The Chase Freedom Flex℠ is one of my favorite no annual fee credit cards, as it offers 5x points in rotating quarterly categories, for up to $1,500 of spend per quarter. Most people use this as a cashback card, meaning the 5x points really translates into 5% cashback in these categories.

However, in conjunction with cards like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® Card, and Ink Business Preferred® Credit Card, points earned on this card can be converted into Ultimate Rewards points, and be transferred to the Ultimate Rewards airline and hotel partners. Since I value one Ultimate Rewards point at significantly more than one cent, that’s my preferred use of those points.

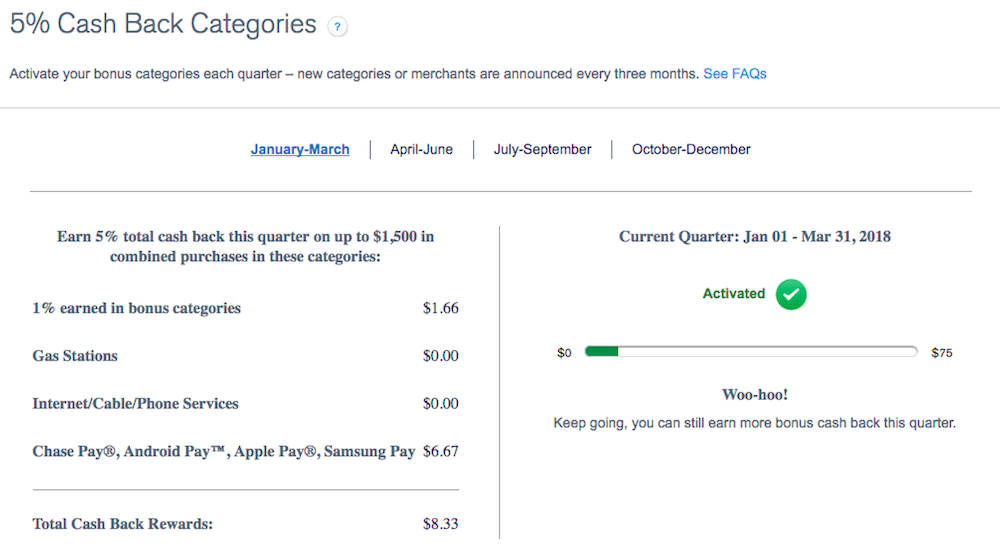

One thing I’ve always found odd is how tough Chase makes it to track your progress in a given quarter. Last July I wrote a post outlining how to look up your progress towards the $1,500 bonus limit in a given quarter. While there was a small progress bar on Chase’s website, you had to actually inspect the element of the webpage to see your exact progress.

As noted by Doctor Of Credit, Chase has now made it easier to track your 5x points progress in a given quarter with the Chase Freedom. Just log into your Ultimate Rewards account and go to the Rewards Activity page, and at the bottom you’ll see that it now breaks down your progress for the quarter for the 5x points category.

The new tracker is fantastic, and makes it much easier to figure out how you’re doing.

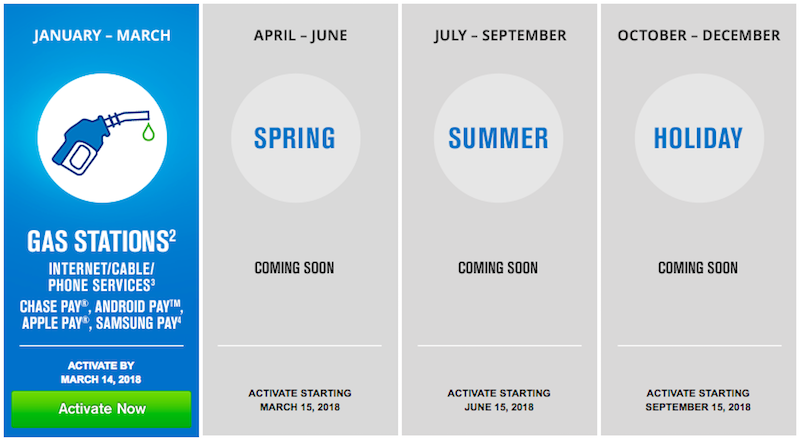

As a reminder, this quarter the card is offering 5x points for mobile payments (Chase Pay, Android Pay, Apple Pay, and Samsung Pay), gas stations, internet, cable, and phone services.

As I’ve explained, I’m maximizing this category by using the mobile payment option. It’s easy to add Apple Pay to things like Uber, Postmates, etc., which really will make the points add up quickly.

@Steve: Most Chase customers would only have 1 credit card from Chase, let alone 3 Freedoms. The only reason Chase hasn't cut down on multiple Freedom cards is the limited $1,500 cap.

@Anon: Usually I can pick up the $1500 spend without any extra spending on my part. It's not huge, but I see it as a free 30,000 miles per Freedom card.

does gas at Costco pay the 5%?

Not sure if everyone is aware but I have bought gift cards (Amazon specifically) through the Samsung Pay app and the transaction shows up as "Eligible mobile wallet" bonus.

Chase needs a phone app. I have 3 freedom cards and it would be great to just look at the app and watch the progress bar. They should also have an option to receive emails as you reach 25%, 50%, 75%, 90% and 100%. That would be great for me and great for Chase because it would remind people to use their card.

I don’t see myself buying 1,500 at gas stations, and I’m flush full off Walmart and Best Buy gift cards from the last bonus period. Do you or anyone else have any creative spend ideas for Apple Pay or mobile pay? $500 VGC at a grocery store is all I can really think of, and that’s just an old habit. Thanks.

With CSR giving 3x on dining and Uber, I am trying not to use Freedom/Samsung Pay, as Lucky points out, try to do the full $1500 in lower earning categories.

However, I am having trouble finding enough of my spend that will support Samsung Pay. My Cable and Phone are on auto-pay so I am going to have to try and do out of cycle payments to intercept the auto-pays for just this quarter. At least my grocery stores support Samsung Pay so I can hit that.

Good info. I was kicking myself during the Freedom "restaurant" quarter. After training myself and my wife to only use only that card when dining out, we pretty quickly maxed out the 5X bonus, didn't realize it, and were earning 1X when we should have switched back to Chase Sapphire Reserve and earned 3X.

There is a part of me that doesn't like being a Chase operated puppet. But it is kind of fun...

Good info. I was kicking myself during the Freedom "restaurant" quarter. After training myself and my wife to only use only that card when dining out, we pretty quickly maxed out the 5X bonus, didn't realize it, and were earning 1X when we should have switched back to Chase Sapphire Reserve and earned 3X.

There is a part of me that doesn't like being a Chase operated puppet. But it is kind of fun to get more points. I guess I'll feel better about the game when my wife and I begin our $200 round trip business class fare to see Western Australian wildflowers next fall!

i won't pass up the 5x, but I won't go out of my way to take advantage of it.

I still have diners club which is 3x on GGD

@anon - that's why you get multiple Freedom cards!

And note that generally warehouse club gas pumps are coded as gas and not warehouse clubs which makes the 5X points a nice bonus.

@Anon- it’s a marathon, not a sprint. By maxing the categories I can transfer 30k points to my wife’s CSR every year. That’s not worth it?

It would be great if they could update the app to show this, too.

"which really will make the points add up quickly." thats because of the low low low cap of $1500

;)

seriously, capped quarterly bonuses are barely worth the trouble