Disclaimer: The owner of this site is not an investment advisor, financial planner, nor legal or tax professional and articles here are of an opinion and general nature and should not be relied upon for individual circumstances.

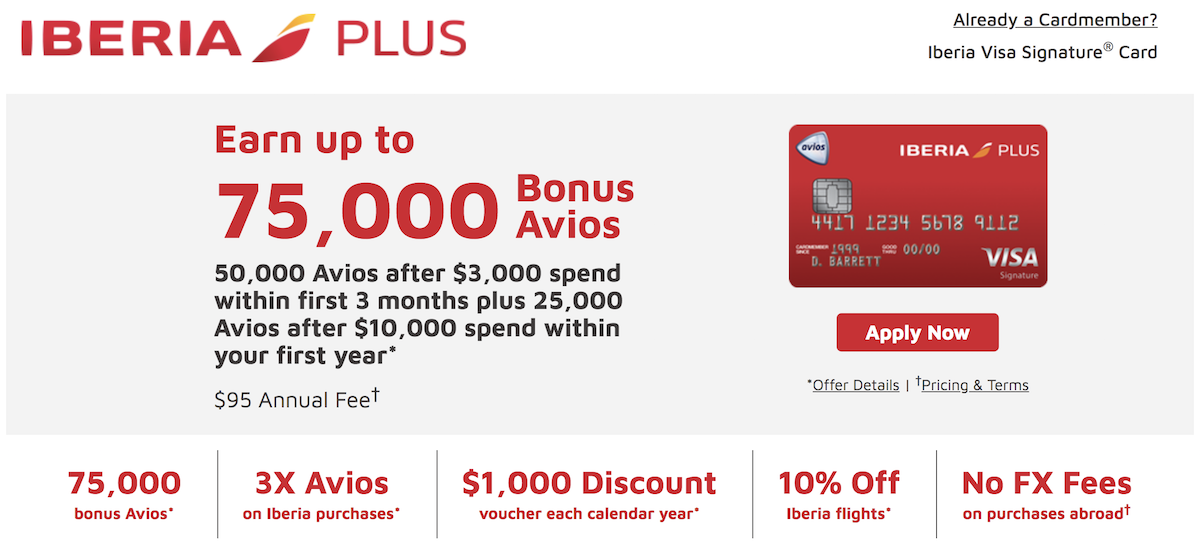

One of the best ways to earn a big chunk of miles easily and quickly is by applying for a credit card with a generous welcome bonus, which can be as high as 100,000 miles/points. When friends and family ask for my advice about how to earn points for their dream trip, this is often the first suggestion I have for them.

However there is usually a condition that you must spend a certain amount within a designated time period, in order to receive those points.

There’s plenty of different advice on creative ways to meet your minimum spend, including pre-paying for household insurance and taxes.

When you shouldn’t have a credit card to begin with

It is just common sense that if you are applying for a card in part for a sign-up bonus and cannot afford to pay off the full balance each and every month, then you should not be applying for credit cards to begin with. The reason for this is because the interest and other penalties you will be charged for not paying the full balance each month will likely far exceed the value of any points you earn for meeting the minimum spend.

Let’s use some very round numbers as an example:

Say you get a credit card that requires a $5,000 minimum spend within 3 months to receive a 50,000 mile/point bonus. And say you value those miles at one cent each, so $500. You spend the $5,000 within the first month but can only pay $100 off the balance each month and you are charged 20% interest per year.

Over the first 12 months of the card alone you would be charged more than $700 in interest, i.e. more than the value of the miles you received for doing so. If this continues in subsequent years you will be hit for thousands of dollars in interest and will be paying interest on the interest.

That doesn’t make any sense.

I’ll say it again — if you can’t pay off the full balance (i.e. all that ‘minimum spend’ you made to get those miles), ASAP then please do not apply for the card to begin with. There are other ways to earn miles without spending large chunks of money.

Being realistic about your minimum spend

I’m financially responsible (even when there’s a particularly tempting mileage sale!), but I know my limits when it comes to the minimum spend I can and cannot achieve. Virgin Australia once offered a Velocity credit card that came with a huge sign-up bonus, but only where you spent $3,000 each month for six consecutive months.

I knew $3,000 for one month was certainly achievable but to repeat that six times was definitely going to be difficult, both finding things to spend $18,000 on, and being able to repay it.

Of course I could have just bought points every months in various loyalty programs, but unless they were being sold at a particularly good sale rate (and I had a trip in mind), that would not have been a sensible purchase. I could have also gone on a shopping spree every month with the mindset of ‘well I need to make the minimum spend so this is really more of an investment than anything.’

But buying things I didn’t need just to earn a comparatively modest number of miles was not a good idea.

Even worse I would have really struggled to pay off the balance each month, meaning interest would start accruing and quickly outweigh the value of the sign-on bonus miles I was trying to earn. I would have been left with a closet full of things I didn’t need, an enormous balance I couldn’t properly service, and feelings of guilt and regret.

So I passed on that application and looked for something more realistic.

Bottom line

I’m not perfect. I received an email from American Express yesterday saying the monthly payment for my British Airways Premium Amex had not been received by the due date. I was sure I had set up a direct debit for it, and I’m likely to be hit with a late payment fee.

But it’s really important when you see those lucrative sign-up bonuses with that minimum spend requirement that you think carefully and responsibly about your own situation. Know what is achievable and what isn’t.

Otherwise those ‘free’ miles could end up being very costly!

How do you meet your minimum spend?

If your only time missing a payment, a quick call and the CC will waive the fee.

I try not to get overzealous with the amount of initial spend I am chasing at any given time. I don't get into manufactured spending, though it seems like the opportunities for that are not as great as when I first started following points and miles a few years ago. I know that if I divert my non-bonused spend along with some of my less lucrative bonused spending to a new card, I can comfortably...

I try not to get overzealous with the amount of initial spend I am chasing at any given time. I don't get into manufactured spending, though it seems like the opportunities for that are not as great as when I first started following points and miles a few years ago. I know that if I divert my non-bonused spend along with some of my less lucrative bonused spending to a new card, I can comfortably satisfy any reasonable new card sign-up bonus spending requirement well within the typical 90 day window.

I recently signed up for the Hilton Amex Business card and I have a unique (though unfortunate!) spending opportunity that will allow me to satisfy my initial spend very quickly. About a month ago, someone lightly hit me from behind at an intersection. The damage was very minor and his insurance company asked if I wanted them to pay the body shop or send the check to me. No brainer! Send the check to me! I will charge ~$1500 later this week for that repair and, along with a large charge I made on a booking for this summer's vacation, my $3000 initial spending threshold will be done!

Finally, as for missing payments, I recently wrote a post about the spreadsheet I use to keep track of all my cards. May not be a method that works for everyone, but so far, it keeps me organized and no missed payments. (http://www.debriantravels.com/blog/2018/2/7/how-i-track-my-credit-card-portfolio)

If you have a large balance and can't pay it off transfer it to a 0% balance transfer. Either suck it up and pay 3% which isnt bad or get a zero fee card. If had to carry balances before

But i have paid like $27 in interest the last 9 years combined. Maybe $1000 or so in transfer fees in past 9 years.

Had this very dilemma with the Virgin Australia card last week!

Don't know how things work in other jurisdictions, but in Canada credit card bills must contain a statement as to how long it will take to pay it off if only the minimum payment is made. I had a particularly busy month a while ago booking a load of flights etc, and my bill said it would take me 96 years and some months to pay it off with the minimum payment. I should live so long!

Of course, I paid it in full immediately.

"It is just common sense that if you are applying for a card in part for a sign-up bonus and cannot afford to pay off the full balance each and every month, then you should not be applying for credit cards to begin with."

Unfortunately as we all know common sense isn't always common, and that's what lenders thrive on.

If I'm not meeting a minimum spend on some card or another I feel like I'm not getting good value for my money!

Currently, I'm finishing a $3K spend in 3 months. Could have paid cash for everything (and I AM paying it off every month) but because I had this new card, I'm going to get a free business class flight to Asia out of it. Score! When I'm within about $1K of...

If I'm not meeting a minimum spend on some card or another I feel like I'm not getting good value for my money!

Currently, I'm finishing a $3K spend in 3 months. Could have paid cash for everything (and I AM paying it off every month) but because I had this new card, I'm going to get a free business class flight to Asia out of it. Score! When I'm within about $1K of meeting a spend, I'll apply for the next card, so I'm never without a minimum spend to work on.

I've got another card in the mail and once that one's finished ($1K/3mo - easy peasy) I'll have enough points for yet another first class Cathay flight. I love layovers in Hong Kong!

When I started this hobby (not too long ago) I started with MSR's that went from $500 then $1000 then $2000 and now I'm satisfying one that is $3000. I am one to always live within my means. Never bought anything unnecessarily just to satisfy a spend requirement. I've always lived within my means and will not let this hobby get me into debt. Great article!

I mostly agree with following these principles. If you’re not financially stable, managing debt while playing with points is a dangerous game. Your time would better be spent figuring out how to get your income to a level hat would allow you to play the game worry free.

However... I currently have a $3500 balance on my BofA Alaska card. I did a balance transfer with a 3% fee and 18 months of 0%...

I mostly agree with following these principles. If you’re not financially stable, managing debt while playing with points is a dangerous game. Your time would better be spent figuring out how to get your income to a level hat would allow you to play the game worry free.

However... I currently have a $3500 balance on my BofA Alaska card. I did a balance transfer with a 3% fee and 18 months of 0% interest. While I could have paid the bill in full (my Amex) I felt like this was too good an offer to pass up.

Great article! I too fell into this trap early in the miles and points game - fortunately the minimum spend wasn't huge and I've since paid it off, and learned my lesson, thankfully not too expensively.

Great article, and you touched on another point that I personally have fallen in to the trap of (but fortunately realized it before it escalated): Finding things to spend money on. All well and good if you're paying rent via Plastiq or putting spend on the card through some other bill, and aware of the fee these services/companies charge for using a credit card. But if you're spending more than you usually would at restaurants,...

Great article, and you touched on another point that I personally have fallen in to the trap of (but fortunately realized it before it escalated): Finding things to spend money on. All well and good if you're paying rent via Plastiq or putting spend on the card through some other bill, and aware of the fee these services/companies charge for using a credit card. But if you're spending more than you usually would at restaurants, department stores, etc. or making purchases you otherwise wouldn't with the mental argument of "it's worth it because I'm earning points/working on a sign-up bonus", then you do need to go back and look over your finances again and make sure chasing credit card bonuses is viable for you. Overspending in order to meet the bonus, or even just to meet it faster, is a trap that's easy to fall into.

Good article James. I think your statement, "it you can’t pay off that minimum spend ASAP then please do not apply for the card to begin with," doesn't go far enough. I think if you cannot pay off 100% of your credit card balances each month you should not be applying for any new credit cards (or spending more on credit cards!) to begin with. In other words, you should be able to afford the...

Good article James. I think your statement, "it you can’t pay off that minimum spend ASAP then please do not apply for the card to begin with," doesn't go far enough. I think if you cannot pay off 100% of your credit card balances each month you should not be applying for any new credit cards (or spending more on credit cards!) to begin with. In other words, you should be able to afford the full balance on all your credit cards, rather than the minimum spend on the new card. (Also, you don't want any readers who skim the article to come away thinking you meant minimum balance rather than minimum spend).

Also, minor typo - I think the first word of your sentence should be "if" not "it."

@ RS - good pick-ups. I've updated that sentence to reflect your points - I agree minimum spend and minimum balance should not be confused! Cheers.

Yes, the predatory banks and financial institutions will continue to sell ( unrealistic, unsustainable) dreams to those who can least afford, hoping to trap them into a vicious debt spiral.

Credit cards are fine for those who can afford them. But the ‘generosity’ of these sign-up deals is funded by the misery of those who can’t afford them , but who have been offered cards anyway. All this in the context of obscenely high...

Yes, the predatory banks and financial institutions will continue to sell ( unrealistic, unsustainable) dreams to those who can least afford, hoping to trap them into a vicious debt spiral.

Credit cards are fine for those who can afford them. But the ‘generosity’ of these sign-up deals is funded by the misery of those who can’t afford them , but who have been offered cards anyway. All this in the context of obscenely high profits and the extraordinary corruption and criminality of many bankers during the last financial crisis ( all funded courtesy of the taxpayer). Most of them belong in jail and yet they avoided that and now thrive, living ‘high on the hog’ and exploiting decent people vis products they can’t afford. Too big to fail but pure evil.

I always know before I apply for a new card how I will make the minimum spend. The only scary part is the card company system of how they determine the three month period - whether it’s from the day of approval or the day of card activation. Almost missed a cutoff date once because the three month clock started the day I was approved and I had assumed the clock started from the date...

I always know before I apply for a new card how I will make the minimum spend. The only scary part is the card company system of how they determine the three month period - whether it’s from the day of approval or the day of card activation. Almost missed a cutoff date once because the three month clock started the day I was approved and I had assumed the clock started from the date of card activation. I always start counting now from the date of card approval just to be in the safe side.

A friend once commented that he'd love to get a card that earned more points, but the interest rates were so high. Until that moment, I never really understood how banks made so much profit from credit cards.

@ Andy - despite what your bank might tell you, their ideal customer is one who maxes out their card and only pays off the minimum balance each month. It's an extremely profitable business model.

This is a great article. A very well worded reminder of when the benefits may outweigh the potential costs. Also glad you touched on being realistic with minimum spend requirements.

Keep up the great work James.