Link: Apply now to open a Bask Bank savings account

Bask Bank, which is my go-to bank for my savings accounts, has a fantastic promotion for both new and existing members. I’ll be taking advantage of this, and I imagine many OMAAT readers will be as well.

In this post:

Bask Bank Mileage Savings Account basics

First for some background, Bask Bank allows you to open an account and earn American Airlines AAdvantage miles or cash interest for your savings, depending on your preferences. As you’d expect, the rewards rates can change over time, and depend on the current interest rate environment.

As it currently stands:

- With a Bask Mileage Savings Account, you can earn 2.5x AAdvantage miles for every dollar deposited annually

- With a Bask Interest Savings Account, you can earn a 5.00% Annual Percentage Yield (APY)

Interest earned with these kinds of accounts is taxed (as you’d expect), so one further advantage of earning miles is that when Bask Bank issues 1099s for AAdvantage miles, they’re only valued at the very conservative amount of 0.42 cents per mile. This is a big advantage if you’re in a high tax bracket.

Personally I have both a Bask Mileage Savings Account and a Bask Interest Savings Account, and I move amounts around between accounts depending on which is more lucrative (since both the AAdvantage miles earned and APY earned do change over time).

For more information, read my review of Bask Bank here.

Lucrative Bask Bank summer bonus offer [EXPIRED]

As a standard, Bask Bank doesn’t offer a bonus when you open an account, since the ongoing rewards are extremely competitive to begin with. Fortunately Bask Bank has just launched a summer bonus offer, which is valid for new and existing members, and is a great incentive to deposit money with the bank.

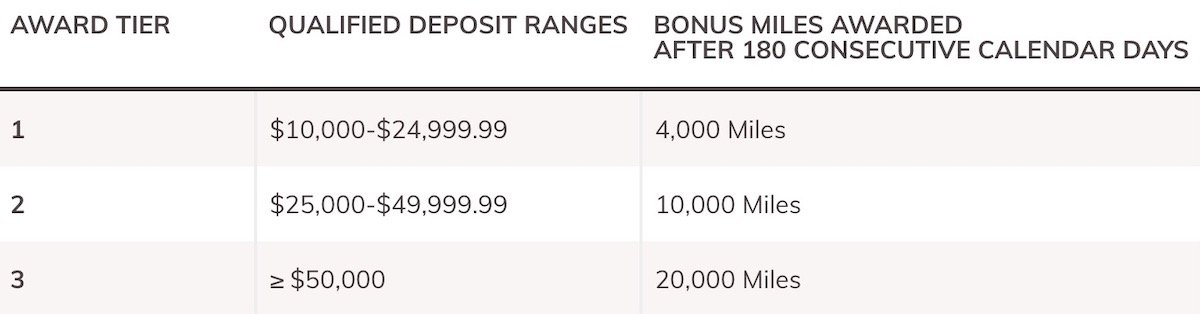

With the Bask Bank summer bonus offer:

- If you deposit $10,000-24,999.99, you can earn 4,000 bonus AAdvantage miles

- If you deposit $25,000-49,999.99, you can earn 10,000 bonus AAdvantage miles

- If you deposit $50,000+, you can earn 20,000 bonus AAdvantage miles

As you’d expect, there are some terms & conditions to be aware of. There’s no registration required, so here’s how you can be eligible:

- For new customers who open an account, you have to complete the online account opening process between June 1 and August 31, 2023, then have to fund the account within 15 business days, and then have to maintain the account balance for 180 consecutive days

- For existing customers, you have to make a deposit between June 1 and August 31, 2023, and maintain an aggregate account balance equal to or greater than the combined qualifying deposit and the account’s ending balance on May 31, 2023, for a period of 180 consecutive days

This is a really great promotion. Just to crunch some numbers, let’s assume you were to deposit $50,000 in a Bask Bank account, and you value AAdvantage miles at 1.5 cents each (as I do):

- If you maintained the balance for a full year, you’d earn 145,000 AAdvantage bonus miles (20,000 miles + 125,000 miles), which is like earning 2.9x AAdvantage miles per dollar saved, which I value at a return of 4.35% (not factoring in the tax advantages)

- If you maintained the balance for half a year, you’d earn 82,500 AAdvantage miles (20,000 miles + 62,500 miles), which is like earning 1.65x AAdvantage miles per dollar saved in half a year, which I value at a return of 2.475% (and this is only half a year, not a full year)

At an absolute minimum, I think most people would consider this to be a very good rate of return for a period of at least six months. This is an excellent offer, and it’s causing me to move around money to put more into my Bask Mileage Savings Account.

Bottom line

Bask Bank has a lucrative new summer bonus offer. This is valid not just for those who open an account, but also for existing members who deposit more money with Bask Bank. You can earn anywhere from 4,000 to 20,000 AAdvantage bonus miles with this offer, based on the amount you deposit and maintain as a balance for at least 180 days.

If you have cash sitting around, it’s hard to beat the value of depositing money in this way for at least 180 days (and even longer, if you’re anything like me).

Do you plan on taking advantage of this Bask Bank summer bonus offer?

Robinhood has 1% deposit bonus right now ($500 for $50k) for holding the balance for much shorter, so unfortunately, if you only have 50k lying around, the Robhinhood promotion is more worth it.

Does the money need to come from outside Bask Bank, or can I move from the interest-bearing account to the miles-bearing account to get the bonus?

If those miles will be LPs, that would move the needle for me. The way things are going - just look at UA recent devaluation - AA miles will be of little of values very soon.

I'm sure I'm doing something wrong. Ben says the miles are valued (for tax purposes) at .42 cents/mile, so 20k miles (for one year) you pay taxes on $84.00 And then let's add in the 125k for the 50k you have in there, so an additional $525.00 = $609 (but you now have 145,000 AA miles).

...If I just put that in in a high yield (let's say 5% APR), that's like what, $2,500?

I'm sure I'm doing something wrong. Ben says the miles are valued (for tax purposes) at .42 cents/mile, so 20k miles (for one year) you pay taxes on $84.00 And then let's add in the 125k for the 50k you have in there, so an additional $525.00 = $609 (but you now have 145,000 AA miles).

If I just put that in in a high yield (let's say 5% APR), that's like what, $2,500?

All before taxes, mind you.

So the question I guess becomes:

Is the $2500 vs. the $809+ miles worth it?

Given AA's new dynamic pricing for flights (at least domestic F, or USA-Mexico flights in F) that I'm seeing, I'd say not really. What used to cost 60k miles (each way) is now 200,000 miles each way.

I'm not sure I'd value AA miles at 1.3 cents/mile any longer since the last devaluation. (but then again I don't fly economy), and no partner awards for me.

Its actually 2500$ (pre-tax) v/s 145,000 miles (pre-tax)

OR

1700$ (after-tax) v/s 145,000 miles -$809 (after tax) [*Tax Rate = 32% for interest]

OR

1700$ (after-tax) v/s $1076 (@1.3CPP)

You would need a redemption of 1.72 CPP to break-even on this.

However, if you only keep this for 6 months, then its

$1250 (pre-tax) v/s 20K(bonus) + 62500(accured) - $404.5

or $850 (after-tax) v/s $668.5 (@1.3 CPP)

You...

Its actually 2500$ (pre-tax) v/s 145,000 miles (pre-tax)

OR

1700$ (after-tax) v/s 145,000 miles -$809 (after tax) [*Tax Rate = 32% for interest]

OR

1700$ (after-tax) v/s $1076 (@1.3CPP)

You would need a redemption of 1.72 CPP to break-even on this.

However, if you only keep this for 6 months, then its

$1250 (pre-tax) v/s 20K(bonus) + 62500(accured) - $404.5

or $850 (after-tax) v/s $668.5 (@1.3 CPP)

You would need 1.52 CPP to break-even. So the question is, which AA or partner flights can give you >1.52 CPP and would you hold this balance to wait for those flights.

Thanks for doing all that math.

At first I was excited but then I began to think about it and something smelled fishy and your calcs confirm what I thought. Even at a 20k bonus for existing customers it turns out to be a buy AA miles at 1.3 to 1.4c/mile. That's pretty slick marketing. I'm not biting though.

I'm not sure if the math is right there...

Keeping it for 6 months and assuming savings opportunity cost is $1250 at 35% tax rate:

$1250 (pre-tax) vs 82500 miles (pre-tax)

= $812.50 (post-tax) vs 82500 miles - (82500 miles * 0.42 c/mile * 35%) (post-tax)

= $812.50 (post-tax) vs 82500 miles - $121.28 tax (post-tax)

= $933.78 vs 82500 miles

So you're effectively buying AA miles at bit over 1.1 CPP. I'm going for it.

Any holes in my logic?

To add to my calculation above... since my savings rate (Robinhood) is 4.65% I think it comes closer to 1 CPP for me. I don't quite have the motivation to buy T-Bills. Another benefit here is that since there is tax difference of $316.22 (from my original calculation) I can harvest that much more in tax loss.

Did a rough estimate, if you pay 35% marginal tax, and earn APY around 4.5% elsewhere, you effectively buy miles slightly above 1.3c

What value does Bask Bank value the miles at for your 1099?

It is an aggregate of the may 31st balance as well that you can not remove for 6 months. So your holding amount for 6 months is more than the deposit being made so you need to make sure to add in even more money in your deposits if you anticipate having any withdrawals in the 6 month period. You can't go below the aggregate even one time in the 6 month period. Be careful.

Come on this is a horrible offer. Even if you're desperate to turn your hard earned, fungible US cash into non-fungible, easily devalued AA miles..... why wouldn't you just get the Citi AA bank bonus instead? These offers + rates are horrible

Am I the only one without 50K to throw in a savings account? Or even 10K?

Yes

You can buy treasury bills that yield well over 5% (5.4% for the 6 month, 5.15% for the 1 year). Assuming a blended 5.25% yield over 1 year, you are forgoing $2,625 in cash (pre-tax) to earn 145,000 AA miles in your example. So you are basically buying AA miles at 1.8 cents per point. This is compared to your 1.5 cents valuation.

However there aren't that many opportunities to buy AA miles. One...

You can buy treasury bills that yield well over 5% (5.4% for the 6 month, 5.15% for the 1 year). Assuming a blended 5.25% yield over 1 year, you are forgoing $2,625 in cash (pre-tax) to earn 145,000 AA miles in your example. So you are basically buying AA miles at 1.8 cents per point. This is compared to your 1.5 cents valuation.

However there aren't that many opportunities to buy AA miles. One that I think needs more consideration is spending on AA credit cards - since you also get the bonus of loyalty points. Depending on your flying with AA, spend, and how many loyalty points you need, spending on an AA credit card, even in unbonused categories, may be a better idea if you really need AA miles.

You're forgetting the fact that for many they get crushed on that $2625. Just federally you get knocked down 32% or higher.

Miles are valued at .42 cents each. 145k miles has a tax value of $609.

Thats a $2000 pretax income difference, it can easily save you $650. If you do it with something specific in mind that is relatively easy to redeem even higher, then it is worth it. Currently I keep it all in Bask Savings at 4.75% as my effective is lower.

And... Loyalty Points?

If not, then no.

there's also an opportunity cost of not keeping for full 180 days and getting none of the 20k miles. Or they may reduce the mileage earning rate within 180 days and one can't move the money around to higher rate products. Even with the optimistic valuation of AA miles, it doesn't seem to make sense to me to take the mileage instead of cash.

I don't think you understand what opportunity cost means... What you're describing is risk. Opportunity cost is the 4.75% cash interest or whatever else you would rather do with your money.

I'm already at the FDIC insurance limit with my bask account. If I withdraw $50K and add it back up in a few days, would i qualify for the bonus?

With interest rates going up, tbh they'd have to be even more competitive for this to be worth it.

If I can get nearly 5% returns on a fidelity account with SPAXX, debit card, and checking, this doesn't really make sense anymore.

Bask was totally worth for emergency fund and whatnot during ZIRP.

Does SPAXX count as long term capital gain if held for a year ? Then it would have a tax advantage over the Bask Bank savings account.

SPAXX is a money market fund, all purchases and sales are at $1 NAV. There are no capital gains.

All the dividends are ordinary investment income.