Link: Apply now to open a Bask Bank savings account

In this post I wanted to take a close look at Bask Bank, which is my go-to bank for my savings accounts. Bask Bank enables you to open an account and earn American Airlines AAdvantage miles or cash interest for your savings, depending on your preference.

For some background, Bask Bank is a digital bank that was introduced in 2020. In reality it’s a new and improved version of BankDirect, which I was a customer of for around a decade prior to the start of Bask Bank. Bask Bank is a division of Texas Capital Bank, Member FDIC, so the sum of your total deposits is insured up to $250,000 per depositor for each account ownership category.

So let’s take a closer look — how does Bask Bank work, is it worth it, and what else do you need to know?

In this post:

How do savings accounts work?

Let me start with the basics. If you’re already familiar with the concept of savings accounts, then by all means skip this section.

A savings account essentially allows you to keep your money in a safe place in exchange for some interest. This doesn’t come with the risk associated with the stock market, and it gets you a better return than your standard checking account.

Generally speaking, the money in savings accounts is fluid, meaning you can access it at any time. The catch is that the interest rates can vary significantly, both between banks and depending on bigger economic factors, like general interest rates.

Personally, I think a savings account is a key part of a smart financial strategy. While I like to invest some money in stocks and in a retirement portfolio, I try to keep as much of my “liquid” cash as possible in a savings account rather than a checking account.

I only keep as much in my checking account as I absolutely need, and I try to earn interest on everything else with my savings account. If an unexpected expense comes up, I can always move money around.

A savings account is very different than a credit card, by the way — there’s no hard credit pull required, and the process of opening an account is quite easy. Then there’s the obvious distinction of a credit card requiring you to spend money, while a savings account rewards you for saving money.

What makes Bask Bank unique?

Now that I’ve explained savings accounts, what makes Bask Bank unique, given the countless savings account options out there?

Option to earn miles rather than cash back

Bask Bank gives you the option to earn American AAdvantage miles in a straightforward way with your savings account, in lieu of earning cash interest. However, Bask Bank also has an attractive savings account option offering cash interest, which I’ll talk more about below.

Those of us who are into miles and points probably already earn miles for the money we spend, so it’s nice to also earn miles for the money we save.

Bask Bank has a great app

Not only does saving money with Bask Bank potentially earn you great awards, but what also impresses me about Bask Bank is the company’s technology, and how easy it is to manage your money.

Technology has clearly been a focus for Bask Bank, and that shows with their user experience. From signing up for an account to managing your money, it’s all quite seamless with Bask Bank, in my experience.

There are no monthly account fees or balance minimums with Bask Bank savings accounts; just fund your account within 10-15 days of opening. You don’t have to pay anything to keep the account open, but if the balance remains at $0 for 15 consecutive business days it may be subject to closure. Furthermore, there’s not some high minimum deposit amount required to earn rewards, as you’ll find with some other savings account options.

Bask Bank rewards you with cash, miles, or both

Bask Bank has some popular options for saving money. You can open one of the following accounts:

- A Bask Mileage Savings Account, where you earn miles for every $1 you save annually

- A Bask Interest Savings Account, where you earn cash interest for your savings

- A Bask Certificate of Deposit, where the cash interest rate is determined by the savings time window you commit to

I appreciate the flexibility that this offers, and over time you can even switch your earnings preference by transferring money around, while keeping it with the same bank.

It’s important to keep in mind that the rewards for the savings accounts can change over time based on interest rates. For example, we’ve seen rewards improve considerably over time, as interest rates have gotten higher. The rewards are never locked in, but can change over time, and I’ve found that Bask Bank is consistently pretty fair when it comes to its updates.

Bask Mileage Savings Account option

If you want to earn miles, Bask Bank is currently offering 2.5 AAdvantage miles for every dollar deposited annually. That means if you put $10,000 in your account for a year, you’ll earn 25,000 AAdvantage miles. Miles are rewarded monthly, meaning you earn ~0.208 AAdvantage miles monthly. That rate can also change over time — for example, it was just recently increased from 2 AAdvantage miles to 2.5 AAdvantage miles.

There are many great uses of American AAdvantage miles, especially for travel on partner airlines in first and business class. Personally I value AAdvantage miles at 1.5 cents each, to give you a sense of how much those miles are worth. Note that AAdvantage miles earned through Bask Bank don’t count as Loyalty Points toward AAdvantage status.

Bask Interest Savings Account option

If you want to earn cash interest, Bask Bank is currently offering a 5.00% Annual Percentage Yield* (APY). That means if you put $10,000 in your account for a year, you’ll earn $500 in interest. That interest rate can change over time — we’ve seen Bask Bank increase the APY several times in recent months, though if interest rates drop, then the APY could also decrease.

Bask Certificates of Deposit

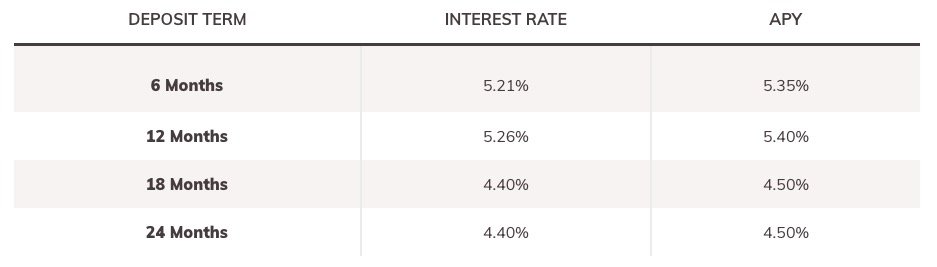

For a more customizable cash interest option, Bask now offers Certificate of Deposit (CD) accounts. $1,000 minimum is required to open the account, and then the APY** rate is determined by whether you choose a 6-, 12-, 18-, or 24-month term.

At the time of this writing, the rates are as follows:

All of the CD offerings are FDIC insured, and CDs in general are considered to be extremely low risk. The fixed rates can also be helpful in setting specific savings goals.

The downsides, however, are the comparative lack of liquidity (there may be penalties if you withdraw funds before the maturity date), and especially in the current environment all fixed-rate securities have some inflation risk.

Paying taxes on your Bask Bank savings

Rewards earned through savings accounts are taxed, as you’ll be issued a 1099-INT form for the rewards you earn. However, not all rewards are taxed in the same way.

If you open a Bask Interest Savings Account or CD and earn cash interest, you’ll pay taxes on the rewards that you earn at the standard rate, in line with your tax bracket. In other words, if you earn $500 worth of interest, you’ll be issued a 1099-INT for that amount.

If you open a Bask Mileage Savings Account, it works a bit differently, since miles don’t have a value that everyone agrees on. When Bask Bank issues a 1099-INT for AAdvantage miles, they’re only valued at the very conservative amount of 0.42 cents each. In other words, at the 2.5 mile earning rate, they’re taxed as if you’re earning a 1.05% APY.

How much that will cost you varies based on your tax bracket. The highest tax bracket is 37%, so at absolute most you’d be paying taxes in the amount of 37% of that 1.05% APY, a cost of 0.39% or ~0.15 cents per mile, which is about a tenth of what I’d value them.

Not only can earning AAdvantage miles as interest be lucrative to begin with, but the fact that you can get outsized value way above the taxable value of these miles potentially makes this even better.

Should you earn cash or miles with Bask Bank?

With the current value propositions of Bask Bank savings accounts, are you better off earning AAdvantage miles or cash back?

- I value 2.5 AAdvantage miles at a 3.75% annual return, given my valuation of 1.5 cents per mile

- That’s less than the 5.00% annual return you can currently get if you choose to earn cash interest

One further consideration is the tax implications. If you were in the highest tax bracket of 37% (which is worst case scenario), you’d potentially be looking at the following after-tax savings:

- 3.36% on an account earning AAdvantage miles (which is 3.75% minus 0.39%, which is the valuation of 0.42 cents per mile minus 37%)

- 3.15% on an account earning cash interest (which is 5% minus 37%)

So, if you value AAdvantage miles similarly to how I do, and if you were in the highest tax bracket, then I do think the mileage savings account is currently the better value. Meanwhile, if you had lower tax obligations associated with this, then the math could work out better for the interest savings account.

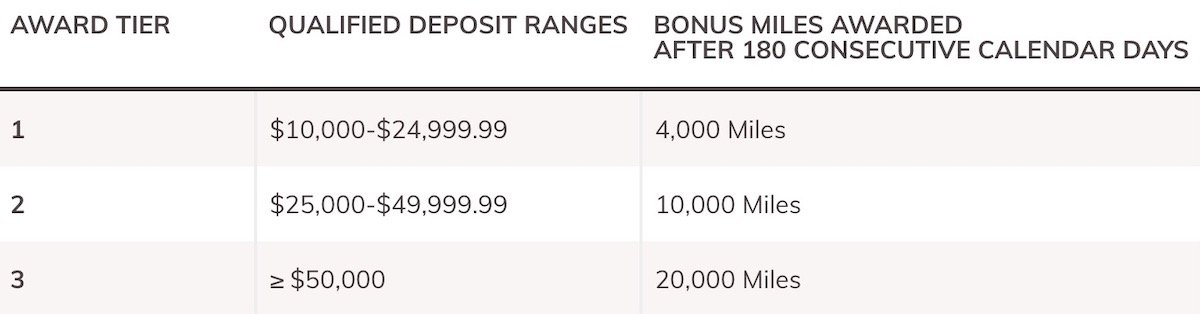

Bask Bank summer bonus offer: earn up to 20K miles

As a standard, Bask Bank doesn’t offer a bonus when you open an account, since the ongoing rewards are extremely competitive to begin with. Fortunately, Bask Bank currently has a summer bonus offer, which is valid for new and existing members, and is a great incentive to deposit money with the bank. Note that this is specifically for a Mileage Savings Account and not for an Interest Savings Account.

With the Bask Bank summer bonus offer:

- If you deposit $10,000-24,999.99, you can earn 4,000 bonus AAdvantage miles

- If you deposit $25,000-49,999.99, you can earn 10,000 bonus AAdvantage miles

- If you deposit $50,000+, you can earn 20,000 bonus AAdvantage miles

As you’d expect, there are some terms & conditions to be aware of. There’s no registration required, so here’s how you can be eligible:

- For new customers who open an account, you have to complete the online account opening process between June 1 and August 31, 2023, then have to fund the account within 15 business days, and then have to maintain the account balance for 180 consecutive days

- For existing customers, you have to make a deposit between June 1 and August 31, 2023, and maintain an aggregate account balance equal to or greater than the combined qualifying deposit and the account’s ending balance on May 31, 2023, for a period of 180 consecutive days

Bottom line

For me, Bask Bank offers the perfect combination of ease and rewards when it comes to savings accounts. The way I view it, the value proposition of Bask Bank comes down to:

- Bask Bank has no monthly account fees, and a great user experience, so it’s easy to use (unlike some other savings accounts I’ve used in the past)

- Bask Bank gives you the flexibility to earn AAdvantage miles or cash interest, and which of those is a better value depends on your own valuation of miles, your tax bracket, and what the current earnings rates are

- Bask Bank’s earnings rates are incredibly competitive, with no minimum or maximum amount you can be rewarded for; 5.00% is an industry-leading APY

If you don’t yet have a Bask Bank account, it absolutely could be worth signing up, especially in the current interest rate environment. You’re basically throwing money out the window if you have a lot of cash sitting around in a no or low interest rate savings account.

If you want to learn more about Bask Bank or want to apply to open an account, follow this link.

Texas Capital Bank is a member of FDIC. The sum of your total deposits with Bask Bank and Texas Capital Bank is insured up to $250,000 per depositor for each account ownership category.

*The annual percentage yield is effective as of Monday, July 31, 2023. Annual Percentage Yields (APY) and Interest Rates shown are offered on accounts accepted by Bask Bank and effective per the dates shown above, unless otherwise noted. Annual Percentage Yield is variable and subject to change at any time. No minimum balance requirement and no monthly service charge. Must fund within 15 business days of account opening.

**The annual percentage yield is effective as of Thursday, December 7, 2023. APY is a fixed rate and a $1,000 minimum balance is required. We will pay this rate and APY through your CD maturity date. Fees could reduce the earnings on your account, and an early withdrawal penalty may be imposed for early withdrawal. If your CD is not funded with at least $1,000 within 10 business days after the date the account is opened, it will automatically be closed. Read the full terms here.

Ben - all the bloggers out there include some version of "Note that AAdvantage miles earned through Bask Bank don’t count as Loyalty Points toward AAdvantage status."

Can you be value added and get a quote from Bask or AA stating why that's the case? Sure, it makes it easier to get status but so do various tricks that people employee.

Updated to add that I've earned over 500k through AA, particularly when rates were low and I was getting 1 mile per dollar. I would be incentivized to start earning AA miles again (despite better options available to me - I have near $0 earning interest at Bask) if I also earned loyalty points.

BaskBank is good, they could improve upon CD rates and adding more terms, also including a reward for renewing CD. A money market account would be nice.

You mention that you earn 2.5 AA points per dollar deposited, but how long does the money have to sit there? Could you deposit and then move the money the next day?

Agree with Jeff's comment about it being a good deal when interest rates were low, but this is clearly a promotion because you do not take into account inflation, and a bank is not necessarily safe. If inflation is between 6% and 7% APR and you are making 5% or less on the savings then it is not a good option. Keep in mind that banks are not necessarily safe. They do fail as we...

Agree with Jeff's comment about it being a good deal when interest rates were low, but this is clearly a promotion because you do not take into account inflation, and a bank is not necessarily safe. If inflation is between 6% and 7% APR and you are making 5% or less on the savings then it is not a good option. Keep in mind that banks are not necessarily safe. They do fail as we have seen with SVB bank. It seems like having this account is more trouble than it is worth.

Oops my bad just saw the promotion

Might do the miles one

Thanks for the post

I am signing up for 5.75 cd for 15 months first thing in the morning with Ctizens State Bank and did one this morning for 13 months @ 5.50 with Pacific Western a regular bank with locations

Can’t think of a reason to do anything with Bark Bank

Perhaps for miles as you can pull out quickly if something comes up that sounds a lot better

And whatever happened to their sign up bonuses ?

"If you were in the highest tax bracket of 37% (which is worst case scenario)..."

Posters are right that's a marginal not overall rate but in some place (say Portland, OR) the top state rate is almost 10% and for high income earners in Multnomah Country as high as an additional 4%. So your marginal tax rate could easily reach 50% meaning a 5% yield on any spare cash would put half that in your...

"If you were in the highest tax bracket of 37% (which is worst case scenario)..."

Posters are right that's a marginal not overall rate but in some place (say Portland, OR) the top state rate is almost 10% and for high income earners in Multnomah Country as high as an additional 4%. So your marginal tax rate could easily reach 50% meaning a 5% yield on any spare cash would put half that in your pocket.

That said you can get over 5% today in a Treasury Bill Money Market which would be exempt from State and local taxes which is probably a better deal than earning miles with Bask

I have $200k in spread out over all three options. I love that Ben turned me on to this and have generated over 8325k AA FF miles. HOWEVER, I recently tried to register all of my accounts into my living trust and was told very short and curtly that Bask Bank does not allow accounts to be registered as business or trust.

That is a deal breaker for me and I will be moving...

I have $200k in spread out over all three options. I love that Ben turned me on to this and have generated over 8325k AA FF miles. HOWEVER, I recently tried to register all of my accounts into my living trust and was told very short and curtly that Bask Bank does not allow accounts to be registered as business or trust.

That is a deal breaker for me and I will be moving my CD out upon expiry in October and my savings account sooner. As a points junkie, I don't think think I can get away from the AA mileage program and will just have to let my heirs deal with that in probate!

All that being said, the service and ease of transfer has been seamless and I hate to walk away from 1/2 of my position here.

Im getting 5.4% at UBS so ill stick with that, now if you could earn Loyalty points on this i would consider opening an account.

Why doesnt AA allow you to earn loyalty points up to a certain amount, i understand why they dont allow all the BASK balance to count but why not allow a max say 10k loyalty points. This would help get a lot of accounts open.

You're not looking at the tax situation correctly, no one is paying 37% because that's a marginal rate, it's actually impossible for your effective rate to be over 37%.

It may make sense for you to take miles since your job is essentially using them but for anyone else taking advantage of the high cash rates is a much better deal.

I think what he's saying is that if you are already in the 37% bracket because of a high income, additional marginal earnings would be taxed at the 37%. He forgot state taxes too, so that might add 10%+ in some high tax states putting people close to 50% on this marginal income. Of course if you are already making $600k, you probably don't care too much about making a tiny bit extra in miles,...

I think what he's saying is that if you are already in the 37% bracket because of a high income, additional marginal earnings would be taxed at the 37%. He forgot state taxes too, so that might add 10%+ in some high tax states putting people close to 50% on this marginal income. Of course if you are already making $600k, you probably don't care too much about making a tiny bit extra in miles, nor do you care about the additional taxes involved.

Also agree that the cash rate is a no-brainer right now. Miles are better when interest rates are closer to zero.

How quick / easy is it to transfer money to and from your checking account?

Bask was a good deal a couple of years ago when it was paying 1 mile/year and interest rates were below 1%. But since then, interest rates have gone up about 6x and Bask has increased its miles payout by 2.5x so the value proposition is far worse. I took out most of my money and put them in treasuries (which are paying well more than the 5% Bask pays in cash interest).