While many of the most popular credit cards offer travel rewards, there are also some popular retail credit cards. Capital One has lots of great cards, and last week they announced two new credit cards in conjunction with Walmart.

Those cards are now open to new applicants, so I wanted to provide a quick update on that front.

In this post:

Capital One Walmart Rewards Credit Card

Capital One and Walmart have now rolled out two new credit cards:

- The Capital One Walmart Rewards Mastercard, which is their main credit card, and which you can apply for here

- The Walmart Rewards Card, which is exclusively for Walmart purchases

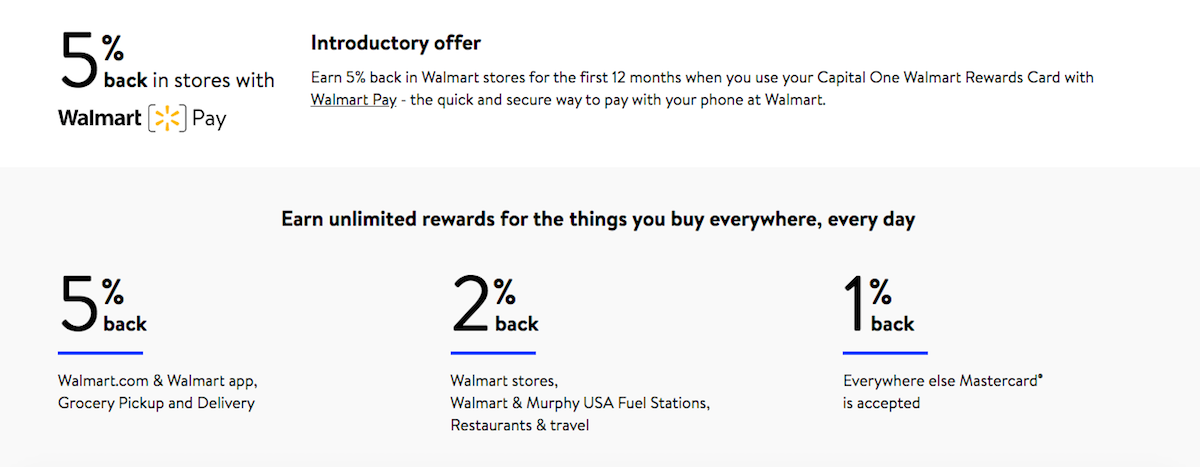

The Capital One Walmart Rewards Mastercard has no annual fee and no foreign transaction fees, and offers the following return on spending:

- 5% back on purchases at Walmart.com, inclusive of Walmart Grocery Pickup and Delivery

- 5% back on in-store purchases when using Walmart Pay for the first 12 months after approval as a special introductory offer

- 2% back on Walmart purchases in stores outside of the introductory offer

- 2% back on restaurants and travel

- 1% percent back everywhere else

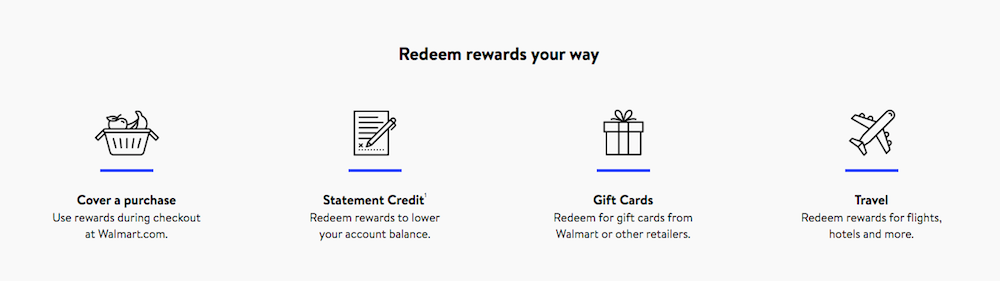

You can redeem your rewards at any time for travel, gift cards, during online checkout at walmart.com, for recent purchases, and even for statement credits, so the rewards are more or less good as cash.

In the press release about the new card, Capital One also stresses the following:

The card also includes a variety of digital-first features that reimagine how customers interact with their credit card. While customers can apply for the card at Walmart.com, the Walmart app, or at CapitalOne.com, Walmart and Capital One have also created a mobile application experience. Applicants can text to apply from anywhere and complete their application from their personal mobile devices. Once applicants are approved and their identity is verified, they will receive immediate access to their card for Walmart purchases.

I’ll admit I’m low tech. While I appreciate them making it easy to apply and to get instant access to cards, I feel like being able to apply either on a smartphone or on a computer wasn’t really a pain point in the cardmember experience?

So I’m not sure what exactly texting to apply for a credit card looks like, but…

What About Current Walmart Cardmembers?

Current Walmart cardholders will be converted to one of these cards, and will earn rewards with the new structure as of October 11, 2019, with new cards arriving in the mail beginning in November.

Current cardholders will also be eligible to earn 5% back when they use their card with Walmart Pay for in-store purchases through October 14, 2020.

Is The New Walmart Credit Card Any Good?

When we see co-branded credit cards introduced, I feel like they generally go in one of two directions:

- They’re lucrative for spending with the co-brand partner, but not for everyday spending

- They’re lucrative for everyday spending, but not with the co-brand partner

In this case, the new Capital One Walmart Rewards Credit Card is great for frequent Walmart shoppers.

For the first year you’re potentially earning 5% cash back both in-store and online, which is excellent. Beyond the first year you’re just earning 5% cash back at walmart.com, and 2% cash back in-store.

Unfortunately beyond that, this card isn’t very lucrative. You earn 2% back on restaurants and travel, and 1% back on everything else. While it’s nice to have a no annual fee card with no foreign transaction fees, you should be able to do better than that.

For example, on the most basic level the Citi Double Cash® Card is an incredible no annual fee card:

- It offers 1% cash back when you make a purchase, and 1% cash back when you pay for that purchase (in the form of ThankYou points)

- Rewards can be combined with Citi ThankYou points earned on Citi Premier or Prestige making them even more valuable

Bottom Line

Capital One and Walmart have launched a new credit card that offers a great return on spending for those who frequently make purchases with Walmart. On top of that, the card has no annual fee and no foreign transaction fees.

Unfortunately the card isn’t otherwise very lucrative for everyday spending, as you’re looking at earning 2% on restaurants and travel, and 1% back on everything else.

So if you’re a frequent Walmart shopper it could be worth picking up this card, but I wouldn’t recommend using this as your primary card for everyday spending.

What do you make of the new Capital One Walmart Card?

I wish walmart comes to India. It has indirect business but dont have a store in india.

This is November 16 and I still haven't received my new Walmart/Capital One card.

Will I still be able to use my existing Master Card? When may I expect to receive my Capital One card?

Still haven't received my new Walmart?CapitalOne card...now what??? Today is October 25th.

I have had a Walmart mastercard for years and now they tell me it is being changed to Capital One...and not to use my credit card for three days..starting October 11...thru Oct 14....but as yet have not RECEIVED MY CAPITAL ONE CREDIT CARD,,,have always paid on time and when had to make some large charges I sent like $1000...to 2000. dollars instead of minimum payment so I can get my card back down to a...

I have had a Walmart mastercard for years and now they tell me it is being changed to Capital One...and not to use my credit card for three days..starting October 11...thru Oct 14....but as yet have not RECEIVED MY CAPITAL ONE CREDIT CARD,,,have always paid on time and when had to make some large charges I sent like $1000...to 2000. dollars instead of minimum payment so I can get my card back down to a natural spending cycle...have I been one they aren't issuing a Capital one Card too. Gaynell McCormick...

Capital One Walmart Reward Card sent Email to do Feedback...how is that possible, when haven't received in the USPS/Snail Mail at my home yet???? Feedback is 'Good til Oct. 13th...' or have to go to the Site to do...sooooo, where's my Card???

I couldn't care less about the rewards. I used the Walmart Credit Card because of promotional financing. It was very helpful at Christmas. Now the card will sit in a drawer at home while I find a different way to pay for Christmas. Nearly every other store offers promotional financing. I'm really disappointed in this.

Also, from time-to-time when Walmart offers promotional financing on purchases, those transactions will not count toward any rewards. I guess Capital One hopes everyone gets pegged seo

I haven't been inside a Wal-Mart store in more than 10 years. True story.

I answered my question in regard to the cash back feature at the register, or what is formally called "Quick Cash". Capital One will continue the option of offering cash back at the register in $20 increments for both the Walmart Master Card and Walmart store card, and the cash back will continue to count as a purchase and not as a cash advance.

The cash back feature will not qualify for any rewards, and...

I answered my question in regard to the cash back feature at the register, or what is formally called "Quick Cash". Capital One will continue the option of offering cash back at the register in $20 increments for both the Walmart Master Card and Walmart store card, and the cash back will continue to count as a purchase and not as a cash advance.

The cash back feature will not qualify for any rewards, and it can't be used with the Walmart pay app in store.

Also, from time-to-time when Walmart offers promotional financing on purchases, those transactions will not count toward any rewards. I guess Capital One hopes everyone gets pegged at the highest intetest rate of 26.99% while getting measely rewards in the process.

SO_CAL_RETAIL_SLUT

Any data points if Capital One is pulling all 3 credit bureaus for new applicants? Capital One is notorious for pulling all 3 credit bureaus for their other cards.

Although, I don't know if they are using this all 3 credit bureau pull practice for their Bass Pro Shops and Cabela's portfolio. I have been told that Capital One is not pulling all 3 bureaus for Bass/Cabela's.

Also, the Sam's Club credit card program is...

Any data points if Capital One is pulling all 3 credit bureaus for new applicants? Capital One is notorious for pulling all 3 credit bureaus for their other cards.

Although, I don't know if they are using this all 3 credit bureau pull practice for their Bass Pro Shops and Cabela's portfolio. I have been told that Capital One is not pulling all 3 bureaus for Bass/Cabela's.

Also, the Sam's Club credit card program is not moving to Capital One, but staying with Synchrony Bank.

For those who already have or who will be applying and accepted for the Capital One-issued Walmart Master Card and Walmart store card, most customer service calls will be answered in the United States by the former Cabela's credit card center and now Capital One call center in Lincoln, Nebraska.

Capital One, for now, has elected to keep the Lincoln, Nebraska call center open. For how long though is anybody's guess. I don't know about the Walmart contract, but Bass Pro Shops has it written into their service level agreement that most Bass Pro Shops and Cabela's Master Card customer service calls have to be answered/handled by United States-based employees.

Will Capital One increase the incentives at the in-store level when hawking credit card applications vs. what Synchrony Bank usually offered....a 2 liter bottle of soda...I'm not kidding...a 2 liter bottle of soda!

At least at Sam's Club, Synchrony Bank will offer from time-to-time an incentive of anywhere from $25 to $50 for new account opening.

What Lucky hasn't mentioned if the Capital One-issued Walmart Master Card will allow you to receive cash back at the register at point of sale, and the cash back counts as a purchase and NOT as a cash advance. This has been a feature of the Synchrony-issued Master Card for both Walmart and Sam's Club, going back to the days when the card was a Discover card before what was then GE Capital, now Synchrony Bank transitioned the Discover portfolio to Master Card.

SO_CAL_RETAIL_SLUT

If grocery stores had Walmart gift cards I would be shopping on Walmart instead of Amazon. I did some shopping when Chase had bonus for using Chase pay with Walmart pay though.

I work at walmart ho and shop at walmart and i read this blog very regularly!I think its great for walmart shoppers!

I dont know how jk got that assumption

In all fairness cards hits the nail for the core customers for whom its targeted. With that introductory offer, its right in alley to bring more of the regular customers use the app and thus be part of that ecosystem. Core walmart customers will...

I work at walmart ho and shop at walmart and i read this blog very regularly!I think its great for walmart shoppers!

I dont know how jk got that assumption

In all fairness cards hits the nail for the core customers for whom its targeted. With that introductory offer, its right in alley to bring more of the regular customers use the app and thus be part of that ecosystem. Core walmart customers will like that card and I think it blows the previous card offerings out of the water!

Sorry to say, not every card needs to be airline miles, flexible currency points. Call me biased but walmart has done excellent job making progress in its offerings

@JK what kind of fairytale elitist cloud are you trying to live on? lol

Haha probably almost everyone reading this site shops at Walmart when it earns 5X or they need to buy some money orders :)

I work at Walmart's Home Office and I read this blog every single day, so I don't think @JK is exactly spot on there.

LOL literally not one person who reads this site shops at Wal Mart. Explains the strong anti-union bias!