a nice afternoon and evening, without all the usual fluff. We cooked ourselves for all of them, and it was wonderful.

We did decide to go on a honeymoon, but once again the "traditional" honeymoon idea which is going to some resort in the tropics did not appeal to us at all. Instead, we went hiking for 10 days in New Zealand and it was truly wonderful and something we bonded over a million times more than sitting at the St Regis Maldives for 2 weeks or whatever other cliché like that.

So as other suggested, you could probably still organize a trip to celebrate your union, plan an adventure (since you said you now like nature more than cities). But do it without thinking about points or generating content for the blog, just do something for yourselves, as a honeymoon should be and if possible at all completely off the grid ;). I promise you'll be surprised how nice it is to truly disconnect from the world!

The first thing that came to my mind was this: take an entire week with no phones or computers. Sure, borrow a flip phone and an in-car navi (or an atlas) for emergencies, but give each other the gift of your undistracted time.

When we got married we spent a long weekend in a cabin in the woods at Frog Meadow Farm in Vermont and left our devices behind. It was magical.

"I can’t help but feel like a “formal” honeymoon would be setting us up for disappointment."

Very well stated and completely agree with your rationale. I know other ultra-frequent-travelers feel the same. Seems like you make the most of every trip and therefore in some senses every trip is the ultimate honeymoon.

Well done, Ben!

I don't mean to tell you and Ford how to live your lives, but marriage is a big deal and deserves to be treated as something special. It'll be a memory the two of you share together for the rest of your lives. At the moment you have a small ceremony and that's it. Do yourselves a favor and do more than just that. I don't mean to make it a big wedding ceremony and...

I don't mean to tell you and Ford how to live your lives, but marriage is a big deal and deserves to be treated as something special. It'll be a memory the two of you share together for the rest of your lives. At the moment you have a small ceremony and that's it. Do yourselves a favor and do more than just that. I don't mean to make it a big wedding ceremony and go on an expensive trip if that's not what you want, but you two should do something that involves taking some time off (dare I even suggest taking a short break from blogging?--trust us, we'd understand) and spending some quality time with Ford. If that means renting a cabin in the woods and just going off the grid a bit, so be it. If that means staying at home and running errands together, so be it. If that means staying in the most expensive hotel you can, so be it. Whatever it is, definitely spend time together and take some time off work to start your marriage off the way it should be: about each other.

(Congrats again!)

We didn't have a honeymoon. We also were married in Vegas with an Elvis impersonator with just family. It was great.

We didn't want to have to do what everyone else does. We wanted a wedding to be simple and not make us go into debt.

As for a honeymoon, we travel as much as we can so we don't feel regretful that we didn't have a honeymoon.

I think most people...

We didn't have a honeymoon. We also were married in Vegas with an Elvis impersonator with just family. It was great.

We didn't want to have to do what everyone else does. We wanted a wedding to be simple and not make us go into debt.

As for a honeymoon, we travel as much as we can so we don't feel regretful that we didn't have a honeymoon.

I think most people that have honeymoons don't travel that much so a honeymoon is a chance to take that once in a lifetime trip. But for your situation, every month you go on a trip that many would consider once in a lifetime. :)

Congrats on your upcoming wedding! And thanks again for your blog over the years.

I guess it comes down to what’s special and would you feel like you were missing out and regretful?

Since you travel so much, i can see how it’s hard to top x, y and z. A safari is incredible (especially the Okavango Delta of Botswana) but in many places means you go off the grid (i was offline for 10 magical days). i don’t know when (if ever) you’ve been offline to immerse...

I guess it comes down to what’s special and would you feel like you were missing out and regretful?

Since you travel so much, i can see how it’s hard to top x, y and z. A safari is incredible (especially the Okavango Delta of Botswana) but in many places means you go off the grid (i was offline for 10 magical days). i don’t know when (if ever) you’ve been offline to immerse yourself in the experience. A safari is amazing adventure and the sunsets are burned into my memory reminding as are the animal experiences

So if i had to suggest a honeymoon it would be going offline to explore a new destination that has nothing to do with points. go have fun together to start your new life - phones down. your readers don’t need to follow along in real time.

Completely agree. For most people, a honeymoon is a once in a lifetime trip. You take multiple “once in a lifetime” style trips every year. I don’t think it’s necessary. But it never hurts to let the hotel staff know it’s your honeymoon. I’ve had many “honeymoons” over the years.

Go somewhere in Africa, with absolutely zero wifi or cell service. That gives you a special time to connect.

@Lucky: I too did not have a honeymoon, for many of the same reasons you listed in your post. My partner and I are fortunate to be able to travel to pretty much wherever we want in fine style, so the concept of a "special" trip to celebrate our marriage just didn't seem necessary. If we want to go somewhere special, we just go there. We had also been living together for five years, so...

@Lucky: I too did not have a honeymoon, for many of the same reasons you listed in your post. My partner and I are fortunate to be able to travel to pretty much wherever we want in fine style, so the concept of a "special" trip to celebrate our marriage just didn't seem necessary. If we want to go somewhere special, we just go there. We had also been living together for five years, so the idea of having special "alone" time did not seem necessary. I feel like the concept of a honeymoon is fairly anachronistic considering how much easier it is to travel nowadays and also because most couples co-habitate before getting married. Back in the 1950's, people might go on one or two big vacations in their life times and also would not live together beforehand, so the idea of a special honeymoon trip made sense. It might still make sense for people who don't travel much, but that clearly isn't the case for you and Ford as it was the case for me. That said, I did plan a special surprise trip (like you) for my proposal.

seems like you guys have already been on several honeymoons, so I think it makes sense to not plan to take a specific trip called a honeymoon. I feel like traditionally honeymoons were meant for people who couldn't or didn't travel much to go somewhere special together. Since you don't fall into that category it seems sensible to me not to plan one. Maybe a "staycation" makes more sense.

Maybe not a traditional honeymoon, but just a low-stress, quaint house rental somewhere to just soak in everything that has happened after the ceremony. We also didn't do a big ceremony or traditional honeymoon, so totally get it.

Ben, firstly, congratulations on your future wedding! Secondly, I agree with you. What’s a honeymoon so special when you and ford travel the world on a lot of trips anyways? Just keep carrying on with what u do best and there’ll be many more trips down the line where ford will join you of course

Go on an anti-honeymoon! Just a pleasant, casual trip with no expectations, where the goal isn't to have the best experience of all time, but just enjoy each other's company without working too much.

Why not honeymoon to somewhere not conducive to points and miles, since that's what the norm is for you?

By the honeymoon is time for reflection and accepting Jesus Christ the one and only true god. As luck would have it Christ was gay too.

I totally understand your logic Ben! Your normal travel scheduled (minus TAAG of course!) is better than what most couples do for their honeymoons. You shouldn't feel obligated to do a traditional honeymoon. Considering your jobs, its probably better for you two to stay home, cook breakfast, walk the dog, etc. and do all the homebody stuff you don't normally do. :)

Congrats again and all the best! Good call on a small ceremony with...

I totally understand your logic Ben! Your normal travel scheduled (minus TAAG of course!) is better than what most couples do for their honeymoons. You shouldn't feel obligated to do a traditional honeymoon. Considering your jobs, its probably better for you two to stay home, cook breakfast, walk the dog, etc. and do all the homebody stuff you don't normally do. :)

Congrats again and all the best! Good call on a small ceremony with your family; it will make the event very special!

Amongst gay can either one propose to the other? There is no chauvinistic shit like among the hetero s where the guy is doing all the work while the woman is shrieking about getting equality?

I think the concept of honeymooning is a bit archaic, and 'cookie cutter', especially if you're living a life that affords travel on the regular. Is a honeymoon important for someone who gets two weeks off a year from an office job? Probably. But let's face it - you're writing this post from a place most people couldn't even dream of for a honeymoon, so what's the point?

Most couples I talk to about...

I think the concept of honeymooning is a bit archaic, and 'cookie cutter', especially if you're living a life that affords travel on the regular. Is a honeymoon important for someone who gets two weeks off a year from an office job? Probably. But let's face it - you're writing this post from a place most people couldn't even dream of for a honeymoon, so what's the point?

Most couples I talk to about their honeymoon only mention how beautiful and exotic it was, how expensive it was (gross), and how their villa was so much nicer than Sally's villa when she got married. Nobody ever talks about how nice it was to spend time with their new partner, which is kind of sad, to say the least.

Spending time with the people you love whenever you can is all that matters, and the venue/location is secondary, in my opinion.

Congratulations to you and Ford on what is most certainly going to be a fantastic life together!

Ben, this post is why this is the best travel blog. Thank you for sharing your life with us knowing that haters will come out of somewhere to say something negative about the most mundane posts.

@ Ben -- I meant that a honeymoon makes no sense (hopefully you know what I meant!).

I just booked flights to Nantucket! But not September ;)

@Ben -- I'm in agreement with you on both events. A big wedding is a colossal waste of money (give it to charity instead), and when your life is travelling like yours and ours, it kinda makes no sense.

A honeymoon was originally a month of time that newlyweds would take to spend time together and focus on the genesis of their marriage. For you and Ford, my suggestion is that you have a "honeyear," or a year's worth of special moments and off-the-beaten-path travel experiences to celebrate the elevation of your relationship. Congratulations, Ben!

I mean, you do the same things on a routine basis that most people do for their honeymoon. So why not do what normal people do for their vacation, which could be a week on Nantucket or something like that?

Just go to Nantucket for a few days and either rent a house or stay at the Wauwinet or the White Elephant. You can unwind and it's fantastic. No points properties, but these are all better.